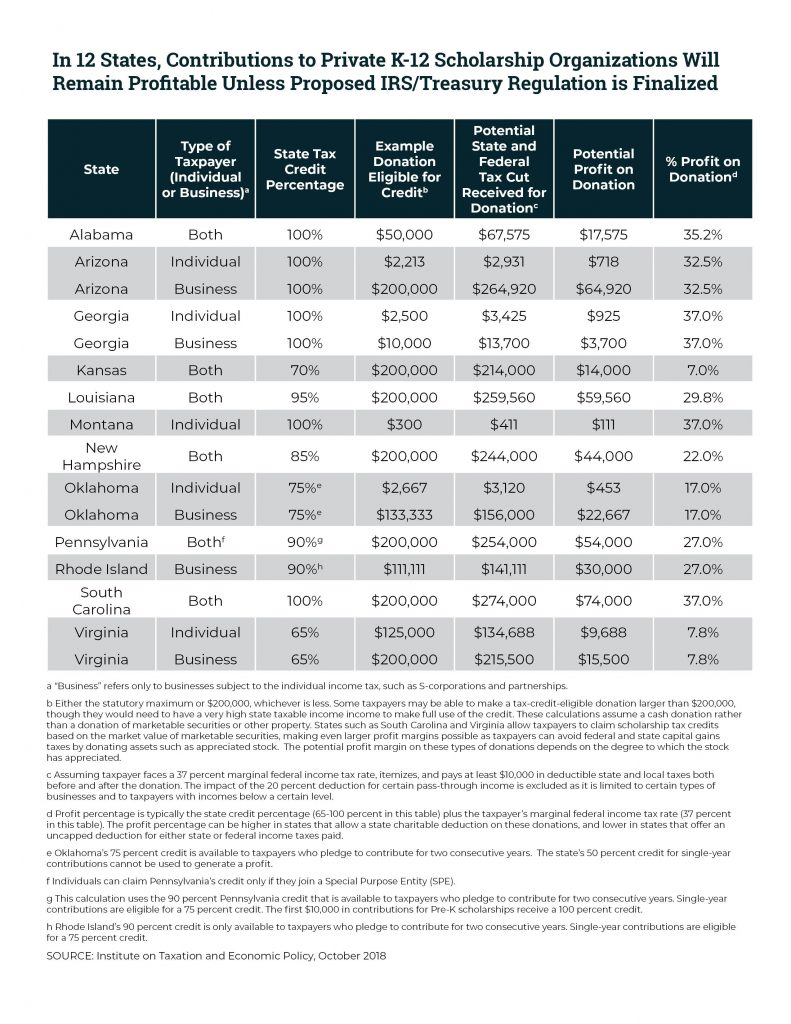

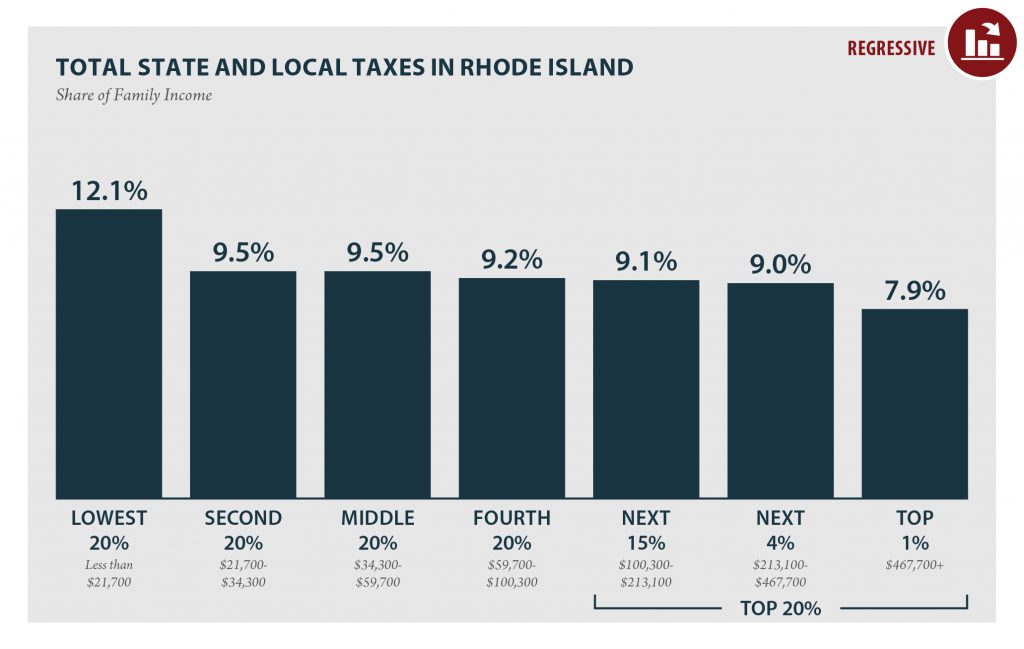

Workers who receive the EITC pay federal payroll taxes, sales and property taxes, and more. In fact, Rhode Island has the 5th highest taxes on low-income households in the nation. The lowest-income taxpayers pay nearly twice as much of their income towards taxes as the wealthiest Rhode Islanders.

Quoted Staff Member

Related Reading

January 9, 2024

Rhode Island: Who Pays? 7th Edition

October 17, 2018

Rhode Island: Who Pays? 6th Edition

Mentioned Locations

Rhode Island