An updated version of this report has been published with data through July 1, 2017.

Read this policy brief in PDF form

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

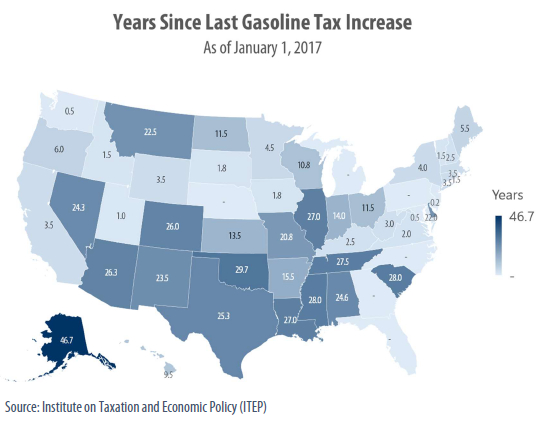

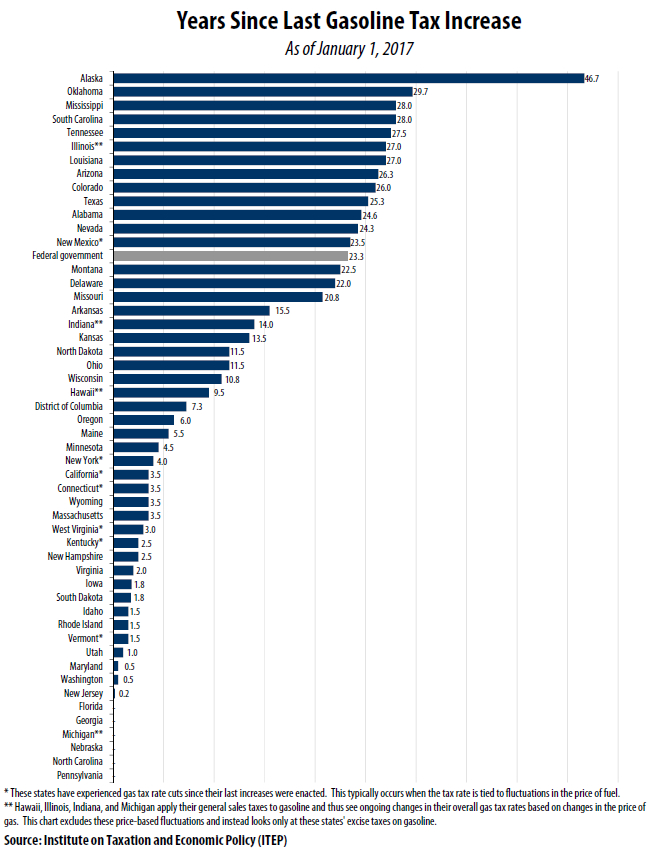

The chart accompanying this brief shows (as of January 1, 2017) the number of years that have elapsed since each state’s gas tax was last increased.[1]

Among the findings of this analysis:

- Twenty-two states have waited a decade or more since last increasing their gas tax rates.

- Sixteen states have gone two decades or more without a gas tax increase.

- Five states have not implemented an increase in their gas tax rates since the 1980s or earlier: Alaska, Oklahoma, Mississippi, South Carolina, and Tennessee.

Gas taxes cannot provide adequate revenue for transportation infrastructure projects unless their tax rates are periodically adjusted to keep pace with rising construction costs, and to offset revenue losses associated with improvements in vehicle fuel-efficiency. State gas tax rates that have not been updated in many years, or even decades, have seen significant declines in their purchasing power. Those declines are negatively impacting state funding of economically vital infrastructure projects.

[1] These figures are based on the date that each gasoline tax increase took effect, as opposed to the date on which it was signed into law.