Contact: Jon Whiten ([email protected])

For decades, the Institute on Taxation and Economic Policy (ITEP) has played a role in shaping equitable and sustainable tax systems at the federal and state level. From the beginning, we have collaborated with advocates, policymakers, and others to advance policies that can foster expansive, inclusionary, and racially equitable tax systems. While ITEP has occasionally analyzed local tax policy options in places like Maryland, Pennsylvania, Alaska, California and Illinois, we have not had a team dedicated to local issues. Until now.

Our new local tax policy team is launching today with two new products:

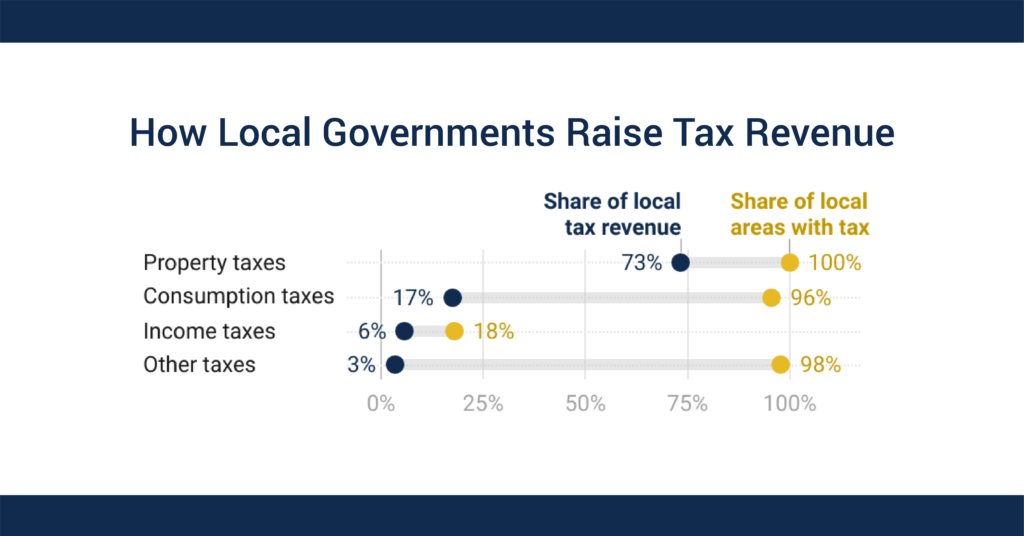

- Blog: Better Local Tax Policy Can Help Communities Thrive

- Brief: How Local Governments Raise Revenue—and What It Means for Tax Equity

Moving forward, the team will explore how to rebalance local taxes, including but not limited to:

- shifting away from fines and fees as revenue-raisers,

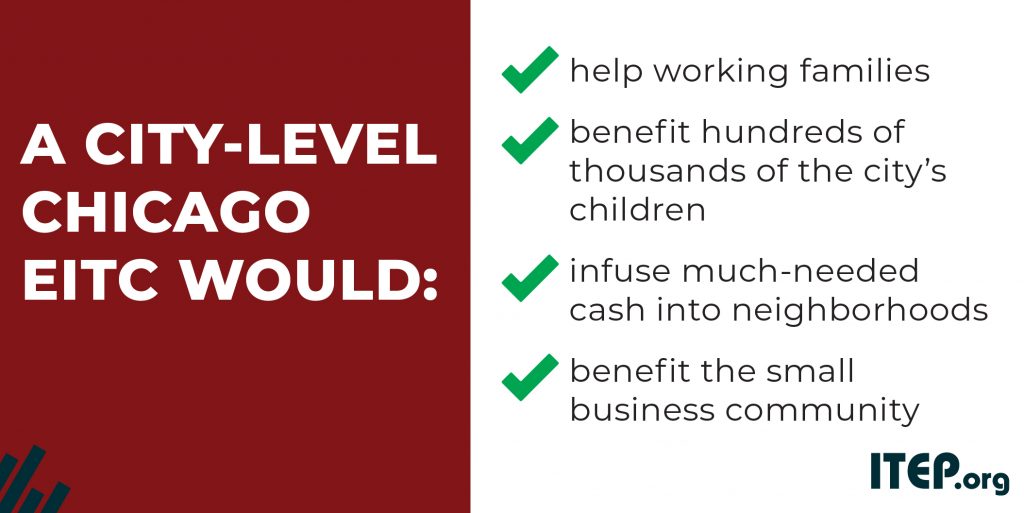

- considering local tax credits to bolster economic security and promote healthy communities,

- removing state legal barriers to equitable local taxes,

- reforming property tax assessments that widen racial and economic disparities,

- and ensuring that localities can raise revenue to tackle urgent challenges in public health, early childhood education, and more.

The new local tax policy team is being led by Kamolika Das, who was previously a Senior State Policy Analyst at ITEP and has experience at the state and local level in her prior work with the DC Fiscal Policy Institute and Prosperity Now. She’s joined by Andrew Boardman, who comes to ITEP from the Urban Institute.

“Economically and racially equitable tax systems are essential to adequately funding education, health, childcare, affordable housing, and other shared priorities,” said Kamolika Das, Associate Director of Local Taxes at ITEP. “This is especially true at the local level, where the connection between revenue and the quality of public services is extremely clear. Local governments must have enough power and autonomy to raise revenue and manage spending in accordance with local needs and priorities – and this new body of work aims to help make that a reality across the nation.”