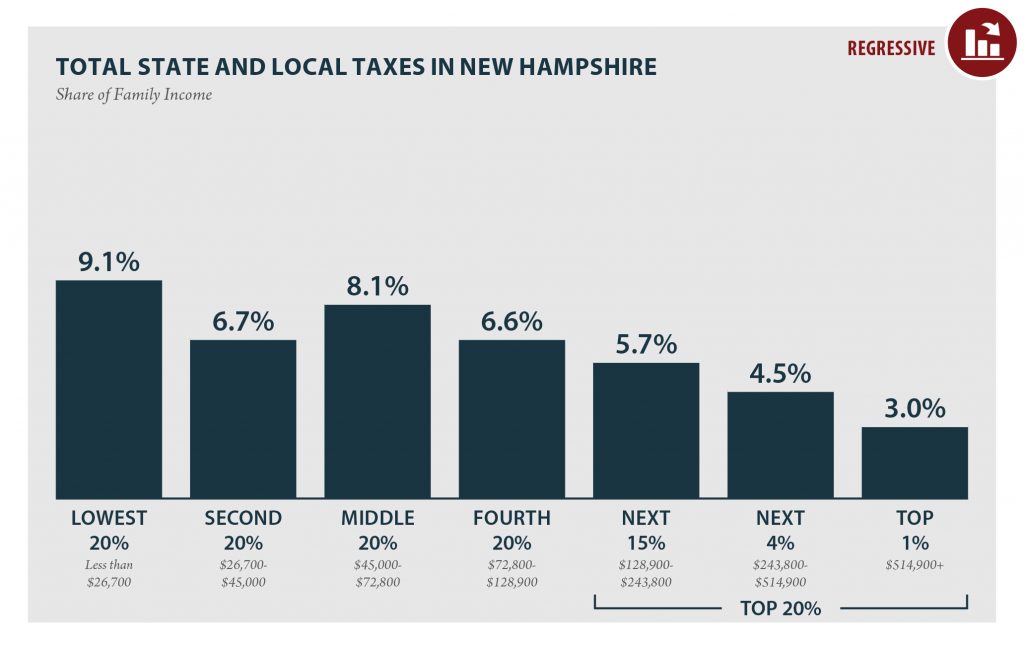

It is beyond the scope of this testimony to do a complete analysis of the New Hampshire tax system. The following table, however, shows that New Hampshire, as with most states, has a regressive tax system–with middle- and lower-income taxpayers paying a higher share of their income in New Hampshire state and local taxes than better-off taxpayers. Generally speaking, consumption taxes (such as sales and excise taxes) are the most regressive taxes, property taxes are somewhat regressive, and income taxes are progressive (or at least proportional). States that lack broad-based personal income taxes are generally among the most regressive tax states because they have no tax to balance their regressive consumption and property taxes. States that lack general sales taxes are generally among the least regressive.

New Hampshire is unusual in having neither a broad-based personal income tax nor a general sales tax. New Hampshire’s tax system is more regressive than average, but is not among the ten most regressive (For more information, see the study Who Pays?, cited above).