This report was updated February 2016

Read as a PDF. (Includes Full Appendix of State-by-State Data)

In the public debates over federal immigration reform, sufficient and accurate information about the tax contributions of undocumented immigrants is often lacking. The reality is the 11.4 million undocumented immigrants living in the United States pay billions of dollars in local, state and federal taxes, and their tax contributions would increase under immigration policy reform.1 To date, however, Congress has not passed comprehensive immigration reform legislation which would grant a pathway to lawful permanent residence for all undocumented immigrants currently living in the United States.

In November 2014, President Obama used his executive authority to announce that he would allow up to 4 million undocumented immigrants to apply for temporary reprieve from deportation and a three year, renewable work permit.2 His action also built on his 2012 grant of this relief to 1.2 million undocumented immigrants who came to the country as children (up to 300,000 new undocumented immigrants are newly eligible under the 2014 action). Eligible individuals must either be parents of US citizens or lawful permanent residents and have resided in the United States for more than five years or be youth who have lived continuously in the United States since 2010, be at least 15 years old, and either be en-rolled in school or have a high school degree or its equivalent. All told, up to 5.2 million undocumented immigrants could benefit from the president’s executive actions taken in 2012 and 2014.3

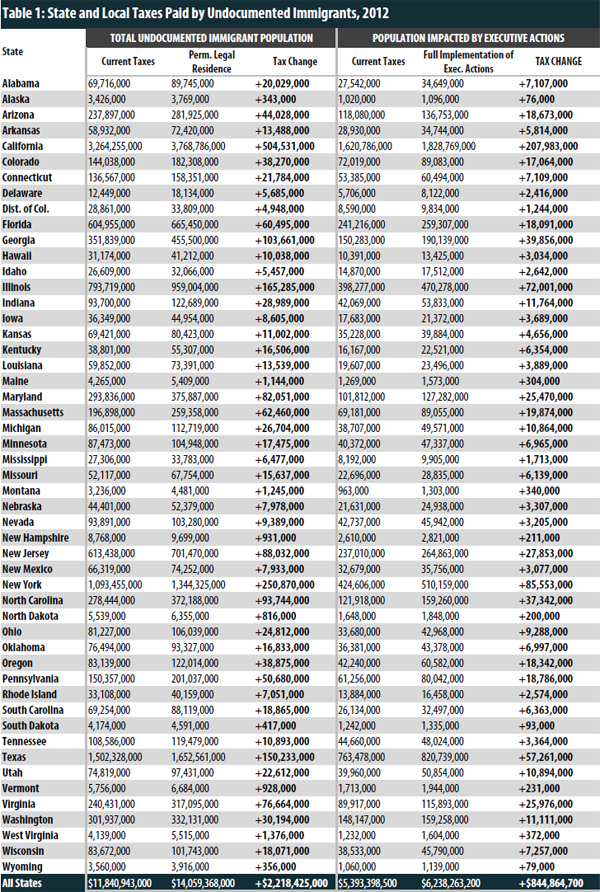

This report provides state-by-state and national estimates on current state and local tax contributions of the 11.4 million undocumented immigrants living in the United States as of 2012, the increase in contributions if all 11.4 million were granted lawful permanent residence, and the increase in contributions of the 5.2 million undocumented immigrants directly affected by President Obama’s executive actions in 2012 and 2014.

Key Findings:

• Undocumented immigrants contribute significantly to state and local taxes, collectively paying an estimated $11.84 billion in 2012. Contributions range from less than $3.2 million in Montana with an estimated undocumented population of 6,000 to more than $3.2 billion in California, home to more than 3.1 million undocumented immigrants. Undocumented immigrants’ nationwide aver-age effective state and local tax rate (the share of income they pay in state and local taxes) in 2012 is an estimated 8 percent. To put this in perspective, the top 1 percent of taxpayers pay an average nationwide effective tax rate of just 5.4 percent.4

• Granting lawful permanent residence to all 11.4 million undocumented immigrants and allowing them to work in the United States legally would increase their state and local tax contributions by an estimated $2.2 billion a year. Their nationwide effective state and local tax rate would increase to 8.7 percent, which would align their tax contributions with economically similar documented taxpayers.

• Under President Obama’s executive actions (2012 and 2014), which would make temporary immigration reprieve available to up to 5.2 million undocumented immigrants, the state and local tax contributions from this group would increase by an estimated $845 million a year once fully in place. It would also raise the effective state and local tax rate for this population from 8.1 to 8.7 percent, but the state and local revenue gain is smaller under the executive actions because fewer undocumented immigrants are affected (around 45% of the total) and the actions do not grant a full pathway to lawful permanent residence.

Undocumented Immigrants Pay State and Local Taxes: Current Contributions

Like other people living and working in the United States, undocumented immigrants pay state and local taxes. In addition to paying sales and excise taxes when they purchase goods and services (for example, on utilities, clothing and gasoline) undocumented immigrants also pay property taxes directly on their homes or indirectly as renters. Many undocumented immigrants also pay state income taxes.5 The best evidence suggests that at least 50 percent of undocumented immigrant households currently file income tax returns using Individual Tax Identification Numbers (ITINs) and many who do not file income tax returns still have taxes deducted from their paycheck.

Collectively, undocumented immigrants will pay an estimated total of $11.84 billion in state and local taxes in 2012 (see Table 1 for state-by-state estimates of aggregate taxes paid). This includes $1.1 billion in personal income taxes and $3.6 billion in property taxes (paid directly as homeowners and indirectly as renters). Sales and excise taxes account for almost 60 percent of their state and local tax contributions, bringing in more than $7 billion.

Another way to measure the state and local taxes that undocumented immigrants pay is through their effective tax rate, which is the share of total income paid in taxes. The effective tax rate is useful for more accurate state-to-state comparisons because it accounts for differences between states’ tax structures and population size. Undocumented immigrants’ nationwide average effective tax rate in 2012 is an estimated 8 percent. To put this in perspective, the top 1 percent of taxpayers pay an average nationwide effective tax rate of just 5.4 percent.6

Granting Lawful Permanent Residence to All Undocumented Immigrants Living in the United States Would Boost Their State and Local Tax Contributions

Creating a pathway to citizenship for the 11.4 million undocumented immigrants living in the United States and allowing them to work here legally would boost their state and local tax contributions, aligning them more closely to contributions of residents with similar incomes. The most significant revenue gain comes from the full compliance of these immigrants with state and local tax systems, specifically the personal income tax. Empirical research shows that undocumented immigrants currently have a roughly 50 percent compliance rate in filing income taxes.7 Given the strong incentives for tax compliance likely to be included in a comprehensive reform measure, we assume full compliance with state personal income tax laws if granted lawful permanent residence. In states with Earned Income Tax Credits, the income tax gains would be offset in part by immigrants being newly eligible to claim the federal credit and thus the state versions.

This analysis also assumes that having the authority to work legally in the United States would increase undocumented immigrants’ wages, thus increasing the taxes paid by those same immigrants.8 This assumption is based on research from the Fiscal Policy Institute, which examined a number of studies on immigrant wages. The research consistently finds that legal immigrants had higher wages than undocumented immigrants and gaining legal status could boost wages anywhere between 6 and 15 percent. The wage boost is in part due to better job opportunities that would be made available to legal workers and also in part to an increase in higher-level skills and better training.

If all 11.4 million undocumented immigrants in the United States were granted lawful permanent residence and allowed to work in the country legally, their state and local tax contributions would increase by more than $2.2 billion over their current tax contributions (See Table 1). Personal income taxes would account for 52 percent of the revenue gain, increasing collections by more than $1.1 billion due to both increased earnings and full compliance with the tax code. Sales and excise taxes would increase by $708 million, and property taxes would grow by $364 million. The overall state and local effective tax rate paid by undocumented immigrants would increase from 8 percent to 8.7 percent.

See Appendix 1 for state-by-state estimates of the current and post-reform state and local tax contributions of the total undocumented immigrant population (reform assumes granting lawful permanent residence to all 11.4 million undocumented immigrants. The appendix includes effective tax rates and totals for personal income, property and sales and excise taxes.

President Obama’s Executive Actions Would Increase State and Local Tax Revenues

President Obama used his executive authority in November 2014 to announce that he would allow up to 4 million undocumented immigrants to apply for temporary reprieve from deportation and a three year, renewable work permit.9 In 2012 the President had made this relief available to up to 1.2 million undocumented immigrants who came to the country as children. Potential beneficiaries of the president’s executive actions must apply, pass criminal and national security background checks, have lived continuously in the United States since 2010, and meet other criteria in order to be considered for this relief, which is granted on a case by case basis.

All told, up to 5.2 million undocumented immigrants could benefit from the president’s executive actions taken in 2012 and 2014 (about 45 percent of the total population of undocumented immigrants living in the United States).

The majority of undocumented immigrants who could benefit from the granting of temporary immigration reprieve under the Deferred Action for Parents of Americans and Lawful Permanent Residents (DAPA) program are undocumented parents of United States citizens or lawful permanent residents who have lived in the country for more than five years (around 3.7 million undocumented immigrants).10 The 2014 executive action would also expand the Deferred Action for Childhood Arrivals (DACA) program for un-documented youth who came to the country as children to include another under 300,000 undocumented immigrants.11 Under DACA, youth must have resided in the country continuously since 2007, be at least 15 years old (but not born before June 1981), and either be enrolled in school or have a high school diploma (or GED equivalent) to be eligible for deferred action. The expanded DACA program expands eligibility by removing the age cap and changing the residency requirement to living in the country continuously since 2010. In sum, close to 1.5 million undocumented immigrants could benefit from the DACA program. The president’s executive action also included some changes that benefit high-skilled immigrants, but this analysis looks solely at those affected by DAPA and DACA (2012 and the 2014 expansion).

Under the terms of President Obama’s executive actions, undocumented immigrants who are granted temporary reprieve must fully comply with current tax laws. Given the current scope of the president’s proposal and the strong incentives for compliance, we assume full compliance with state personal income taxes. In states with Earned Income Tax Credits, the income tax gains would be offset in part by immigrants being newly eligible to claim the federal credit and thus the state versions.

Granting temporary immigration reprieve to up to 5.2 million undocumented immigrants would boost the affected population’s state and local tax contributions, thus increasing state and local tax revenue by more than $845 million over the current level once fully implemented. Personal income taxes would account for 56 percent of the revenue gain increasing collections by almost $476 million due to both increased earnings and full compliance with the tax code. Sales and excise taxes would increase by $243 million, and property taxes would grow by $125 million. The overall state and local effective tax rate paid by the undocumented immigrants covered by the executive action would increase from 8.1 percent to 8.7 percent. This estimated revenue gain assumes every undocumented immigrant eligible for temporary relief applies and is approved thus the more people who become part of the executive action programs, the larger the state and local revenue gain.

See Appendix 2 for state-by-state estimates of the current and post-reform state and local tax contributions of the 5.2 million undocumented immigrants directly affected by President Obama’s executive actions. The appendix includes effective tax rates and totals for personal income, property and sales and excise taxes.

Methodology

While the spending and income behavior of undocumented immigrant families is not as well document-ed as that of US citizens, the estimates in this report represent a best approximation of the taxes families headed by undocumented immigrants likely pay.

The ITEP methodology used to calculate the current and potential tax contribution of undocumented immigrants uses six main data points:

1. Estimated undocumented immigrant population in each state

2. Estimated impacted population under the Executive Action in each state

3. Average size of undocumented immigrant families/taxpaying units

4. Range of annual undocumented immigrant family/taxpayer income in each state

5. Estimated number of undocumented immigrants who are homeowners

6. Estimated effective tax rates (taxes as share of income) for income, sales and property taxes paid by low- and moderate-income families in each state.

Additional assumptions are made (and described below) about the change in tax contributions that would occur if all 11.4 million undocumented immigrants were granted lawful permanent residence and under deferred action for the 5.2 million undocumented immigrants granted temporary relief by President Obama’s executive actions.

See Appendix 3 for state-by-state details on data used to assist in calculating the state and local tax contributions.

1. Number of undocumented immigrants living in each state

Estimates of each state’s undocumented immigrant population are from the Migration Policy Institute (MPI).12 According to MPI, an estimated 11.4 million undocumented immigrants resided in the U.S. as of 2012.

2. Number of undocumented immigrants affected by President Obama’s executive actions in each state

Estimates of each state’s impacted undocumented immigrant population under the 2012 and 2014 executive actions are from the MPI.13 According to MPI, an estimated 5.2 million undocumented immigrants (45% of the total undocumented population) are potentially eligible to receive immigration relief under the executive actions.

3. Average size of undocumented immigrant families/taxpaying units

The Pew Research Center calculated a nationwide estimate of the number of people per undocumented immigrant family. The most recent estimate, 2.29, is used to find an estimated number of undocumented families, or taxpaying units, by state.14 ITEP divided population estimates for each state (total and affected populations) by the average family size to find an estimated number of undocumented families / taxpaying units living in each state and the number of families/taxpaying units impacted by the 2012 and 2014 executive actions.

4. Range of annual undocumented immigrant family/taxpayer income in each state

Estimates of the income distribution of undocumented families are from MPI data on the number of undocumented families in five discrete income groups.15 ITEP used the midpoint of the income ranges in each group as an estimate of average income within each group, and multiplied by the number of families/ taxpaying units in each group to calculate aggregate income in these groups.

5. Estimated number of undocumented immigrants who are homeowners

ITEP used MPI data on undocumented families’ homeownership rates for each state. We then calculated separate property tax incidence analyses for homeowners and renters in each state. Applying the homeowner effective tax rates to the homeowner population and the renter tax rates to the renter population yielded a combined property tax estimate for all undocumented families in each state. 16

6. Estimated effective tax rates (taxes as share of income) for income, sales and property taxes paid by low- and moderate-income families in each state.17

ITEP’s microsimulation computer model is a sophisticated program that applies the state and local tax laws in each state (including income, sales, excise and property tax laws) to a statistically valid database of tax returns to generate estimates of the effective tax rates paid by taxpayers at various income levels under current law. In January of 2015, ITEP released the 5th edition of Who Pays? which estimates the effect of the state and local tax laws as of January 2015 on taxpayers at 2012 income levels. This report applies effective tax rates calculated in the 2015 Who Pays? report to the undocumented population.

The following assumptions were made to calculate the sales, property and income taxes of the undocumented immigration population:

• Sales tax: Sales taxes are collected by retailers every time a purchase is made on a taxable good or service. It is reasonable to assume that undocumented immigrants pay sales tax at similar rates to US citizens and legal immigrants with similar incomes. This analysis adjusts the estimated annual incomes for each state downward by 10 percent for purposes of calculating the sales tax paid to account for remittances. Research shows that undocumented immigrants send about 10 percent of their income to families in their countries of origin, so this portion of undocumented taxpayers’ income is unavailable for taxable consumption. 18

• Property tax: The first step in calculating property taxes was to identify the share of undocumented immigrant families who are homeowners or renters in each state. This analysis used state-by-state data from the MPI to estimate homeownership rates for undocumented immigrants in each state. The mod-el assumes that for renters, half of the cost of the property tax paid initially by owners of rental properties is passed through to renters.

• Income tax: Various studies have estimated between 50 and 75 percent of undocumented immigrants currently pay personal income taxes using either false social security (SSN) or individual tax identification (ITIN) numbers.19 This analysis assumes a 50 percent compliance rate for current taxes and 100 percent post-reform (for both granting permanent lawful residence to all undocumented immigrants and under the executive actions).

Undocumented taxpayers are currently unable to claim state Earned Income Tax Credits (EITC) in states where they are available to documented taxpayers. This has the effect of increasing the effective income tax rates paid by these undocumented taxpayers under current law. Post-reform (for both granting lawful permanent residence to all undocumented immigrants and under the executive actions), the model assumes eligible undocumented taxpayers would receive the benefits of state EITCs in the 24 states with fully-funded credits.

Additional indicators used to make calculations for anticipated state and local tax changes from granting permanent legal residence or under the executive actions:

• Wage boost: Researchers at the Fiscal Policy Institute examined a number of studies on immigrant wages including some on the experience of legalization post-1986 immigration reform on wages as well as more recent studies. The consistent finding was that legal immigrants had higher wages than undocumented immigrants and that gaining legal status could boost wages anywhere between 6 and 15 percent.20 A Congressional Budget Office report on the economic impact of immigration reform estimated the eventual wage boost to be 12 percent.21 An analysis from the Center for American Progress estimates that the 5 million workers who directly benefit from the president’s action will see a wage premium of 8.5 percent.22

Our analysis assumes a conservative estimate of a 10 percent wage hike under granting permanent legal residence for all 11.4 undocumented immigrants and a 7.5 percent wage hike under the terms of the president’s executive actions which affects up to 5.2 million undocumented immigrants. An increase in income would also contribute to a slight increase in the sales, property and income tax payments of the currently undocumented immigrant population.

• Personal income tax compliance: As explained above, current estimates of undocumented immigrants’ income tax compliance rates ranges from 50 to 75 percent. To calculate the anticipated income tax gain from allowed undocumented immigrants to work in the US legally (under permanent legal residence or the executive actions), this analysis assumes full compliance with state personal income tax laws post-reform. It is important to note that the same tax rules and provisions that apply to the general population will apply to undocumented immigrants filing income taxes.

• Earned Income Tax Credit eligibility: Undocumented immigrants are currently ineligible to receive the federal Earned Income Tax Credit (EITC). The federal EITC was introduced in 1975 to provide targeted tax reductions to low-income workers. The credit varies with income levels and is based on earned income such as salaries and wages as well as family size.

This analysis assumes that undocumented immigrants will become eligible for the credit if granted permanent legal residence and under the executive actions thus making them eligible for the state versions of the credit. The states with permanent EITCs included in this report are: Connecticut, District of Columbia, Delaware, Iowa, Illinois, Indiana, Kansas, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Nebraska, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Rhode Island, Virginia, Vermont, and Wisconsin. Colorado and Washington are excluded because their EITCs are currently unfunded.

For more indepth appendices read the pdf.

End Notes

1Migration Policy Institute, Unauthorized Immigrant Population Profiles, November 2014. Available at: http://www.migrationpolicy.org/ programs/us-immigration-policy-program-data-hub/unauthorized-immigrant-population-profiles

2 Migration Policy Institute, National and State Estimates of Populations Eligible for DAPA and DACA Programs, 2009-2013.

3 Ibid.

4 Institute on Taxation and Economic Policy, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, January 2015. Available at: www.whopays.org

5 See this report’s methodology section for more information about tax compliance.

6 Supra note 4.

7 See among others: Feinleib, Joel and David Warner, The Impact of Immigration on Social Security and the National Economy, Social Security Advisory Board, Issue Brief No. 1, December 2005 (Available at www.ssab.gov/brief-1-immigration.pdf); Singer, Paula and Linda Dodd Major, Identification Numbers and U.S. Government Compliance Initiatives, Tax Analsyts Special Report, 2004; and Cornelius, Wayne and Jessica Lewis, Impacts of Border Enforcement on Mexican Migration: The View from Sending Communities, La Jolla, Calif.: University of California at San Diego, Center for Comparative Immigration Studies, 2007.

8 Kallick, David Dyssegaard, Three Ways Immigration Reform Would Make the Economy More Productive, Fiscal Policy Institute, June 4 2013. Available at: http://fiscalpolicy.org/wp-content/uploads/2013/06/3-ways-reform-would-improve-productivity.pdf See Appendix A: A Review of the Literature on Legalization and Earnings. Also, see this report’s methodology section for more information on the wage effects of granting permanent legal residence to the entire undocumented population as well as the wage effects on those affected by the presidents executive actions.

9 Supra note 2.

10 Supra note 2.

11 Supra note 2.

12 Supra note 1.

13 Supra note 2.

14 Passel and Cohn, Unauthorized Immigrant Population, National and State Trends, 2010, Pew Research Center, Feb. 1, 2011.

15 Supra note 1.

16 Supra note 1.

17 Supra note 4.

18 See, for example, Manuel Orozco, Remittances to Latin America and the Caribbean: Issues and Perspectives on Development, Report Com-missioned by the Organization of American States, September 2004.

19 Supra note 7.

20 Supra note 8.

21 Congressional Budget Office, Cost Estimate for S. 744 (Border Security, Economic Opportunity, and Immigration Modernization Act), June 2013. Available at: http://cbo.gov/sites/default/files/cbofiles/attachments/s744.pdf

22 Oakford, Patrick and Philip E. Wolgin, The Economic and Fiscal Benefits of Deferred Action, 2014, Center for American Progress. Avail-able at: https://www.americanprogress.org/issues/immigration/news/2014/11/21/102041/the-economic-and-fiscal-benefits-of deferred-action/