By Steve Mistler [email protected]

State House Bureau

AUGUSTA — A Maine family of four earning $50,000 a year would save about $647 on its state income taxes under a sweeping tax reform proposal to be aired in a public hearing today before the Legislature’s Taxation Committee.

However, that same family also would pay hundreds more in sales taxes, which would be raised and extended to a host of goods and services, such as heating oil, groceries and amusement park tickets.

The tradeoff — more and higher sales taxes in exchange for lower income and property taxes — is where the bipartisan tax reform plan, detailed in L.D. 1496, gathers enemies from affected industry groups, Republicans and Democrats.

The long list of opponents was expected.

“No state has pulled this off, not in this comprehensive way,” said Meg Gray Wiehe, the state tax policy director for the Washington D.C.-based Institute on Taxation and Economic Policy.

Nonetheless, the plan’s architect, independent Sen. Dick Woodbury, a Harvard-trained economist from Yarmouth, thinks it can work.

Woodbury has calculated the effects: Maine property owners would see an average $500 drop in their property taxes; he says the tax decrease will be higher, up to $1,000 in communities with high property tax rates. He believes a significant tax credit for low- and middle-income individuals and families will moderate, if not completely mitigate, the regressive effect of higher sales taxes.

It’s not just wealthy Mainers who would see a tax cut, Woodbury said. It’s everybody.

Woodbury said his preliminary calculations are undergoing an analysis by Maine Revenue Services. Woodbury is confident. “The underlying philosophical rationale for this plan is powerful,” said Woodbury. “This should work.”

But will it?

Industry groups affected by sales and excise taxes oppose the plan. Some Democrats don’t like paying for an income tax cut by broadening the sales tax, particularly when the result — a significant tax cut for the wealthy — is antithetical to the campaign rhetoric that helped the party gain control of the Legislature.

Republicans like the idea of cutting Maine’s top income tax rate of 8 percent and replacing the tiered system with a flat 4 percent rate. However, some would rather pay for it with reduced government, not sales tax increases. Conservative groups have called the plan a “Trojan horse” for future tax increases.

Woodbury and the so-called “gang of 11” say swapping lower income taxes for higher consumption taxes is necessary to overhaul a tax system that currently places too heavy a burden on residents and property taxpayers. They believe their plan would spread more of the burden to nonresidents while encouraging business growth through reduced income and corporate taxes.

The coalition will make the same argument when it presents the proposal, L.D. 1496, to the Taxation Committee today. Sen. Roger Katz, R-Augusta, one of the bill’s co-sponsors, has acknowledged the obstacles.

“Would you rather have what we have now?” he said last week.

Regressive?

Wiehe, with the Institute on Taxation and Economic Policy, generally believes that broadening the sales tax base to pay for a large income tax cut is bad policy.

Her group has published critiques of other tax overhaul proposals in Louisiana, North Carolina and Ohio.

However, Wiehe said, the Maine plan is different.

“It has more potential than anything I’ve seen to truly offset the impact of the sales tax changes on low- and middle-income households,” Wiehe said.

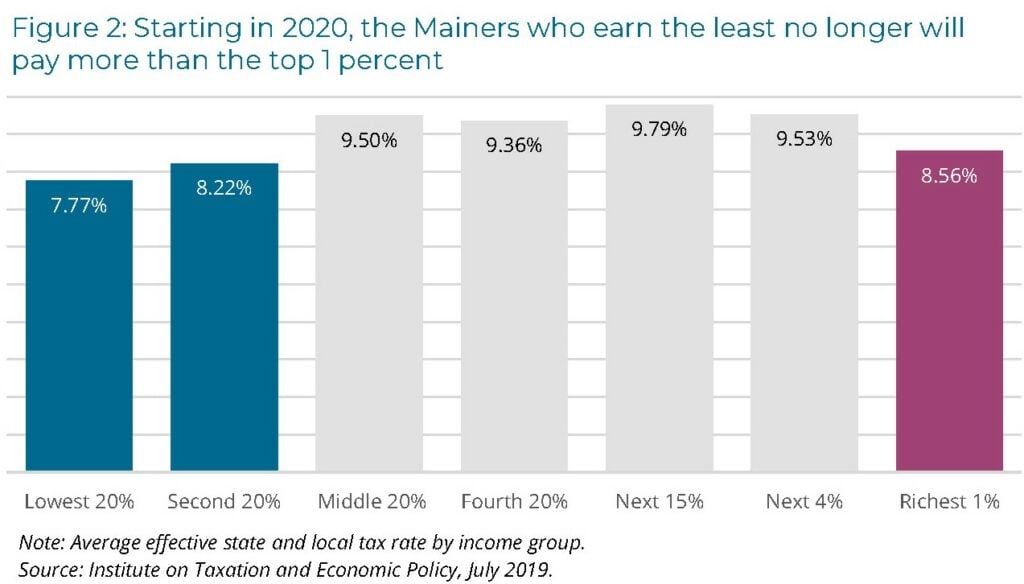

Tax experts say higher sales taxes hit low-income residents harder because they devote a larger portion of their paycheck to the purchase of taxed goods. A report by Institute on Taxation and Economic Policy found that Mainers with an average annual salary of $11,800 devoted 6.2 percent of their earnings to sales and excise taxes, while individuals earning $25,100 paid 5.1 percent. Those earning $328,000 or more paid an average of 0.7 percent in sales taxes.

The new bill, L.D. 1496, attempts to offset that effect with a “tax fairness credit.”

Wiehe said the credit is “massive.”

It provides up to $1,000 for individuals and $2,000 for joint filers, plus $500 per dependent and $500 for each household member over 65 years of age.

According to Woodbury’s calculations, some low-income Mainers not paying income taxes in the current tiered system actually would receive a rebate check under his plan.

Woodbury’s analysis showed that a single taxpayer making $40,000 a year — about the median income — using the standard deduction would save $478 on his or her income taxes, a 27 percent savings over the current tax system. A four-person family earning $23,550 — the federal poverty level — and now paying no state income taxes would receive a $1,200 check.

About 70,000 Mainers don’t pay state income taxes, under changes enacted by the Legislature in 2011. Maine has an earned income tax credit, but it’s nonrefundable. Additionally, those that don’t pay income taxes can’t qualify for the current credit program.

The coalition plan allows residents with no tax liability to qualify for the fairness credit.

“People who have no income tax liability or very little would still get the full benefit,” Wiehe said.

Paying for it

Opposition to the plan is focused on the coalition’s proposal to raise about $700,000,000 in additional sales and excise tax revenue to pay for the income and corporate tax cuts.

According to Maine Revenue Services, raising the state’s sales tax rate from 5 percent to 6 percent would generate $155 million next year. The state’s sales tax rate was last changed July 1, 2000. The rate ranks Maine No. 31 in the country.

Another $400,000 would be raised by eliminating about 87 sales tax exemptions. Some of the exemptions have existed since Maine implemented a sales tax in 1951.

Such exemptions include amusement park tickets, movies and sporting events. According to a 2013 report by Maine Revenue Services, the amusement exemption will cost the state $48.6 million in lost revenue in the next two fiscal years beginning July 1.

The exemption on groceries is one of the most expensive. Maine Revenue Services estimated the exemption will cost over $165 million over the next biennium.

Eliminating the exemption might prove controversial. Maine is one of 31 sales-tax states that totally exempt groceries from the tax, according to the Federation of Tax Administrators. Seven states that tax groceries do so at a rate lower than the general sales tax.

Woodbury identified a host of other exemptions that the coalition might want to lift, including heating fuel ($36.4 million in projected revenue next year); barber shop and personal care services ($6 million); funeral services ($3.8 million); dry cleaning services ($2.8 million) and other personal and professional services.

Woodbury said the group hasn’t targeted all of the exemptions, but that it plans to “look at everything.”

“Real care needs to be exercised to make sure it’s administratively feasible and that it’s not anti-competitive,” he said.

A 2007 report by the Federation of Tax Administrators found that only 11 states taxed fewer services than Maine.

Michael Allen, the governor’s associate commissioner of tax policy, said some of the exemptions exist to make the state more competitive for certain businesses.

The exemptions, however, have come under scrutiny. A 2012 report by The New York Times found that Maine and other states were surrendering a combined $80 billion each year to companies through tax exemptions and incentives. The report found that Maine allocated nearly one-fifth of its spending to such incentives. The Times used Maine’s annual report on tax exemptions as the basis for its report.

Allen disputed some of the findings in the report, saying the state didn’t have a lot of economic development incentives in its tax exemptions.

Wiehe said some tax experts support taxing services as a way to increase revenue.

“All or our sales taxes were created back in a time when a lot of this stuff never existed,” she said. “Pet grooming did not exist in 1930. It’s a historical accident that these were left out of the sales tax base.”

Higher excise taxes

Increasing sales taxes and removing exemptions is just one part of the coalition plan.

It also hopes to increase excise taxes on lodging from 7 percent to 10 percent. A 1 percent hike would generate $6.8 million in the next fiscal year, according to Maine Revenue Services. The rate was increased to 7 percent on July 16, 1986.

The plan also increases the cigarette tax from $2 to $3.50 per pack, generating an estimated $58.6 million in the next fiscal year. The rate was last increased from $2 to $3 per pack in 2005.

Another $8 million would be generated from taxing other tobacco products at the same rate as cigarettes. About $3 million in revenue would come from increasing sales taxes on short-term auto rentals, from 10 percent to 15 percent.

All of the proposals have generated opposition from industry groups.

Scott Drenkard, economist for Tax Foundation, said increasing excise taxes goes against free-market ideals.

“I see excise taxes as taxes that are designed to distort choices of people,” he said. “I don’t support the idea that we should tax certain products because they’re politically expedient or they’re better for us.”

There’s also a sustainability issue, Wiehe said.

She said the cigarette tax hike can curb consumption. That’s why, she said, health advocates lobby for increased tobacco taxes.

Fewer smokers mean less excise tax collections.

“You can raise a massive chunk of money through a massive cigarette tax hike, but that amount could erode over time,” she said. “Banking a reform plan on a excise tax can be problematic.”

Outlook

The response to the concept tax reform bill has been tepid at best.

Gov. Paul LePage has since called the proposal a “bad deal.”

“They have some daring ideas,” said David Clough, with the National Federation of Independent Business, in a recent statement. “High taxes dampen growth and jobs, and they seem to realize that small business is the engine of growth in Maine.”

Thus far, the most common description of the plan is “bold.”

With boldness comes anxiety, however, and neither boldness nor anxiety have been able to defeat the politics of tax reform.

“You can’t have comprehensive plan without having winners and losers,” Wiehe said.

Additionally, there are deep ideological divisions about whether cutting income taxes is an effective pro-growth approach.

Drenkard and conservative groups such as the Tax Foundation say it is. The Institute on Taxation and Economic Policy, Wiehe’s group, say it isn’t.

Wiehe said she really likes many elements of the Maine plan, but she’s not quite sold.

“Unlike other tax swaps, it doesn’t appear to be a huge tax cut for the wealthy and a huge tax hike for most everyone else,” she said. “But I don’t necessarily think that this plan helps to balance the three pegs of the revenue stream stool. I think it could throw it off balance.”

Woodbury and the coalition hope to make a different argument on Friday.

“This plan basically balances,” he said. It’s going to need some tweaking, but it balances with a 4 percent income tax and $50,000 homestead exemption.”

He added, “Do we want to do that? Maybe not, but let’s talk about it.”

Steve Mistler — 620-7016

[email protected]

Twitter: @stevemistler