Read Report as PDF (Includes Full Appendices)

INTRODUCTION

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of loopholes in state tax systems by corporate accountants; significant cuts in state corporate tax rates; and the erosion of state corporate tax bases, largely due to ill-advised state-level linkages to the federal system.

How is this playing out in the states? Indiana offers one illustration. In 2011, state lawmakers enacted a significant across-the-board tax cut for corporations, which is still being phased-in and will eventually slash the state’s effective tax rate from 8.5 to 4.9 percent. But even with this cut on the way, the Carrier Corporation announced in February of 2016 that it was going to move 2,100 jobs from Indiana to Mexico. Later the same year, in a move that made national headlines, the “Carrier Deal” was struck by incoming President Trump and Indiana Governor Mike Pence, keeping 1,000 jobs in the state in exchange for a package of state and local tax incentives. Oddly enough, however, those incentives were dwarfed in size by the cost savings the company stood to receive from making the move to Mexico. There has since been speculation that tax considerations were inconsequential to the company’s decision-making process and that Carrier, whose parent company depends heavily on taxpayer-funded federal contracts for its business, simply wished to remain in the good graces of the Trump Administration. Nonetheless, Carrier accepted both the incentives and the rate cuts while the state’s revenue collections for vital programs suffered as a result.

This report is the third in a series of comprehensive studies that look at the taxes paid by the most consistently profitable Fortune 500 corporations (over the eight-year period from 2008 to 2015). In March of 2017, we released The 35 Percent Corporate Tax Myth, showing that many Fortune 500 corporations have been able to sharply reduce their federal income tax bills, often reducing them to zero—or less—in years when they were quite profitable. Here, we take a hard look at what many of these same corporations paid over that eight-year span in state income taxes nationwide.

Of the 258 profitable Fortune 500 corporations included in our federal study, 240 fully disclosed their state and local income tax payments.[1] Here are some of the key facts that these companies’ annual reports reveal:

• Between 2008 and 2015, these 240 companies paid state income taxes equal to less than 2.9 percent of their U.S. profits. Since the average statutory state corporate tax rate is about 6.25 percent (weighted by gross state product), that means that over this period, more than half of their profits escaped state taxes entirely.

• If these 240 corporations had paid the 6.25 percent average state corporate tax rate on the $3.7 trillion in U.S. profits that they reported to their shareholders, they would have paid $231.8 billion in state corporate income taxes over the 2008-15 period. Instead, they paid only $105.8 billion. Thus, these 240 companies avoided a total of $126 billion in state corporate income taxes over the eight years.

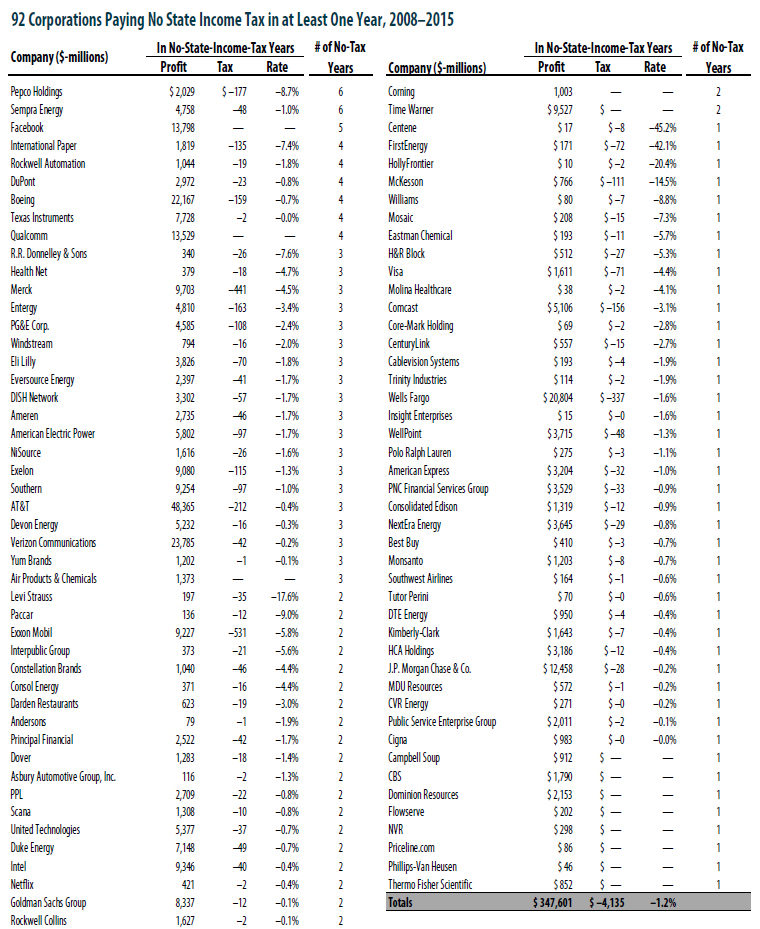

• 92 of the 240 companies managed to pay no state income tax at all in at least one year from 2008 through 2015, despite telling their shareholders they made $348 billion in pretax U.S. profits in those no-tax years. Forty-nine of these companies enjoyed multiple no-tax years.

• Nine companies, including Dupont, International Paper, and Facebook, paid no net state income tax in at least four years during this eight-year period.

• And four companies, Pepco Holdings, International Paper, Levi Strauss and Ameren, managed to pay zero or less in state income tax during the eight-year period taken as a whole.

• In 2015 alone, 24 companies paid no state income tax. Another 131 of the companies paid less than half the weighted-average statutory state corporate tax rate that year, meaning that more than half of the companies in our sample paid less than half the average legal state tax rate in that year.

This report comes at a time when lawmakers in a number of states (including Louisiana, Oklahoma, and West Virginia) have considered outright repeal of their state corporate income taxes, and when several other states (including Arizona, Illinois, Indiana, Mississippi, New Mexico, North Carolina, and the District of Columbia) have moved to cut their corporate tax rates. In a continued “race to the bottom” in corporate tax policy, many states are also moving toward a “single sales factor”—more on this below.

But the report’s findings suggest that the first step in true corporate tax reform should be ensuring that the very biggest and most profitable corporations are paying something resembling the legal tax rate. When these large companies are able to dodge state income taxes on their U.S. profits, the inevitable impact is a tax shift away from big corporations and onto everyone else, including small businesses and middle-income families. Creating a level playing field between large businesses and “mom and pop” businesses should be a priority for state policymakers—but that is best done by repealing harmful tax giveaways, not by repealing the corporate tax outright.

Note on interpreting the findings of this report

The companies in our survey typically operate all over the country. But they don’t disclose their profits and taxes on a state-by-state basis—so the findings of this report don’t tell us conclusively whether individual companies paid any income tax in specific states. Instead, what we know is how much these companies have paid to all states in which they do business. The tables at the end of this report sort the tax data for all 240 companies not only alphabetically and by tax rates, but also by the location of each company’s headquarters. On the pages that follow, we give details about the 92 firms that paid no state income tax in at least one year from 2008 through 2015.

THE LONG-TERM DECLINE OF STATE CORPORATE INCOME TAXES

Few state tax trends are as striking as the rapid decline of state corporate income tax revenues. As recently as 1986, state corporate income taxes equaled 0.5 percent of nationwide Gross State Product (GSP) (a measure of statewide economic activity). But in fiscal year 2013 (the last year for which data are available), state and local corporate income taxes were just 0.33 percent of nationwide GSP—representing a decline of over 30 percent. Even more worrisome is that as corporate profits have rebounded (and boomed) in recent years, state and local corporate taxes have not kept pace: corporate taxes as a share of nationwide corporate profits remain near the lowest point in the past quarter century.

This long-term decline in the state corporate income tax has three broad causes: the trickle-down impact of federal corporate tax cuts, ill-advised tax “incentives” intentionally enacted by state lawmakers, and unintended tax shelters created by companies armed with creative accounting staffs.

State tax “incentives”

State elected officials often find it difficult to resist entreaties from corporations for tax breaks justified on the dubious grounds that they will stimulate “economic development.” Hardly a week goes by without a state contemplating some kind of new corporate tax break, either as an across-the-board entitlement for all corporations or to attract a high priority target.

Individual corporations often push for special tax breaks to supposedly encourage new business investment—or to prevent a company from leaving the state—and will make threats of what will happen if these demands are not met. But these standoffs gloss over an important fact: that taxes and public investment go hand in hand. A sustainable, loophole-free tax system is vital to maintaining high-quality infrastructure that ultimately makes a state a good place to live, work, and invest.[2]

And yet, more than half the states continue to offer investment tax credits against their corporate tax, more than thirty years after the federal government abandoned its investment credit because Congress and President Reagan concluded that it was ineffective in stimulating investment. According to a study by University of Iowa economist Peter Fisher, the effective corporate tax rate on manufacturing companies in the 20 states he studied fell by 30 percent between 1990 and 1998 alone. Tax incentives, most of them corporate tax credits, offset 30 percent of corporate tax liability in these states in 1998—up from 10 percent in 1990.[3] State corporate tax credits for everything from providing child care to employees, to conducting product research and development, to cleaning up polluted “brownfields” continue to proliferate.

In the short run, it may be too much to ask for states to stop offering company-specific tax breaks. But as the work of the nonprofit watchdog group Good Jobs First has documented, states can at least adopt straightforward job-creation requirements and “clawback rules” designed to ensure that states get their money’s worth when they offer companies tax breaks to expand, relocate or simply stay where they are.

Corporate tax sheltering through profit-shifting among states

Besides extorting new tax incentives from state officials, big corporations have become increasingly adept at taking advantage of loopholes in state corporate tax systems—loopholes over and above the ones that plague the federal corporate income tax and flow down to the state level. Most of these loopholes allow corporations to artificially shift their profits (on paper) from the states in which they are actually earned into states that tax them at lower rates or not at all.

Profit shifting among states is enabled by a provision of most states’ corporate tax laws that treats every individual corporation in a multi-corporate group (that is, the parent and potentially dozens or even hundreds of subsidiaries) as a separate corporation for tax purposes. This practice —known as “separate-entity taxation”—enables a number of tax avoidance techniques:

The Toys “R” Us Shelter: The most notorious tax shelter that separate-entity taxation facilitates is the “Delaware Holding Company,” used most famously by Toys “R” Us. In the most common scenario, a corporation that operates retail stores transfers its logos and other trademarks to a subsidiary corporation it has created in a tax-haven state such as Delaware or Nevada. The stores then pay royalties to this subsidiary for the right to display the trademarks. These royalties are tax-deductible (as a cost of doing business) and hence can be used to largely or entirely eliminate corporate income tax liability in the states in which the corporation is actually operating stores and earning its profits. Meanwhile, the royalty payments are not taxed by the tax-haven state.[4]

Asset-Transfer Shelters: A second tax-avoidance strategy exploiting state corporate income taxes that treat parents and subsidiaries as separate taxpaying entities involves spinning off income generating assets into subsidiaries in tax haven states. This technique received a lot of attention in Wisconsin.[5] There, state auditors discovered that the vast majority of banks in the state had set up subsidiaries in corporate-income-tax-free Nevada, to which they had transferred the ownership of loans, mortgage-backed securities, and “other intangible assets” in a tax-free transaction involving taking back an equal amount of stock. Even though the intangible assets had been purchased with deposits from Wisconsin households and businesses, and even though the interest paid to those depositors was presumably being deducted by the banks (not to mention the depreciation on the bank branches and the wages paid to the bank employees), the interest and capital gains generated by the Nevada-based intangibles had been placed beyond the tax reach of Wisconsin. If small-town banks in Wisconsin had discovered how to use Nevada subsidiaries to cut their taxes, it’s a safe bet that big multistate banks have figured it out, too.

Transfer-Pricing Shelters: Finally, most state corporate income taxes are vulnerable to serious erosion through what is called “transfer pricing.” If a widget manufacturer in Georgia (with a top corporate income tax rate of 6 percent) has a warehouse in South Carolina (top rate of 5 percent), it can reduce its total taxes due to the two states by incorporating the warehouse as a “wholesaling subsidiary.” The plant then charges the subsidiary an artificially-low price for the widgets, which reduces its taxable income in Georgia and shifts it into South Carolina, where it will be taxed at a lower rate. This same transfer-pricing game, played internationally, is widely understood to be a major source of the recent erosion of the federal corporate income tax. The IRS, with all of its tax lawyers and economists, has had a poor track record in proving that multinational corporations’ international transfer prices are resulting in an abusive shifting of income beyond U.S. borders. State revenue officials are well aware of this, and some make no more than a token effort to police interstate transfer prices—opening the door to significant revenue losses.

State level policy changes

Over the past decade, states have seen a long-term decline in their corporate income taxes. In the name of economic development, there has been an onslaught of corporate income tax rate cuts and steps taken to gradually phase out these taxes. Such attempts to roll back corporate taxes across the country have resulted in extensive revenue loss, deeper budget gaps, and resulting cuts to vital programs. Yet, this session alone, despite revenue shortfalls, Oklahoma’s Gov. Mary Fallin, Louisiana’s Gov. John Bel Edwards, and the West Virginia legislature have called for the elimination of the tax.

In the past two decades, business lobbyists have prioritized one particular tax break, the “single sales factor,” in their state tax lobbying efforts. The single sales factor is an arcane, but costly change in the formula that states use to divide the profits of multistate corporations among themselves for tax purposes.[6] Historically, many states taxed multistate businesses using a “three-factor” formula that takes into account the proportion of a company’s property, payroll and sales that were made in each state. But in the name of economic development, these corporations are now pressuring states to tax them only in proportion to the sales they make in a state. Among the problems with this approach, however, is the fact that federal law says that merely making sales in a state doesn’t necessarily make a corporation taxable. So if a state adopts the sales-only formula, then a resident corporation whose sales are entirely out of state won’t pay anything to its home state, and it may not be taxable in any of its customers’ states, either. This could lead to no corporate income tax liability to any state—what is often called “100 percent nowhere income.”

The single sales factor is a classic example of the “race to the bottom” in state corporate tax policy. When only a few states offered this giveaway, it may have helped to convince some companies to relocate or expand. But when a majority of states have abandoned the traditional “three-factor” formula in favor of heavily weighting sales, it is likely that companies will be rewarded with tax cuts no matter where they invest—which means that this incentive has no incentive effect in any particular state. As Appendix A

shows, all but eight of the states with corporate income taxes have increased the weight of their sales factor. Under these circumstances, the only winners from the single sales factor are the companies that ultimately pay less in taxes.

Linkage to federal tax laws means a steady stream of federally-imposed tax cuts

States levying a corporate income tax generally use federal income definitions as a starting point in calculating their own corporate tax base, so that the first line on state corporate tax forms is typically “taxable income” as previously calculated on federal tax forms. This makes state tax compliance and enforcement easier—but also means that in many states, every new corporate loophole that gets tucked into the federal code will also erode the state tax base. Even if these federal tax breaks, many of which are ostensibly designed to encourage business investment, are having an effect nationally, it makes little sense for any state to piggyback on a tax cut that could encourage investment anywhere in the United States.

Fortunately, every state has the option of “decoupling” from specific federal corporate giveaways—and many have chosen to disallow some of the costly tax deductions enacted by Congress in the last decade. For example, more than half of the states with corporate income taxes decoupled from the “bonus depreciation” first enacted by Congress in 2002, and almost half the states rejected the special manufacturing tax breaks ratified by Congress in 2004. But dozens of states have seen their tax bases shrink due to federal base-narrowing measures, often because they cannot marshal the legislative votes to decouple in a timely way.

POTENTIAL PATHS TO STATE CORPORATE TAX REFORM

Some people have looked at the wide variety of corporate state-tax-avoidance strategies and concluded that the state corporate income tax is beyond repair. But the truth is that states have lots of tools in their arsenals to revitalize this still important—and progressive—source of revenue. Appendix A provides a state-by-state matrix showing which of these options are currently available to each state. Here are some of the most promising possibilities:

Combined Reporting

The single most important corporate tax reform available to states is to adopt a practice used by 25 states and the District of Columbia called “combined reporting,” which effectively treats a parent and its subsidiaries as one corporation for state tax purposes. Combined reporting eliminates most of the tax benefits of shifting profits into Delaware or Nevada by adding them back to the profits of the corporation that is taxable in the state and then taxing a share of the combined profit.[7] As the visibility of corporate “income shifting” scams has increased in recent years, support for this reform has grown nationwide: in the past decade, several states have enacted combined reporting. The two most recent states to enact combined reporting are Rhode Island in 2014 and Connecticut in 2015.

It is likely that the spread of combined reporting has helped to keep the state income tax from experiencing a much more serious decline, and it is a tremendous accomplishment that more than half of the states with broad-based corporate income taxes now require combined reporting. Yet the combined-reporting states could make their reporting regime even more leakproof by adopting “worldwide” combined reporting. Combined reporting is usually limited to the “water’s edge”—that is, to U.S. based parents and subsidiaries. About a half-dozen states, most notably California, have adopted worldwide combined reporting, but each of these states allow companies to elect to use water’s edge rules—which any company engaged in international tax avoidance would presumably choose to do. Several states, most recently Oregon, have taken a valuable half-step toward worldwide combined reporting by including in the combined report subsidiaries set up in a number of foreign tax havens—eliminating the state corporate income tax benefits of artificially shifting income into those countries. Almost all of the other states with combined reporting could productively enact a similar change.

“Nowhere Income”

Another key reform is a rule implemented by about half the corporate income tax states that eliminates “nowhere income” arising from the mismatch between the laws that establish when a corporation has crossed the taxability or “nexus” threshold in a state and the rules that divide a corporation’s profit for tax purposes among the states. As noted above, federal law prevents a state from automatically being allowed to tax any corporation that makes sales to its residents. At the same time, the income-division rules always take sales into account to some extent in assigning income for tax purposes—meaning that income can be assigned to states that don’t have the authority to tax it. “Nowhere income” can be eliminated by a so-called “throw-back rule” that effectively assigns any corporate profit that cannot be taxed in the states where a corporation’s customers are located back to the state(s) where the goods are produced. About half the states lack this rule.[8]

Alternative Corporate Taxes

States can consider adopting some form of alternative minimum tax (AMT) to ensure that corporations pay some tax no matter how many loopholes they are able to take advantage of. A number of states piggyback on the federal corporate AMT, but this has become much less useful because the federal AMT has been seriously watered-down over time by Congress. States could consider rejuvenating the older federal AMT rules as an alternative, less loophole-prone tax regime. States could also consider using the pretax profits that companies report to their shareholders as the basis for an alternative tax. Since companies are usually reluctant to tell their shareholders they aren’t making healthy profits, this approach provides a built-in check against corporate tax avoidance. Corporations are required to show their profits reported to shareholders on their federal tax returns, and this could prove helpful to states in obtaining the necessary data.

A second-best approach to alternative corporate taxes is a flat-dollar minimum tax, which over a dozen states currently require. These taxes can act as a vital backstop to ensure that large corporations have some “skin in the game,” although these flat-dollar taxes are often set perilously close to zero. For example, a 2009 report from the Oregon Center for Public Policy found that more than 5,000 profitable corporations operating in Oregon had paid no income taxes in 2006 beyond the state’s $10 minimum tax.[9] (While Oregon lawmakers have not responded to this finding by eliminating corporate tax loopholes, they did subsequently increase the minimum tax for large corporations.) Flat-dollar minimum taxes are typically between $100 (as is the case in Utah) and $300 (Vermont). Appendix A shows the states that have not yet adopted a meaningful corporate minimum tax, by our standards one that exceeds $100.

| REPEAL CORPORATE INCOME TAXES?

Policymakers in a number of states have contemplated repealing state corporate income taxes in recent years. This session alone, Oklahoma’s governor pushed a tax agenda that would eliminate the state’s corporate income tax and West Virginia’s legislature moved proposals to do the same. Both states touted elimination despite sizable revenue gaps and in many cases without much discussion of how difficult it would be to structure a sustainable replacement for the corporate tax. Our 2011 ITEP Guide to Fair State and Local Taxes discusses the strong arguments for preserving, rather than repealing the corporate tax. Texas, a state that repealed its limited corporate tax in the last decade, has found that neither the revenue yield nor the popularity of its gross receipts tax replacement have lived up to expectations. The result has been a series of funding crises for vital Texas public investments. |

Enacting a Corporate Income Tax

Six states currently do not levy a broad-based corporate income tax at all. Three of these (Ohio, Texas and Washington) have chosen to levy a tax that falls primarily on a company’s gross receipts in lieu of a corporate income tax, usually on the theory that such a tax will be less volatile than a tax on profits. The other three states (Nevada, South Dakota and Wyoming) have neither a broad profits tax nor a meaningful gross receipts tax, although South Dakota does tax the income of certain financial corporations. Each of these six states could make their tax systems fairer and more sustainable by enacting a general tax on corporate profits.

Stop Providing State Corporate Tax Subsidies

When you find yourself in a hole, the first thing you need to do is stop digging. States need to stop giving away corporate taxes in the name of economic development. Chasing after businesses by fighting over who can give the largest tax concessions is a zero-sum game.[10] States should coordinate and agree to stop this futile, destructive competition. They should sunset ineffective tax credits and enter into pacts with each other not to use tax giveaways to compete for jobs. A good place to start would be to renounce the single-sales factor interstate income division formula that threatens to eviscerate what is left of the state corporate tax and return to a more balanced formula that all states can follow.

Decoupling from federal tax giveaways

The focal point of state “decoupling” efforts has been the so-called “bonus depreciation” measures enacted by Congress. This provision has been repeatedly extended and is set to phasedown and then expire at the end of 2019. These measures generally allow companies to deduct the cost of investments in machinery and equipment faster than they would otherwise be able to. When President George W. Bush pushed through a 2002 plan to allow companies to immediately write off 30 percent of the cost of eligible investments in the first year, more than 30 states decoupled from this measure by requiring companies to add back the bonus depreciation deduction to their taxable income. Similar numbers of states have decoupled from the more generous 50 percent bonus depreciation measures signed by President Bush in 2008 and extended by President Barack Obama in 2009, 2010, 2013 and 2015 but fifteen states lost corporate income tax revenue due to the federal bonus depreciation laws during the years covered in this report.

States have been less successful in decoupling from the so-called deduction for “qualified production activities income (QPAI).” This deduction was enacted in October of 2004 to compensate manufacturers for the loss of an unjustified and illegal (under World Trade Organization law) export subsidy. It is bad enough that Congress decided to hold manufacturers harmless for the loss of a tax break they didn’t need or deserve to begin with. But more than half of the states with corporate income taxes have compounded this error by conforming to a tax break that in no way is tied to the creation of manufacturing jobs in any particular state. Twenty-two states are now losing substantial amounts of corporate tax revenue due to this misguided federal tax break.[11]

The QPAI deduction is one major factor reducing state corporate tax rates over the past eight years—but its effect on state revenues in the future will likely be worse. This is because the deduction only took full effect at the beginning of 2010: from 2004 to 2006, the deduction was equal to 3 percent of qualifying income, increasing to 6 percent in 2007 and its permanent 9 percent rate at the beginning of 2010. This means that the full effect of this tax break on states was only felt for six of the eight years studied in this report.

A third type of federal tax break that has a pass-through effect on states is the “net operating loss carry-back” provision, which allows companies to use current-year income losses to offset income from earlier years. While virtually every state allows companies to carry losses forward, in accordance with federal rules, many states have decoupled from the federal provision that allows companies to rewrite history by carrying their losses back two years. Seventeen states, however, have not done so, and face continued revenue losses from their inaction on this tax break.[12]

Of course, if the perpetual rumblings about federal corporate tax reform develop into viable legislation in Congress, decoupling from at least some of these federal tax breaks may become a moot point: if federal law no longer allows these tax breaks, then neither will the states. While both the Trump administration and Republican leaders in Congress have put forth plans that would pare back some corporate tax breaks, however, the details of these plans have not yet been codified into legislation. And it’s likely that corporate lobbyists will put on a full court press to preserve their tax breaks when this legislation emerges.

Apart from decoupling their corporate income taxes from unwise federal corporate tax provisions, there are many other useful steps states can take on their own to revitalize their corporate income taxes.

CORPORATE TAX DISCLOSURE: A VITAL FIRST STEP TOWARD CORPORATE TAX FAIRNESS

While closing the corporate tax loopholes described above should be the immediate goal of any state policymakers who seek a sustainable corporate income tax, wishing cannot make it so. An important first step toward achieving these reforms is to build awareness among policymakers of the need for loophole-closing measures. Unfortunately, the deck is stacked against those who would create a more level playing field for business taxation at the state level, because typically no one—from lawmakers to the media to the general public—knows how their corporate tax system actually works. The vast majority of states now require “tax expenditure reports,” which provide a complete list of the corporate tax breaks allowed under state law along with an annual cost estimate for each tax provision. (Amazingly, a handful of states do not provide even this basic information; these states are listed in Appendix A.) But virtually none of the states provide comprehensive company-specific information on the wide array of corporate tax breaks allowed by the tax laws. This harsh reality affects the implications of this report as well: our finding that many companies are paying zero or less in state income taxes nationwide does not tell us whether they paid—or did not pay—the tax in any specific state. This is because the financial reports that all publicly traded companies must file with the Securities and Exchange Commission (SEC) each year include information on the nationwide amount of state corporate income taxes paid by each company in a given year, but do not provide similar numbers for each state in which the companies do business.

For this reason, a vital starting point for state corporate tax reform is a procedural move: states need to require corporations to disclose publicly, on a state-by-state basis, the amount of corporate income tax they pay and the major factors determining that liability (or lack thereof). Studies like the present one can show that there’s a serious problem with the state corporate tax on a national basis. However, without some clearer sense of the specific states in which tax payments are low—or nonexistent—and whether the low payments are due to “nexus” thresholds, income-division rules, the definition of taxable profits, and/or tax credits, policymakers cannot readily identify what they can do to rectify the situation, or even determine the seriousness of their particular state’s corporate tax problems.

Sensible goals for corporate tax disclosure efforts include:

✓ Identifying all the substantial tax deductions, exemptions and credits claimed by each large corporation in a state.

✓ Evaluating the net impact of these tax breaks on the bottom-line income tax payments of each corporation.

✓ Assessing the effectiveness of these tax breaks in creating jobs and growing the state’s economy.

While the measures listed above can help identify prominent “zero-tax” corporations, they are insufficient in determining whether corporations are paying their “fair share” of corporate taxes. Only disclosure of a company’s in-state profits and tax payments can allow an accurate analysis of whether specific companies are paying anywhere close to the statutory tax rate in their state.

Efforts to publicly “name names” of corporate tax avoiders, or even to publish statistics showing the aggregate number of profitable companies avoiding tax liability, have played a key role in encouraging meaningful loophole-closing reforms.

Happily, as the tax-subsidy watchdog group Good Jobs First has documented, a number of states have opened the door to corporate tax disclosure by requiring disclosure of a limited number of tax breaks claimed by specific companies. In dozens of states, companies claiming specific tax breaks must disclose how much they received, and how many jobs they have created in exchange for these tax breaks.

The policy path to a more sustainable state corporate income tax is clear. But absent detailed information about the extent of corporate tax avoidance and the effectiveness of the tax breaks lawmakers have chosen to allow, policymakers will likely never see corporate tax reform as a goal worth pursuing. Disclosure of company-specific tax breaks can help lawmakers to see the light.

CONGRESSIONAL ACTIONS THREATEN TO FURTHER WEAKEN THE CORPORATE TAX

Tax breaks enacted by the federal government are at least partly to blame for the long, slow decline of the state corporate income tax—and Congress has shown remarkably little interest in minimizing the damage its enacted tax breaks do to state finances.

From this perspective, the good news is that Congress seems at least somewhat aware of the impact federal laws can have on state corporate taxes. The bad news is that leading tax writers in the U.S. House of Representatives appear ready to use this knowledge to hamstring state corporate taxes rather than enabling them. In June of 2015, Representative Steve Chabot re-introduced the so-called “Business Activity Tax Simplification Act” (BATSA), which would make it substantially more difficult for states to effectively tax the income earned by corporations from activities within their borders. An earlier version of this bill was approved by the House Judiciary Committee in 2011.

The bill’s sponsors—and the corporate lobbyists pushing this plan— say that the goal of the bill is to limit state and local governments to taxing only those businesses with a “physical presence” in a state. But this argument is problematic in two important ways.

First, the “physical presence” standard may have made sense in an earlier era, but doesn’t make any sense in the internet age. We all buy many goods and services from companies that do not have physical facilities in our state, and these companies clearly benefit from the state and local services that make these purchases possible.

Second, even if physical presence were a sensible standard, the current BATSA legislation’s definition of physical presence is so loophole-ridden as to be meaningless. The bill has a variety of loopholes that allow large corporations with lobbying clout to avoid state and local taxes even though they have what any rational person would call a “physical presence” in the jurisdiction. For example, under BATSA, a company that sends a full-time worker into another state each day to install equipment could be subject to that state’s taxes. But if the company simply created two subsidiaries which each provided half of the equipment and which each hired the worker to perform the installations, the state would be unable to tax the business under BATSA.

Under BATSA, the state would also be able to tax a business if the employee was only sent into the state for 14 days each year, or if the company created several subsidiaries that each hired the employee and sent him or her into the state for 14 days each year. Even warehousing items in a state before shipping them to customers could easily be done in a way that avoided the “physical presence” standard, if a company hired a second company to warehouse the goods before shipping them to in-state customers.

Put another way, the BATSA legislation currently before Congress would greatly increase the complexity of tax administration while providing clear incentives for companies to “game the system” in an effort to avoid paying any state corporate taxes on their income.

ECONOMIC NEXUS: A SENSIBLE STANDARD FOR DEFINING CORPORATE TAXABILITY

Even as some corporate lobbyists are encouraging Congress to enact a “substantial physical presence” standard that would further curtail the ability of states to tax at least some of the income of multi-state corporations, a number of states are taking somewhat aggressive—but sensible—steps to tax some of the income of companies that clearly benefit from using their infrastructure to sell into a state, yet don’t satisfy the “physical presence” standard because they don’t have property or employees based in the state. The common-sense observation behind this alternative “economic presence” standard is that in the internet age, multi-state companies can routinely do millions of dollars in business in a given state without ever setting foot there—and that there needs to be a way to define the threshold level of business activity above which these companies should be taxed by each state.

Economic nexus has been upheld by a number of courts. Most recently (in 2011), the U.S. Supreme Court declined to consider overturning a decision by the Iowa Supreme Court that allowed the state of Iowa to tax fast-food giant KFC, which avoids having a traditional “physical presence” in Iowa by leasing its secret recipe (and logo) to independent franchisees based in the state. This series of court decisions clearly indicates that many states could (and should) do more to prevent companies like KFC from using the physical presence standard to avoid paying their fair share of state corporate income taxes. While almost every state asserts nexus over at least some corporations based on economic activities (with California, Colorado, Connecticut, Michigan, New Hampshire, New York, Oregon and Wisconsin each adopting an economic nexus standard in the last decade), virtually none of the states have fully exercised this ability.

CONCLUSION

The data in this report show in stark terms just how successful large, multistate and multinational corporations have become at shirking their tax responsibilities to state and local governments. They have been abetted in this effort by America’s major accounting firms, have used heavy lobbying and even threats to extract further tax breaks, and have often persuaded state elected officials to become their facilitators. As a result, individual taxpayers and purely in-state (usually smaller) businesses are paying a heavy price, in the form of higher taxes, reduced public services and unfair competition.

But the report is as notable for what it does not tell us—and for what state policymakers are simply not equipped to know—about how businesses in each state are paying taxes.

State taxpayers can continue to tolerate this situation, or they can call on their elected representatives to take steps to address it. This report outlines some pathways to state corporate tax reform. If adopted, they would help restore state corporate income taxes to the progressive—and popular—way to pay for needed state programs.

METHODOLOGY

This study represents an in-depth look at state (and local) corporate income taxes over the 2008-15 period. It is based on data collected for a March 2017 study of federal corporate tax payments published by the Institute on Taxation and Economic Policy, titled The 35 Percent Corporate Tax Myth. That report covered 258 large Fortune 500 corporations. This new state corporate report includes the 240 companies of those 258 that fully disclosed their state corporate income tax payments. Over the eight-year period, these 240 companies reported $3.7 trillion in pretax U.S. profits, and, on average, paid state taxes on about half of that amount.

1. Choosing the Companies

Our report is based on corporate annual reports to shareholders and the similar 10-K forms that corporations are required to file with the Securities and Exchange Commission (SEC). We relied on electronic versions of these reports from the companies’ web sites or from the SEC web site.

As we pursued our analysis, we gradually eliminated companies from the study based on two criteria: either (1) a company lost money in any one of the eight years; or (2) a company’s report did not provide sufficient information for us to accurately calculate its domestic profits, current state income taxes, or both.

Some companies did not report data for all of the eight years between 2008 and 2015, either because their initial public offering occurred after 2008 or because they were spun off of parent companies after 2008. We included these companies in the sample only if they reported data for at least 6 of the 8 years.

2. Method of Calculation

Conceptually, our method for computing effective state corporate tax rates was straightforward. First, a company’s domestic pretax profit was determined. (We excluded foreign profits since state income taxes do not apply to them.) We then determined a company’s current state income taxes. Current taxes are those that a company is obligated to pay during the year; they do not include taxes “deferred” due to various “tax incentives.” Finally, we divided current taxes by pretax profits to determine effective tax rates.

A. Issues in measuring profits

The pretax U.S. profits reported in the study are generally as the companies disclosed them.[13] In a few cases, if companies did not separate U.S. pretax profits from foreign, but foreign profits were obviously small, we made our own geographic allocation, based on a geographic breakdown of operating profits minus a prorated share of any expenses not included therein (e.g., overhead or interest), or we estimated foreign profits based on reported foreign taxes or reported foreign revenues as a share of total worldwide profits.

Where significant, we adjusted reported pretax profits for several items to reduce distortions. In the second half of 2008, the U.S. financial system imploded, taking our economy down with it. By the fourth quarter of 2008, no one knew for sure how the federal government’s financial rescue plan would work. Many banks predicted big future loan losses, and took big book write-offs for these pessimistic estimates. Commodity prices for things like oil and gas and metals plummeted, and many companies that owned such assets booked “impairment charges” for their supposed long-term decline in value. Companies that had acquired “goodwill” and other “intangible assets” from mergers calculated the estimated future returns on these assets, and if these were lower than their “carrying value” on their books, took big book “impairment charges.” All of these book write-offs were non-cash and had no effect on either current income taxes or a company’s cash flow.

As it turned out, the financial rescue plan, supplemented by the best parts of the economic stimulus program adopted in early 2009, succeeded in averting the Depression that many economists had worried could have happened. Commodity prices recovered, the stock market boomed, and corporate profits zoomed upward. But in one of the oddities of book accounting, the impairment charges could not be reversed.

Here is how we dealt with these extraordinary non-cash charges, plus “restructuring charges,” that would otherwise distort annual reported book profits and effective tax rates:

1. Smoothing adjustments

Some of our adjustments simply reassign booked expenses to the year’s that the expenses were actually incurred. These “smoothing” adjustments avoid aberrations in one year to the next.

a. “Provisions for loan losses” by financial companies: Rather than using estimates of future losses, we generally replaced companies’ projected future loan losses with actual loan charge-offs less recoveries. Over time, these two approaches converge, but using actual loan charge-offs is more accurate and avoids year-to-year distortions. Typically, financial companies provide sufficient information to allow this kind of adjustment to be allocated geographically.

b. “Restructuring charges”: Sometimes companies announce a plan for future spending (such as the cost of laying off employees over the next few years) and will book a charge for the total expected cost in the year of the announcement. In cases where these restructuring charges were significant and distorted year-by-year income, we reallocated the costs to the year the money was actually spent (allocated geographically).

2. “Impairments”

Companies that booked “impairment” charges typically went to great lengths to assure investors and stock analysts that these charges had no real effect on the companies’ earnings. Some companies simply excluded

impairment charges from the geographic allocation of their pretax income. For example, Conoco Phillips as-

signed its 2008 pretax profits to three geographic areas, “United States,” “Foreign,” and “Goodwill impairment,”

implying that the goodwill impairment charge, if it had any real existence at all, was not related to anything on this planet. In addition, many analysts have criticized these non-cash impairment charges as misleading, and even “a charade.”[14] Here is how we treated “impairment charges”:

a. Impairment charges for goodwill (and intangible assets with indefinite lives) do not affect future book income, since they are not amortizable over time. We added these charges back to reported profits, allocating them geographically based on geographic information that companies supplied, or as a last resort by geographic revenue shares.

b. Caveat: Impairment charges to assets held for sale soon were not added back. All significant adjustments to profits made in the study are reported in the company-by-company notes to The 35 Percent Corporate Tax Myth, which is available at www.ctj.org or www.itep.org.

c. Impairment charges to assets (tangible or intangible) that are depreciable or amortizable on the books will affect future book income somewhat (by reducing future book write-offs, and thus increasing future book profits). But big impairment charges still hugely distort current year book profit. So as a general rule, we also added these back to reported profits if the charges were significant.

B. Issues in measuring state income taxes.

The primary source for current state income taxes was the companies’ income tax notes to their financial statements. From reported current taxes, we subtracted “excess tax benefits” from stock options (if any), which reduced companies’ tax payments but which are not reported as a reduction in current taxes, but are instead reported separately (typically in companies’ cash-flow statements). We divided the tax benefits from stock options between federal and state taxes based on the relative statutory tax rates (using a national average for the states).

3. Negative Tax Rates

A “negative” effective tax rate means that a company enjoyed a tax rebate, usually obtained by carrying back excess tax deductions and/or credits to an earlier year and receiving a tax refund check.

4. Note

Companies do not provide information on their state income taxes on a state-by-state basis. As a result, the figures in our report show only the companies’ nationwide state income taxes.

[1] A full methodology for the report is available in the appendix.

[2] See Institute on Taxation and Economic Policy. “Taxes and Economic Development 101.” September 2011. http://itep.org/itep_reports/2011/09/taxes-and-economic-development-101.php

[3] See Peter Fisher, “Tax Incentives and the Disappearing State Corporate Income Tax,” State Tax Notes, Mar. 4, 2002, pp. 767-774. Policy Priorities, revised Sept. 2005.

[4] See Michael Mazerov, “Closing Three Common Corporate Income Tax Loopholes Could Raise Additional Revenue for Many States,” Center on Budget and Policy Priorities, Revised May 21, 2003, pp. 6-9.

[5] See Paul Gores, “State Reaches 87 Deals with Banks on Tax Shelters,” Milwaukee Journal Sentinel, Dec. 1, 2004.

[6] See Michael Mazerov, “The ‘Single Sales Factor’ Formula for State Corporate Taxes: A Boon to Economic Development or a Costly Giveaway?,” Center on Budget and Policy Priorities, revised Sept. 2005.

[7] See Michael Mazerov, “A Majority of States have Now Adopted A Key Corporate Tax Reform—Combined Reporting ,” Center on Budget and Policy Priorities, April 3, 2009.

[8] See Michael Mazerov, “Closing Three Common Corporate Income Tax Loopholes Could Raise Additional Revenue for Many States,” Center on Budget and Policy Priorities, Revised May 21, 2003.

[9] See “New Data Show Thousands of Profitable Corporations Pay No Oregon Income Taxes Except the $10 Minimum,” Oregon Center for Public Policy, February 23, 2009. http://www.ocpp.org/2009/02/23/new-data-show-thousands-profitable-corporations/

[10] See Institute on Taxation and Economic Policy. “Tax Incentives: Costly for States, Drag on the Nation,” August 2013. http://itep.org/itep_reports/2013/08/tax-incentives-costly-for-states-drag-on-the-nation.php

[11] See Institute on Taxation and Economic Policy, “The QPAI Corporate Tax Break: How it Works and How States can Respond,” 2001, http://www.itep.org/pdf/pb33qpai.pdf

[12] See Michael Mazerov, “Minority of States Still Granting Net Operating Loss ‘Carryback’ Deductions Should Eliminate Them Now,” Center on Budget and Policy Priorities, May 11, 2009.

[13] For multinational companies, we are at the mercy of companies accurately allocating their pretax profits between U.S. and foreign in their annual reports. Hardly anyone but us cares about this geographic book allocation, yet fortunately for us, it appears that the great majority of companies were reasonably honest about it.

[14] One article describes goodwill impairment charges as “a ludicrous charade” “which everyone and their brothers and sisters dismiss as merely the result of an arbitrary recalculation of an arbitrary calculation.” http://accountingonion.typepad.com/theaccountingonion/ 2010/01/goodwill impairment i love a charade reposted.html