Read this report in pdf form here.

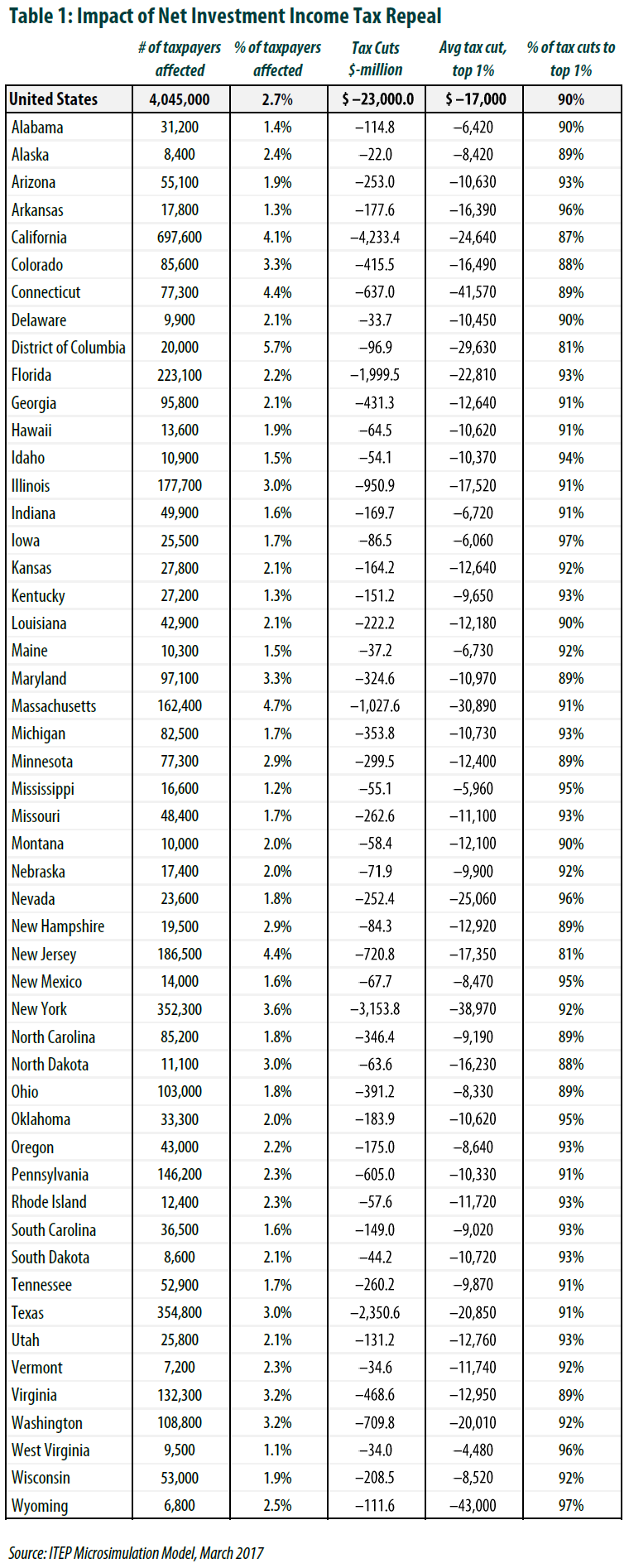

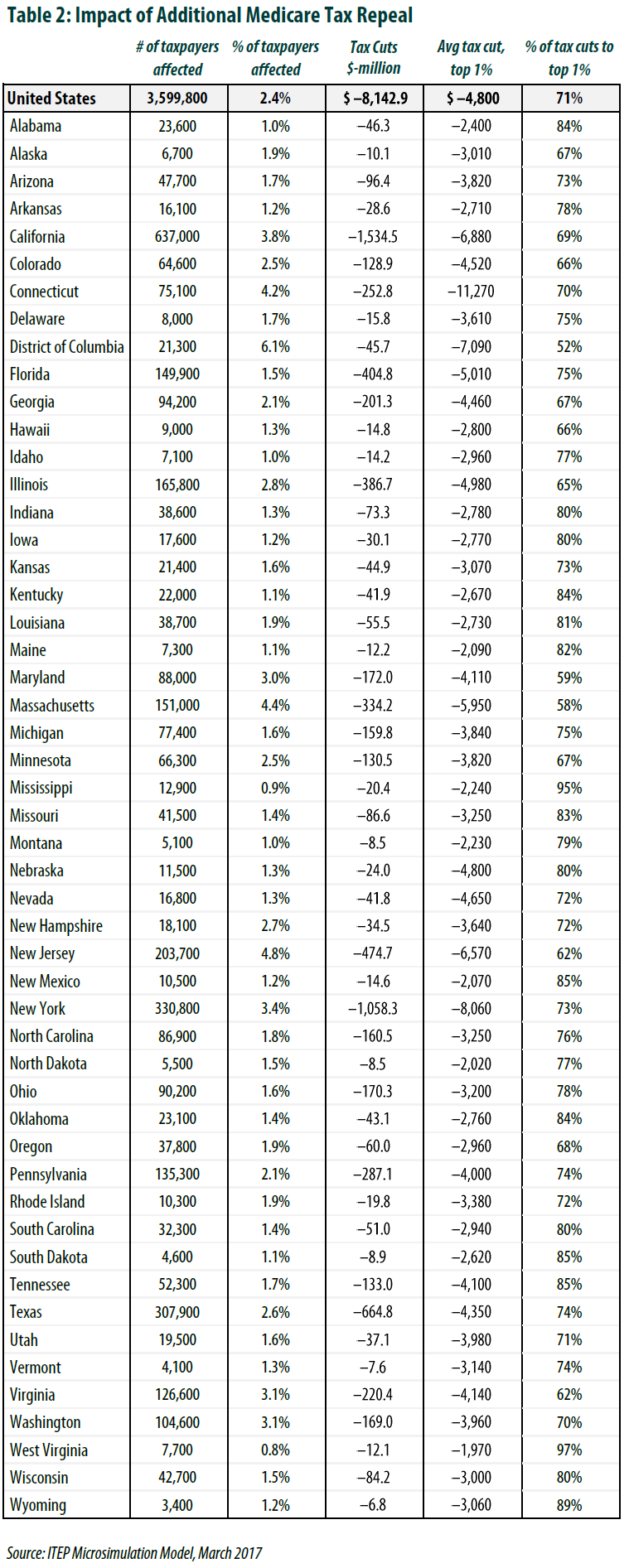

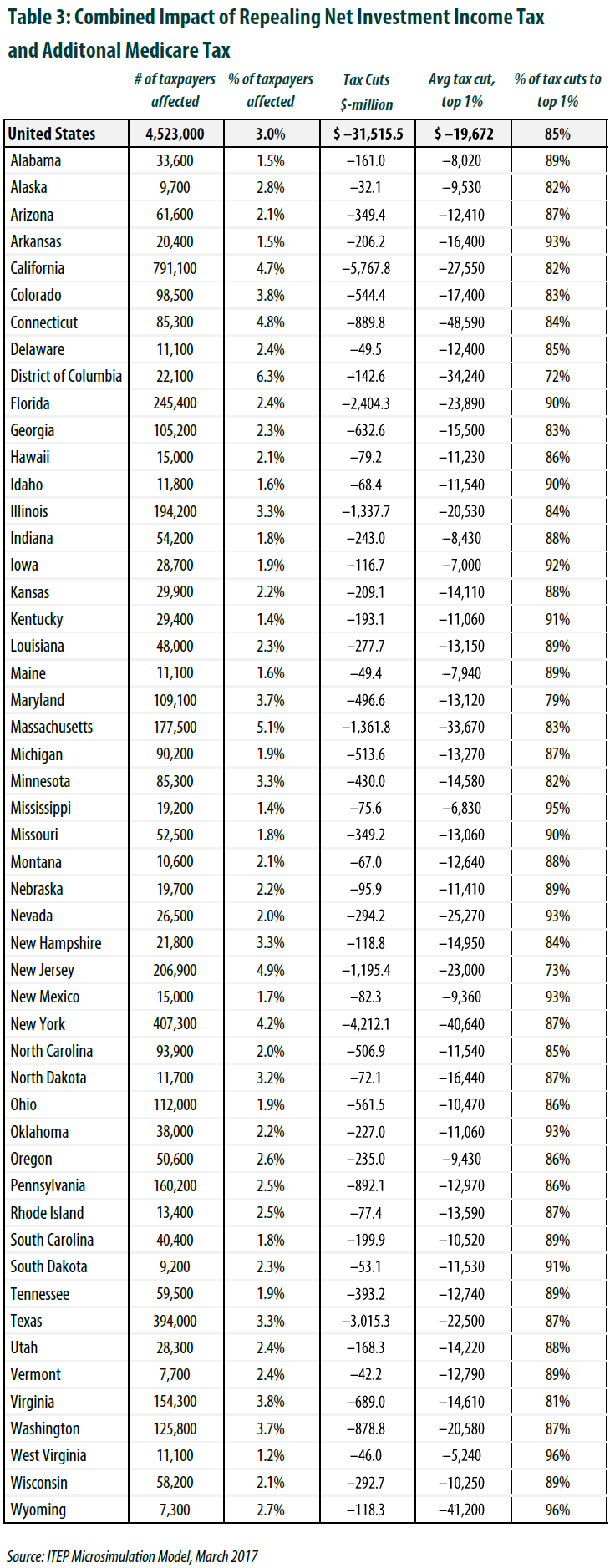

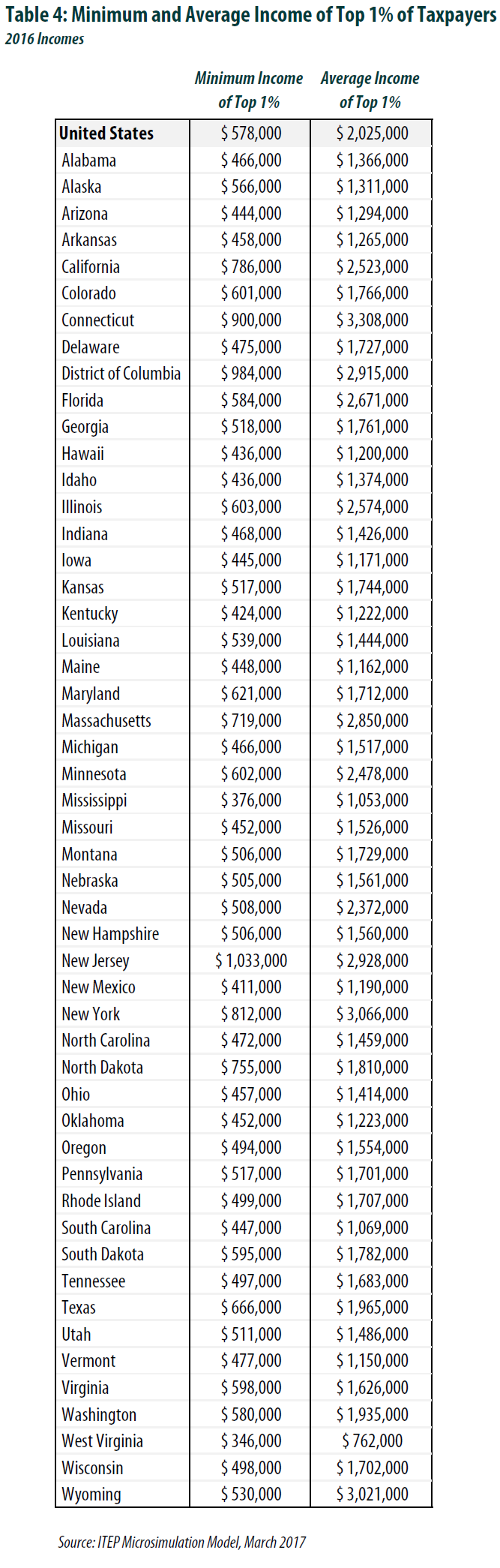

Congressional Republicans have proposed legislation that would repeal the Affordable Care Act (ACA), including rolling back a number of tax changes that were enacted to pay for the ACA’s health care expansions. Among these tax changes are two targeted income tax increases that took effect in 2013, each of which apply only to a small number of the wealthiest Americans: the net investment tax and additional Medicare tax. Repealing these two taxes would cost over $31 billion a year if implemented in tax year 2016, and 85 percent of the benefit from repealing these taxes would go to the best off 1 percent of Americans nationwide.

The following tables provide state-by-state estimates on the impact of repealing the net investment tax (Table 1), the additional Medicare tax (Table 2), and the combined effect of repealing the two taxes (Table 3). The state-by state breakdown includes: number of taxpayers affected, share of total taxpayers affected, the total tax cut, average tax cut for the top 1 percent of taxpayers, and the share of the tax cuts going to the top 1 percent of taxpayers.