The following is the testimony submitted by ITEP State Policy Analyst Neva Butkus to the Arkansas Senate Revenue and Tax Committee on Sept. 11, 2023.

Members of the Senate Revenue and Tax Committee,

Thank you for the opportunity to submit written comments regarding Senate Bill 8.

In my capacity as a state policy analyst with the Institute on Taxation and Economic Policy – a nonprofit and nonpartisan research organization that focuses on state and federal tax policy issues with an emphasis on revenue sustainability and tax equity – my testimony is intended to provide information regarding the deeply regressive nature of this proposal, Senate Bill 2, to cut both Arkansas’ personal and corporate income tax rates. And place those cuts in context with the deep income tax cuts that have taken place in the state over the past decade.

Over the past couple of years, states across the nation have benefited from surplus revenue. And with those additional resources, lawmakers were presented with two distinct options: to make investments and improve the lives of state residents or to use temporary boosts in revenue to continue making permanent tax cuts. The latter, which continues the path that Arkansas has taken over the course of the past decade, has increased the regressivity of the state’s tax system, asking low- and middle-income Arkansans to pay more in taxes as a share of income than the state’s wealthy families and individuals. It has also drastically reduced state revenue, the resources the state needs to afford high-quality education for your children, safe and efficient roads and infrastructure, affordable health care, and the many other services needed to support all the residents of the state and a robust state economy.

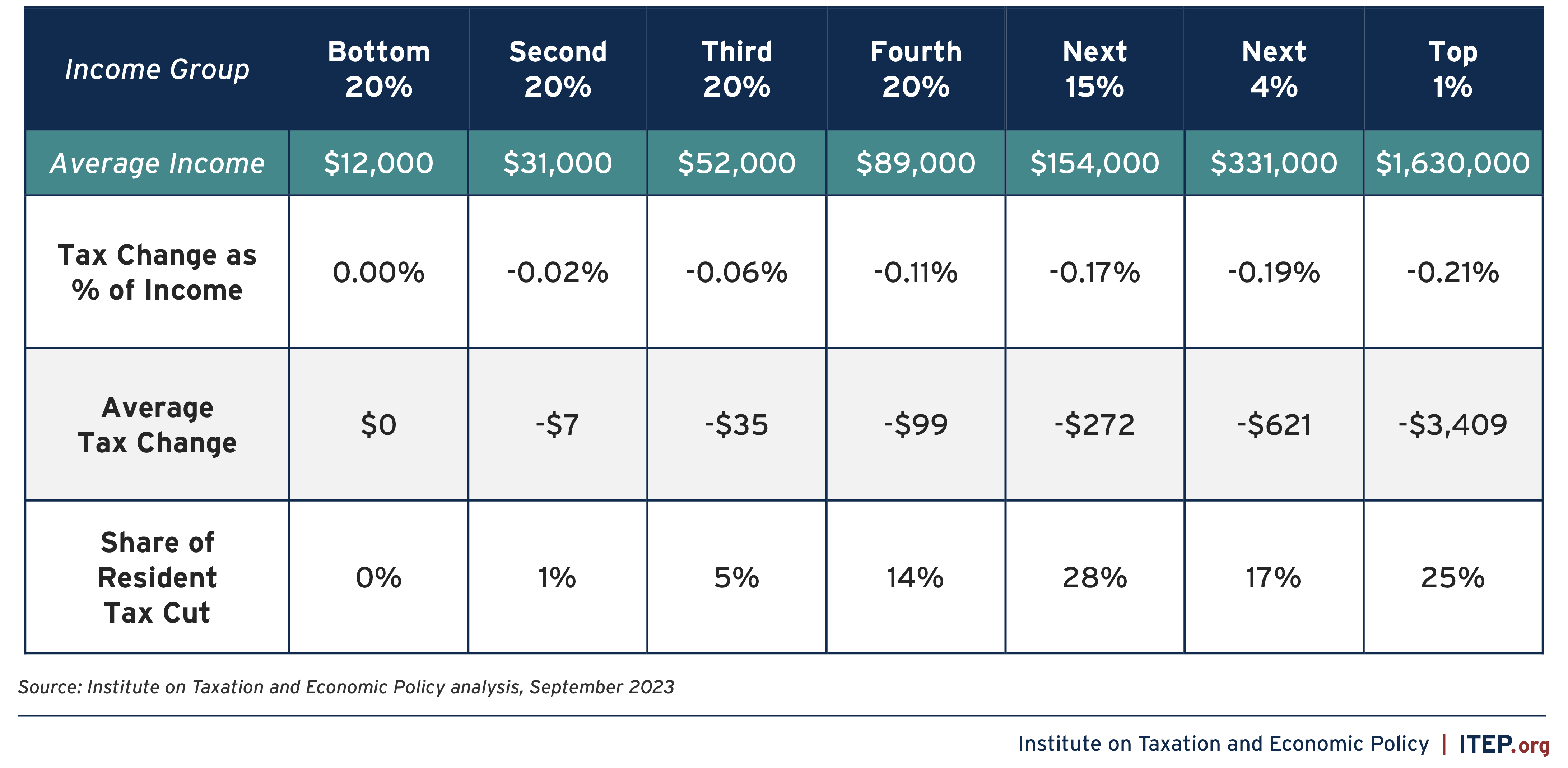

The corporate and personal income tax changes under Senate Bill 8 would cost the state more than $200 million, with 70 percent of the overall cuts benefiting Arkansans in the top 20 percent of households. The top 1 percent of Arkansans, whose average annual incomes exceed $1.6 million, would receive an average tax cut of $3,409 while families making an average of $52,000 a year would see a $35 tax cut under this proposal. The plan also includes a one-time nonrefundable $150 per household rebate for individuals earning less than $90,000.

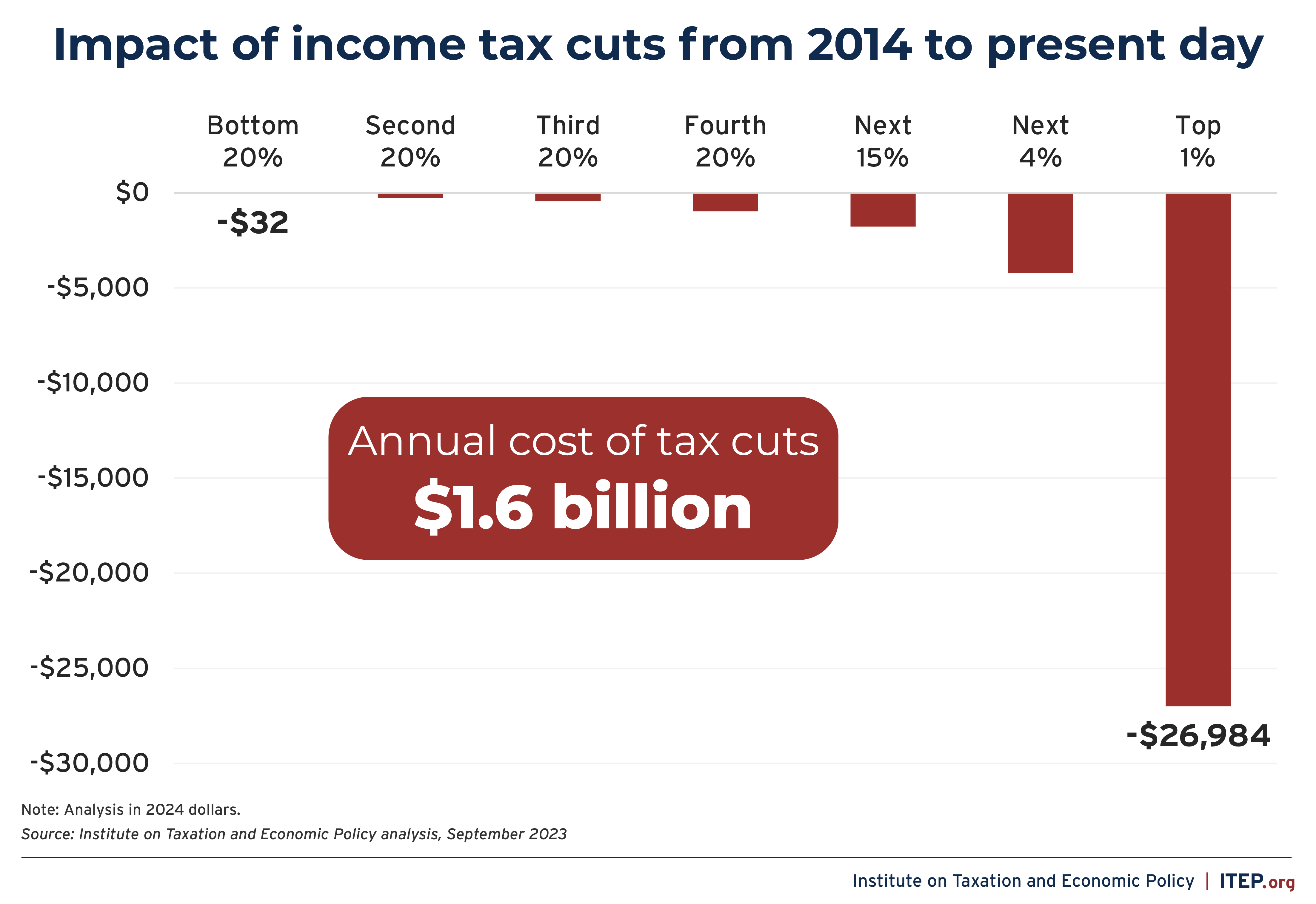

Key components of the proposed tax cuts currently before this committee would reduce the state’s top personal income tax rate to 4.4 percent and the top corporate income tax rate to 4.8 percent. While at the moment these cuts alone may seem affordable, they are building on a decade of deep cuts to the state’s personal and corporate income taxes. Since 2014, Arkansas has repeatedly cut personal income taxes to the tune of $1.6 billion. At ITEP, we’ve analyzed the impact of these income tax cuts, quantifying the impact of cuts from 2014 to present day (in 2024 dollars), and our data show that they have overwhelmingly benefited the wealthiest Arkansans. For example, the average Arkansan household making $52,000 annually received an average tax cut of $439 from the income tax cuts since 2014. But an Arkansan making more than $1.6 million a year saw an average tax reduction of nearly $27,000 annually. Of that $1.6 billion in revenue loss over the past decade, 67 percent of the benefit went to households in the top 20 percent who on average bring in $264,000 annually. And less than 6 percent of the overall tax cut benefited households making less than $42,000 a year.

Senate Bill 8, which is currently under consideration, would compound the regressive nature of, and the deep revenue loss from, these already devastating cuts. Tax cuts do not make state economies competitive. Well-funded K-12 education, a top-notch higher education system, easy access to quality health care and child care, and a dependable infrastructure network are what makes a state’s economy truly competitive and a state vibrant and livable. I urge you to vote against these additional tax cuts that will primarily benefit Arkansas’ wealthiest residents, and do little to position your state, and the next generation of Arkansans, for success.

Thank you for your time and consideration.