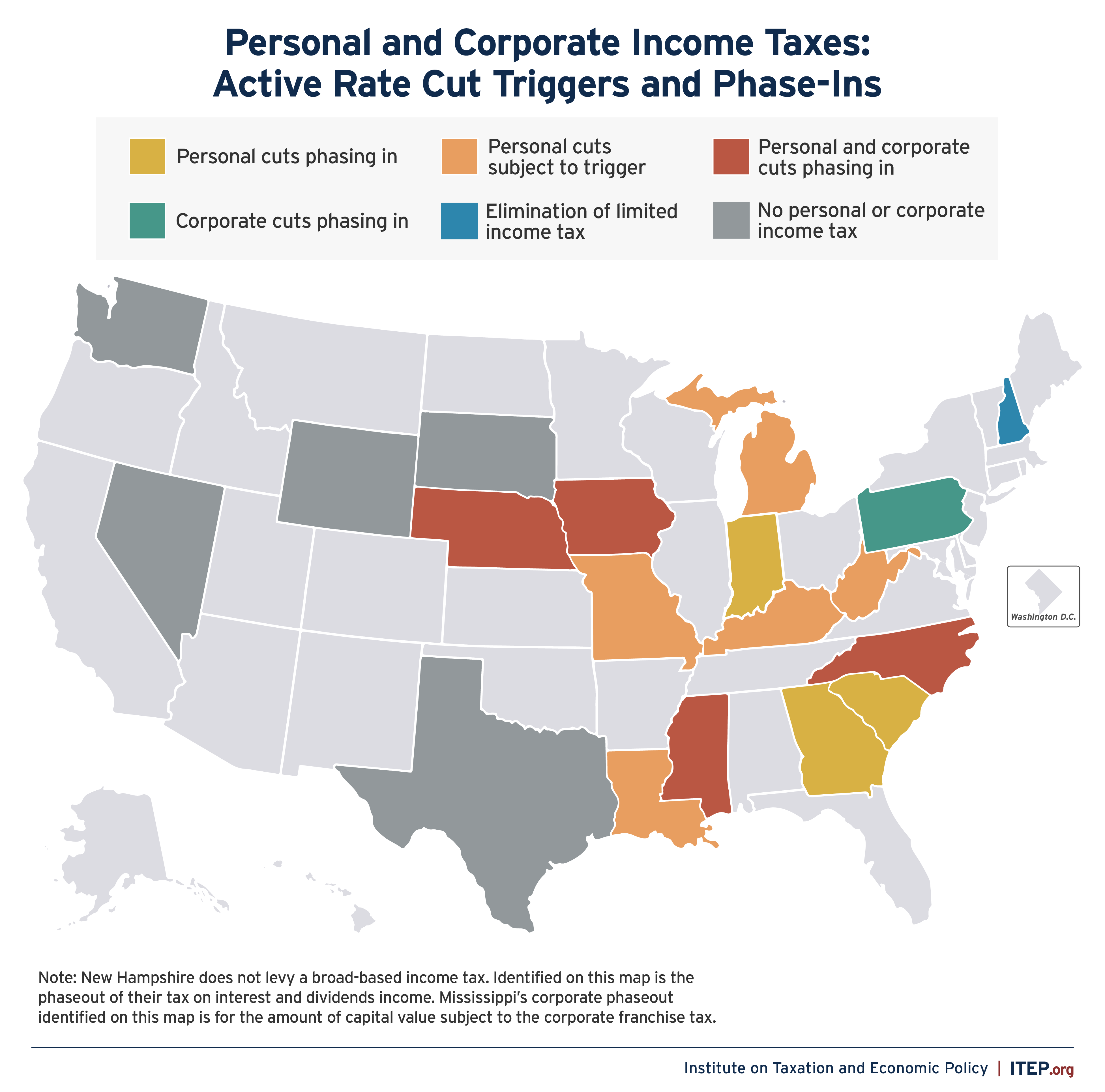

Which States Have Tax Cut Triggers or Phase-ins?

mapBudgeting decisions involve tradeoffs, and the public deserves to know how tax cutting efforts will ultimately affect their quality of life. In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. This year, for example, Kentucky sped up their trigger to lower their income tax rate and West Virginia passed a trigger that could ultimately eliminate the state’s income tax. As of March 2023, 14 states have active provisions on the books that could lower their personal or corporate income tax rates through an automatic phase-in or a trigger mechanism. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

These approaches are often touted as fiscally responsible given that they structure tax cuts to go into place over multiple years, or in some cases decades. However, this framing around responsibility is questionable, at best. By putting off the real impact of tax cuts lawmakers limit their real-time decision-making power by locking in cuts before all of the facts are known, while in many cases depicting tax cuts as costless without any downsides. The reality is that when a decision is made to cut taxes and reduce revenue there will be fewer resources available to fund public investments – like education, healthcare and our infrastructure networks – that benefit us all. Further, time and time again, lawmakers are quick to flip the script on their stated goals of fiscal responsibility by speeding up scheduled or triggered tax cuts.