By Monitor staff

Created 02/14/2011 – 01:00

Monitor editorial

Republican Rep. Paul Mirski is leading a drive to amend the state Constitution to prohibit any new tax on personal income. House Speaker Bill O’Brien is on board, and, given the makeup of this Legislature, it’s easy to imagine that 60 percent of the House and Senate will agree to put the amendment before voters.

Last week, in discussing the amendment with Union Leader reporter Garry Rayno, Mirski made this remarkable statement: “The property tax is a great tax because it is a voluntary tax. I pay property taxes based on how large I want to live.” Similar statements have been made by politicians who were challenged to defend a tax system that imposes its largest burden on those least able to pay.

Mirski and O’Brien, however, want to ensconce unfairness in the Constitution, just in case some future governor and Legislature, perhaps when facing a monumental budget deficit, start stuttering when they recite the ancient pledge to oppose a broad-based sales or income tax. Fortunately, it takes agreement by two-thirds of all voters to amend the Constitution, and Mirksi’s amendment is unlikely to garner that kind of support – at least not once the public understands what it will mean for property tax bills.

People who already live in modest homes can’t downsize to reduce their tax bill – not unless they want to live in a cardboard box. Renters can’t either. The property tax is built into the rent they pay. The owners of the most humble homes are already paying a bigger share of their income in property taxes than anyone else. Those on fixed incomes pay higher taxes each year, leaving less to spend on necessities. Often those homes are in property-poor communities. With no power plant or waterfront homes to pick up a big share of the municipal tab, tax rates are high; $4,000 on a $160,000 home isn’t uncommon.

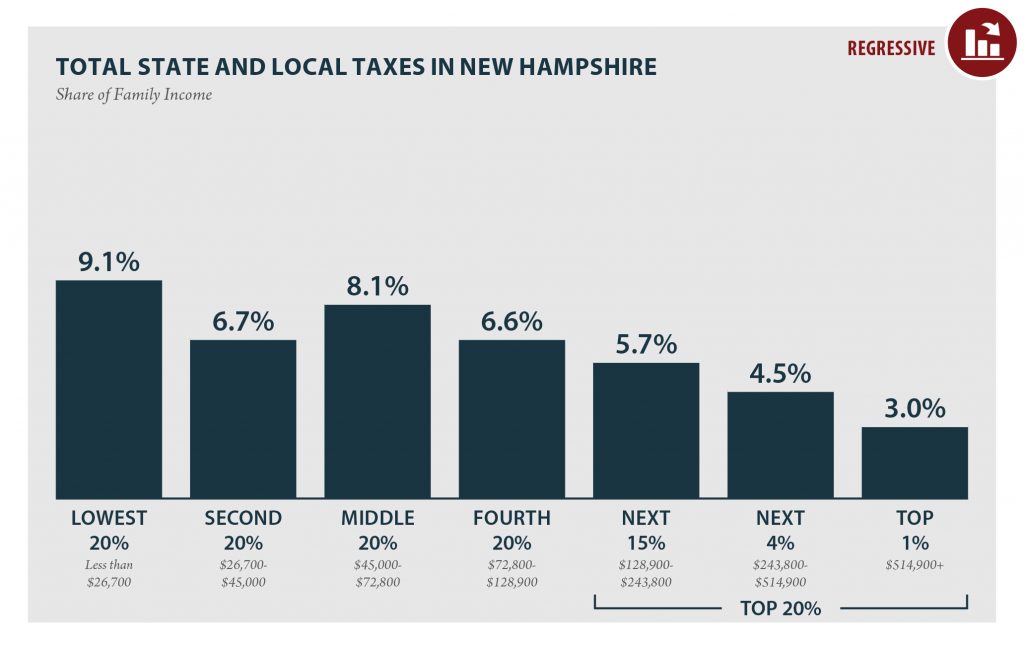

Every few years, the Washington-based Institute on Taxation and Economic Policy publishes a study of state tax systems and who pays the most and least in them. In 2009, the institute found that New Hampshire families making less than $25,000 per year pay 8.3 percent of their income in state and local taxes. The percentage falls as family income rises. For families in the $40,000-$65,000 range it was 6.3 percent; for those earning $102,000 to $204,000, 4.6 percent. Those earning $480,000 or more per year paid just 2 percent.

That is the system Mirksi and his fellow Republicans want to enshrine in the state’s founding document. Despite what could be a billion-dollar budget shortfall. New Hampshire could escape the need to impose an income tax, a far fairer way to raise the money the state needs to meet its obligations. After all, it always has. But to do so, the Legislature will have to do what it has always done: shirk some responsibilities and pass as many costs as possible down to cities, counties and towns and their taxpayers.

A vote for Mirski’s amendment is a vote in favor of permanently escalating property tax bills, of increasing the burden on low- and middle-income homeowners, and the preservation of the most regressive tax system in the land. It’s almost enough to make living in an old refrigerator box look pretty good.