Re: Recommendation for Inclusion of Section 1001 Regulation in 2023-2024 Priority Guidance Plan

To Whom It May Concern,

We are writing to respectfully urge that the IRS return to the work it left unfinished in 2019 when it issued final regulations on “Contributions in Exchange for State or Local Tax Credits” (RIN: 1545-BO89). Specifically, we are suggesting that the IRS issue a regulation clarifying the following:

A contribution of property in exchange for a 100 percent tax credit should be treated as equivalent to a sale at market value (“other disposition of property” under IRC section 1001) and the taxpayer should either owe tax on the portion of that sale that represents a gain, or recognize a loss if appropriate. When the contribution is made in exchange for a tax credit worth less than 100 percent of the amount donated, the transaction should be treated as part gift and part sale.

As background, RIN 1545-BO89 specified that a significant state tax credit received in return for a contribution to a charitable organization (i.e. a credit exceeding 15 percent of the amount contributed) shall be considered a quid pro quo that reduces the amount of allowable charitable deduction. The IRS has not yet issued guidance, however, on how contributions of property are affected by this rule. This lack of guidance has led to both uncertainty and inconsistency in the administration of the tax law. Some taxpayers are treating tax-credit-reimbursed contributions as being charitable gifts for purposes of avoiding realization of capital gains income, even though those contributions are not considered charitable gifts under IRC section 170.

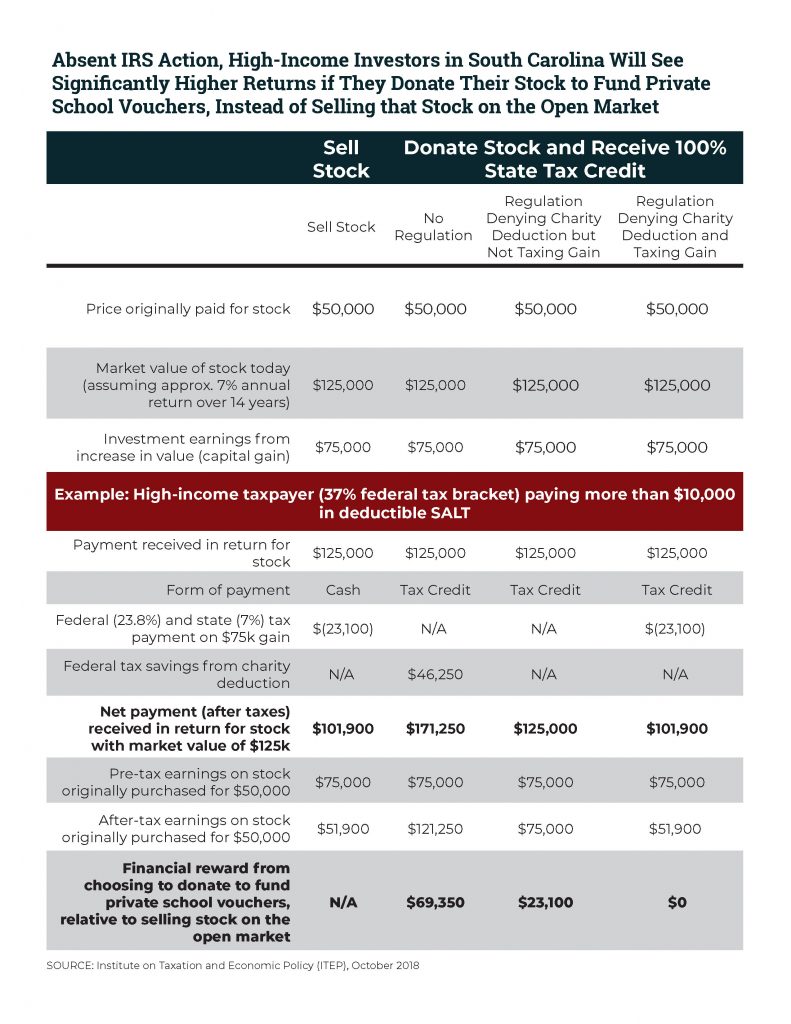

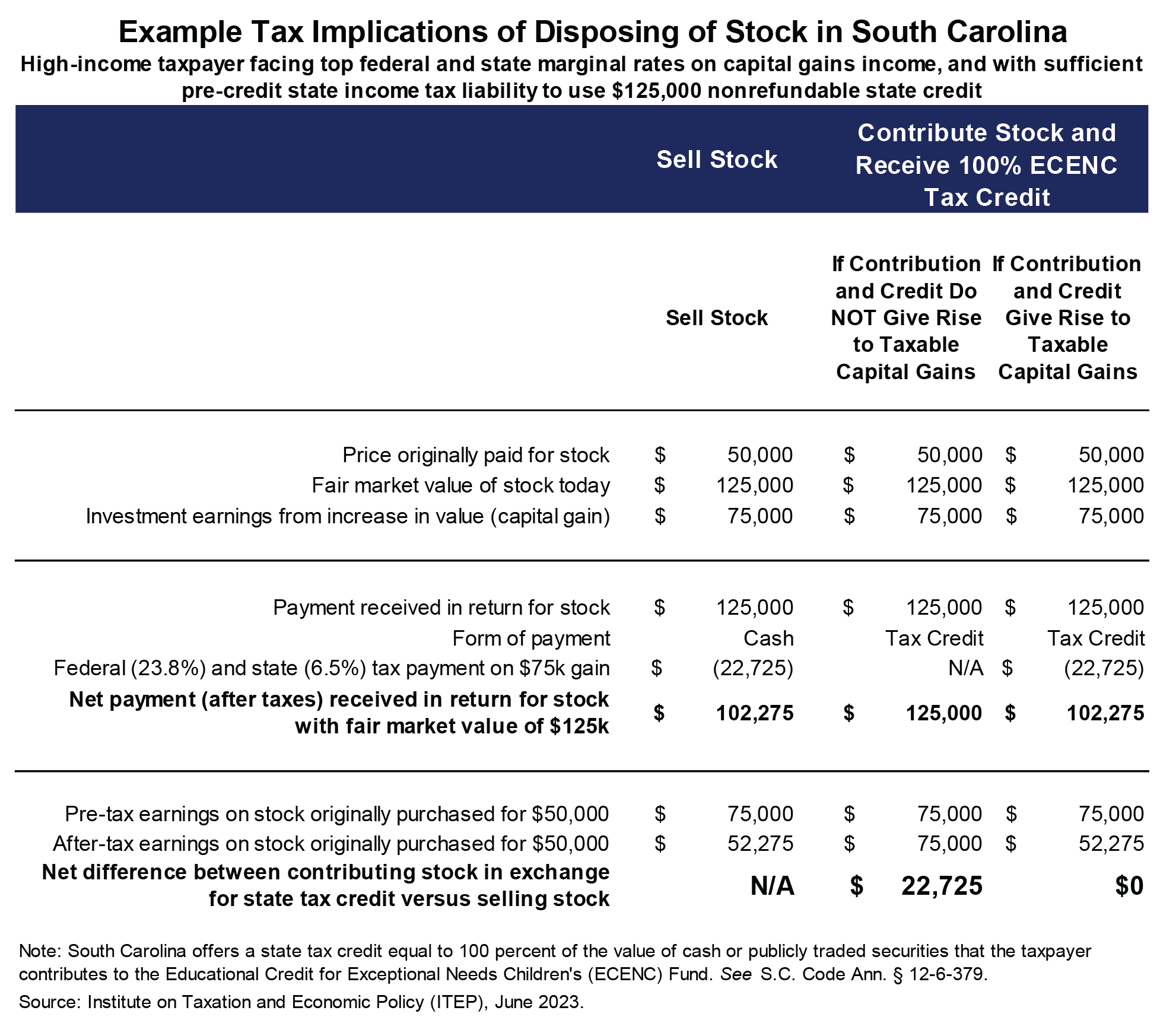

The table below provides an example calculation involving a tax credit in South Carolina equal to 100 percent of the market value of securities contributed to a fund, specified in state law, that pays certain students’ tuition at private K-12 schools.[1] The example illustrates how taxpayers can find it more advantageous to contribute their stock under the program than to sell it to an interested buyer.[2] The latter requires recognition of capital gains income but the former, absent further guidance from the IRS, arguably may not. In other words, some accountants in South Carolina are likely advising their clients that “donating” appreciated property under the state’s tax credit program is in their financial best interest—an outcome that flies in the face of any commonsense understanding of charitable giving.

Contributing appreciated property in return for a 100 percent state tax credit is the functional equivalent of selling the property for its fair market value and using the proceeds to pay the state tax. Since that equivalent approach would obviously trigger a tax on any capital gains arising from the sale, the contribution should also do so (absent any statutory directive to the contrary, which there is not).

While it is true that charitable donations of appreciated property generally do not constitute a realization event, the clear upshot of RIN 1545-BO89 is that the portion of contributions reimbursed with state and local tax credits are no longer considered charitable donations for federal income tax purposes because of the application of quid quo pro principles. If contributions of property in exchange for tax credits are not charitable donations, then they must be characterized as something else and the most logical characterization is “other disposition of property” under IRC section 1001.

In addition to South Carolina, other states offering large state tax credits in return for donations of marketable securities to private K-12 school programs include Illinois, Iowa, Kansas, Oklahoma, and Virginia.[3] Other states may also allow for donations of securities to such programs, though state statutes are not always clear on this question. Tax credits for donations of property are also common in the conservation easement space.[4]

The IRS has already said that additional guidance is needed on this issue. Specifically, it stated in RIN 1545-BO89 that:

Some commenters pointed out that the proposed regulations failed to fully address the tax consequences of treating tax credits as quid pro quo benefits and suggested that additional guidance is needed. For example, commenters noted that the proposed regulations did not address the tax treatment of the sale, use, or lapse of the credits. In particular, commenters suggested that additional guidance may be needed to clarify application of the rules under sections 61, 164, 1001, and 1012 to the receipt, expectation of receipt, or use of tax credits. The Treasury Department and the IRS agree with commenters that additional guidance is necessary to address these complex issues. (emphasis added)

The need for additional guidance is clear. We have recently become aware that organizations in Illinois, Oklahoma, and Virginia have publicly advertised tax-credit-reimbursed stock donations as a means of avoiding tax on capital gains income. Those statements are as follows:

- Oklahoma Society of CPAs / Opportunity Scholarship Fund (Oklahoma): “With appreciated stocks, donor gets: 1. state income tax credit, 2. federal and state net charitable contribution deductions at fair market value of stock donated (if they itemize), AND 3. no capital gains tax”[5] (emphasis original)

- Agudath Israel (Illinois): “Marketable securities (e.g. stocks) donations are exempt from federal capital gains taxes making the potential tax benefit even greater.”[6]

- Fenwick High School (Illinois): “The stock market is still trading near all-time highs! Take advantage of double tax savings by contributing long-term appreciated stock to an SGO (thus avoiding capital gains tax).”[7]

- The Hague School (Virginia): “Donors contributing appreciated marketable securities save on capital gains tax.”[8]

We expect that such advice is also being made in less public forums, even though it conflicts with the intent of the 2019 regulations to ensure that the portion of contributions reimbursed with large tax credits are not treated as charitable gifts for federal income tax purposes. We therefore urge action on this issue to resolve lingering uncertainty and ensure the consistent, proper treatment of tax-credit-reimbursed contributions of property.

Sincerely,

Institute on Taxation and Economic Policy

AASA, The School Superintendents Association

American Federation of Teachers

Americans United for the Separation of Church and State

In the Public Interest

Interfaith Alliance

National Education Association

Network for Public Education

[1] S.C. Code Ann. § 12-6-3790.

[2] For additional discussion of this issue, see the second recommendation included in ITEP’s 2018 comments to the IRS on REG-112176-18, available at: https://itep.org/itep-comments-reg-112176-18/.

[3] 35 ILCS 40/1-65 and 35 ILCS 5/224. Iowa Stat. § 422.11S. K.S.A. § 72-4531 through 4357. Okla. Stat. tit. 68 § 2357.206. Va Code. § 58.1-439.25-28.

[4] Bankman, Joseph and Gamage, David and Goldin, Jacob and Hemel, Daniel J. and Shanske, Darien and Stark, Kirk J. and Ventry, Dennis J. and Viswanathan, Manoj, State Responses to Federal Tax Reform: Charitable Tax Credits (April 30, 2018). State Tax Notes, Vol. 159, No. 5, 2018, UCLA School of Law, Law-Econ Research Paper No. 18-02, UC Hastings Research Paper No. 264, Available at SSRN: https://ssrn.com/abstract=3098291 or http://dx.doi.org/10.2139/ssrn.3098291.

[5] Oklahoma Society of CPAs and Opportunity Scholarship Fund, “Oklahoma Equal Opportunity Scholarship Act & Contributions to State Tax Credit Programs,” August 2019. https://tcoscpa.org/images/downloads/2019_Presentations/august_15__2019___12pm_ok_equal_opportunity_scholarhship_act_state_tax_credit.pdf. Accessed June 1, 2023.

[6] Agudath Israel of Illinois, “Scholarship Tax Credit: How It Works,” website accessed March 1, 2023. https://agudahstc.org/how-it-works/. Accessed June 1, 2023.

[7] Fenwick High School, “Reduce Your Illinois Income Taxes and Help Fenwick Students!,” website accessed March 1, 2023. https://www.fenwickfriars.com/giving/illinois-tax-scholarship-program. Accessed June 1, 2023.

[8] The Hague School, “Virginia Department of Education, Education Improvement Scholarship Tax Credits,” website accessed March 1, 2023. https://www.thehagueschool.org/support/scholarship-tax-credits/. Accessed June 1, 2023.