Idaho Governor Butch Otter and the state legislature are seriously considering repealing the personal property tax on business equipment. The governor claims that repealing the tax would help the state’s economy, but says that he is “painfully aware” that repeal would dramatically cut into the revenues that many local governments depend on to provide public services. 1 The tax generates $141 million in revenue every year for cities, counties, and public schools. As a result, the Governor says that he “can’t predict” whether lawmakers will be able to reach agreement on repealing the tax.

Big businesses, lobbying through the Idaho Association for Commerce and Industry (IACI), have made repealing the tax their top legislative priority for 2013.2 For smaller businesses, simply raising the personal property tax exemption to $100,000 would be enough to exempt them from the tax. Such a reform would exempt 90 percent of all Idaho businesses from the personal property tax while reducing local revenues by just 20 percent.3 Agricultural equipment is already exempt from the tax. 4

If the personal property tax is repealed, Idaho Power, held by IDACorp, stands to benefit more than any other company in the state, according to an analysis by the Idaho Center for Fiscal Policy. Depending on the details of the repeal plan, the company would see its taxes fall by anywhere from $10.5 to $15.3 million per year. 5

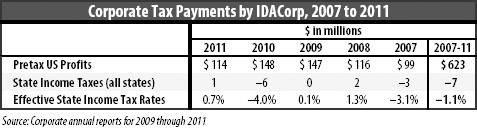

Against this backdrop, a new analysis of IDACorp’s financial disclosures with the Securities and Exchange Commission (SEC) reveals that, overall, the company already pays nothing in state income taxes to the states in which it operates. Despite earning $623 million in profits from 2007 to 2011, the company’s effective state income tax rate across all states was actually negative. IDACorp received $7 million in tax rebates from the states, giving it an effective tax rate of negative 1.1 percent for the five year period as a whole.

Historically, state residents and business have together shouldered the responsibility of building public infrastructure and providing public services. These tax dollars provide services that are the foundation of a healthy economy, including schools, public safety, and transportation systems, among others.

In recent years, however, tax breaks and credits for business have led to taxes being increasingly shifted away from corporations and toward citizens. Repealing the personal property tax would only exacerbate this trend, giving huge tax breaks to businesses that in some cases are already paying little in state taxes.

1Messick, Molly. “Governor Otter: Lawmakers May Not Come Up With a Personal Property Tax Plan This Year.” State Impact Idaho. February 5, 2013. Available at: http://stateimpact.npr.org/idaho/2013/02/05/governor-otter-lawmakers-may-not-come-up-with-a-personal-property-taxplan-this-year/

2Popkey, Dan. “Otter sides with business lobby on targeting hated tax.” Idaho Statesman. June 12, 2012. Available at: http://www.idahostatesman.com/2012/06/12/2151576/otter-sides-withbusiness-lobby.html

3Messick, Molly and Emilie Ritter Saunders. “Map: Who Benefits Most if Idaho’s Business Personal Property Tax is Eliminated.” State Impact Idaho. January 23, 2013. Available at: http://stateimpact.npr.org/idaho/maps/map-who-benefits-most-if-idahos-business-personal-propertytax-is-eliminated/

4Ellis, Sean. “Idaho farm leaders keep an eye on tax repeal effort.” Capital Press. February 8, 2013. Available at: http://www.capitalpress.com/idaho/SE-personal-property-tax-021513

5Idaho Center for Fiscal Policy. “Idaho Personal Property Exemption Impacts on Idaho Personal Property Taxpayers.” January 2013. Available at: http://idahocfp.org/wpcontentuploads/2013/01/Personal-Property-Taxpayer-Impacts.pdf