By Sheila Leslie

This article was published on 02.21.13.

“There’s a woman in Chicago. She has 80 names, 30 addresses, 12 Social Security cards and is collecting veteran’s benefits on four non-existing deceased husbands. And she is collecting Social Security on her cards. She’s got Medicaid, getting food stamps and she is collecting welfare under each of her names. Her tax-free cash income alone is over $150,000.”

—President Reagan during 1976 presidential campaign

The tale of the Cadillac-driving welfare queen has a rich tradition in our country, despite the fact that after 37 years of searching by the media, this mythical creature has never been located. Yet her legacy lives on in the 2013 Legislature in the personification of the substance-abusing “taker” whose goal in life is to get on the dole to get funds to buy drugs instead of food for her children.

Think I’m kidding? Over the past couple of years, at least 30 states have had bills introduced to require some form of drug testing as a requirement of public assistance. The current incarnation of this foolishness is SB 89, sponsored by Senator Settlemeyer, R-Minden. The bill requires drug testing of persons applying for public assistance on the premise that if people can afford illegal drugs, they certainly don’t need help from the taxpayers.

The bill requires saliva tests, confirmed by urinalysis—never mind that the window of detection using these two methodologies is completely different, rendering the confirmation useless—with those who fail being forced to enter a state-approved treatment program—never mind that those few programs that exist have long waiting lists and their own admission criteria.

And never mind that drug testing of welfare recipients has already been found to be unconstitutional by courts throughout the nation. Or that in Florida, where more than 7,000 people were tested before the federal court stepped in, only 32 people—less than 1 percent—were positive for drugs, a rate much lower than in the general population. Florida actually lost money on the plan because the state reimbursed applicants who tested negative.

In Indiana last year, a similar bill was withdrawn by its sponsor after another representative amended it to include testing of state legislators. Suddenly, the concept became intrusive and demeaning.

Instead of focusing so much time and energy trying to out-wit the mythical moochers, why not spend a few moments taking a hard look at poverty and income inequality in Nevada.

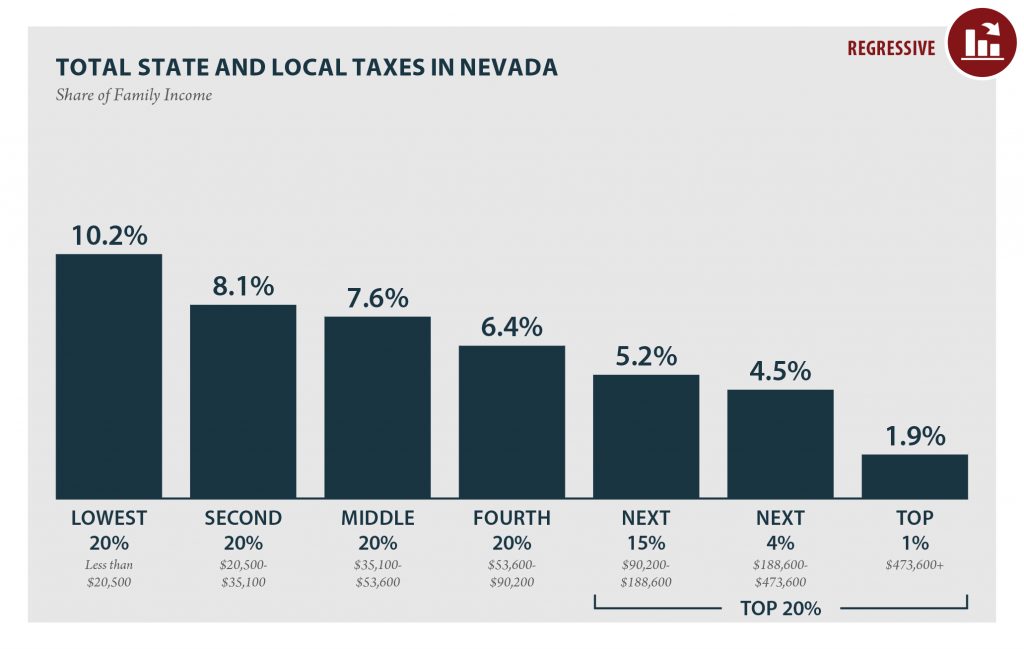

Alabama barely edged out Nevada for the last spot in the Terrible 10 list issued by the Institute on Taxation and Economic Policy of the 10 states whose tax systems favor the wealthy most heavily. The study only includes permanent taxes. If the temporary “sunset” taxes had been included, Nevada would have made the list for sure.

The new 50-state study issued last month, “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States,” concludes that nationwide, when you combine all state and local income, property, sales and excise taxes, the average overall effective tax rates by income group are 11.1 percent for the bottom 20 percent of the population and 5.6 percent for the top 1 percent. So-called “low tax” states are better characterized as “high tax” states for low- and middle-income families.

In Nevada, the lowest 20 percent of income earners pays 9.0 percent while the top 1 percent pays just 2.4 percent. When the sales/excise tax share of family income is calculated, the lowest 20 percent pay 6 percent while the top 1 percent pay just 0.7 percent. Increasing reliance on consumption taxes—such as the proposed sales tax on services—makes the regressive nature of our tax structure worse.

This fundamental unfairness contributes to the growing income gap which fuels the increasing poverty and hopelessness we see reflected in our state’s high drop-out rate, suicide rate and the like.

It’s not the welfare queen we should be demonizing.