June 11, 2025

June 11, 2025

For over a decade, North Carolina lawmakers have prioritized tax cuts for the rich while underfunding important needs like educating and caring for North Carolina’s children. Now disaster-stricken communities are still rebuilding basic infrastructure, and federal cuts threaten essential services, health care, and universities. Despite all that, North Carolina Senators are proposing to yet again ignore the core needs of the majority of North Carolinians in favor of more income tax cuts for the wealthy few.

For background, in 2013 the top rate for the state’s graduated income tax was 7.75 percent. Since then, the legislature has hacked away at both personal and corporate income taxes – going so far as to set the state on a path to fully eliminate its corporate income tax by 2030. This has created a massive windfall to large corporations and the wealthy. The state has transitioned to a flat personal income tax that will drop to 3.99 percent in 2026 and is scheduled to reach 2.49 percent by 2029. Cuts to the personal income tax alone are expected to exceed $14 billion in foregone revenue with the benefits overwhelmingly flowing to the rich.

Rather than freezing the rate at 3.99 percent or reversing recent cuts to raise revenue for the state’s glaring needs, as has been proposed to varying degrees by Gov. Josh Stein and lawmakers in the House, the North Carolina Senate plan would double down on this approach by further reducing the personal income tax. The Senate’s budget would take the rate to 1.99 percent as soon as 2031 if certain revenue triggers are met, once again delivering billions of dollars in tax cuts mostly to the rich. And the cost of those tax cuts for North Carolina will be steep cuts to the state’s future, including public education and community colleges.

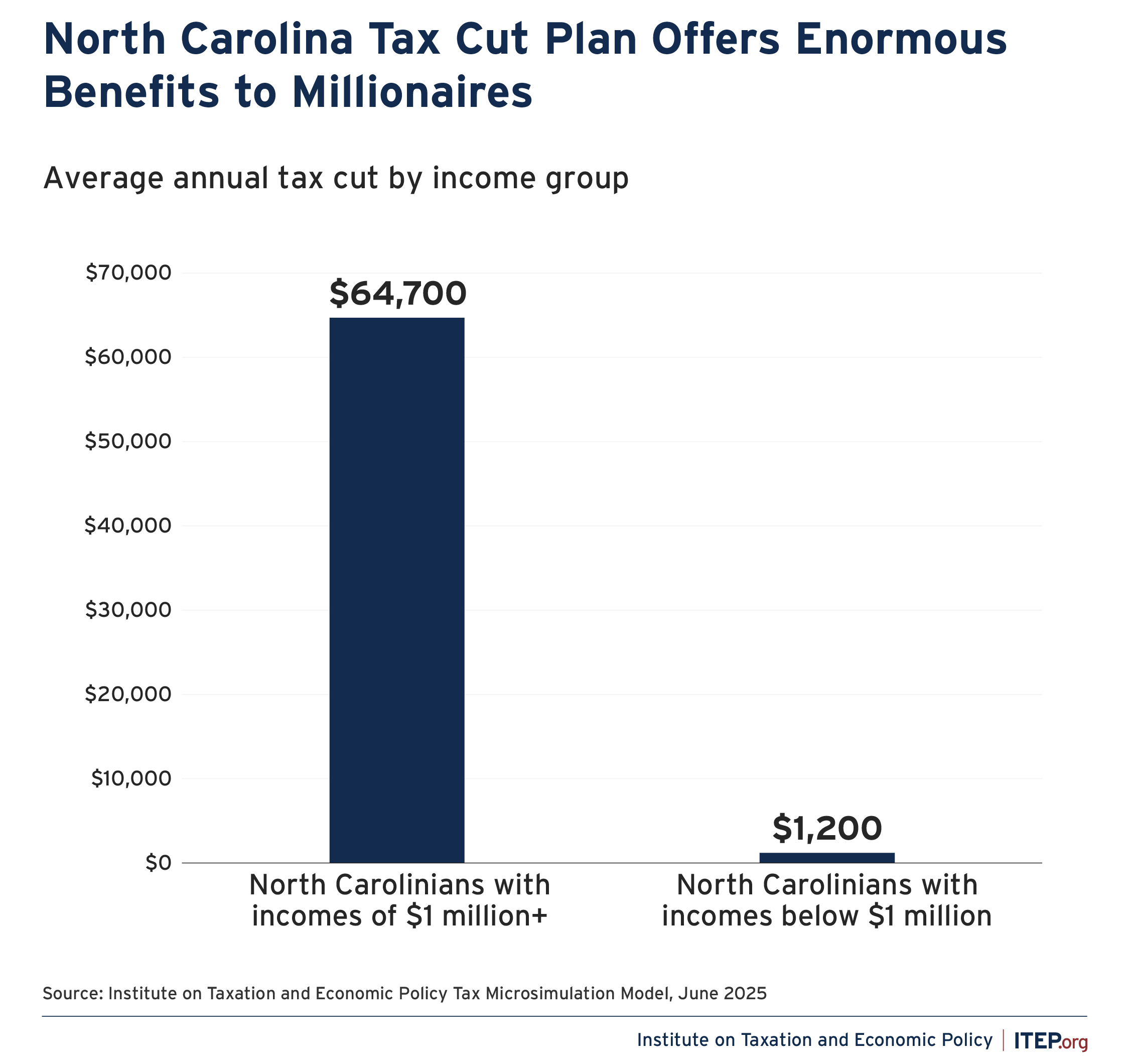

To be clear about who these lawmakers are choosing to prioritize, let’s put these stark choices in stark terms: how does the full proposed income tax cut from 3.99 percent to 1.99 percent affect North Carolina millionaires and everyone else?

The answers are staggering.

In 2026, North Carolina millionaires (North Carolina residents with federal adjusted gross income of at least $1 million) would receive an average annual tax cut approaching $65,000 – more than 52 times the average non-millionaire cut of roughly $1,200.

What does that mean in terms of everyday life for North Carolinians?

| Average millionaire tax cut ($64,740) could buy: | Average non-millionaire tax cut ($1,230) could buy: |

|---|---|

| A brand new Porsche SUV | New tires with alignment for a budget SUV |

| A full year at the University of North Carolina for two, including room and board, or almost a full year of tuition at Duke University | Tuition and books for a couple of community college classes |

| A private jet to Aspen during peak ski season, or an entire year at the beach house to the right | A one-week rental at a modest beach house in the Outer Banks during hurricane season |

| A full family membership at Pinehurst Country Club with access to 10 championship golf courses and much more | About a year of youth soccer |

The table above provides examples of how generous the Senate proposal is for North Carolina millionaires while leaving average constituents with relative scraps. And there’s more to the story.

For one, this only includes the upcoming proposed tax cuts, which are on top of the decade of cuts that millionaires are already disproportionately enjoying. And it doesn’t begin to account for the new costs and hardships that will disproportionately affect everyday families as their schools, roads, bridges, health care, and safety net deteriorate, nor the costs that continue to shift to local governments to foot the bill.

North Carolina lawmakers should stop handing these tax cuts out to the richest people in the state and start restoring and shoring up the core services their constituents rely upon and the public amenities that make North Carolina a great place to live.