The property tax is an extremely important revenue source for local and state governments, though one that comes under frequent criticism. While some of that criticism arises from problems with the way property is valued for tax purposes, much of it is tied to the fact property taxes are frequently disconnected from families’ ability to pay. Whether you are in your prime earning years, recently laid off, or living in a gentrifying area, your property tax bill is based on the value of your home with little or no consideration for the resources that you have to pay that bill. Fortunately, states have a shovel-ready means of fixing this problem, popularly called property tax circuit breakers.

In our Who Pays? report, we analyzed how current tax policies affect people at different income levels and found that most states have regressive tax systems that disproportionately favor wealthy households. Regressive taxes require lower- and middle-income earners to pay a larger share of their income in taxes than high-income families. We sometimes refer to this as an “upside-down” tax code because it’s the exact opposite of the kind of progressive system that most Americans support.

Well-designed property tax circuit breaker programs allow states to reduce the impact that property taxes have on the upside-down tilt of their tax codes.

In all, 29 states and D.C. administer circuit breakers of some kind, though they vary widely in size and scope. Among the more serious limitations in these programs are age cutoffs that deny any benefit to working-age adults. Of the 30 jurisdictions with circuit breaker credits, just 13 make those credits available to working-age homeowners and only 8 make them available to working-age renters who pay substantial property taxes indirectly through their rent.

Of the states with the 10 most regressive tax codes in Who Pays? all fail to provide working-age taxpayers with a circuit breaker option. Even among the 20 most regressive states, just New Hampshire has a circuit breaker for working-age adults—a modest program available only to homeowners.

On the other hand, half of the 10 least regressive jurisdictions make circuit breakers available to working-age homeowners and renters: Maine, Minnesota, New York, Vermont, and the District of Columbia. Circuit breakers prevent homeowners and renters from being “overloaded” by their property tax bills by rebating property taxes paid over a certain amount of their income. In other words, if your family is devoting too much of its household budget to paying property taxes, the circuit breaker is activated and remedies the problem with a carefully designed tax rebate. This can be especially crucial for people from historically marginalized communities who are likely to work in lower-wage jobs and face high housing costs relative to their incomes.

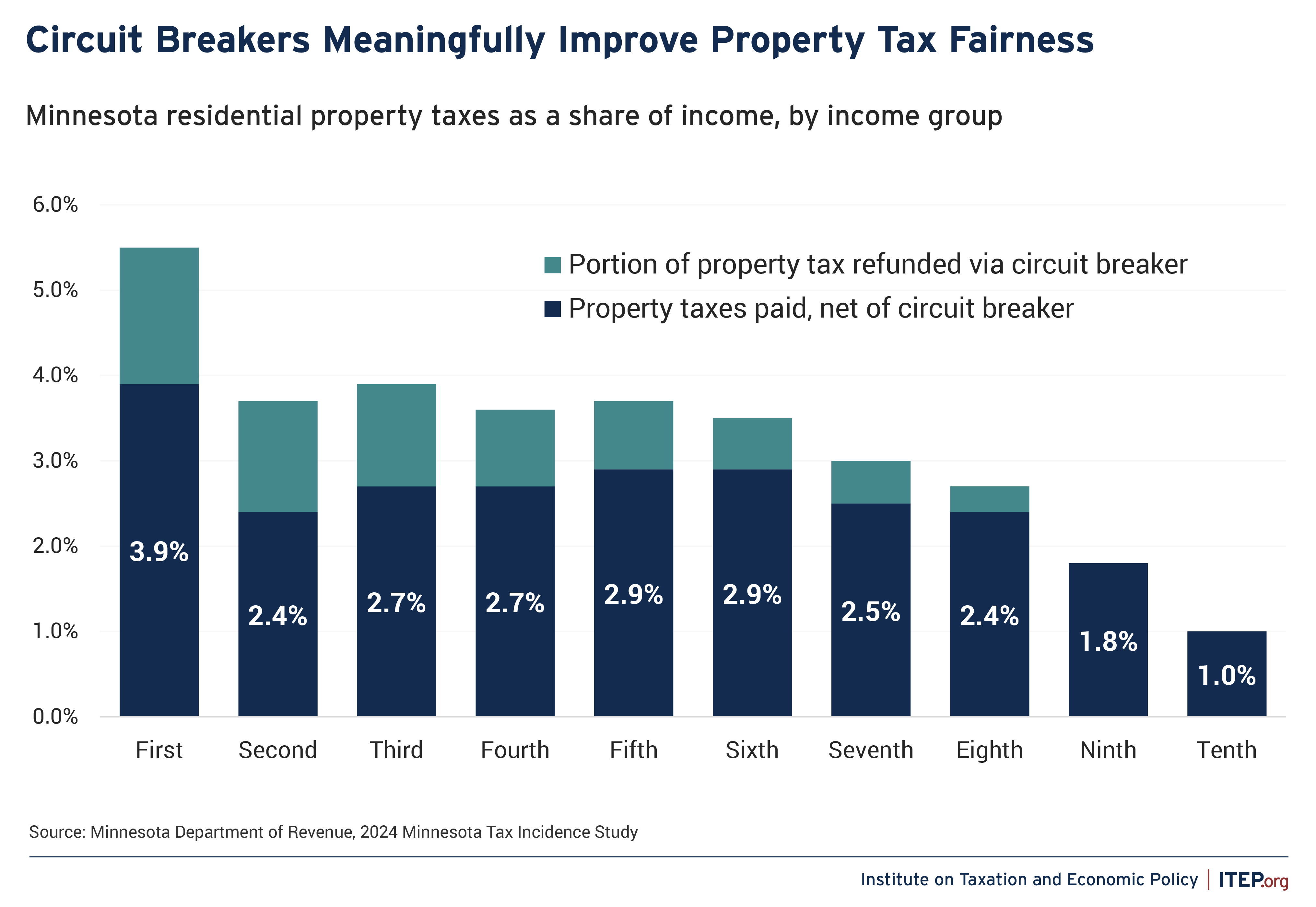

The chart below shows the significance of this kind of policy in Minnesota, which has among the most robust circuit breakers in the country and, not coincidentally, among the least regressive overall tax codes as well. According to data from the state’s department of revenue, Minnesota’s circuit breaker transforms a steeply regressive residential property tax into a moderately regressive one that is actually somewhat flat throughout much of the income scale.

The stark difference in circuit breaker policies between the most and least regressive states is a telling example of how states vary greatly in the extent to which they take seriously the idea of charging taxes based on families’ ability to pay.

Implementing or improving circuit breakers is a straightforward way for policymakers to ensure that property taxes are set at levels that families can afford.

Read more in ITEP’s 2023 report: Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability