An updated version of this report was published in July 2025.

The federal government and many states are seeing shortfalls in their transportation budgets in part because the gasoline taxes they use to generate those funds are poorly designed. Thirty-two states and the federal government levy “fixed-rate” gas taxes where the tax rate does not change even as the cost of infrastructure materials inevitably increases over time. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty years. And almost half the states (24) have gone a decade or more without a gas tax increase.1

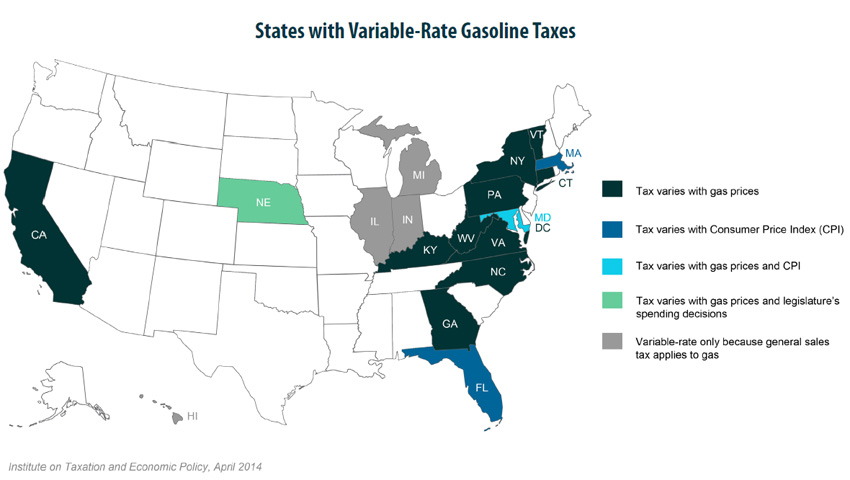

Fortunately, there is a growing recognition of the problems with this “fixed-rate” gas tax design. Four states (Maryland, Massachusetts, Pennsylvania, Virginia) and the District of Columbia (DC) abandoned this gas tax structure last year in favor of a more sustainable, “variable-rate” design where the tax rate gradually rises alongside gas prices, the general inflation rate in the economy, or both. As a result of these reforms, a majority (55 percent) of the U.S. population now lives in a state where the gas tax rate tends to grow over time.

The following map highlights the eighteen states (plus DC) that levy “variable-rate” gas taxes and identifies the specific type of variable-rate structure used in each of those states. Transitioning toward this type of gas tax at the federal level, and in more states, would put funding for the nation’s infrastructure investments on a much more sustainable course.

(Click Here for High Quality Version of Chart)

1 Institute on Taxation and Economic Policy, “How Long Has it Been Since Your State Raised Its Gas Tax?” April 2014. Available at: https://itep.sfo2.digitaloceanspaces.com/gastaxincreases0414.pdf.