This is an updated analysis reflecting tariffs imposed by the Trump administration as of April 23, 2025. It uses the same methodology as described in our earlier report.

During his campaign, President-elect Donald Trump proposed significant tariffs on products imported from other countries. While targeted tariffs can have a useful role in trade policy, economists agree that tariffs, particularly broad-based tariffs, raise the prices paid by consumers and businesses on the goods and services they buy. The sweeping tariffs imposed by the Trump administration will significantly raise the prices faced by American consumers across the income scale.

As of this writing, President Trump has imposed a minimum tariff of 10 percent on goods from most countries, 25 percent sector-specific tariffs for certain goods from many countries, and a 145 percent tariff on most (but not all) goods from China.

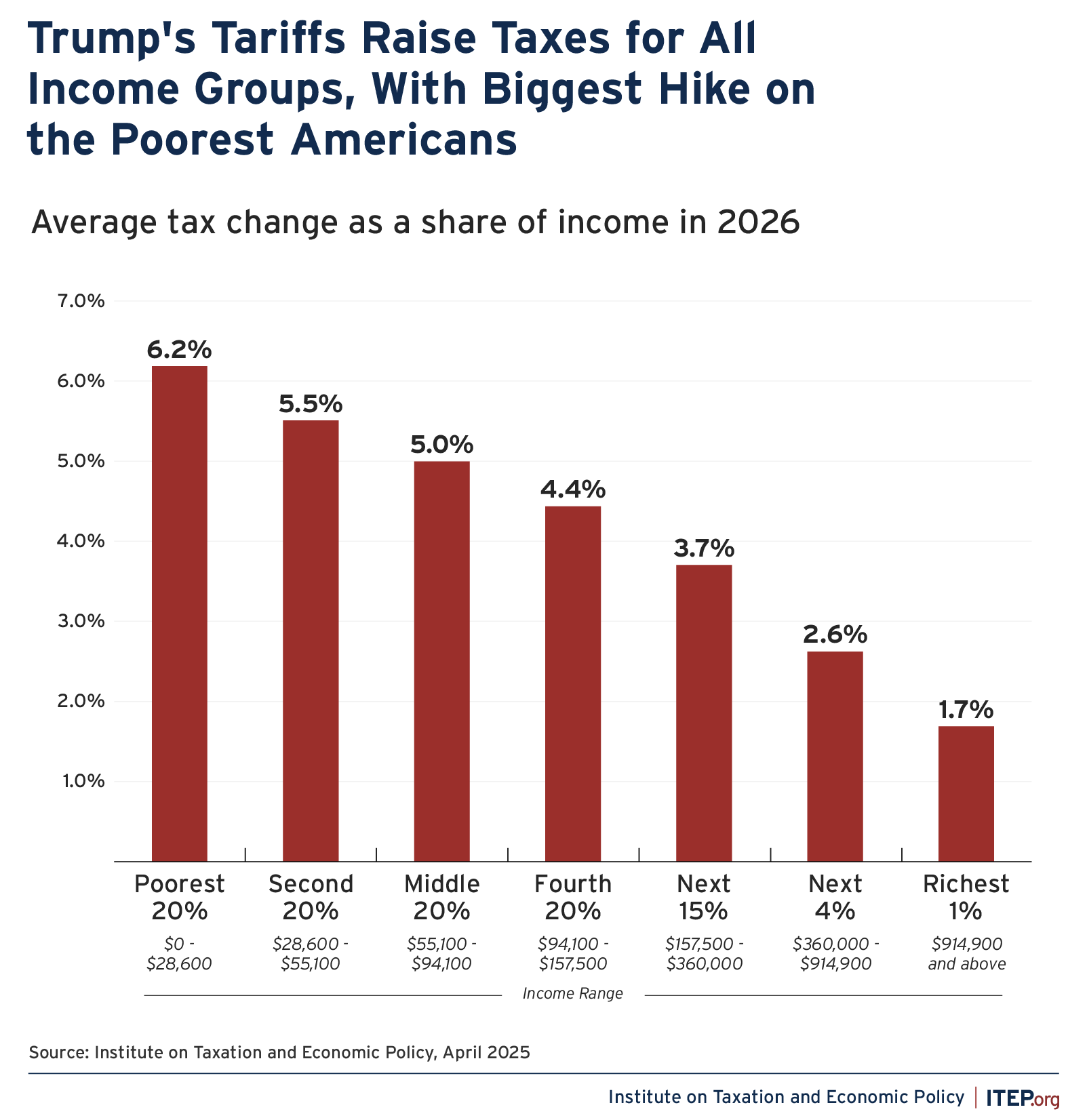

If these tariffs are in effect next year, we find:

- For the poorest fifth of Americans, who will have incomes of less than $29,000 in 2026, the tariffs will impose a tax increase equal to 6.2 percent of their income that year.

- For the middle fifth of Americans, who will have incomes between $55,000 and $94,000 in 2026, the tariffs will impose a tax increase equal to 5.0 percent of their income.

- The richest 1 percent, who will have incomes of more than about $915,000, will face a smaller tax increase relative to their income, just 1.7 percent.

For further discussion of the analysis underlying this work, see A Distributional Analysis of Donald Trump’s Tax Plan.