What's New

June Budget Report Doesn’t Erase Our Nation’s Fiscal Challenges

July 15, 2025 • By Joe Hughes

Nobody should be too excited and think this means our country is headed toward lower deficits - especially when the administration recently signed one of the most expensive budget reconciliation bills in history.

Anti-Tax Revolts Backfire: What We’ve Learned from 50 Years of Property Tax Limits

July 15, 2025 • By Rita Jefferson

Across-the-board property tax cuts create less fair local tax systems in the long run. State legislators and local governments should prioritize the residents who can least afford their property taxes, not the residents and businesses who can.

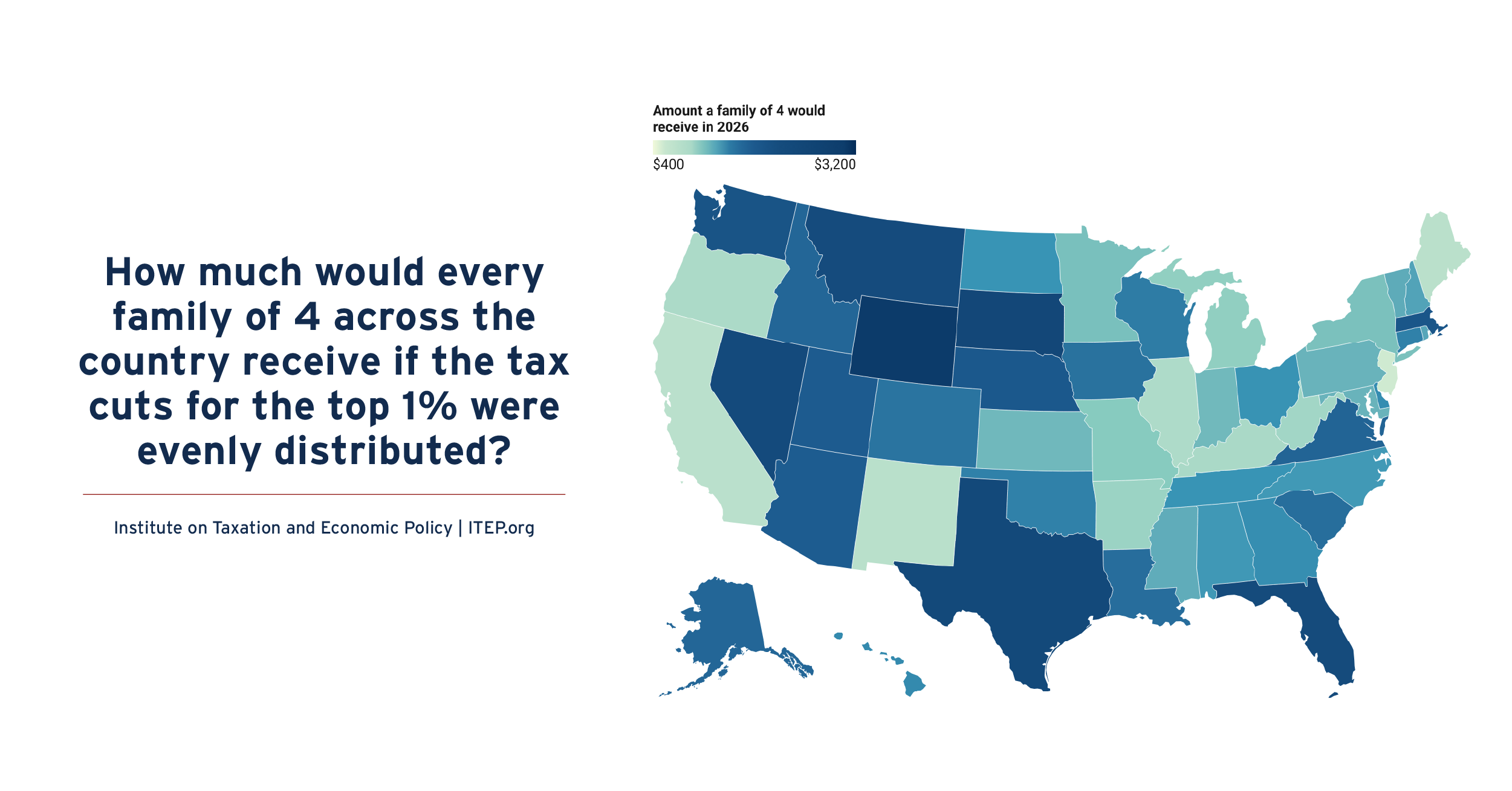

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

GOP Megabill Breaks America’s Promise to Future Generations

July 10, 2025 • By Amy Hanauer

This country’s biggest historical challenge has been delivering this progress to all Americans, but Republicans have cut it back for everyone, retreating from many 20th century achievements in ways that will slam doors, rather than opening them, for the next generation.

10 Crazy Comparisons Showing How Much Trump and Congress Just Cut Taxes for the Rich

July 10, 2025 • By ITEP Staff

$117 billion is a big number, so we thought it could use a little context.

ITEP in the News

USA Today: Would Mamdani's 'Millionaire Tax' Chase the Rich Out of New York City?

Rolling Stone: Every Dirty Gift Trump’s Big Bill Gives the Fossil Fuel Industry

Washington Post: Conservatives Are Asking Trump for Another Big Tax Cut

NC Newsline: NC Lawmakers Urged to Act as Federal Cuts Threaten State Services

The American Prospect: Right-Wing State Tax ‘Revolution’ Rolls On

ITEP Work in Action

Joint Center for Political and Economic Studies: Joint Center Launches 2025 Tax Advisory Committee

Florida Policy Institute: What Floridians Should Know About the FY 2025-26 Tax Package

The Bell Policy Center: Colorado’s Rural Communities Will Suffer from the Federal Budget Bill

CAP: A New Immigration System To Safeguard America’s Security, Expand Economic Growth, and Make Us Stronger

DC Fiscal Policy Institute: Statement on Final Passage of Federal Budget Reconciliation Bill

Across the States

Tax Watch

State Tax Watch 2025

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Get weekly updates by signing up for our State Rundown newsletter.

Learn more about state taxes across the country, read Who Pays?

State Rundown & On the Map

State Rundown 7/8: State Tax Cuts Continue Despite Federal Megabill Passing

The last states are wrapping up legislative sessions, and some are crossing the finish line with major income tax cuts.

How Much Would Every Family in Every State Get if the Megabill's Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 -…

State & Local Tax Policy

Anti-Tax Revolts Backfire: What We’ve Learned from 50 Years of Property Tax Limits

July 15, 2025 • By Rita Jefferson

Local Tax Trends in 2025

July 1, 2025 • By Rita Jefferson

With Fiscal Uncertainty Looming, Louisiana Senate Did the Right Thing on Tax Bills

June 27, 2025 • By Neva Butkus