Posted by Max Brantley on Wed, Jan 30, 2013 at 9:56 AM

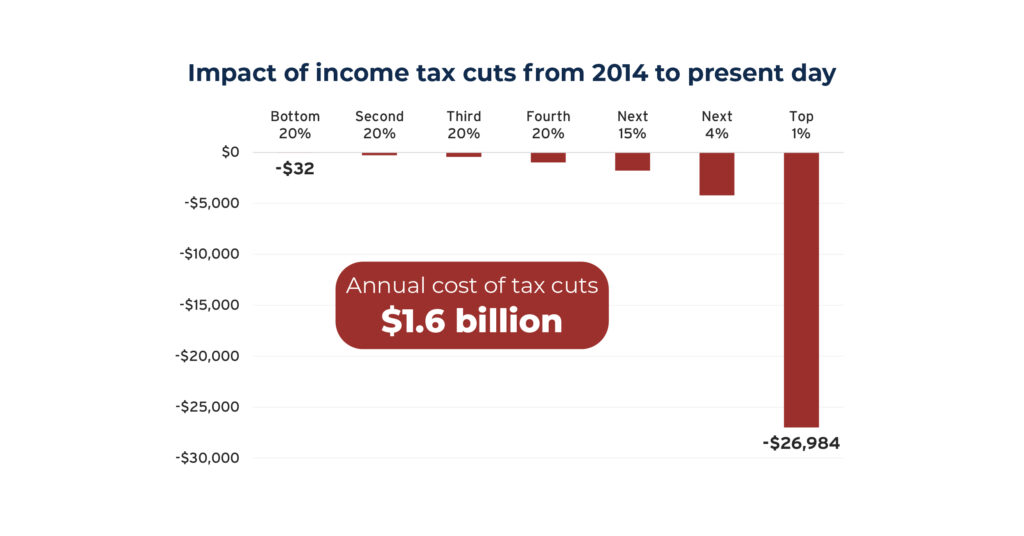

Arkansas is on the cusp of a Republican-led charge to reshape taxation. Where they don’t want to cut taxes, they want to dramatically reduce the burden on wealthy taxpayers, by reducing or eliminating the tax on unearned income and by reducing the top income tax brackets. To the extent the money would be replaced, the Republican Party as a matter of official policy has shown its affection for the sales tax, the most punishing of all taxes on poor and middle-income people.

In that context comes a new national report on how the tax burden falls in each state. In sum:

Most significantly, the report concludes that all states have regressive tax systems that ask more from low- and middle-income families than from the wealthiest. It also finds:

– The average overall effective state and local tax rates by income group nationwide are 11.1 percent for the bottom 20 percent, 9.4 percent for the middle 20 percent and 5.6 percent for the top 1 percent

– Ten states with the most regressive tax systems are: Washington, Florida, South Dakota, Texas, Illinois, Tennessee, Arizona, Pennsylvania, Alabama and Indiana.

– States praised as “low tax” are often high tax states for low and middle income families.

Here’s a link to the specific findings on Arkansas. The accompanying table shows Arkansas makes the top 10 in socking it to low-income taxpayers.