Read the Report in PDF.

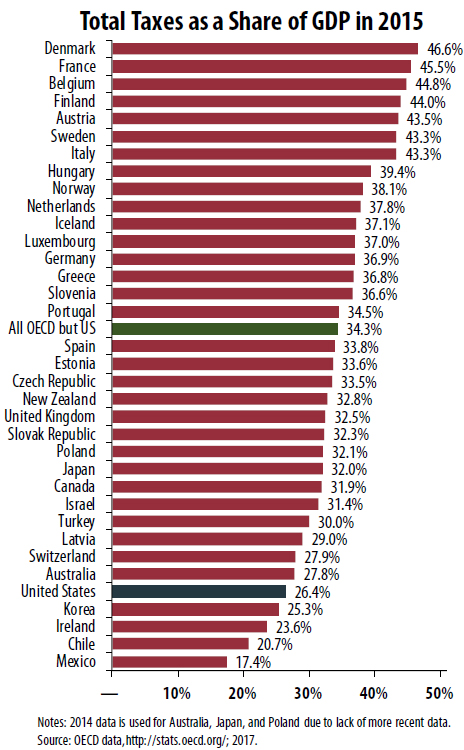

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.

According to the OECD, the United States had the fifth lowest level of total taxes — 26.4 percent of gross domestic product (GDP) — among the 35 OECD countries. Only Mexico, Chile, Ireland and Korea collected less in taxes as a percent of GDP. The level of taxation in the United States is well below the 34.3 percent OECD weighted average.

These facts offer important context at a time when the President of the United States and members of Congress wrongly insist that U.S. taxes are too high and that the path to economic prosperity is tax cuts.

This assertion has no basis in sound research and more federal tax cuts could, in fact, set the nation on an irresponsible fiscal path. Already, years of relatively low taxes have increased the national debt and forced draconian spending cuts. The nation’s current relatively low level of taxes leaves us unable to raise enough revenue to adequately fund education, infrastructure and healthcare and other priorities that are crucial to long-term economic growth and competitiveness. It is not a badge of honor that the United States is one of the least taxed developed countries. The OECD data demonstrate that even if lawmakers implemented necessary corporate and individual tax reforms that allowed the nation to collect more revenue in a progressive, fair way, the United States would remain one of the lowest taxed nations in the developed world.

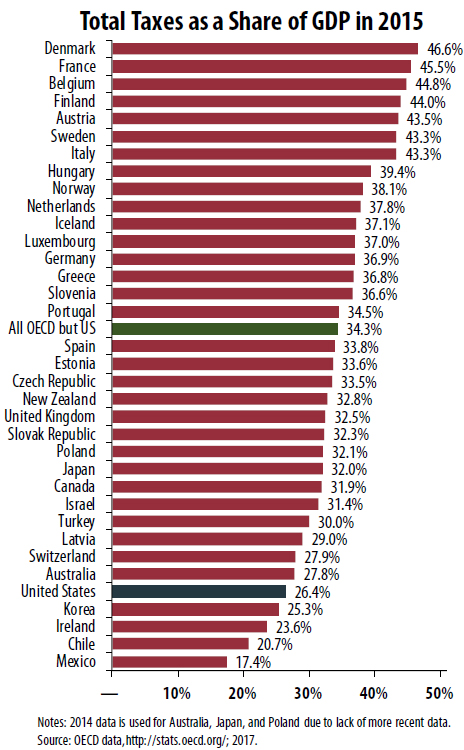

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.

According to the OECD, the United States had the fifth lowest level of total taxes — 26.4 percent of gross domestic product (GDP) — among the 35 OECD countries. Only Mexico, Chile, Ireland and Korea collected less in taxes as a percent of GDP. The level of taxation in the United States is well below the 34.3 percent OECD weighted average.

These facts offer important context at a time when the President of the United States and members of Congress wrongly insist that U.S. taxes are too high and that the path to economic prosperity is tax cuts.

This assertion has no basis in sound research and more federal tax cuts could, in fact, set the nation on an irresponsible fiscal path. Already, years of relatively low taxes have increased the national debt and forced draconian spending cuts. The nation’s current relatively low level of taxes leaves us unable to raise enough revenue to adequately fund education, infrastructure and healthcare and other priorities that are crucial to long-term economic growth and competitiveness. It is not a badge of honor that the United States is one of the least taxed developed countries. The OECD data demonstrate that even if lawmakers implemented necessary corporate and individual tax reforms that allowed the nation to collect more revenue in a progressive, fair way, the United States would remain one of the lowest taxed nations in the developed world.