Apr. 12, 2013 12:45 PM

Written by Gilda Jacobs is president and CEO of the Michigan League for Public Policy.

Tax day is right around the corner — and if you are a hardworking family in a low-paying job, you may be in for a big surprise.

That’s because in 2011 the Michigan Legislature slashed the state Earned Income Tax Credit from 20 percent of the federal EITC to just 6 percent. This effectively raised taxes on thousands of low-income working Michigan families this year — and they’re just finding out about it now.

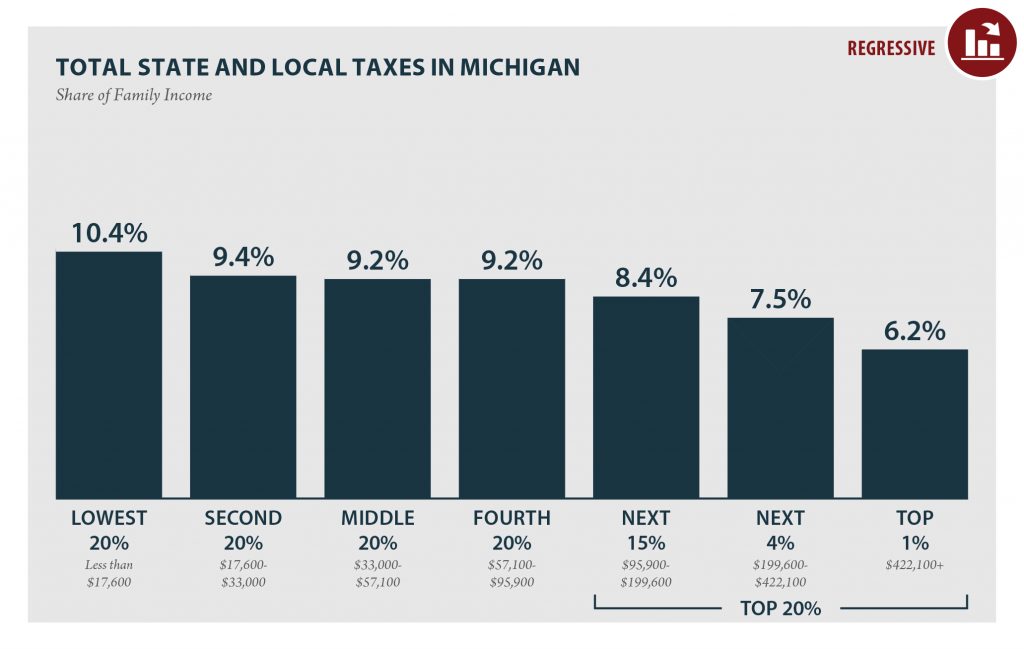

The EITC was an important tool to reduce Michigan’s regressive tax structure, which today finds working families in the bottom half of family income paying about 9.6 percent of their income in state and local taxes, while those in the top 1 percent pay only 5.8 percent of their income in state and local taxes, according to an analysis by the Institute on Taxation and Economic Policy.

A family of four earning $30,000 saw its state taxes increased by $505. Here in Ingham County, the average EITC-eligible family got hit with a $279 increase this year. These are devastating numbers for low-income families just struggling to get by as it is. That’s why the Michigan League for Public Policy and many other groups around the state are joining together to support a restoration of the Michigan Earned Income Tax Credit.

The affected families — including about 10,000 headed by members of the military — are hoping to pull themselves into a more prosperous life with just a little help from the state’s tax system. Most families don’t use the EITC for long — three out of ?ve families who receive the credit use it for just one or two years until they get back on their feet.

These families receive the EITC because they work — you cannot collect this credit if you don’t earn income through work. That’s why the EITC is one of the best anti-welfare programs around — it encourages people to leave welfare for work and for low-wage workers to increase their work hours.

The EITC is a proven tool in the fight against poverty. Last year — at 20 percent of the federal credit — the state EITC kept 14,000 children from falling into poverty. This year, at just 6 percent, the Michigan EITC will only keep 5,000 children out of poverty, leaving another 9,000 children behind.

The data is clear — states with no or very low EITCs tend to have the highest poverty rates among children and adults. For instance, eight of the 10 states with the highest poverty rates have no earned income tax credit at all or a very small one — states like Mississippi, Louisiana, Alabama and Texas. Meanwhile, eight of the 10 states with the lowest poverty rates have a state EITC. Minnesota, which has the lowest poverty rate in the Midwest, has a state EITC that averages about 33 percent of the federal credit.

The EITC touches every corner of Michigan — from the poor neighborhoods of large cities like Detroit to rural counties in northern Michigan, where the majority of EITC recipients reside. It’s vital for children, for families, for veterans — even for local businesses, where EITC funds are quickly spent on things like car repairs.

Each 1 percentage point added to the current 6 percent would cost only $18 million — and it would do much to combat poverty in our state. It’s a small investment that will make a big difference. If you support Michigan’s working families, contact your lawmaker and ask him or her to restore the EITC. For more information, please visit www.saveoureitc.com and learn how you can help.