Alaska Gov. Bill Walker recently proposed tripling his state’s motor fuel tax rates.[1] Three-fourths (or $60 million) of the revenue raised each year would come from higher taxes on gasoline and diesel fuel—sometimes referred to as highway fuels—purchased by Alaska motorists. Heating fuel would not be affected by the proposal but taxes would rise on marine, jet, and aviation fuel. This brief focuses specifically on Alaska’s gasoline and diesel taxes.

Absent any national or historical context, tripling Alaska’s gasoline and diesel fuel tax rates may sound like a radical policy change. But an adjustment of this size is necessary because Alaska lawmakers have not updated the state’s basic highway fuel tax rate since May 1970—almost 47 years ago.[2] Because of this inaction, Alaska’s highway fuel tax has become an outlier when compared to other states’ tax rates, or when compared to Alaska’s own history.

This brief discusses four ways in which Alaska’s highway fuel tax on gasoline and diesel fuel is an outlier:

- Alaska’s tax rate on gasoline and diesel fuel is the lowest in the nation.

- Alaska has waited longer than any state since last updating its gasoline and diesel tax rate.

- Adjusted for inflation, Alaska’s tax rate on gasoline and diesel fuel has reached its lowest level in history.

- Alaska households are spending a smaller share of their earnings on state gasoline and diesel taxes than at almost any time since Alaska became a state.

Lowest Rates in the Nation

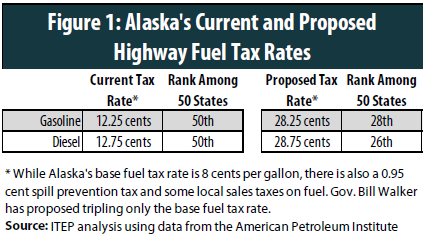

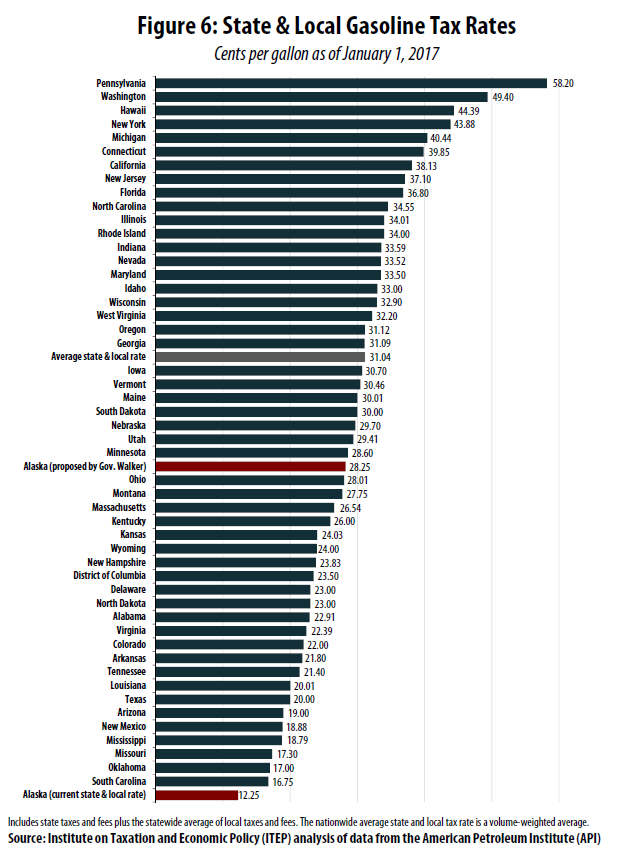

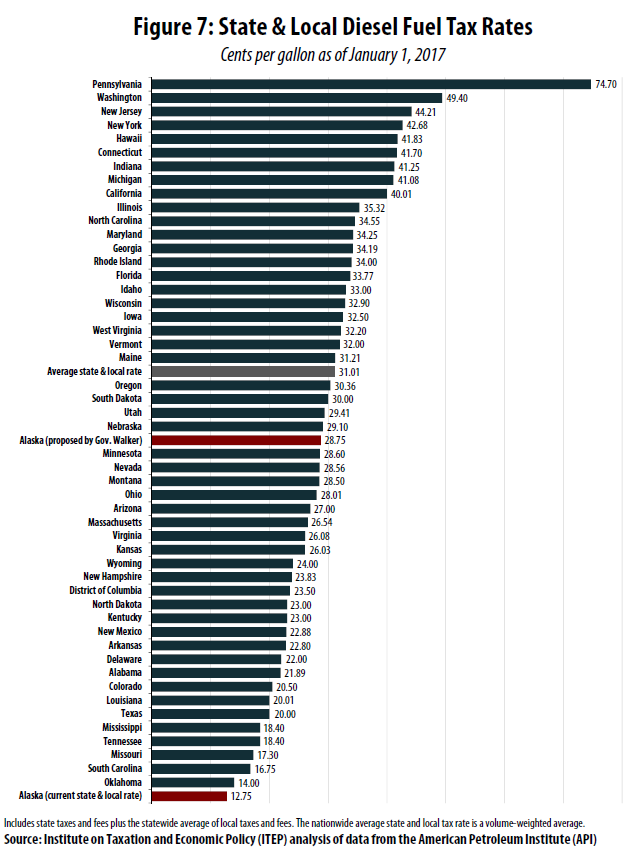

Alaska’s base excise tax rate on gasoline and diesel fuel is 8 cents per gallon, with local sales taxes and the state’s spill prevention tax brining the statewide average rate to 12.25 cents for gasoline and 12.75 cents for diesel fuel. These rates are the lowest in the nation and are less than half the national average state and local tax rate of 31 cents per gallon.[3] If Gov. Walker’s proposed highway fuel tax increase were enacted, Alaska’s gasoline and diesel tax rates would remain below the national average and below the tax rates levied in most states (see Figure 1).

Most Outdated Rates in the Nation

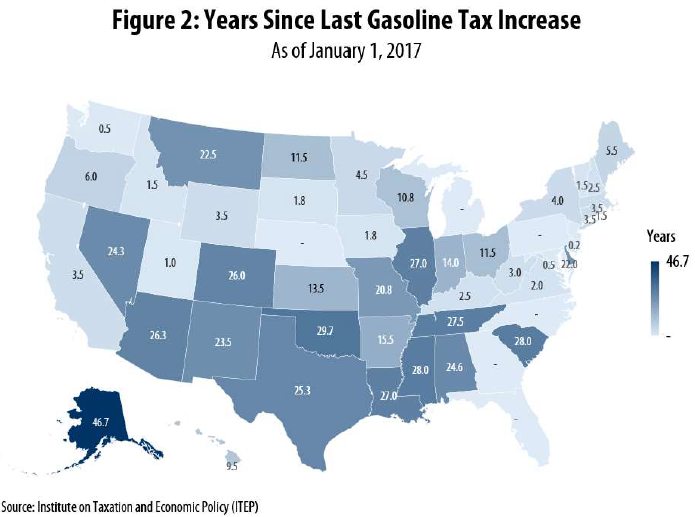

Alaska’s highway fuel tax rate of eight cents per gallon was typical at the state level when it was enacted in 1970. Since then, however, every other state in the nation has opted to raise its gasoline and diesel tax rates while Alaska’s rate has stood still.

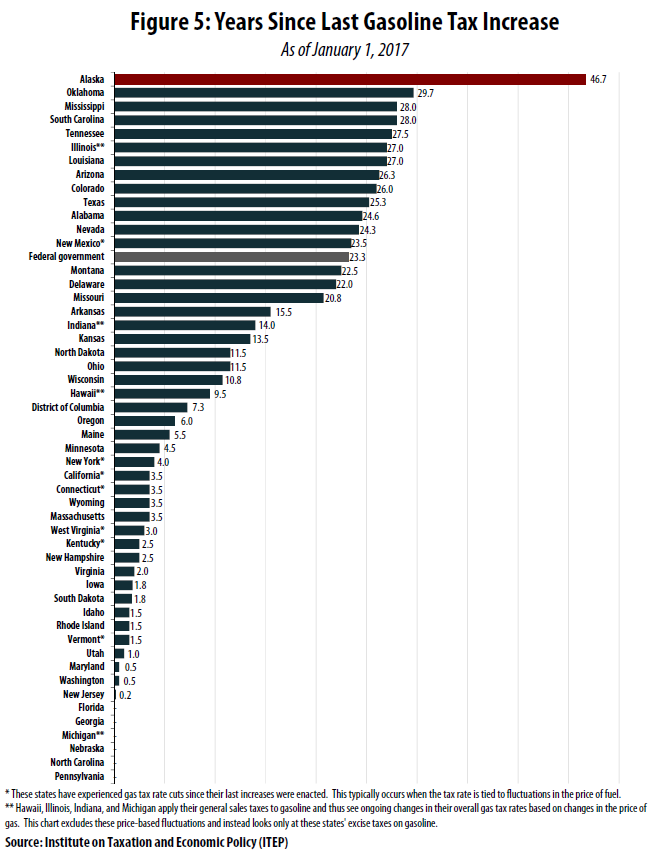

At almost 47 years of age, Alaska’s base fuel tax rate of eight cents per gallon is now far more outdated than any other state’s (see Figure 2 below as well as Figure 5 at the end of this brief). As of this writing only sixteen states have waited more than twenty years since last updating their fuel tax rates and no state other than Alaska has waited more than thirty years.[4]

Gov. Walker’s proposed fuel tax increase comes at a time when many states are contemplating similar increases. In just the last four years, nineteen states have either updated or reformed their motor fuel taxes.[5] Many of the states currently levying decades-old fuel tax rates—including Louisiana, Oklahoma, South Carolina, and Tennessee—will be debating their own increases during their 2017 legislative sessions.

Lowest Rates in Alaska’s History

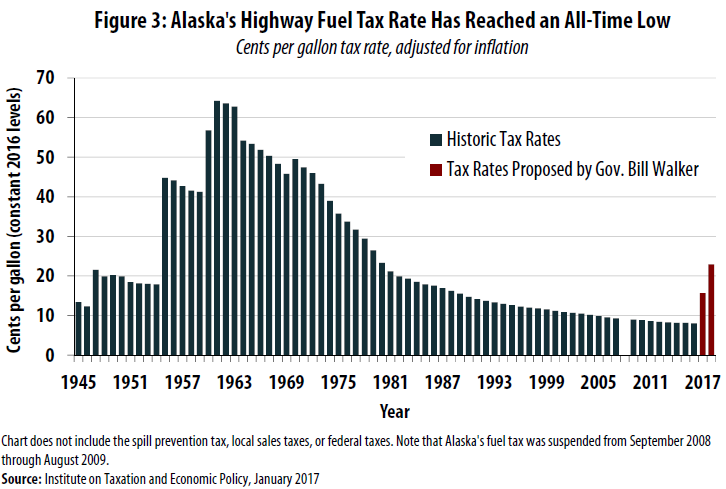

While Alaska’s eight cent fuel tax rate may appear to have held steady in recent decades, the economic reality is that its real value has declined significantly. After adjusting for inflation, an 8 cent fuel tax rate in 1970 was the equivalent of what would be a 49.5 cent tax today. In other words, Alaska’s fuel tax rate has lost 81 percent of its purchasing power since 1970.

Looking back further to the tax’s creation in 1945, Figure 3 shows that the eight cent rate in effect today is the lowest in Alaska’s history. In inflation-adjusted terms, the one cent per gallon tax initially enacted in 1945 would have been the equivalent of 13.3 cents today. Sixteen years later in 1961, Alaska’s highway fuel tax reached a peak value of 64.2 cents per gallon (adjusted for inflation) before beginning the long decline to its current eight cent rate.

Throughout its 72-year history, Alaska’s real highway fuel tax rate has averaged 24.9 cents per gallon, when expressed at 2016 levels. Gov. Bill Walker’s proposal to triple the state’s 8 cent rate to 24 cents per gallon would bring the state’s tax rate in rough alignment with this historic average.

A Smaller Share of Personal Income

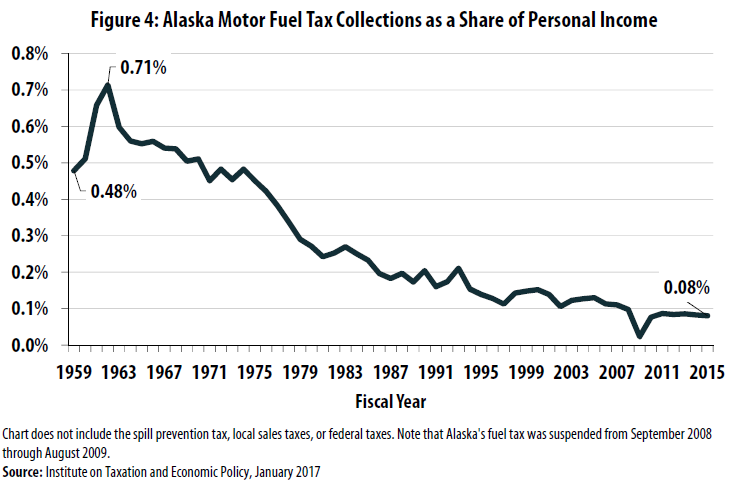

Alaska households are spending less of what they earn on state highway fuel taxes than at almost any time since Alaska became a state. In 1959 Alaska’s highway fuel tax of 5 cents per gallon collected revenues equal to 0.48 percent of the state’s personal income. After peaking at 0.71 percent of personal income in 1962, the state’s highway fuel tax revenues underwent a long decline to just 0.08 percent of personal income today.

Put another way, Alaska households are spending less than one-tenth of a percent of their earnings on state highway fuel taxes. This is the lowest level on record aside from fiscal years 2009 and 2010, when revenue collections were impacted by the temporary suspension of the state’s fuel taxes. Gov. Bill Walker’s proposal to triple the state’s base highway fuel tax rate would likely raise the share of income Alaskans are spending on fuel taxes to 0.24 percent, or less. This would remain below the levels paid by Alaska households in the 1960s and 1970s while also helping to bring about meaningful improvements in the state’s ability to fund transportation maintenance, and in its general fiscal health.

Conclusion

Alaska’s highway fuel tax rates are badly outdated. Because they have not been updated for almost 47 years, the state’s gasoline and diesel tax rates are now the lowest in the nation and have seen most of their purchasing power disappear in the face of inflation. Updating the state’s fuel tax rates in the manner that Gov. Bill Walker has proposed would undo much of the decline witnessed in recent decades while making a meaningful contribution toward improving the state’s fiscal health.

[1] Governor Bill Walker. Letter to the Honorable Pete Kelly. Available at: https://www.omb.alaska.gov/ombfiles/18_budget/PDFs/12-15-16_Motor_Fuel_Tax_House_Senate.pdf

[2] ITEP. “How Long Has It Been Since Your State Raised Its Gas Tax?” January 2017. Available at: https://itep.org/itep_reports/2017/01/how-long-has-it-been-since-your-state-raised-its-gas-tax-3.php

[3] American Petroleum Institute. “Motor Fuel Taxes.” January 2017. Available at: http://www.api.org/oil-and-natural-gas/consumer-information/motor-fuel-taxes

[4] See note 2.

[5] Davis, Carl. “Looking Back at Four Years of Gas Tax Reforms.” Tax Justice Blog. October 2016. Available at: http://www.taxjusticeblog.org/archive/2016/10/looking_back_at_four_years_of.php

Alaska Gov. Bill Walker recently proposed tripling his state’s motor fuel tax rates. Three-fourths (or $60 million) of the revenue raised each year would come from higher taxes on gasoline and diesel fuel—sometimes referred to as highway fuels—purchased by Alaska motorists. Heating fuel would not be affected by the proposal but taxes would rise on marine, jet, and aviation fuel. This brief focuses specifically on Alaska’s gasoline and diesel taxes.

Absent any national or historical context, tripling Alaska’s gasoline and diesel fuel tax rates may sound like a radical policy change. But an adjustment of this size is necessary because Alaska lawmakers have not updated the state’s basic highway fuel tax rate since May 1970—almost 47 years ago. Because of this inaction, Alaska’s highway fuel tax has become an outlier when compared to other states’ tax rates, or when compared to Alaska’s own history.

This brief discusses four ways in which Alaska’s highway fuel tax on gasoline and diesel fuel is an outlier:

¨ Alaska’s tax rate on gasoline and diesel fuel is the lowest in the nation.

¨ Alaska has waited longer than any state since last updating its gasoline and diesel tax rate.

¨ Adjusted for inflation, Alaska’s tax rate on gasoline and diesel fuel has reached its lowest level in history.

¨ Alaska households are spending a smaller share of their earnings on state gasoline and diesel taxes than at almost any time since Alaska became a state.

Governor Bill Walker. Letter to the Honorable Pete Kelly. Available at: https://www.omb.alaska.gov/ombfiles/18_budget/PDFs/12-15-16_Motor_Fuel_Tax_House_Senate.pdf

ITEP. “How Long Has It Been Since Your State Raised Its Gas Tax?” January 2017. Available at: https://itep.org/itep_reports/2017/01/how-long-has-it-been-since-your-state-raised-its-gas-tax-3.php