“The tax cutting in Mississippi didn’t stop with the franchise tax. The measure signed by the governor also significantly reduced personal income taxes. Basically, the state will exempt the first $10,000 of earnings from income tax. This will, as my friends at the Institute on Taxation and Economic Policy (ITEP) point out, skew the benefits toward the wealthy. Those making $16,000 or less will save an average of $14 a year. Those with income over $150,000 will save about $270 a year. Is that ideal? No. But letting a person making a quarter of a million dollars keep another $270 will hardly exacerbate income inequality. More importantly, the state is cutting these taxes while balancing its budget. Yes, the state is cutting services to do so, but this is not a situation in which the state is cutting a billion dollars in taxes and hoping it will make up the money somehow. If the people want more services and higher taxes, they should be electing different political leaders.”

Quoted Staff Member

Related Reading

October 16, 2025

The 5 Biggest State Tax Cuts for Millionaires this Year

Mentioned Locations

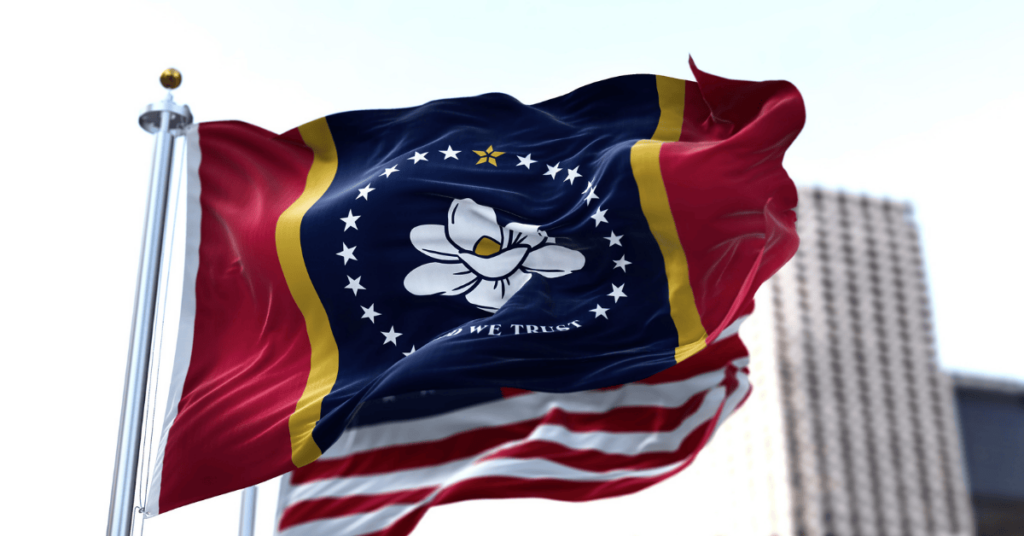

Mississippi