Maryland’s New Budget Boosts Tax Revenue and Equity

briefThe final budget adopted by the Maryland General Assembly shows progress in advancing tax equity in the state while boosting state revenues to address the state’s budget deficit.

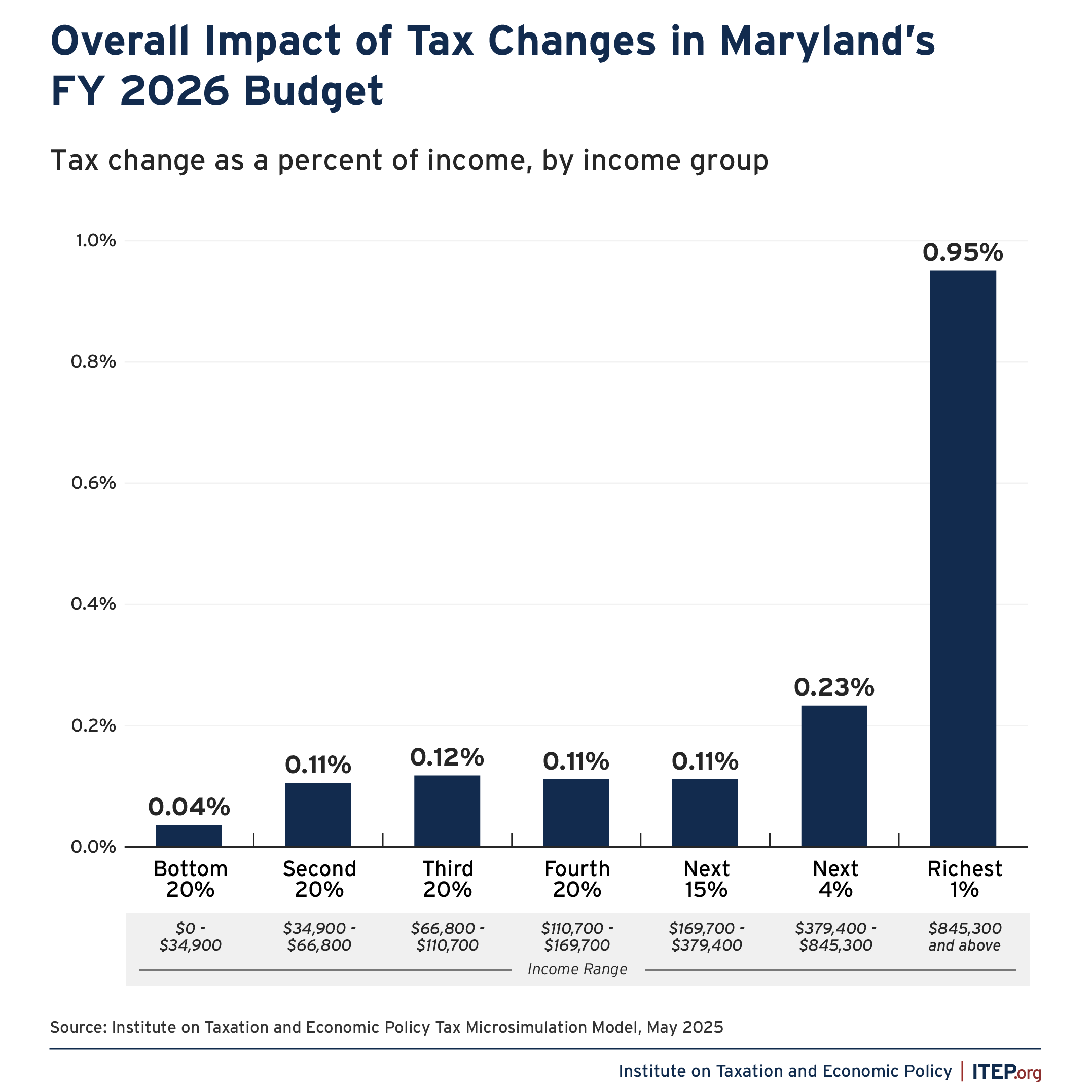

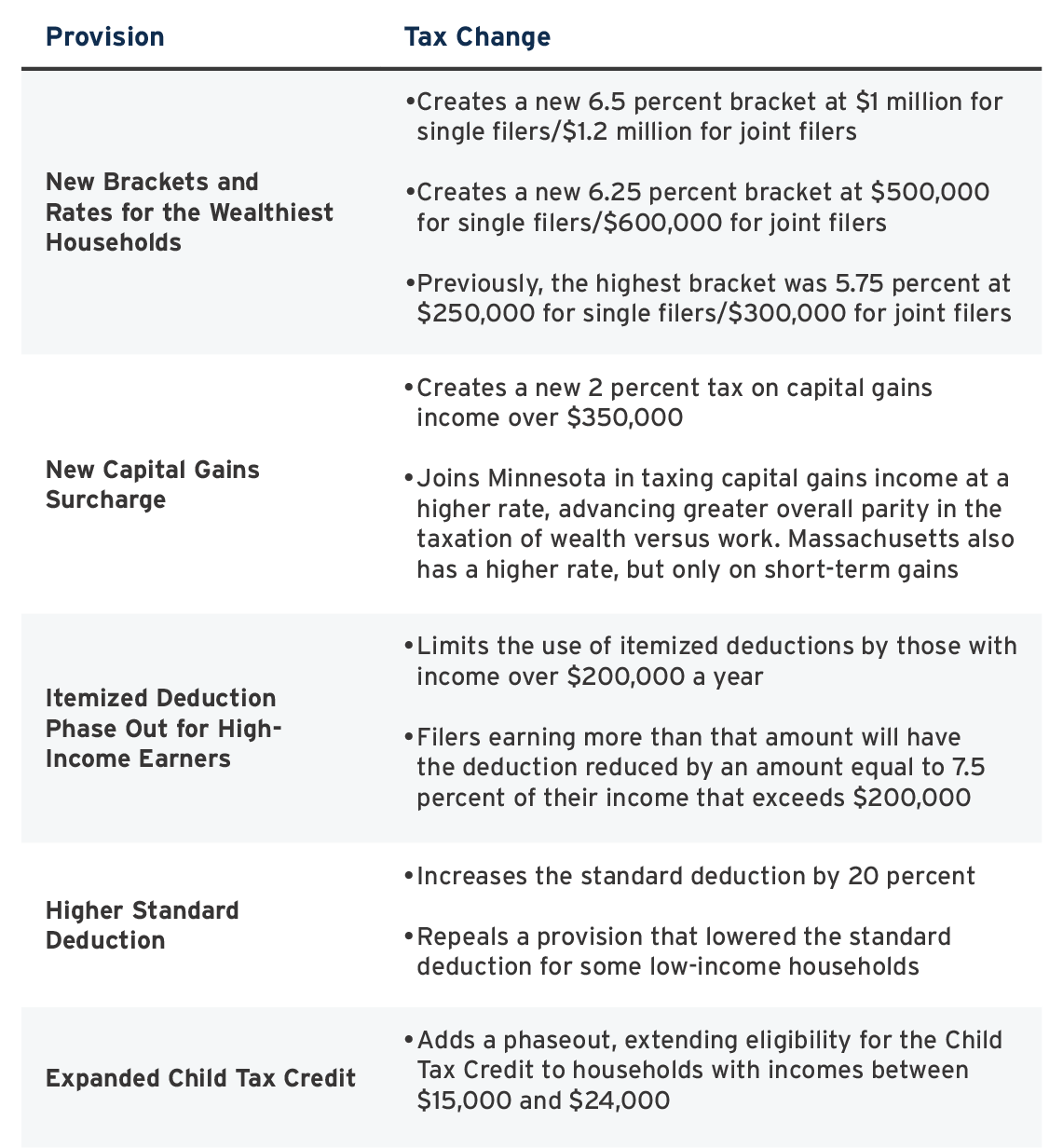

To help close a $3.3 billion budget deficit, Maryland legislators enacted much-needed tax reforms and progressive revenue raisers that help meet the state’s needs while making the tax code less regressive. As a result, all Marylanders will chip in to fund vital services and avoid deeper cuts, but high-income families will contribute a greater amount. Among other changes, the state’s highest income households will have new income tax brackets, a reduced itemized deduction, and a capital gains surcharge, while low- and middle-income Marylanders will benefit from a higher standard deduction and a modestly enhanced Child Tax Credit.

Steps Toward a Fairer Tax Code

Prior to the tax changes in the new budget, the wealthiest 1 percent of Marylanders paid the lowest state and local taxes as a share of their income of all income groups. However, once this legislation becomes law the wealthiest 1 percent will no longer pay the lowest share.

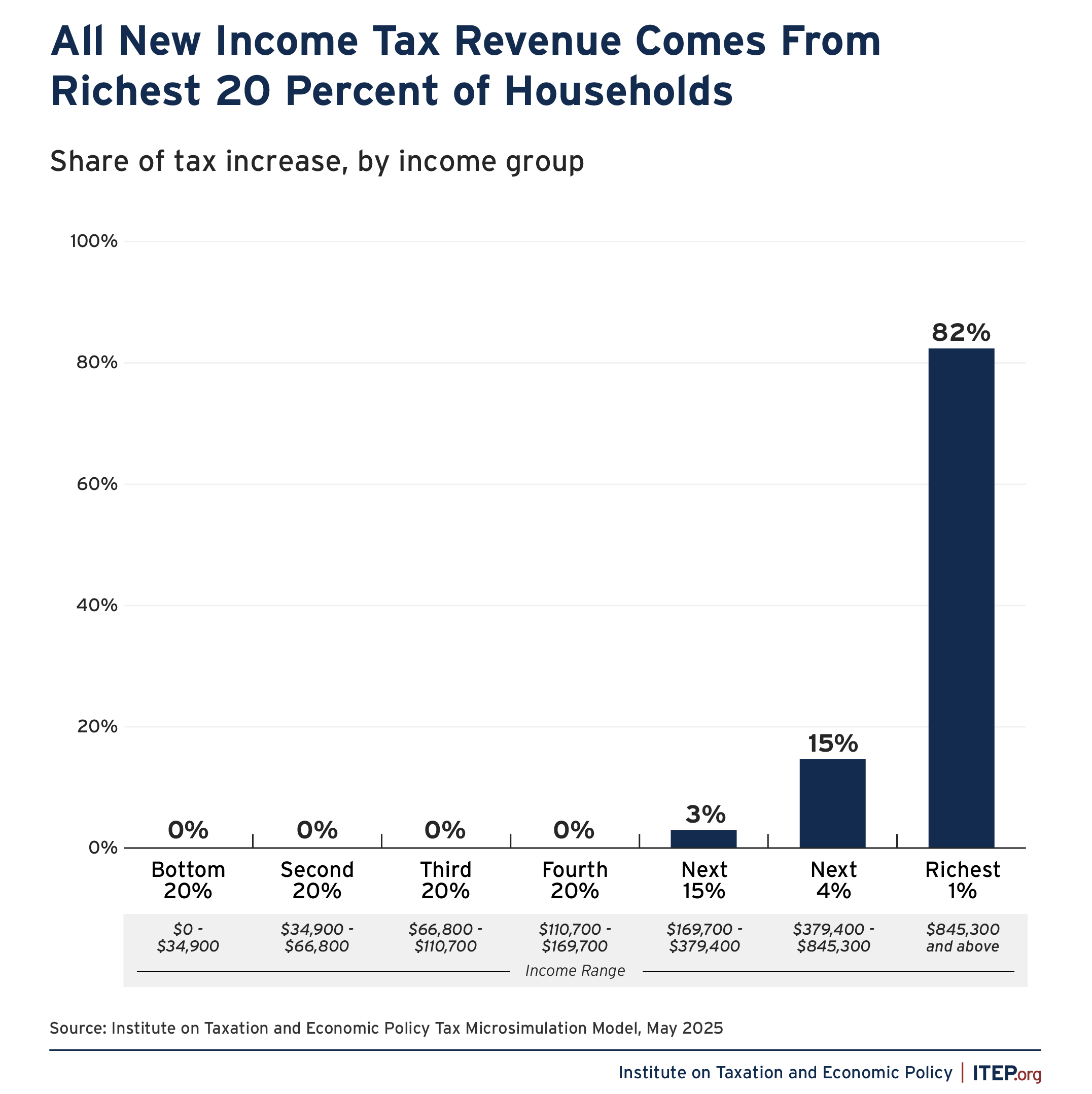

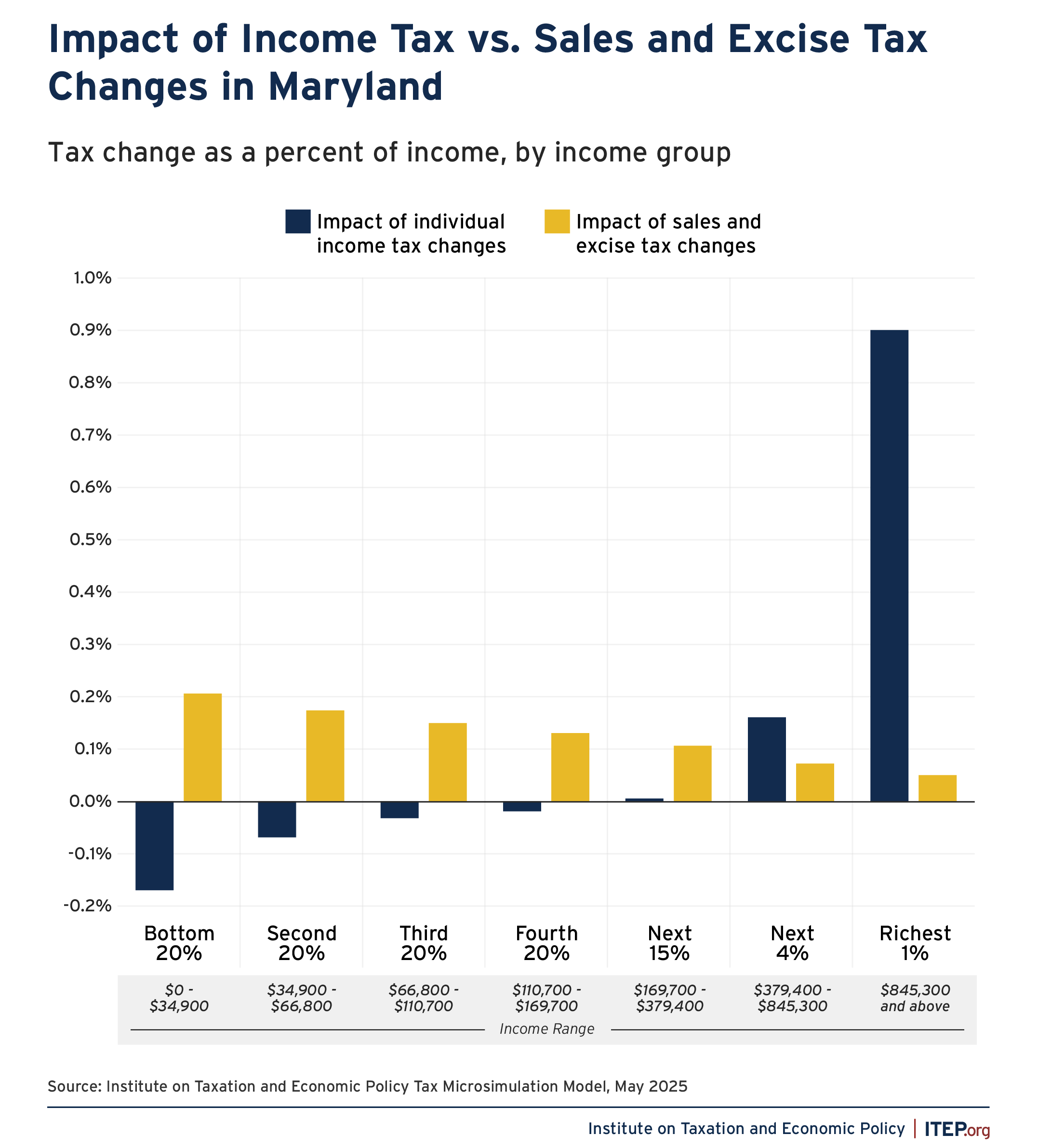

The personal income tax changes alone are estimated to raise $580 million a year in new revenue, according to state estimates. Nearly all the new income tax revenue – 82 percent – will be paid by the wealthiest 1 percent of Maryland households with incomes over $845,000. When looking at the income tax changes alone, no household earning less than roughly $200,000 per year will pay more. In fact, 63 percent of Maryland residents will see an income tax cut.

The state budget also includes sales tax expansions and other consumption tax changes that lessen the overall progressivity of the plan, but taken as a whole, the package increases tax equity in the state. Those tax changes include an expansion of the sales tax base, a tax increase on cannabis, and a new tax on data and IT services.

Tax Policy Highlights

Other notable tax policy changes and additional details in the budget include:

- A new sales tax on data and IT services. The budget raises $450 million in new revenue a year from a 3 percent tax on digital services like cloud storage and custom software that are not already subject to the state’s 6 percent sales tax.

- Higher tax rate on cannabis. The budget increases the cannabis sales tax rate from 9 to 12 percent.

- Expanded sales tax base. Some items previously exempt from sales tax will now be taxed, including vending machine snacks, rental vehicles, and photographic and artistic material used in advertising.

- Increased sports wagering tax. The budget increases the sports wagering tax rate from 15 to 20 percent.

Bolder Reforms Still Needed

While these tax changes helped lawmakers close this year’s budget deficit and reduce the size of budget cuts that would otherwise be needed, the state still has several policy options available to create sustainable funding for the future while making further gains in tax equity.

- Take steps to mitigate (or stop) corporate tax avoidance. The final budget failed to include Gov. Moore’s original budget proposal to close a long-standing corporate loophole by implementing combined reporting, which would require corporations and their affiliates in other states to file a combined return so they can’t hide profits in other states. The state should not only enact combined reporting, but go even further by pursuing worldwide combined reporting, which outright stops the incentive for multinational corporations to game revenue departments and shelter their profits in tax havens overseas. This change would raise an estimated $717 million a year.

- Broaden the capital gains surcharge. Maryland could expand the new capital gains tax for high-income households to include other forms of passive investment income such as interest and dividends.

- Bracket recapture. Maryland could implement an income tax recapture —which exists in Connecticut and New York—to limit how much high-income households benefit from lower marginal tax rates.

- Further improvements to the Child Tax Credit. While the legislature improved the design and slightly increased income eligibility for the Child Tax Credit by creating a gradual phaseout of the credit up to $24,000, the income limit is still relatively low compared to other states and could be further extended. Further, lawmakers could boost the credit to provide a larger benefit and build upon the credit’s known ability to reduce child poverty.