What Corporations Have to Gain from the Gutting of the IRS

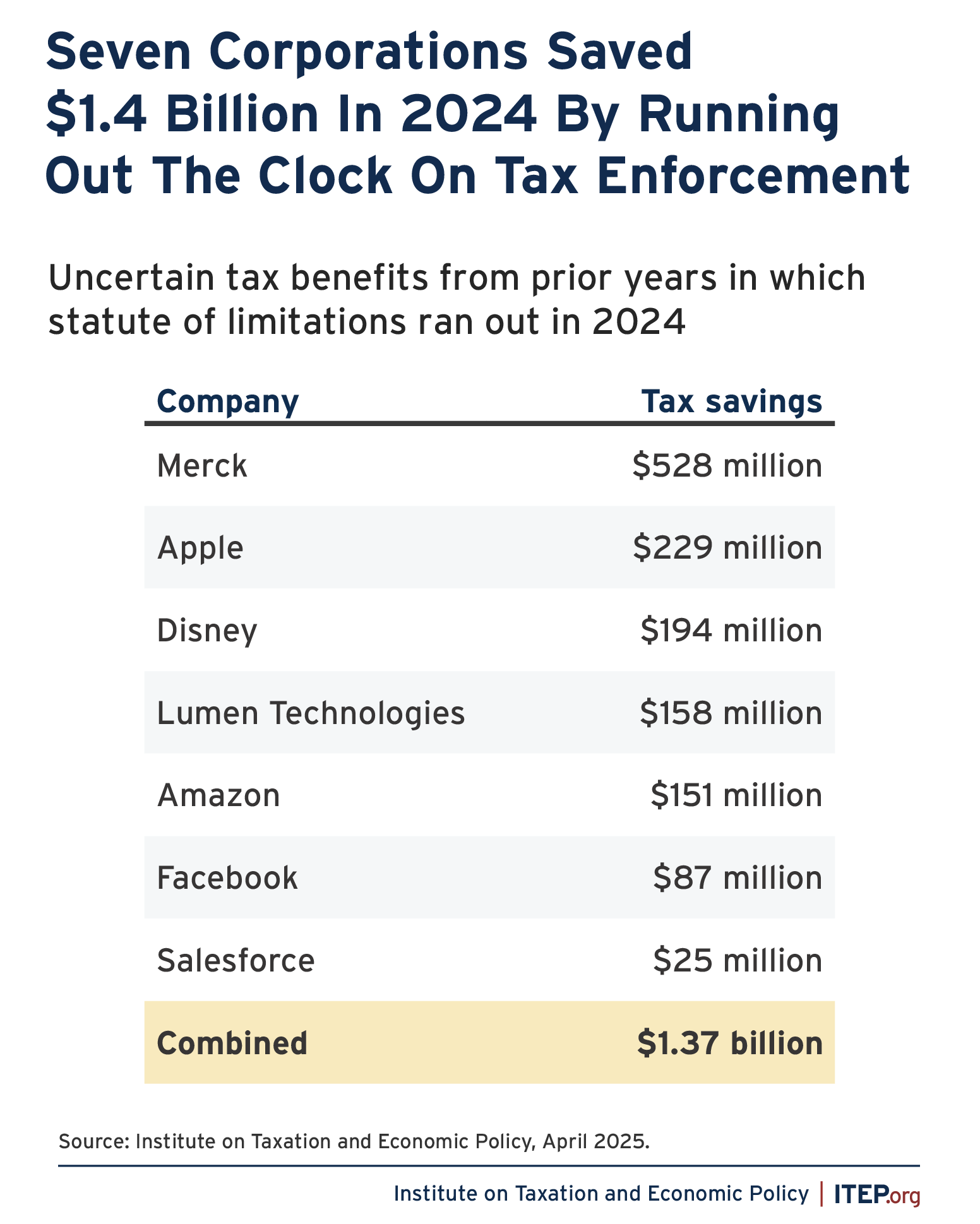

briefSeven huge corporations recently announced that in 2024 they were allowed to collectively keep $1.4 billion in tax breaks from previous years that they had publicly admitted would likely be found illegal if investigated – all because the tax authorities were unable to identify and disallow them before the statute of limitations ran out. These corporate tax windfalls come at a time when the Trump administration has indicated its desire to further gut the already-diminished enforcement powers of the Internal Revenue Service.

FIGURE 1

Corporate taxes are complex. But some things should not be so complicated. For example, it is straightforward that when a huge corporation publicly discloses that it has done something the government would likely find illegal, the government should investigate.

American corporations make these disclosures about their income tax practices, because for almost two decades the Securities and Exchange Commission has sensibly required them to do so. In the annual financial reports these companies publish each year, publicly traded corporations must report the amount of “uncertain tax benefits” they have claimed, meaning the amount of tax breaks that are likely to be disallowed if investigated. The SEC mandated this disclosure to give current and potential shareholders, and tax administrators, a metric for evaluating the aggressiveness of these companies’ tax practices.

But absent effective tax enforcement, these disclosures of current tax avoidance are clearly insufficient. Each year, many corporations also report that millions of dollars in uncertain tax benefits from prior years have been successfully realized, not because they convinced the government that they were valid, but because the government was simply unable to investigate and disallow these probably-illegal tax breaks before the statute of limitations ran out, which is usually three years.

The pharmaceutical giant Merck was allowed to keep more than half a billion dollars in tax breaks for this reason last year alone. Apple and Disney each were allowed to keep around $200 million. Meta, the company that owns Facebook, was allowed to keep a little less than $90 million.

These are tax breaks that companies themselves admit would likely not withstand scrutiny. One can only speculate on the amount of questionable tax breaks they claim without making any such public disclosure, which could be even larger.

The companies do not always explain whether the breaks they claim are related to federal, state, or even foreign taxes. But federal corporate income taxes loom far larger than other taxes for these companies, so it is almost certain that most taxes saved are federal.

This is why limited IRS resources – which Elon Musk and his team are further cutting at this moment – are the most plausible explanation for what is happening. Americans would likely agree that the IRS should investigate, at very least, the most suspicious corporate tax practices. It is difficult to imagine what could be more suspicious than companies announcing that they did something the IRS would likely disallow.

But it appears the IRS lacks the resources to carry out this basic task. From 2010 through 2018, lawmakers cut the IRS budget by 20 percent in inflation-adjusted dollars, resulting in a 22 percent staff reduction, including 30 percent of the IRS’s enforcement staff.

The Biden administration was on course to reverse these cuts with new funding provided in the Inflation Reduction Act. The agency had just begun to hire experienced tax lawyers and tax accountants to handle complex business cases. But Congressional Republicans have eliminated nearly all of the tax enforcement funds provided under that law.

Meanwhile, Elon Musk and his so-called Department of Government Efficiency (which is not a government department) have made their own cuts to the IRS, which are almost certainly illegal and unconstitutional given that no law authorizes him to do so. The Trump administration seems to be planning for even more cuts to the IRS and other agencies according to news reports.

Musk’s cuts have been particularly damaging to the Large Business and International Division, which ideally should scrutinize the tax schemes of these types of companies. Recent news stories describe highly-skilled people brought into the IRS to do this compliance work and then fired by Musk’s team while they were in the middle of audits of large companies that had the potential to save significant revenue.

The DOGE cuts in IRS enforcement and taxpayer services are clearly not really about saving money and achieving efficiencies, as Musk claims. IRS officials have informed the administration that revenue could fall this year by an incredible $500 billion because the DOGE cuts have hindered the IRS’s ability to do its job.

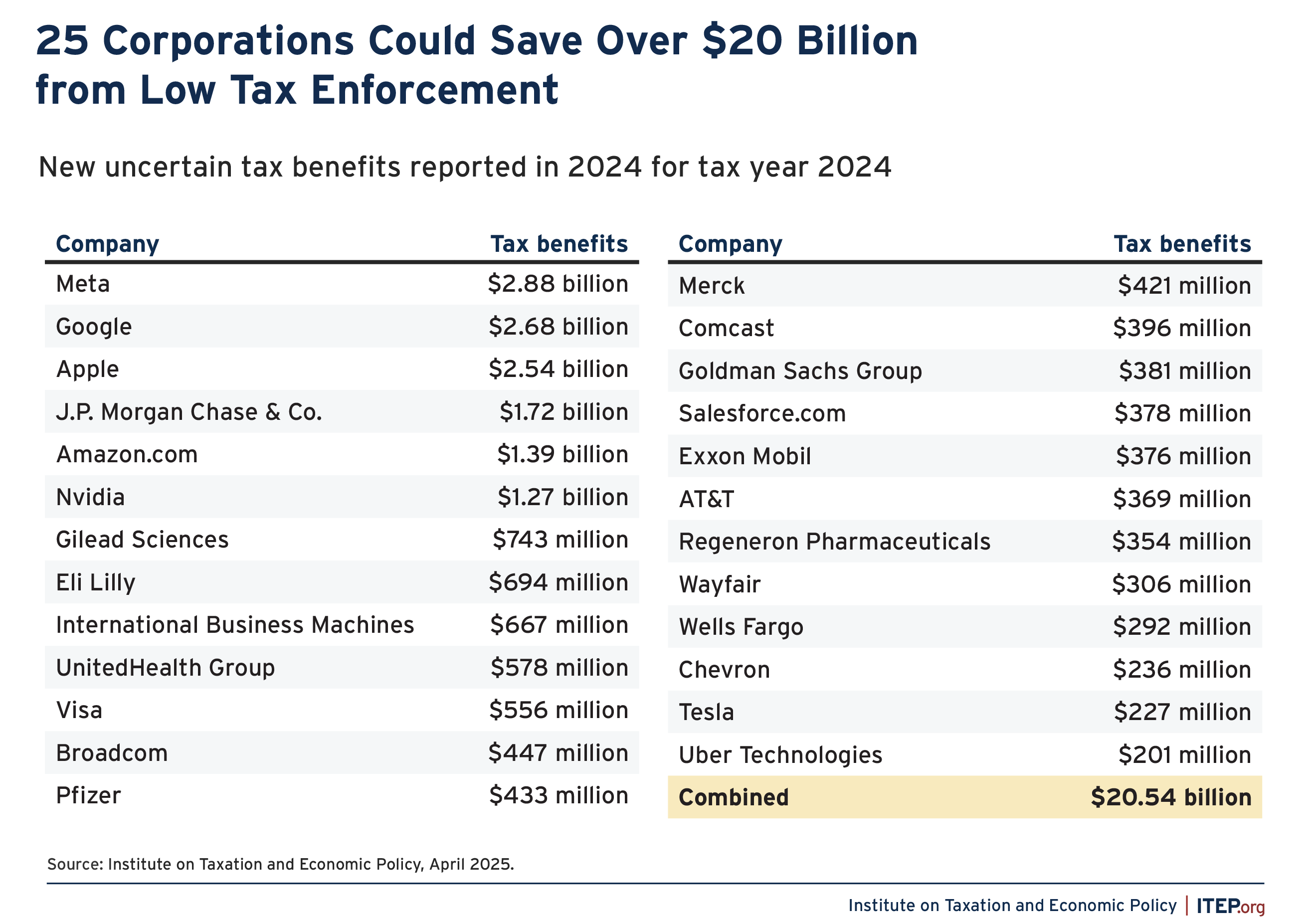

FIGURE 2

In fact, companies like Musk’s Tesla and others have much to gain from hobbling the IRS’ ability to investigate even their most suspicious tax practices. The most recent financial disclosures show that 25 corporations collectively reported more than $20 billion in new uncertain tax benefits, meaning $20 billion in new questionable tax cuts that they would be able to keep if the IRS is unable to investigate them.

Meta, Google, and Apple each report more than $2.5 billion. (These are only the new ones reported in 2024 and most of these companies have additional uncertain tax benefits from prior years.) JP Morgan Chase, Amazon, and Nvidia all reported more than $1 billion.

Musk’s Tesla reported more than $200 million in new uncertain tax benefits, which the Trump-favored company will almost certainly keep if the Large Business and International Division at the IRS is unable to do its job. This is one of several ways in which Musk and other corporate leaders could benefit from shaping policies, and the government’s ability to implement policies, in the Trump administration.