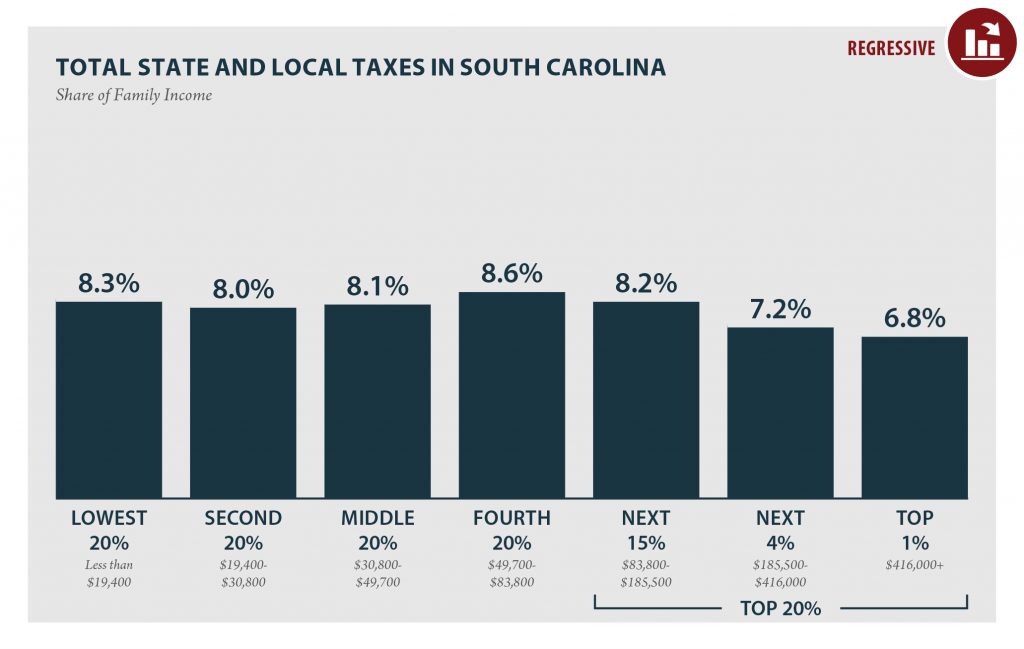

My testimony today offers several broad thoughts on the implications of the proposals for sales and use tax reform laid out so far by the Tax Realignment Commission (TRAC). The testimony stresses that while base-broadening is of paramount importance in achieving a more sustainable state sales tax, policymakers should be aware of the need for lowincome refundable tax credits to mitigate the impact of such reforms on low-income families—and should carefully examine the state’s long-term structural deficit before making a decision that the entire revenue gain from these important changes should be devoted to reducing the state sales tax rate on currently taxable items.

Author

Carl Davis

Research Director

Related Reading

January 9, 2024

South Carolina: Who Pays? 7th Edition

October 17, 2018

South Carolina: Who Pays? 6th Edition

Mentioned Locations

South Carolina