Read the Report in PDF (Includes appendices detailing methodology)

EXECUTIVE SUMMARY

This report contains ITEP’s analysis of the distributional and revenue consequences of the revised version of House Bill 115 (Version L) as proposed on March 23, 2017. This proposal would reduce Alaska’s Permanent Fund Dividend (PFD) payout and implement a personal income tax based on a modified version of Federal Adjusted Gross Income, with rates ranging from 0 to 7 percent. The analysis was produced using ITEP’s Microsimulation Tax Model.[1] Its core findings include:

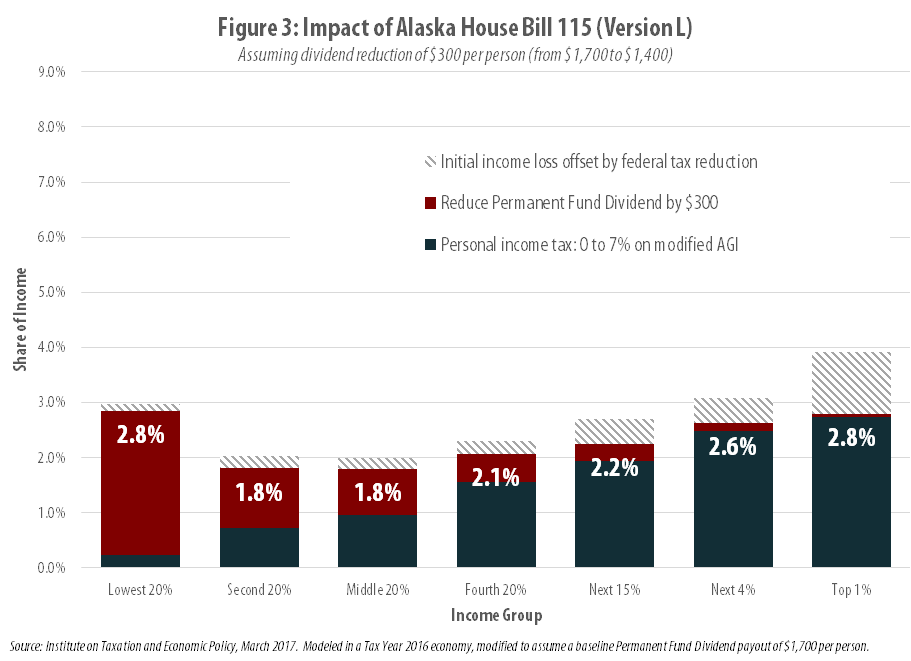

- When fully implemented, HB 115 (Version L) achieves a relatively consistent impact across every income group in Alaska. The long-run scenario modeled in this report indicates that the impact on each group would range from 1.8 to 2.8 percent of their incomes. (See Figure 3 and Table C.)

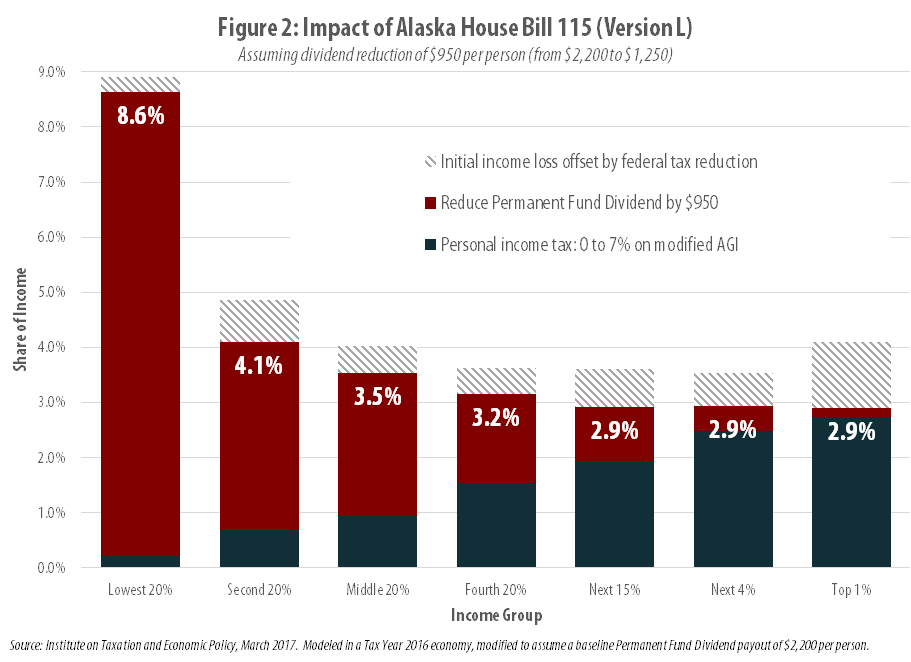

- Low-income families, for whom the PFD represents a major source of income, would be impacted more heavily in the years immediately following implementation of this bill. This is because reductions in the PFD payout are forecast to be largest in the short-term. If the PFD payout is reduced by $950 per person, the bottom 20 percent of earners could expect to see an impact from this bill equal to 8.6 percent of their incomes. This far exceeds the 2.9 to 4.1 percent impact felt by other groups under this scenario. (See Figure 2 and Table A.)

- Most states with personal income taxes offset some of the impact of regressive fiscal policies on their low-income taxpayers by offering a refundable Earned Income Tax Credit (EITC) patterned after the federal EITC. In Alaska, a state credit calculated at 25 percent of the federal EITC could reduce the impact of this bill on the state’s low-income taxpayers by 1 percent of their income. Such a credit would reduce Alaska income tax revenues by roughly $25 million per year.

- Reducing the PFD and creating a personal income tax would lower Alaskans’ taxable income for federal income tax purposes. In a scenario where the PFD is reduced by $950 per person, this would trigger a short-term federal income tax cut of $202 million for Alaska residents. (See Table A.) The size of this cut would be smaller in years when the cuts to the PFD payout are less dramatic. (See Tables B and C.)

- Approximately one-fifth (20 to 21 percent) of the impact of this bill would not fall on Alaska residents, but rather on the federal government and non-resident workers. In effect, these sources would contribute up to $255 million in revenue toward closing Alaska’s budget gap. (See Table A.)

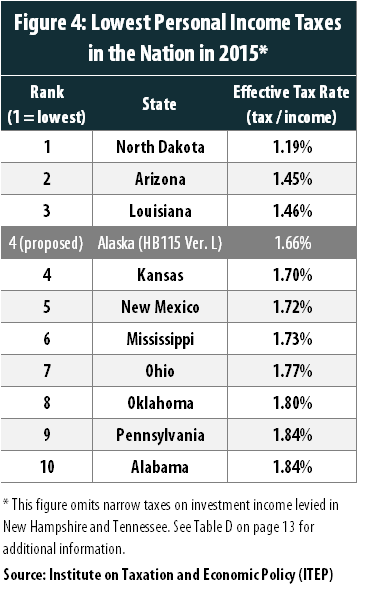

- The personal income tax proposed in HB115 (Version L) would be low by national standards. When measured relative to personal income in Alaska, it would rank as the fourth lowest among the 41 states with broad-based personal income taxes. The tax would amount to roughly 1.7 percent of Alaskans’ overall personal income, though low- and middle-income families could expect to pay less than this amount while high-income families could expect to pay more. (See Figure 4 and Table D.)

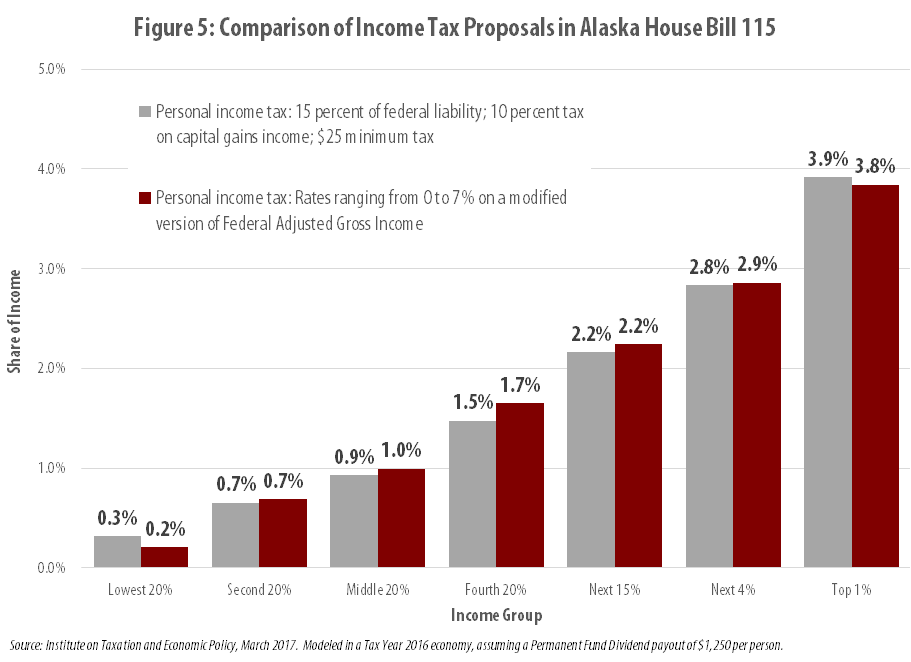

- The personal income tax proposed in HB 115 (Version L) on March 23 is very similar in its overall distribution to the original income tax contained in this bill. Most income groups would see their average tax payments change by an amount less than 0.1 percent of their income relative to the original proposal. (See Figure 5.) The most significant result of this change in structure would be to limit the tax’s vulnerability to changes in federal tax law.

DESCRIPTION OF SCENARIOS MODELED

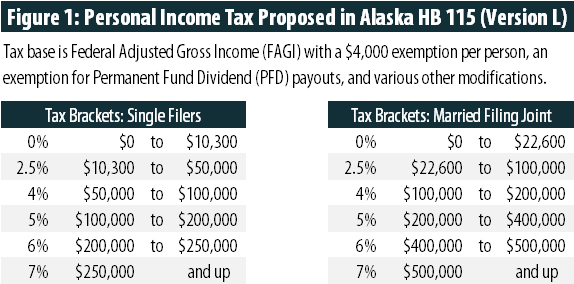

This report examines both the personal income tax proposed on March 23 and the amended reduction in the PFD payout adopted on March 14. The personal income tax is based on a modified version of Federal Adjusted Gross Income (FAGI) that includes a $4,000 exemption per person and an exemption for income received from the PFD. Tax rates range from 0 to 7 percent, as shown in Figure 1.

The impact of HB115 (Version L) on Alaska’s PFD payout would vary each year, as would the PFD provided under current law. The Alaska Legislative Finance Division forecasts that the cuts to the PFD would be larger in the short-run than in the long-run.[2] Based on that forecast, ITEP modeled three scenarios meant to reflect the short-term, medium-term, and long-term impacts of HB115 (Version L).

The short-term scenario assumes that the PFD payout, which is projected by the Legislative Finance Division to be approximately $2,200 per person in 2017 under current law, is reduced to the $1,250 floor set in HB115 (Version L). This represents a cut to the PFD of $950 per person.

The medium-term and long-term scenarios reflect the Legislative Finance Division’s forecast that the baseline PFD will shrink in the years ahead to approximately $1,700 per person, even absent any change in law. Relative to that baseline, ITEP modeled a medium-term cut in the PFD payout of $450 per person (down to $1,275), and a long-term cut of $300 per person (down to $1,400).

Because of the uncertainty inherent in any effort to forecast future income levels in Alaska, all of these scenarios were modeled as if they had been implemented in a Tax Year 2016 economy.

DISTRIBUTIONAL CONSEQUENCES

Reductions in the PFD are regressive. That is, when measured as percentage of household income, these reductions fall most heavily on families with low and moderate incomes. This analysis finds that while a $950 reduction in the PFD payout would reduce the income of Alaska’s lowest-income families by 8.7 percent, the impact on the top 5 percent of earners would be less than 0.7 percent of income (see Table A on page 10).

At the same time, a personal income tax of the type contained in HB 115 (Version L) would be progressive, asking more of families with higher incomes than of families of more modest means. Tax payments would range from 0.2 percent of income at the bottom of the income distribution to 3.8 percent of income at the top, before any offsetting reductions in federal tax liability are considered (see Table A).

This analysis reveals that the balance of these two policies, as proposed in HB 115 (Version L), comes close to achieving a proportional impact across most of Alaska’s population in the long-run, though it would have a disproportionate impact on lower-income families in the short-run.

In the years immediately following implementation, low-income families would be impacted more heavily than any other group because the steep reduction in the PFD payout would eliminate a significant share of these families’ incomes. As seen in Figure 2, if this package had been implemented in Tax Year 2016, the impact on most families would have been fairly consistent, between 2.9 and 4.1 percent of income. But the bottom 20 percent of Alaska earners would have seen impacts more than twice as large as their more affluent neighbors, at 8.6 percent of their incomes.

The lopsided nature of this impact would decline over time, however, as the cuts to the PFD payout became less steep. Figure 3 shows that low-income and high-income families would have faced similar impacts (equal to approximately 2.8 percent of income) in a scenario in which the PFD was reduced by just $300 in Tax Year 2016. Middle-income families would have enjoyed a somewhat smaller impact than other Alaskans because the PFD is a less vital source of income for this group relative to low-income families, and because the graduated rate structure of the proposed income tax levies lower rates on this group relative to high-income families.

Table B on page 11 of this report also shows the impact of a medium-term scenario where the PFD was reduced by $425 per person in Tax Year 2016 (rather than the $950 and $300 reductions depicted in Figures 2 and 3, respectively). Under this scenario, most families would have seen impacts ranging from 2.1 to 2.8 percent of income, while the bottom 20 percent of Alaskans would have seen a somewhat larger impact equal to 3.9 percent of their incomes.

OPTIONS FOR REDUCING THE IMPACT ON LOW-INCOME FAMILIES

Low-income tax credits could mitigate some of the regressive impact of a sizeable PFD reduction at a relatively low cost to Alaska’s coffers.

The federal Earned Income Tax Credit (EITC), for instance, has been used to improve the financial situation of low-wage workers for over forty years. Workers below a certain income level receive a credit calculated based on a percentage of the wages they earn. Offering a similar credit at the state level is an effective strategy for mitigating the impact of regressive fiscal policies. Among the 41 states with broad-based personal income taxes, 25 offer a state-level EITC based on the federal credit.[3]

In Alaska, an EITC equal to 25 percent of the federal credit, for example, could boost the income of the state’s bottom 20 percent of earners by roughly 1 percentage point (or, put another way, offset roughly 1 percentage point of income lost due to a PFD reduction). A credit of this size would reduce state revenue by approximately $25 million per year. This is a small fraction of the annual savings that could be realized by cutting the PFD payout. Every $100 cut from the PFD payout, for instance, reduces expenditures by roughly $64 million.

FEDERAL TAX IMPLICATIONS AND NONRESIDENT IMPACTS

This analysis reveals that reducing the PFD payout and implementing a personal income tax as proposed in HB 115 (Version L) would reduce Alaskans’ federal tax liability by as much as $202 million per year (see Table A).

Specifically, reducing family income by cutting the PFD by $950 per person, as has been forecast for the first year of implementation, would reduce Alaskans’ federal tax payments by $100 million per year.

Smaller PFD reductions would trigger smaller federal tax cuts. Table B indicates that a PFD cut of $425 per person would trigger a $45 million federal tax cut while Table C shows that a PFD cut of $300 per person would result in a federal tax cut of $32 million.

Alongside these PFD changes, the new income tax contained in HB 115 (Version L) would trigger a $102 million federal tax cut because many Alaskans would be able to deduct the cost of their state income taxes on their federal tax forms. Additionally, researchers at the University of Alaska Anchorage’s Institute of Social and Economic Research (ISER) found that more than 7 percent of the revenue raised by a progressive personal income tax would be collected from nonresidents.[4] Applying this figure to ITEP’s estimates of the revenue raised by the income tax in HB 115 (Version L) suggests that nearly $53 million in revenue would be raised via nonresident income tax payments.

The combined impact of federal tax cuts and income tax payments by nonresidents would be to raise as much as $255 million, or 20 percent, of the revenue in HB 115 (Version L) from sources other than Alaska residents. That figure is somewhat lower in scenarios with smaller PFD reductions. Table B depicts an overall out-of-state contribution of $199 million while Table C reveals a $186 million contribution from outside of Alaska.

COMPARING INCOME TAXES ACROSS STATES

COMPARING INCOME TAXES ACROSS STATES

The personal income tax proposed in HB 115 (Version L) would be low by national standards. As seen in Figure 4, it would rank as the fourth lowest in the nation among states with broad-based personal income taxes. The tax would amount to less than 1.7 percent of Alaskans’ overall personal income, though low- and middle-income families could expect to pay less than this amount while high-income families could expect to pay more. A full summary of state income tax revenue relative to personal income is available in Table D on page 13.

COMPARING ALTERNATIVE INCOME TAX PROPOSALS IN ALASKA

As originally proposed, HB 115 included a personal income tax equal to 15 percent of each Alaskans’ federal income tax liability, plus a 10 percent levy on capital gains income and a $25 minimum tax on Alaskans required to file a federal tax return. While the new income tax proposal unveiled in Version L on March 23 appears significantly different on its face, its effect on Alaskans at varying income levels is remarkably similar to the original proposal.

Figure 5 shows that on net, most groups would see no meaningful change in their average tax payment under this modification to the proposed personal income tax. At the bottom of the income distribution, tax payments would fall slightly because of the generous exemptions contained in the new proposal. At the top of the income distribution, income tax payments would also decline very slightly on average, though the impact on specific households would vary according to the types of income they receive. While the top tax rate on ordinary income would rise under this change (from 5.94 to 7 percent), the top tax rate on capital gains income would fall (from 13 to 7 percent).

The most significant change in moving from the original proposal to this new structure would be to limit the vulnerability of the tax to changes in federal tax law. Under the tax as originally proposed, most changes in federal tax liability would impact Alaska’s income tax revenues. This means that virtually every change in federal exclusions, adjustments, exemptions, deductions, tax rates, or credits would have impacted Alaska’s revenue collections. This new proposal, by contrast, is only linked to a basic federal definition of income (Federal Adjusted Gross Income, or FAGI) and is thus likely to be much more stable even under a potentially significant overhaul of the federal tax code.

CONCLUSION

House Bill 115 (Version L) would make a significant contribution toward closing Alaska’s budget gap in a manner that, in the long-term, is relatively consistent in its impact on Alaskans at every income level. It does this by balancing regressive cuts to the PFD payout with a modest, progressive personal income tax. The bill also raises significant revenues from sources outside of Alaska, both via income taxes collected from non-resident workers and by bringing federal dollars into the state in the form of federal income tax cuts for Alaska residents.

In the short-term, however, the PFD reductions contained in this bill would impact low-income families more heavily than other Alaska families. One option for mitigating this outcome would be to offer a refundable Earned Income Tax Credit (EITC) patterned after the federal EITC.

Read the full report (PDF) here including appendices detailing methodology

[1] An overview of the ITEP Microsimulation Tax Model is available in Appendix B of this report and at: https://itep.org/about/itep_tax_model_simple.php.

[2] Alaska Legislative Finance Division, “HB 115- POMV draw amended: 5.25% in FY18 & FY19. 5% after. $1250 PFD floor in FY18 & FY19. Flat budget,” Mar. 14, 2017, at http://www.akleg.gov/basis/get_documents.asp?session=30&docid=13968.

[3] See ITEP’s Policy Brief, “Rewarding Work Through state Earned Income Tax Credits,” at https://itep.org/itep_reports/2016/09/rewarding-work-through-state-earned-income-tax-credits-2.php.

[4] Knapp, Gunnar et al., “Short-Run Economic Impacts of Alaska Fiscal Options,” at http://www.iser.uaa.alaska.edu/Publications/2016_03_30-ShortrunEconomicImpactsOfAlaskaFiscalOptions.pdf.