Tax Cuts 2.0

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

Tax Cuts 2.0 Resources

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. GOP leaders wrote the bill this way to adhere to their own rule that limits how much a piece of legislation can add to the federal debt. But it’s clear that proponents planned all along to make those provisions permanent. Less than a month after the law passed, the White House and Republican leaders began calling for a second round of tax cuts. Now, they have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which…

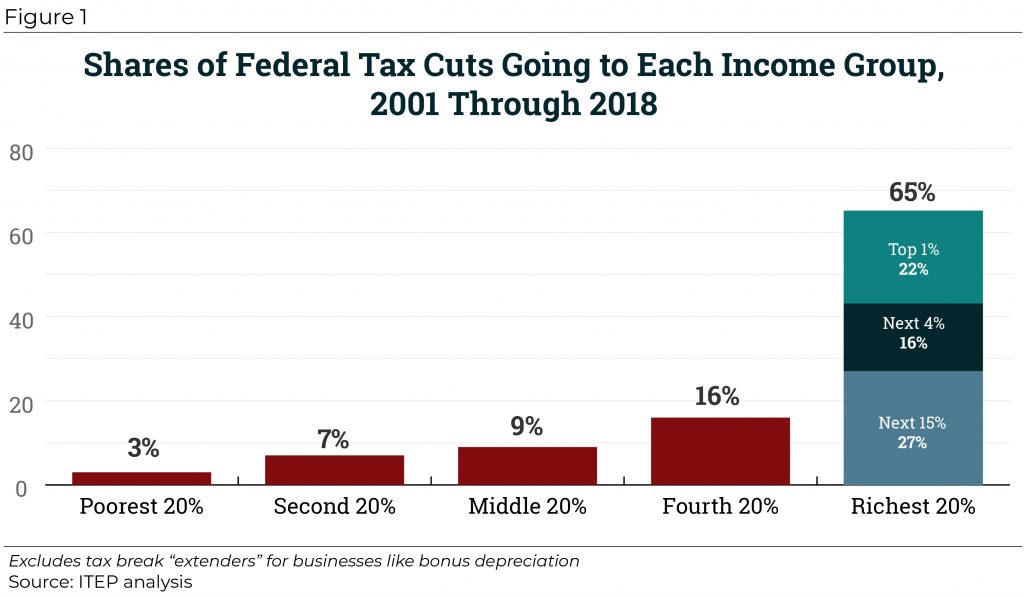

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By Matthew Gardner, Steve Wamhoff

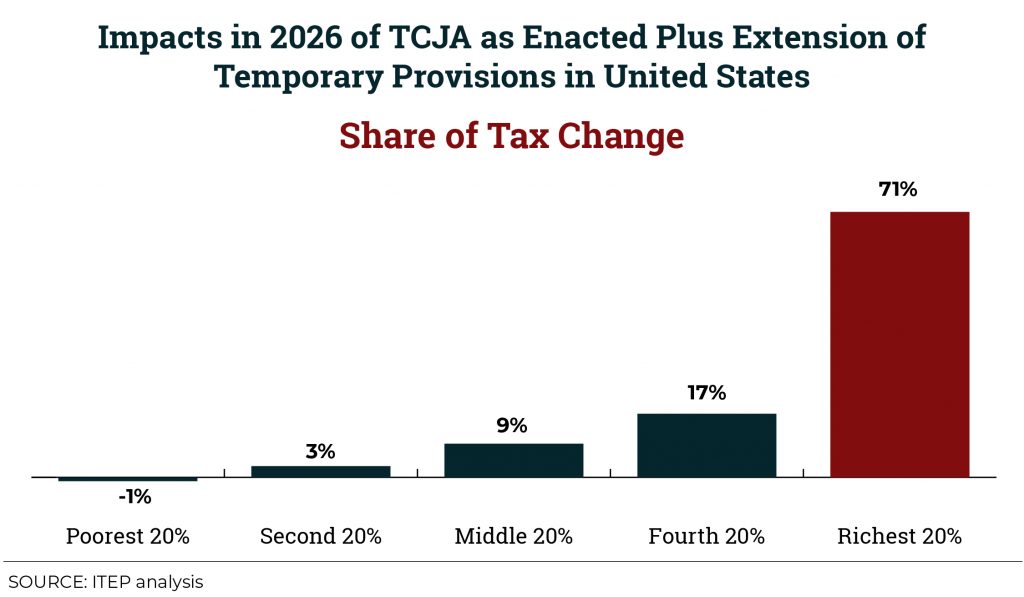

This analysis finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.