June 4, 2025

June 4, 2025

States face threats of deep budget cuts due to the looming federal tax debate and economic uncertainty from the Trump administration’s unpredictable tariffs and trade wars. The Delaware leaders cited these threats as reasons to delay pursuing some of the progressive tax increases that Gov. Matt Meyer proposed in recent months. In fact, just the opposite is needed. Instead, Delaware lawmakers should advance tax policies that can simultaneously protect state revenue to fund important priorities and improve tax equity in the state ahead of the approaching fiscal storm.

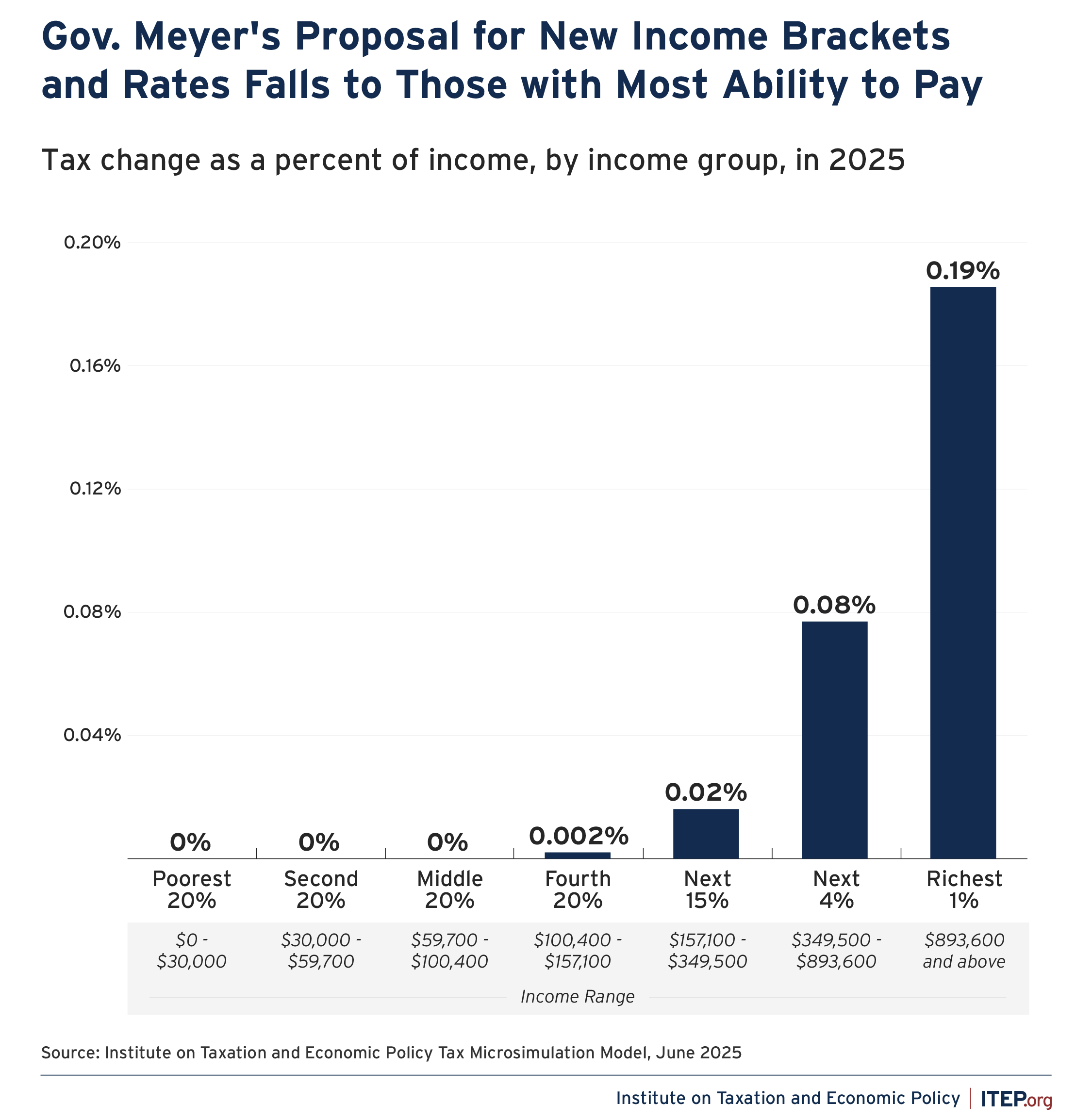

In Delaware, the wealthiest currently pay lower taxes as a share of their income than low- and middle-income households. According to our Who Pays? report, the top 1 percent of Delaware taxpayers, with annual incomes exceeding $893,600, pay 6.8 percent of their income in total state and local taxes—the lowest of any income group in the state. By comparison, the lowest 20 percent pay 8.2 percent, and the middle 20 percent pay 7.9 percent. Gov. Meyer proposed an excellent remedy for this inequity: personal income tax reforms that ask more of those at the top of the income scale.

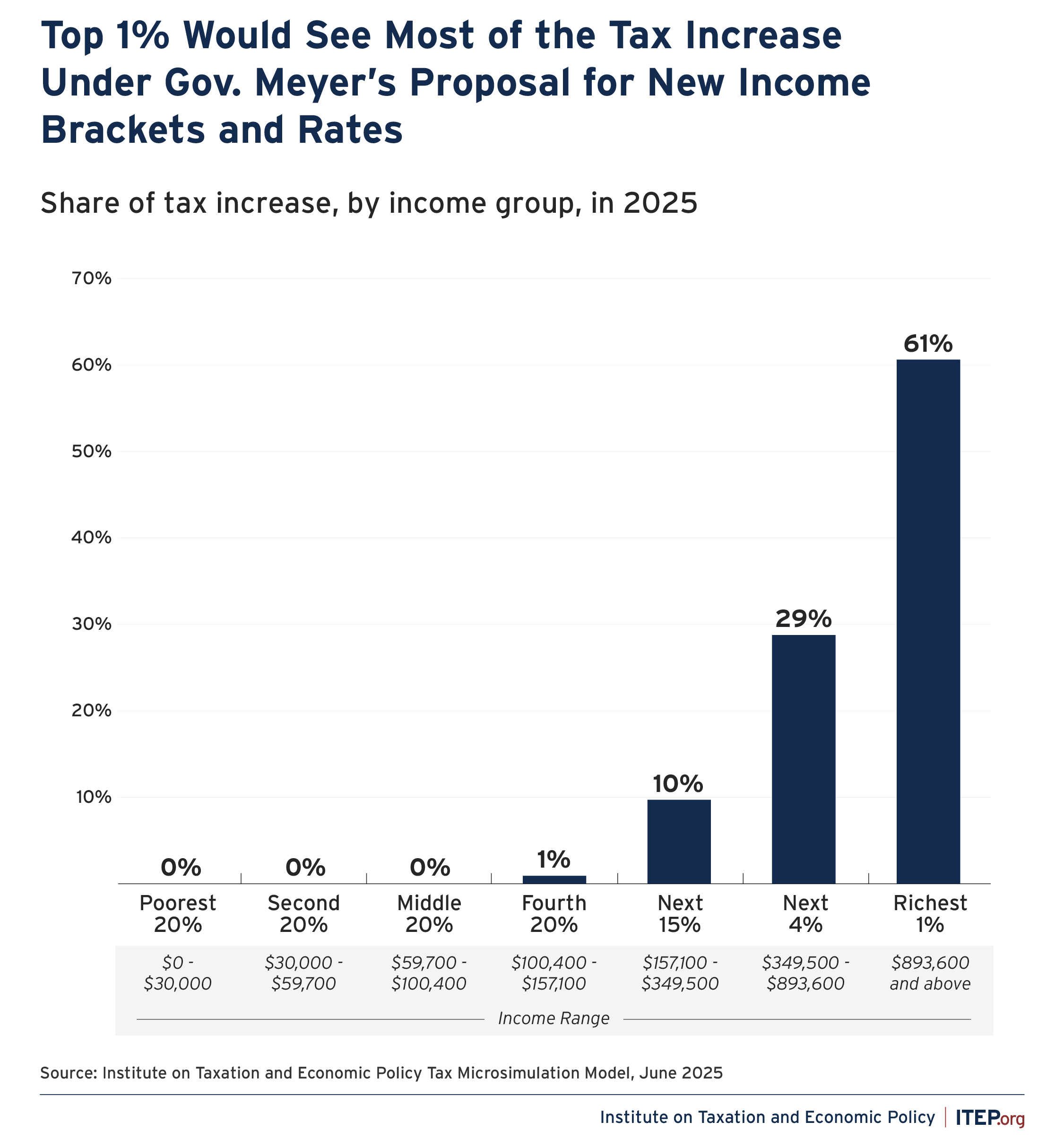

Under Delaware’s current income tax system, Delawareans earning over $60,000 pay the top tax rate of 6.6 percent. Gov. Meyer’s proposal would create three new tax brackets at $125,000, $250,000, and $500,000 of income, setting the top rate at 6.95 percent. According to our analysis, the proposal would raise about $30 million per year, with 99 percent of the new revenue flowing from the top 20 percent. This would build a more robust and sustainable income tax while helping to ensure that wealthy individuals start contributing their fair share to the public services that benefit all Delawareans.

While some opponents of the proposal argue that now is not the time to increase taxes due to current economic uncertainties, a perfect storm of federal policy changes – federal funding reductions, erratic tariff policy, federal layoffs, aggressive immigration actions, and cuts to IRS enforcement – pose significant risks that could leave states without enough revenue to meet their current responsibilities. Delaware lawmakers can make important strides by pursuing progressive reforms during this period of fiscal uncertainty. Otherwise, inaction could lead to the erosion of public services that would make life harder for everyday Delawareans.