Policymaking includes short and long-term strategies aimed at transforming laws, cultures, and norms that govern and influence society. Lately, when it comes to tax policy, deep, permanent income tax cuts and anti-tax sentiment seem to be at the forefront of shaping both those short- and long-term strategies. But in some states, like Kansas, sound fiscal policy is still winning the day.

This week Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging tax package that would have, among other things, flattened the state personal income tax. In doing so, the state narrowly avoided traveling again down the disastrous yet well-worn path of deep income tax cuts. A slim one-vote margin prevented the legislature from overturning the veto despite the mountains of evidence proving the failure of the draconian tax cuts enacted during the Brownback administration.

States across the country can learn from Kansas’ experience by rethinking tax policy decisions and broader statewide priorities. Rather than digging in with a narrow tax-cutting mentality, lawmakers can advance sound fiscal policies centered on creating fair and progressive taxes that can raise enough revenue to make public investments that boost incomes, create jobs, and grow the economy. This is a simple tax policy formula that will result in great dividends for families and communities.

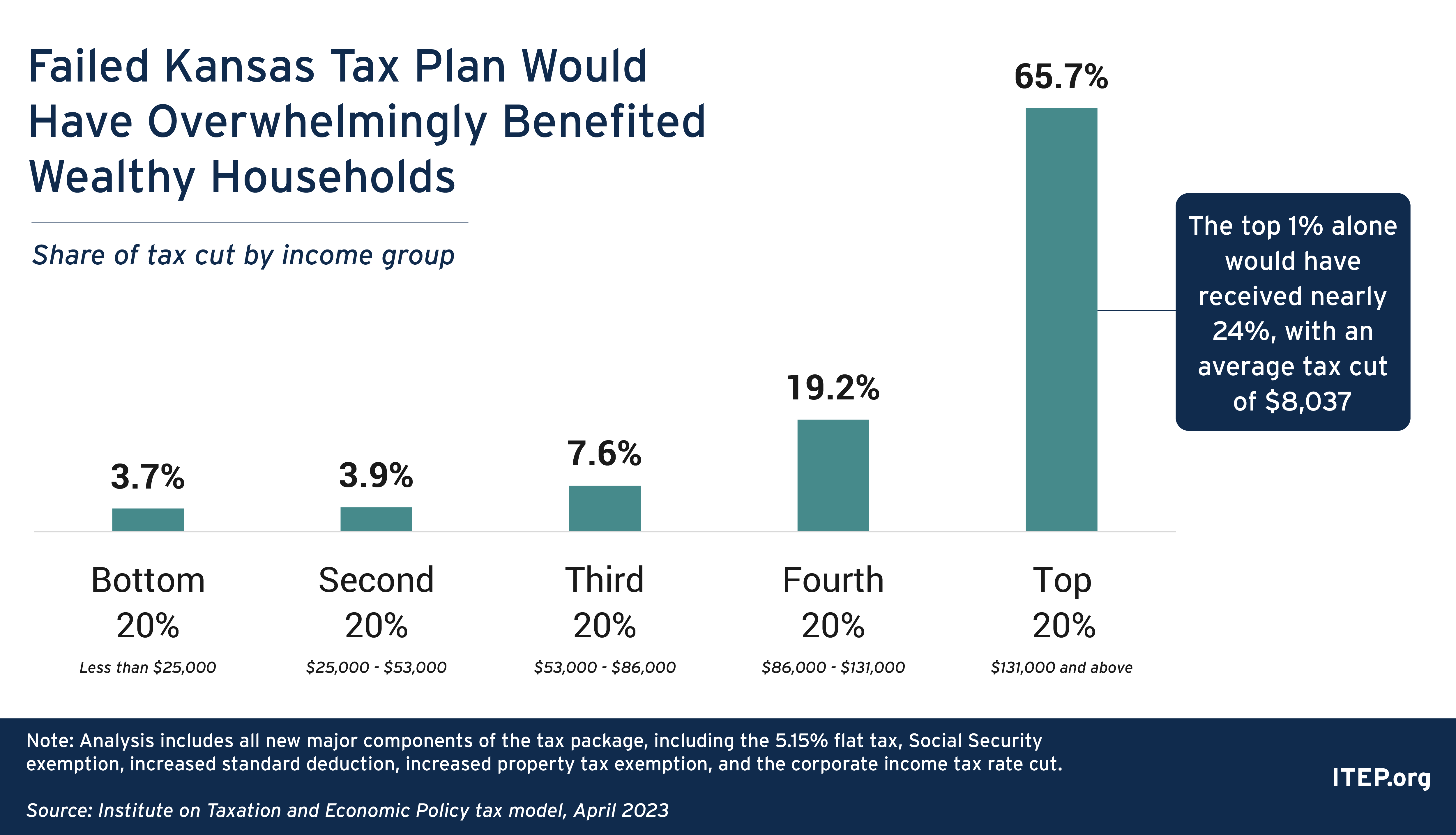

The plan vetoed by Gov. Kelly included major changes to their income tax system, particularly shifting it to a 5.15 percent single flat rate. Other changes included a cut to corporate income and privilege taxes, cuts to income taxes for wealthier Social Security recipients that will grow over time, increases to the standard deduction, property tax cuts for homeowners, and accelerating the elimination of the state’s food sales tax. The new provisions of the tax cut package would push nearly two-thirds of the overall benefit to the top 20 percent of households in the state (those earning, on average, close to $300,000 a year).

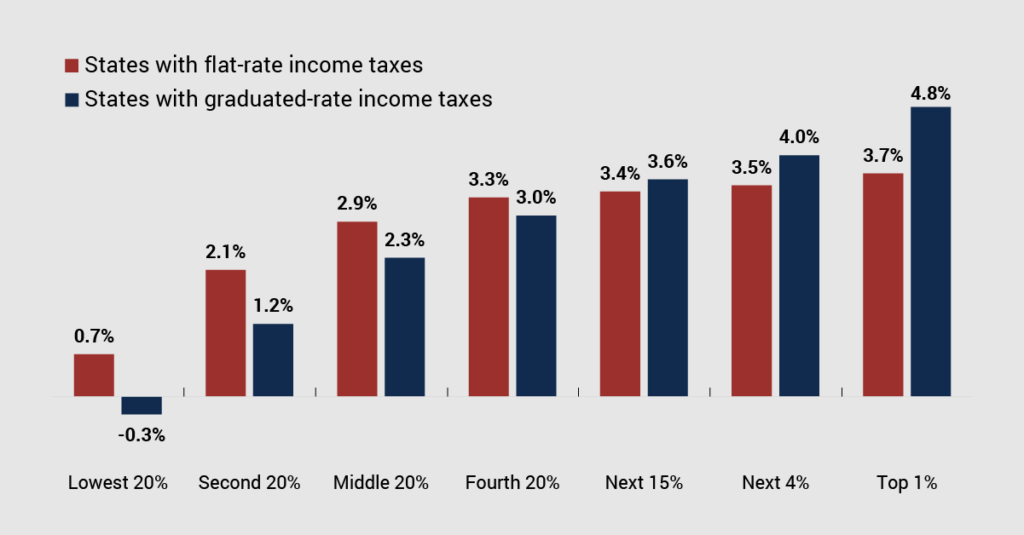

The major structural change, switching to a flat tax, results in a system where every taxpayer pays the same percentage of their taxable income. It sounds like it’s a fair deal, but in actuality, it guarantees that wealthy families will pay a lower overall state and local tax rate than families of more modest means after regressive taxes like the sales tax are taken into account.

Like most states, Kansas has a graduated tax rate system (two-thirds of broad-based personal income tax structures have graduated rates). Under these kinds of taxes, different levels of income are subject to different rates, with high-income families seeing more of their income taxed at higher rates than lower-income families. This is an important part of any equitable tax code, especially given the rising levels of inequality across the nation.

On the other hand, a flat tax like the one vetoed in Kansas isn’t fair. A factory worker shouldn’t face the same marginal tax rate as the CEO of the company. But that’s how a flat tax works.

Taxes are the primary way states fund programs that invest in providing students with an education to set them up for success, doctors with advanced medical tools for pioneering procedures, and libraries with books that allow children to travel the galaxy with the turn of a page. This session, Kansas lawmakers, like those in many other states, pushed the mirage of a tax plan with widespread benefits when in reality it would overwhelmingly help the state’s wealthiest and result in less long-term revenue and fewer direct investments in Kansas’s communities and its people. But tax proposals like this continue to be debated by lawmakers across the country. Time for them to step back and connect the dots to the long-term harm tax cuts will cause state budgets, communities, and hardworking families. Progressive taxes that help low- and moderate-income families thrive are needed to rebuild society, not tax cuts for the wealthy.