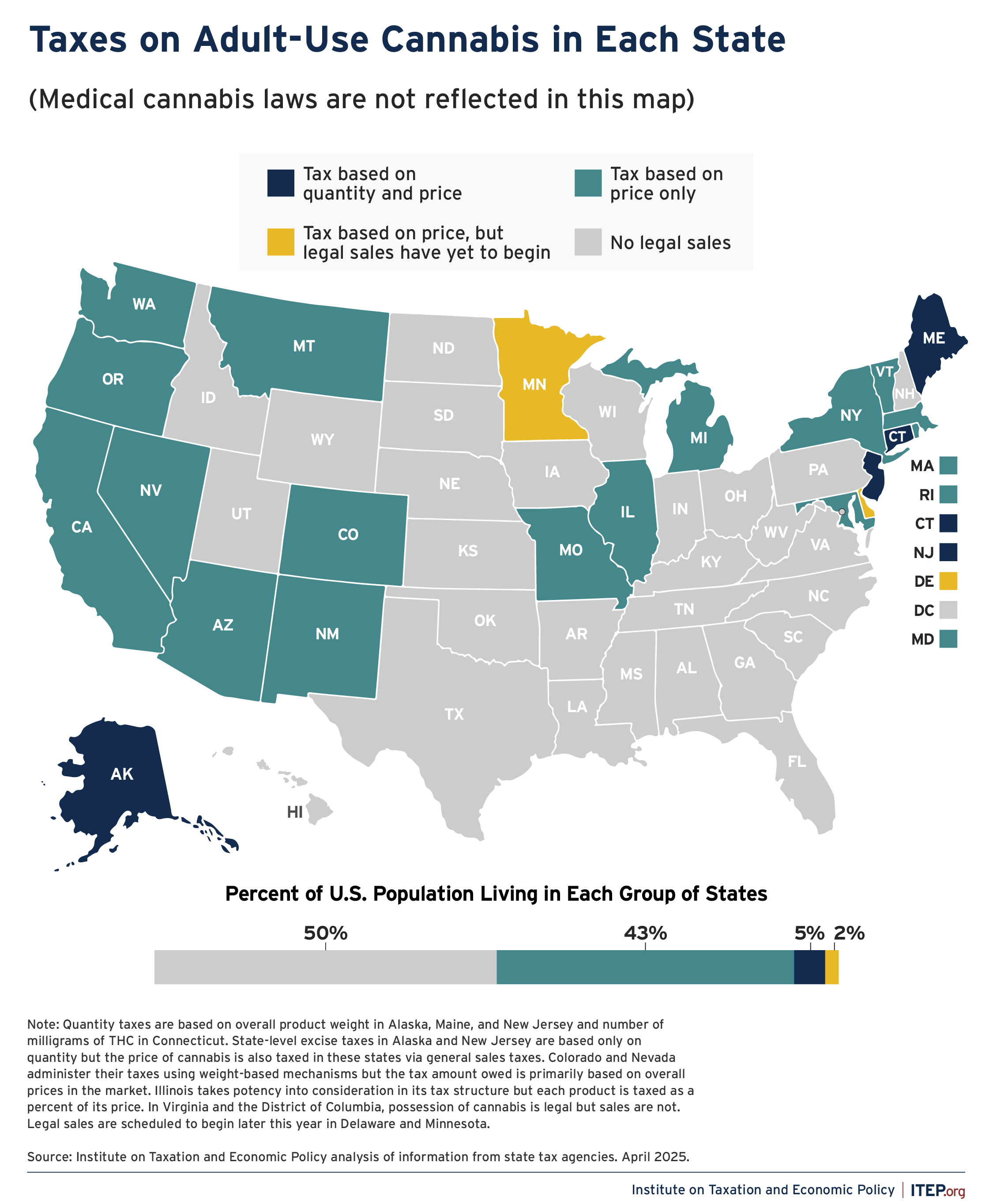

Taxes on Adult-Use Cannabis in Each State

mapTwenty-three states have legalized the sale of cannabis for general adult use, and sales are already underway in 21 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold.

ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the product and local sales or excise taxes typically apply as well.