Exempting overtime pay from income tax has become a hot topic at both the state and federal levels. Alabama became the first state to pass the exemption – albeit temporarily – in 2023. Numerous states and the federal government are considering following their lead, touting it as a way to reward workers and fill labor shortages. While there is little evidence that exempting overtime pay from tax achieves these goals, one thing is clear as shown by Alabama lawmakers’ decision not to extend the policy: it is expensive.

Alabama passed its overtime exemption in 2023, with a sunset of July 1, 2025 unless renewed. While the legislature passed the exemption with a $25 million cap, Gov. Kay Ivey struck this provision, uncapping the exemption, and shifted the expiration date (from 2027 to 2025).

This “no tax on overtime” policy was initially projected to cost Alabama’s schools $34 million, but the final tally is now expected to be 10 times as much. When all is said and done, state officials expect the exemption will reduce revenue to the state’s Education Trust Fund by $350 million. For this reason, Alabama lawmakers chose not to renew this exemption, instead using the savings to reduce the state’s grocery tax and fund other priorities.

The choice made by Alabama lawmakers to allow the policy to sunset should be a warning for the state and federal lawmakers considering overtime exemptions, and there are plenty of additional reasons this policy is an ineffective way to help workers.

Subjecting different types of income to different levels of taxation opens the door to more inequities within the tax system. By opening loopholes to classify more income as tax-exempt, businesses and wealthy taxpayers are positioned to benefit over working-class households. High-earners like C-suite executives could reclassify their positions to hourly wages to avoid taxes. On the other end of the income scale, businesses could lower regular wages and hold untaxed overtime hours over the heads of employees who need the extra hours to make ends meet. This would mean that taxpayers, rather than employers, bear more of the extra costs.

The original reason to create the now near century-old 40-hour work week was to allow a balance between work and other parts of life: parenting, rest and recreation to name a few. If employers couldn’t get work completed with their current workers in forty hours, they should pay extra, giving them an incentive to create more jobs rather than exploiting current staff. Instead of exempting overtime pay from income tax, labor experts argue that increasing overtime rates beyond time-and-a-half and raising the annual income threshold for overtime pay (currently set at $35,685) is how to best support workers and boost wages.

Alabama’s short-lived overtime exemption provides a clear lesson for other states and lawmakers: exempting overtime is an expensive gimmick and distraction from the real issues faced by our nation’s workforce.

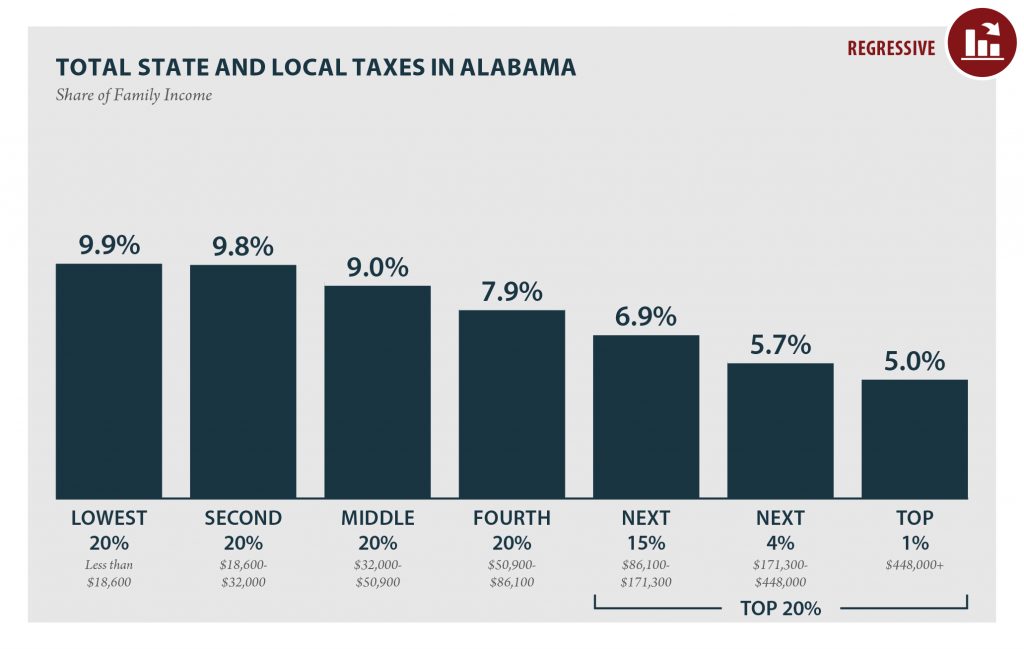

Lawmakers would be better off focusing on making Alabama’s tax system more equitable. As of now, Alabama’s state and local tax system is upside down, asking the most of low- and middle-income families, while asking the richest in the state to pay the lowest tax rates. To move toward a fix to this clearly regressive and inequitable tax system, lawmakers have a wealth of options at their disposal.

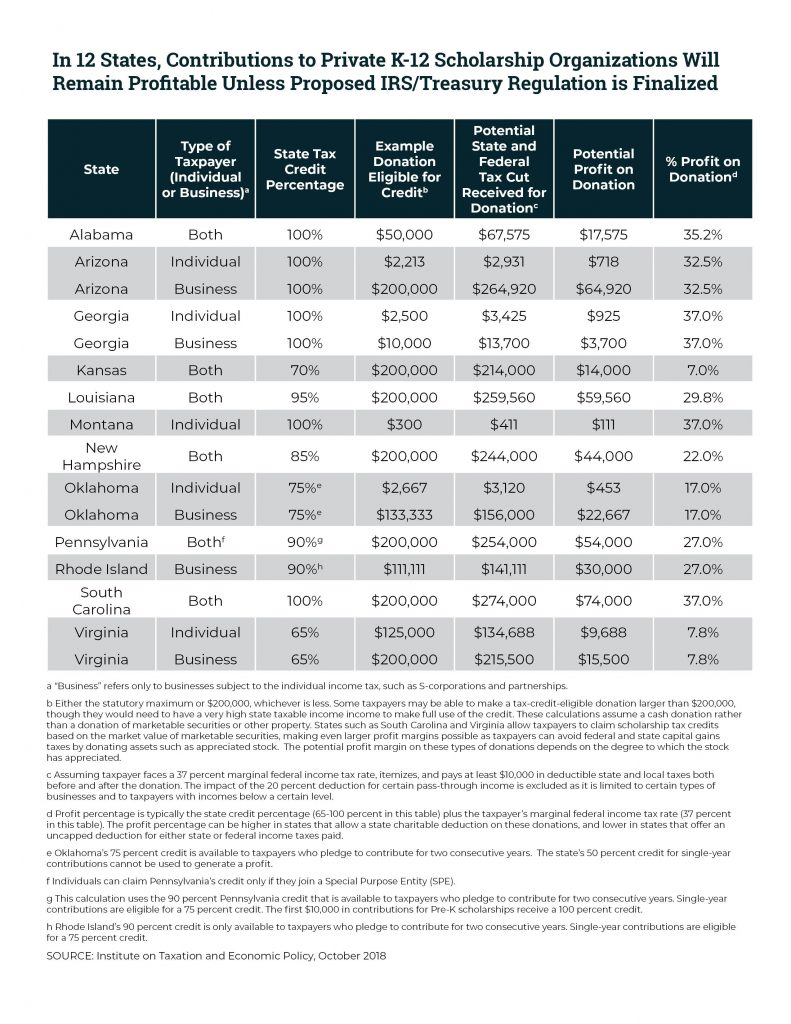

Lawmakers could rid the state of the Federal Income Tax Deduction which allows the state’s wealthiest taxpayers and corporations to avoid nearly $1 billion in state income taxes a year. Instead, this money could be put towards policies that make Alabama stronger like additional funding for education and healthcare and implementing refundable tax credits for workers and families.