See the Updated 2013 Edition of this Brief

Read this Policy Brief in PDF Form

Sales taxes are among the most important—and most unfair—taxes levied by state governments. Sales taxes accounted for a third of state taxes in 2011, but sales taxes are regressive, falling far more heavily on low- and middle- income taxpayers than on the wealthy. In recent years, lawmakers thinking they might lessen the impact of these taxes have enacted “sales tax holidays” that provide temporary sales tax breaks for purchases of clothing, computers, and other items. This policy brief looks at sales tax holidays as a tax reduction device.

How Sales Tax Holidays Work

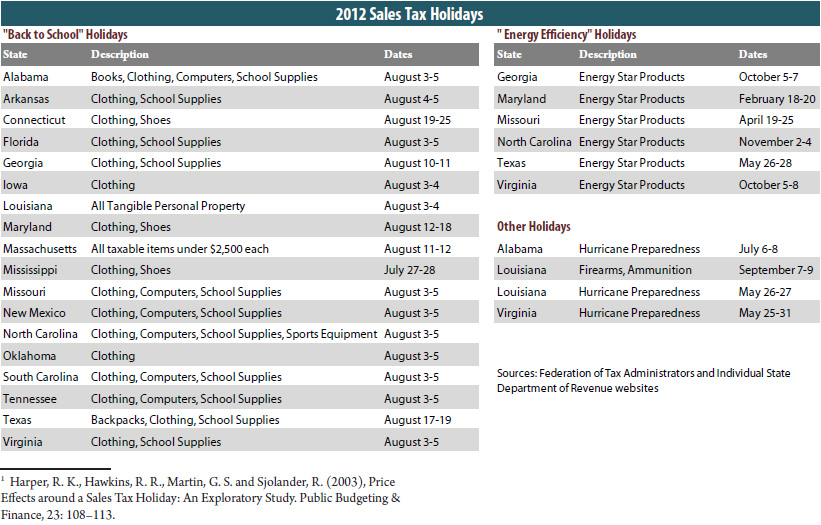

Sales tax holidays are temporary sales tax exemptions, applying to a small number of taxable items for a very limited period of time (usually two or three days). These holidays are usually timed to take place in August, during the traditional “back to school” shopping season. Since New York experimented with the fi rst sales tax holiday in 1996, well over a dozen other states have passed similar legislation (See chart on below for a list of 2012 sales tax holidays).

The majority of sales tax holidays include an exemption of clothing, though holidays for computers, school supplies, and other “back to school” expenses are also common. Separate holidays for energy efficient appliances are becoming increasingly common as well. Many holidays apply only to items below some specified price (e.g. clothing items worth over $100 are generally not exempted).

Problems with the Sales Tax Holiday Approach

Advocates of sales tax holidays usually justify these tax breaks in a variety of ways, suggesting that sales tax holidays: make a state’s tax structure more fair, spur economic activity, and come with little cost to the states in terms of revenue and administrative difficulties. These justifications don’t hold up under closer examination.

Sales Tax Holidays are Poorly Targeted

- Sales tax holidays are poorly targeted, providing tax breaks to even the wealthiest taxpayers and offering less assistance to the elderly or families without children who don’t have “back to school” needs.

- A three-day sales tax holiday for selected items does nothing to provide relief to low-income taxpayers during the other 362 days of the year. In the long run, sales tax holidays leave a regressive tax system basically unchanged.

- Sales tax holidays are less beneficial for low income taxpayers than more targeted tax breaks such as low-income sales tax credits (described in ITEP Policy Brief, “Options for Progressive Sales Tax Relief ”).

- Wealthier taxpayers are more likely to be able to time their purchases to take advantage of the sales tax holiday without throwing their finances out of kilter. On the other hand, many low-income taxpayers spend most or all of their income on necessities—which means that they have less disposable income than wealthier taxpayers. These taxpayers may not have the luxury of shifting the timing of their consumption to coincide with a three-day sales tax holiday.

- The benefits of sales tax holidays are not limited to state residents, but also extend to consumers visiting from other states.

Sales Tax Holidays Do Not Boost Sales

- Evidence supporting the claim that sales tax holidays boost retail sales is weak. Rather, increased sales during sales tax holidays have been shown to be primarily the result of consumers’ shifting the timing purchases they had already planned.

- Unscrupulous retailers can take advantage of the shift in the timing of consumer purchases by increasing their prices during the tax holiday. One study of retailers’ behavior during a sales tax holiday in Florida found evidence of precisely that: up to 20 percent of the potential benefits from the state’s sales tax holiday were reclaimed by retailers.*

Sales Tax Holidays Create Administrative Difficulties

- Sales tax exemptions create administrative difficulties for state and local governments, and for the retailers who collect the tax. For example, exempting groceries requires a sheaf of government regulations to police the border between non-taxable groceries and taxable snack food. A temporary exemption for clothing (or for any other back-to-school item) requires retailers and tax administrators to wade through a similar quantity of red tape for an exemption that lasts only a few days. Further complexity can arise in states with local sales taxes when some localities opt not to participate in the holiday and consumers unexpectedly end up paying local sales taxes on their purchases.

Sales Tax Holidays Cost Revenue

- Sales tax holidays are costly. Revenue lost through sales tax holidays will ultimately have to be made up somewhere else, either through painful spending cuts or increasing other taxes. For this reason, Illinois lawmakers cancelled their holiday in 2011. If the long-term consequence of sales tax holidays is a higher sales tax rate, low income taxpayers may ultimately be worse off as a result of these tax breaks.

Conclusion

Sales tax holidays do have advantages, of course. As previously noted, the biggest beneficiaries from any sales tax cut will be the low- and middle-income families affected most by sales taxes. In states that rely heavily on sales taxes, a sales tax holiday slightly reduces the overall collections from this unfair tax. But in the long run, sales tax holidays are too poorly targeted and temporary to meaningfully change the regressive nature of a state’s tax system. Policymakers seeking to achieve greater tax equity would do better to provide a permanent low-income sales tax credit.