April 10, 2024

April 10, 2024

Taxes paid to local governments support the building blocks of thriving families and communities. Public investments in education, parks, public health, and much more, facilitated by local tax dollars, change lives for the better. Three leading localities are also using their tax systems to invest directly in workers and families with local refundable credits modeled after the Earned Income Tax Credit, as we detailed in a recent report.

This tax season more than 800,000 households in New York City, Maryland’s Montgomery County, and San Francisco are set to receive a boost through local refundable EITCs. These credits put dollars directly into the pockets of low-income households, equipping families with resources to better make ends meet and invest in their futures. In turn, they can help build stronger, fairer, and more resilient communities.

Refundable credits at federal, state, and local levels boost the after-tax income of households by providing annual tax credits targeted to workers and families with low and moderate incomes.

The federal EITC, in place since 1975, reaches approximately 25 million households in every corner of the country, directly raising incomes and helping to offset the taxes these households pay. Thirty-one states plus the District of Columbia and Puerto Rico offer their own credits as well, typically matching a certain percentage of residents’ federal EITC. It’s an approach with a powerful track record of lifting children and adults from poverty, promoting upward mobility, improving racial equity, and rebalancing upside-down tax systems.

At the local level, three leading localities — New York City, Montgomery County, and San Francisco — invest in their people through their own refundable EITCs. These credits, like the federal and state credits, deliver targeted support to workers and their families at tax time.

New York City’s Earned Income Credit

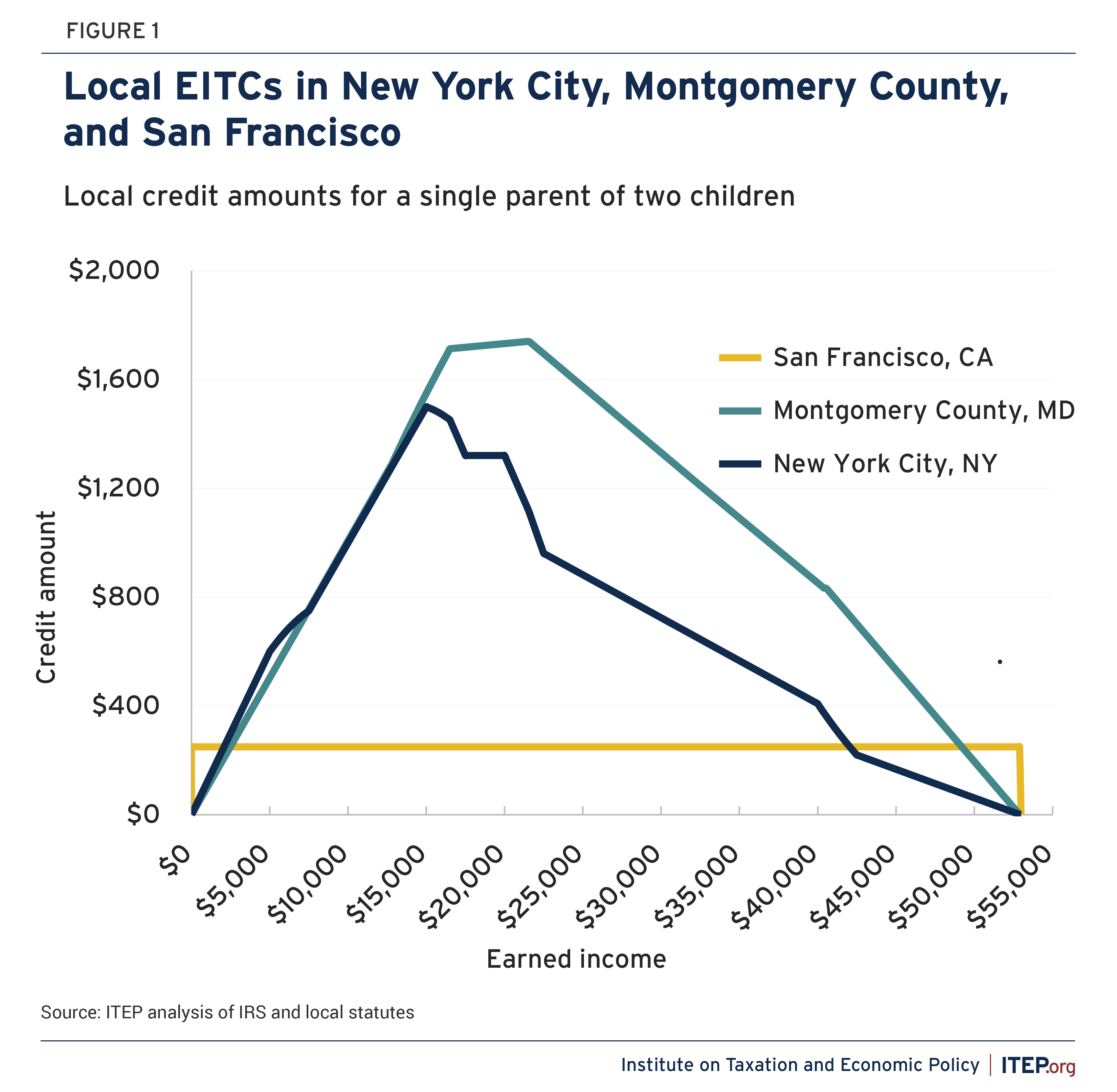

New York City’s refundable Earned Income Credit matches between 10 percent and 30 percent of residents’ federal EITC. Households with very low incomes receive the full 30 percent match, and the match rate declines incrementally as income rises. This sliding-scale approach builds on the structure of the federal EITC while targeting greater support to households with lower incomes.

For a single parent with two children, the New York City credit offers a boost of up to about $1,500 per year. The credit is applied to offset city income taxes. If it is larger than the amount owed in income taxes, the remaining portion is paid directly to the household. Last year the credit reached 754,000 workers and families, reducing taxes and raising incomes by an average of $459 per household.

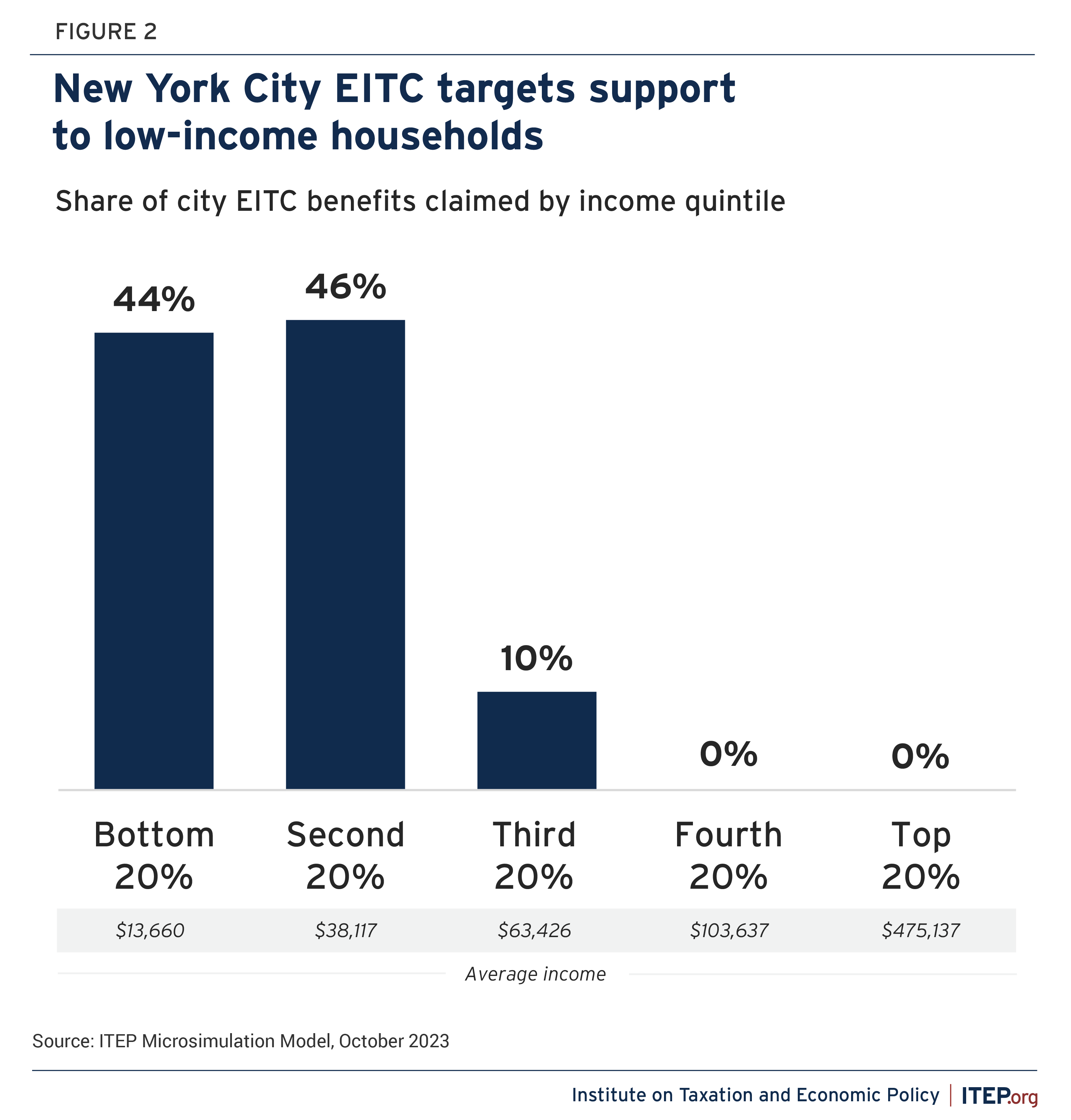

The boost from the Earned Income Credit is targeted to low-income workers and their families, an ITEP analysis shows. We find that nine in ten EIC dollars reach households in the bottom two-fifths of New York City income earners. Households claiming the credit have an average income of $29,000, far below the $139,000 average household income of New York City at large.

The credit supports workers and families of all races and ethnicities. It plays an especially important role for Hispanic and Black households, according to ITEP estimates. We find that approximately one in five Hispanic households who file income taxes in New York City claim the EIC, and approximately one in six Black households receive the credit. In comparison, about one in seven tax filers overall claim the EIC, including approximately one in 14 white households.

New York City households claim the local credit on top of New York’s state Earned Income Credit, which matches 30 percent of the federal credit. A New York City resident who claims the state and city EICs can receive a combined boost worth up to 60 percent of the federal credit, the fourth largest EITC match in the country.

Eligible New York City residents can claim the Earned Income Credit while completing their annual city and state tax returns. IRS-certified NYC Free Tax Prep sites across the city offer no-cost services for residents with low and modest incomes seeking to complete their income taxes and claim local, state, and federal tax credits. This year, eligible residents of New York and 11 other states can complete their federal tax returns and claim the federal EITC for free using the IRS Direct File pilot.

Montgomery County’s Working Families Income Supplement

Residents of Montgomery County, Maryland, are eligible for two local tax credits based on the federal EITC. The most substantial portion is the refundable Working Families Income Supplement, which delivers a direct payment equal to a percentage of a household’s Maryland state EITC refund. A nonrefundable county EITC is available separately to offset county income taxes for lower-income residents. Many households claim both credits.

These local credits together match between one quarter and one third of the federal EITC for families with children and up to two thirds of the federal credit for workers without children. Around 70,000 households claimed them last year, including 64,000 claiming the refundable WFIS. All Maryland counties and Baltimore levy local income taxes and provide nonrefundable EITCs; only Montgomery County offers a refundable credit.

For a single parent with two children, the Montgomery County credits offer a boost of up to about $1,700 per year. A single worker with no children at home can receive up to about $400. Households receive approximately $600 on average, the bulk provided by the refundable Working Families Income Supplement.

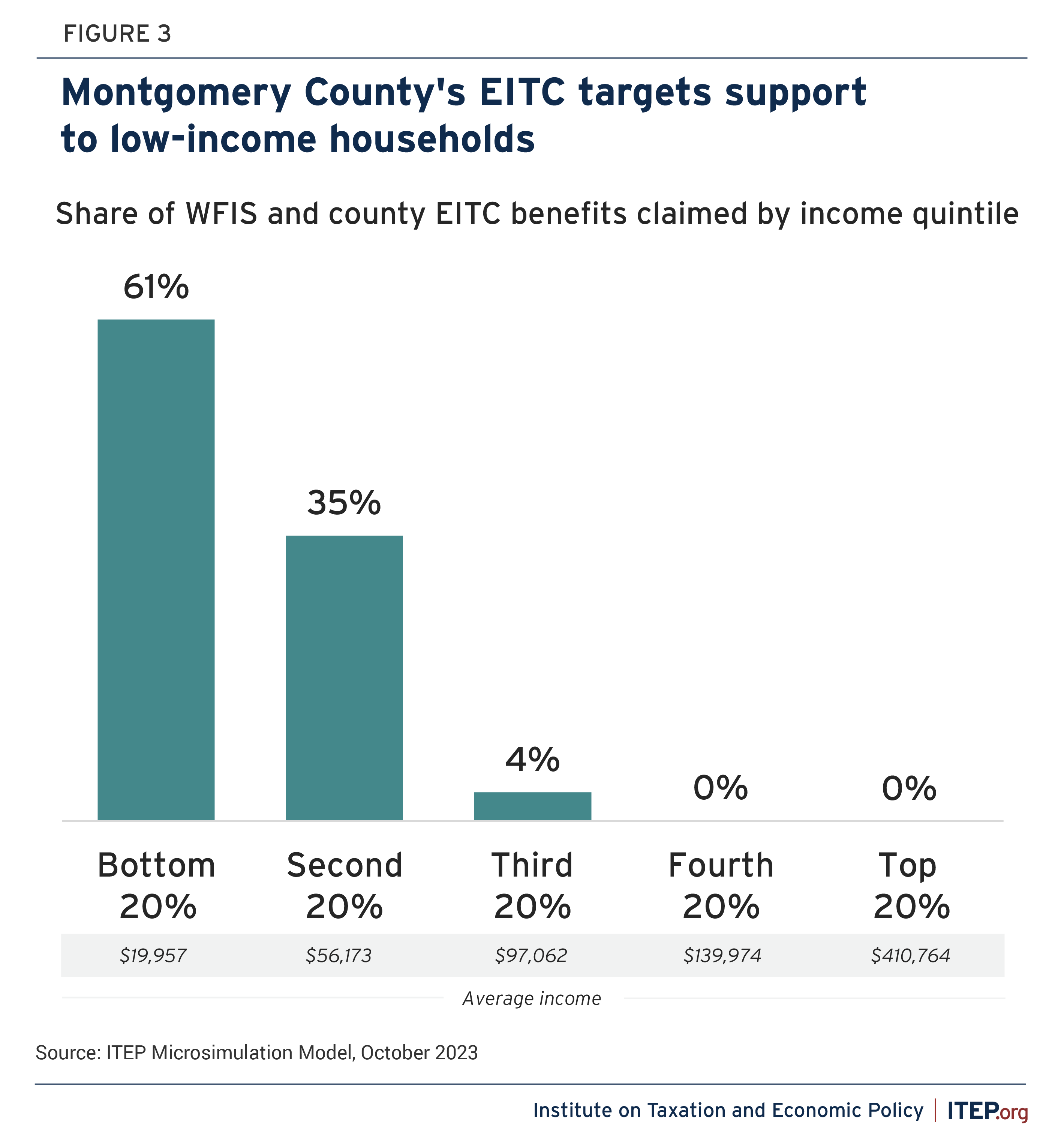

The gains are targeted to low-income workers and their families, results from ITEP’s Microsimulation Tax Model show. Households claiming the WFIS or nonrefundable credit have an average income of $26,000, substantially less than the $145,000 average household income of Montgomery County. Over 95 percent of local EITC dollars flow to households in the bottom two-fifths of income earners.

Montgomery County’s EITC-linked credits are provided on top of Maryland’s robust state EITC. The state matches between 45 percent and half of the federal credit for families and 100 percent of the federal credit for workers without children. A family in Montgomery County who claims the state and county EITCs can receive a combined match worth up to 82 percent of the federal credit, one of the most robust EITC matches in the country. A single worker with no children can claim state and local credits up to 167 percent of the federal EITC, the largest EITC match in the country. The Maryland and Montgomery County credits are available to younger and older workers without children in the home and households using Individual Taxpayer Identification Numbers, allowing these residents to claim vital support even as they are excluded from the federal EITC.

The Working Families Income Supplement is delivered automatically to Montgomery County residents who received a refund from the Maryland EITC. Beyond claiming the state EITC, no additional application is required to receive the refundable WFIS. This straightforward approach, the result of a partnership between the state and county, allows Montgomery County to achieve a high level of participation in this income-boosting credit. The nonrefundable county EITC is claimed as residents file county income taxes each year. IRS-certified Volunteer Income Tax Assistance sites in Montgomery County offer free tax-filing services to residents with low and modest incomes.

San Francisco’s Working Families Credit

San Francisco’s Working Families Credit offers a $250 per-household direct payment to families with at least one child in the home who claim the federal or California EITC.

The Working Families Credit builds on the income targeting of the EITC, focusing support on low- and moderate-earning households. But while the federal EITC phases in its benefits, the WFC provides $250 to all eligible families with at least some earnings.

San Francisco does not levy a personal income tax, unlike New York City and Montgomery County but like four-fifths of U.S. localities. Rather than offsetting a local income tax, San Francisco’s WFC acts as a direct cash boost to low-income residents, helping to bolster family resources and alleviate unbalanced effects from sales, property, and other taxes levied by the city.

Families claim the Working Families Credit by submitting an application to the San Francisco Human Services Agency, attaching a copy of a tax return documenting the filer has at least one child and qualifies for the federal EITC, or, if filing with an Individual Taxpayer Identification Number, the California EITC. Last year around 4,000 households claimed the credit.

Households with low and modest incomes can receive no-cost tax help from IRS-certified Volunteer Income Tax Assistance sites in San Francisco. This year, eligible residents of California and 11 other states can complete federal tax returns and claim the federal EITC at no cost using IRS Direct File.