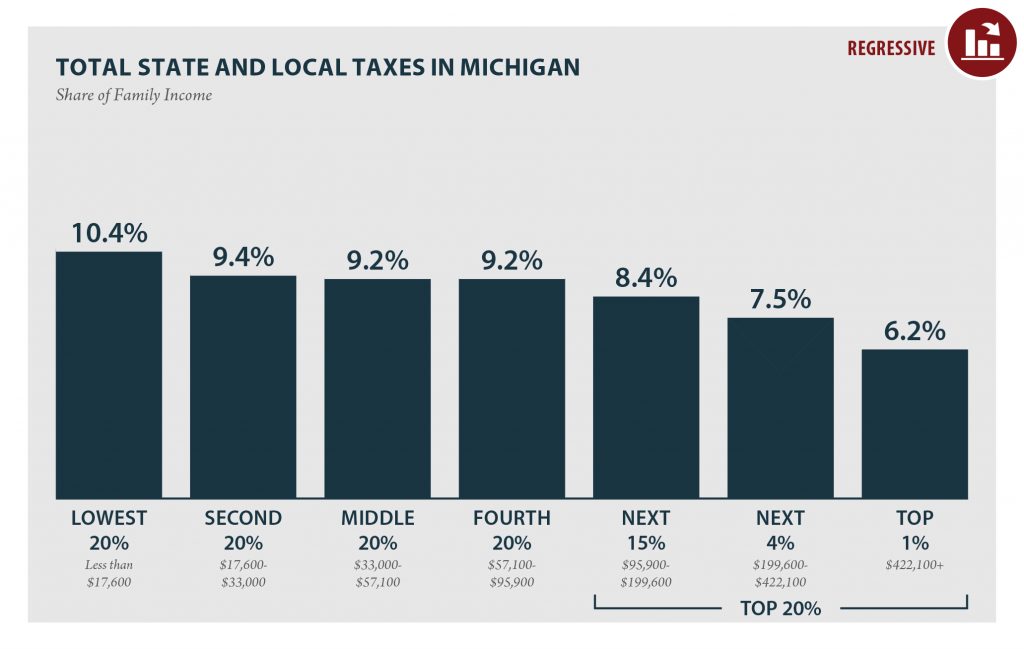

Across-the-board income tax cuts will not boost Michigan’s economy but would contribute to rising income inequality, and further drain resources from public schools, community colleges, universities, health care and public safety—the very services that fuel economic growth. Despite claims that income tax cuts create economic growth, there is no evidence that they generate the good jobs our state needs.

State economists are now predicting that Michigan revenues will be higher than originally predicted, creating a “surplus” of approximately $970 million over a three-year period. In response, some leaders in the Michigan Legislature are advocating a rollback of the state’s personal income tax. Their primary sales pitch is that it will improve Michigan’s economy—despite clear evidence from other states and a large body of research that show income tax cuts do not produce the often-promised economic benefits.

Across-the-board income tax cuts will not boost Michigan’s economy but would contribute to rising income inequality, and further drain resources from public schools, community colleges, universities, health care and public safety—the very services that fuel economic growth. Despite claims that income tax cuts create economic growth, there is no evidence that they generate the good jobs our state needs.

State economists are now predicting that Michigan revenues will be higher than originally predicted, creating a “surplus” of approximately $970 million over a three-year period. In response, some leaders in the Michigan Legislature are advocating a rollback of the state’s personal income tax. Their primary sales pitch is that it will improve Michigan’s economy—despite clear evidence from other states and a large body of research that show income tax cuts do not produce the often-promised economic benefits.

Read the Full Report