October 19, 2023

October 19, 2023

In hopes of building on the state’s already-in-effect income tax reduction, Indiana’s State and Local Tax Review Task Force is studying the feasibility of fully eliminating the state’s individual income tax. The existing flat rate tax is scheduled to fall to 2.9 percent in 2027 following this year’s legislation to speed up the tax cut and eliminate triggers that would have considered both state general fund revenue growth and the state’s ability to pay down pension debt. The task force, comprised of eight legislators, has been asked to evaluate the state’s financial outlook, debt obligations, pension funds, methods to reduce or eliminate the individual income tax, and other tax policy issues.

Lawmakers’ attempts to reduce or eliminate the income tax are rooted in misguided assumptions about the building blocks of strong, vibrant communities. Meaningful investments in Indiana’s future require a smart, and fair, tax code that recognizes current economic realities and can raise a sustainable stream of funding from those most able to pay.

Indiana already has one of the most regressive tax systems in the nation, meaning it asks low- and middle-class households to contribute a larger share of their income than the state’s richest households to fund state services that benefit us all. The state’s existing tax structure exacerbates inequality. More and deeper cuts to the income tax will only make this matter worse. A heavy reliance on sales and excise taxes are characteristics of the most regressive state tax systems, and Indiana’s 7 percent sales tax is one of the highest in the nation.

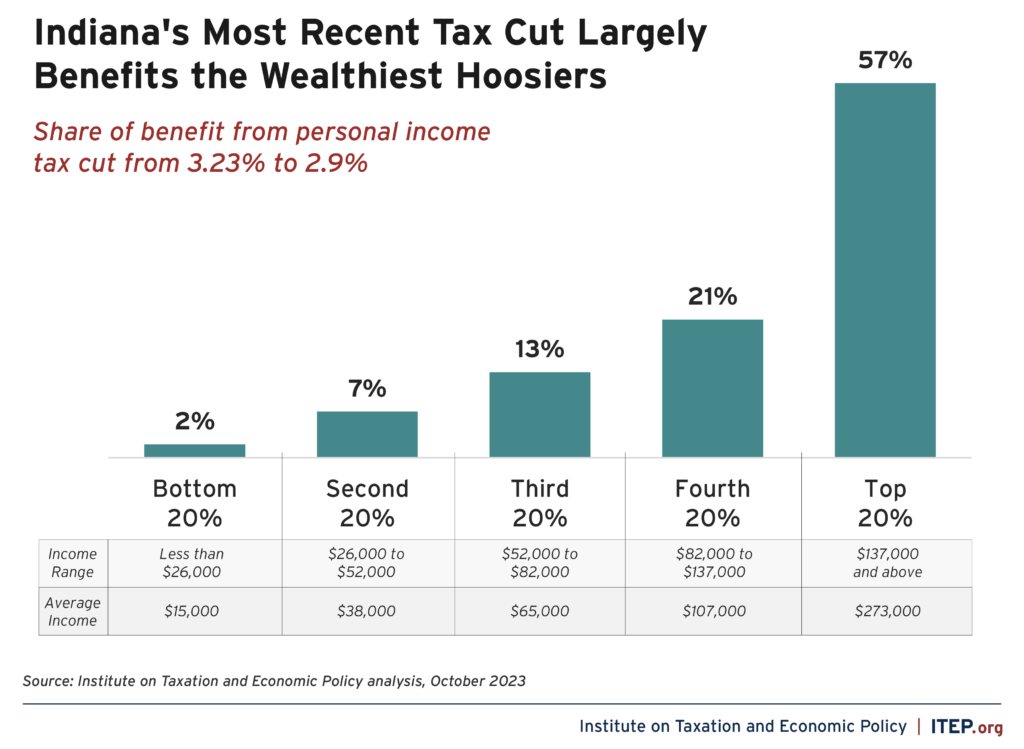

Fortunately, Indiana already has tax policies in place that could be used to make their tax system fairer: individual and corporate income taxes. But the design of these taxes helps determine whether a state’s tax system is progressive or regressive. Indiana’s individual income tax rate is low and flat, and has been steadily decreased from 3.4 percent since 2015. The most recent tax cut, enacted in 2022 and accelerated in 2023, will bring the income tax rate from 3.23 percent to 2.9 percent over the next four years. This limits the state’s ability to raise adequate revenue, particularly from Indiana’s highest earners. This reduction will cost the state nearly $900 million a year while being a boon for Indiana’s wealthiest residents, with well over half (57 percent) of the tax cut going to households in the top 20 percent of income earners.

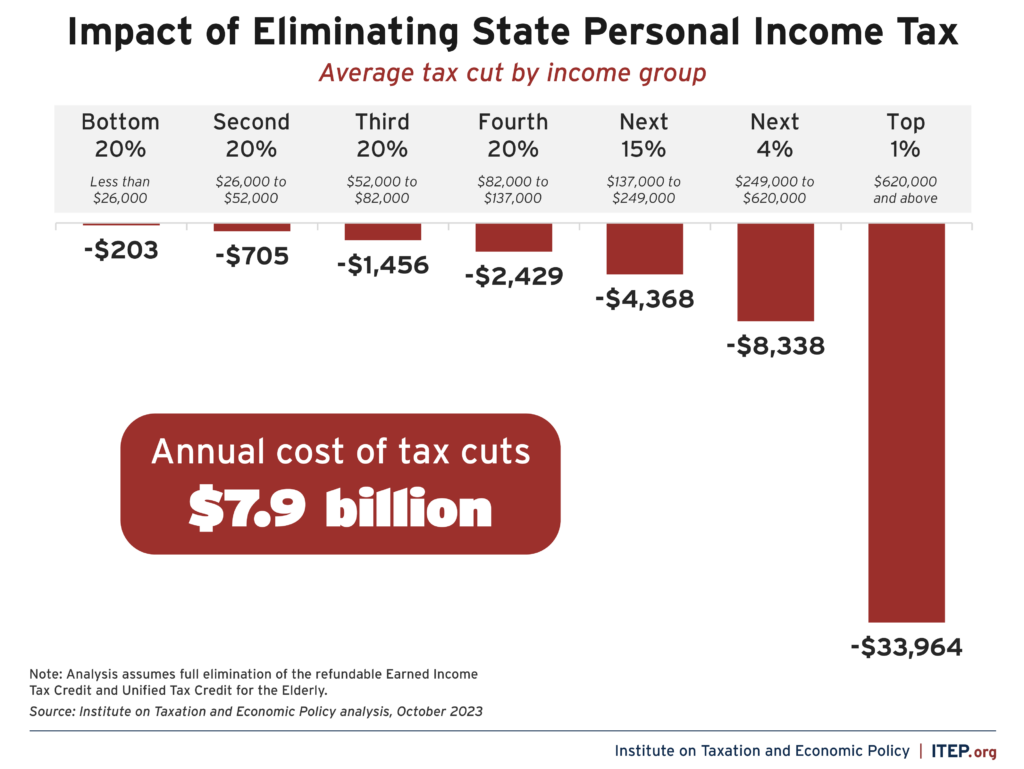

Indiana’s individual income tax is expected to bring in nearly $7.9 billion during the 2023-2024 fiscal year – 37 percent of the revenue in the state general fund. These tax dollars raise needed revenue to support Hoosiers around the state, paying for teachers, universities, health care, and more.

Eliminating Indiana’s individual income tax would not only reduce funding for essential public services by $7.9 billion a year, it would also primarily benefit the state’s most well-off households. If Indiana were to fully eliminate the individual income tax in 2024, a household in the top 1 percent of earners, with average annual incomes of $1.5 million, would see an average $34,000 tax cut – which is more than a quarter of Hoosier households even take home in a year. Meanwhile, low- and middle-income families would see a tiny sliver of that benefit. Overall, 58 percent of the tax cut from full income tax elimination would go to households in the top 20 percent of earners with average annual incomes of $273,000.

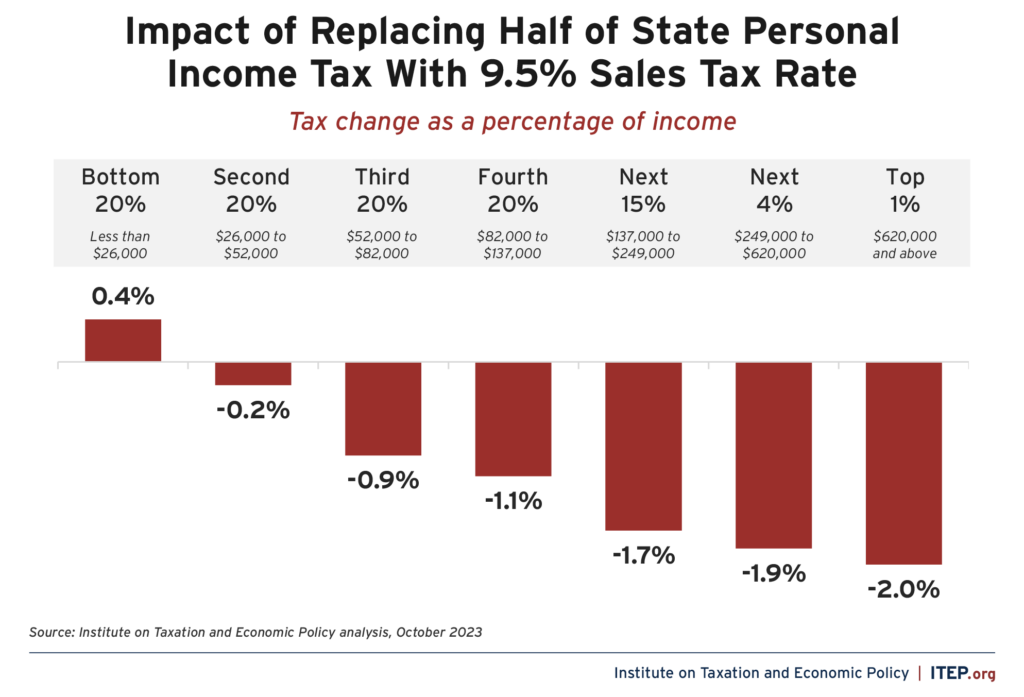

Deep and permanent income tax cuts will ultimately necessitate either tax increases in other less equitable ways or cuts to public services – likely both. If Indiana sought to replace half of its lost revenue from eliminating the individual income tax with higher sales taxes, the state sales tax rate would need to reach 9.5 percent. This swap would still result in a nearly $30,000 tax cut for Indiana’s wealthiest households in the top 1 percent of earners, but low- and moderate-income households would either be near break-even or would experience a tax increase due to the regressivity of the sales tax.

Under this scenario, the state tax system would become even more regressive, as low-income households would be paying an addition 0.4 percent of their income in taxes each year while the wealthiest households would see a tax cut equal to 2 percent of their annual income. The details of how the state would make up lost revenue from further income tax cuts or elimination are unknown, but it’s clear that the remaining options would ask more of everyday families. And if the reduced revenue meant cuts to school funding or road maintenance or college costs, regular families would bear the even bigger costs of lower quality education, more pothole-ridden roads, or less ability to send their kids to college. That’s the hidden cost of top-heavy tax cuts like the one being considered in Indiana right now.