Read this Policy Brief in PDF Form

In 2011, thirty one states and the District of Columbia allow a group of income tax breaks known as “itemized deductions.” Itemized deductions are designed to help defray a wide variety of personal expenditures that affect a taxpayer’s ability to pay taxes, including charitable contributions, extraordinary medical expenses, mortgage interest payments and state and local taxes. But, these deductions cost states billions of dollars a year while providing little or no benefit to the middle- and low-income families hit hardest by the current economic downturn. This policy brief explains itemized deductions and explores options for reforming these upside down tax breaks at the state level.

What are Itemized Deductions?

Itemized deductions are the collective name for a group of about a dozen separate tax deductions available as an alternative to the basic standard deduction at the federal level, and in most states with personal income taxes. Generally, better-off families are more likely than lower-income families to have enough deductions to make itemizing worthwhile. Deductions related to homeownership are often what makes a family’s itemized deductions exceed its standard deduction.

In general, the rationale for each itemized deduction is to take account of large or unusual personal expenditures that affect a taxpayer’s ability to pay. Itemized deductions are also offered as a way of encouraging certain types of behavior and include: charitable contributions; mortgage interest paid by homeowners ; very large medical expenses; and state and local income and property taxes. Most states require resident itemizers to add back any state income tax deduction in calculating their itemized deductions for state purposes.

Fairness Implications of Itemized Deductions

Itemized deductions impact tax fairness: low-income families receive virtually no benefit from these deductions, and the biggest benefits are reserved for the upper-income families who arguably need them the least.

Each itemized deduction tax break is frequently defended as an important means of offsetting large household expenses that reduce a family’s ability to pay taxes. But because they are structured as deductions, they typically provide much larger tax breaks to the best off families than to middle-income taxpayers. This is because the tax cut you get from an itemized deduction depends on your income tax rate: imagine two families, each of which has $10,000 in mortgage interest payments that they include in their itemized deductions. If the first family is a middle-income family paying at the 15 percent federal tax rate, the most they can expect is a $1,500 federal tax cut from this deduction ($10,000 times 15 percent). But if the second family is much wealthier and pays at the 35 percent top rate, they could expect a tax cut of up to $3,500.

Federal tax changes enacted during the presidency of George W. Bush gradually made itemized deductions even more unfair and expensive by repealing a provision, known as the Pease disallowance, which reduces some itemized deductions for upper-income taxpayers. The tax compromise package passed by Congress in late 2010 extended the Bush tax cuts into 2011 and 2012 continuing the repeal of the itemized deduction disallowance. This amounted to an automatic state tax cut for a handful of the best-off taxpayers in each of the states that allow federal itemized deductions. States allowing federal itemized deductions (with the exception of California which is not tied to federal rules) stand to lose more than $2 billion from this tax cut in 2011 at a time when states can ill afford any revenue loss.

State Treatment of Itemized Deductions

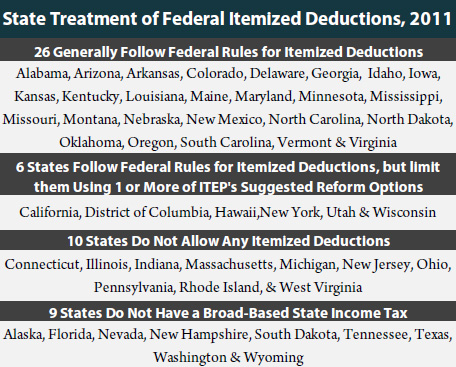

Thirty one states and the District of Columbia allow itemized deductions patterned after federal rules. 26 states closely follow federal guidelines for itemized deductions (with the exception of the federal deduction for state income taxes paid, which most states have sensibly chosen to disallow). Five other states and DC use the same federal guidelines, but impose their own limits on some (or all) of these deductions.

Thirty one states and the District of Columbia allow itemized deductions patterned after federal rules. 26 states closely follow federal guidelines for itemized deductions (with the exception of the federal deduction for state income taxes paid, which most states have sensibly chosen to disallow). Five other states and DC use the same federal guidelines, but impose their own limits on some (or all) of these deductions.

Options for Itemized Deduction Reform

In recent years, lawmakers in a number of states have ratified bold reforms that phase out or outright repeal itemized deductions. The outright repeal of itemized deductions in Rhode Island in 2010 has been the most significant of those efforts. Other states have capped the value of some deductions or converted them into credits—making these tax breaks less unfair and broadening the state’s income tax base. Most recently, the District of Columbia and Hawaii enacted changes to reduce the value itemized deductions for their best-off taxpayers. Options for itemized deduction reform include:

- Repealing Itemized Deductions Entirely: The most comprehensive reform approach available to states is simply to repeal all itemized deductions and ensure that most middle- and low-income families are held harmless by simultaneously increasing the basic standard deduction available to all families.

- Capping the Total Value of Itemized Deductions: Itemized deductions typically have no caps—so the well-off taxpayers who have the largest mortgages, for example, are able to use these deductions to an extent that is unavailable to lower- and middle-income taxpayers. States could pare back deductions for the best-off taxpayers by limiting the total amount of itemized deductions of all kinds that can be claimed.

- Converting Itemized Deductions to Credits: One important reason for the “upside-down” nature of itemized deductions is that they give bigger benefits to the upper-income taxpayers who pay at higher marginal tax rates. Converting the deduction to a credit is one way to ensure that the tax impact of itemized deductions depends more directly on the amount of deductions you claim—not on your marginal income tax rate.

- Enacting Stand‐Alone Phaseouts: States seeking to phase out itemized deductions for the best-off taxpayers can also choose to set their own income limits and phaseout rules in lieu of the constantly evolving federal rules.

- Decoupling from Federal Pease Repeal: The most straightforward option is to “decouple” from the recent federal tax change that extended the repeal of the Pease provision through 2011 and 2012. This approach is relatively simple in that it relies on pre-existing federal rules, but it also would have a relatively small impact on state revenues.

To find out more about options for reforming state itemized deductions, see ITEP’s report “Writing Off Tax Giveways.”

Conclusion

Reforming itemized deductions will make tax systems fairer and more sustainable at a time when they are badly in need of such changes. Itemized deductions are costly, “upside-down” subsidies for the best-off taxpayers, offering little or no benefit for many low- and middle-income families.

Itemized deduction reform continues to gain traction. Recent bipartisan national fiscal commissions have recommended reducing or eliminating specific federal itemized deductions as an important step toward improving the federal tax code. State tax commissions in Vermont and Georgia recently recommended repealing all itemized deductions and more states are exploring this option.