North Carolina

North Carolina Justice Center: Five Takeaways from the Senate’s Budget Proposal

June 23, 2021

The Senate’s budget plan would bring the state’s investments to a new low while committing the state to untold losses in the form of revenue reductions by eliminating income taxes for profitable corporations by 2028 and lowering the already flat (read: regressive) personal income tax rate. Read more

Taxing rich households and large corporations to fund vital investments in education and other shared priorities has long been a winner in the eyes of the American public, and more recently has also enjoyed a string of victories in state legislatures and at the ballot box. That win streak continued this week as Arizona’s voter-approved tax surcharge on the rich and Seattle, Washington’s payroll tax on high-profit, high-salary businesses both survived court challenges, and Massachusetts leaders approved a millionaires tax to go before voters next year.

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Gentrification and the Property Tax: How Circuit Breakers Can Help

April 27, 2021 • By David Crawford

Property tax circuit breakers are effective because they provide property tax relief to families whose property taxes surpass a certain percentage of their income. If a family in a gentrifying area sees their property tax bill (or their rent) surge to an unaffordable level, a circuit breaker credit kicks in to offer relief. This targeted approach assists low- and middle-income families without significantly reducing overall tax revenue.

NC Policy Watch: NC needs to fix its tax code to secure a just recovery — for everyone

April 23, 2021

North Carolina’s current tax code asks the top to pay less as a share of their income than taxpayers with poverty-level incomes. By putting in place tax policies that would ask just 1 percent of North Carolinians to pay slightly more, North Carolina can invest in a more equitable, just recovery for everyone. Read more

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

NC Policy Watch: Some simple truths about the taxes corporations pay and Biden’s proposal blow the whistle on them

April 14, 2021

Discovery No. 1 one is that almost no major U.S. corporation, certainly not those that do business overseas, actually pays the 21% corporate tax rate, set by law. In fact, on average, Fortune 500 companies pay about half that much – 11.3% according to the non-profit Institute for Taxation and Economic Policy and Taxation, working […]

NC Policy Watch: New report: NC tax policy promotes racial inequities in numerous ways

April 14, 2021

North Carolina’s tax code and budget are wrought with such policy choices, which can result in racist outcome that worsen barriers to well-being for people and communities of color, according to new data from the Institute on Taxation and Economic Policy (ITEP). The greater tax load carried by Black, Indigenous, and Latinx residents has been […]

North Carolina Justice Center: State Tax Policy Is Not Race Neutral

April 13, 2021

North Carolina’s tax code and budget are wrought with such policy choices, which can result in racist outcomes that worsen barriers to well-being for people and communities of color, according to new data from the Institute on Taxation and Economic Policy (ITEP). The greater tax load carried by Black, Indigenous, and Latinx residents has been […]

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

Indy Week: Anti-Poverty Advocates Rejoice Over New Child Tax Credit

March 24, 2021

It’s hard to overstate the significance of the expanded tax credit for low-income families. Information released by the Institute on Taxation and Economic Policy found that more than 2.6 million children in North Carolina stand to benefit from the credit, and the Center on Budget and Policy has calculated that the legislation will move 137,000 […]

It was a relatively quiet week in state fiscal policy, likely partly due to states waiting for federal guidance on some of the details in the American Rescue Plan. As they await those details, lawmakers in Mississippi and West Virginia continue to wrangle over whether to recklessly eliminate their income taxes, while leaders in states including Connecticut and New York considered more productive and progressive reforms. And in the meantime, groundbreaking work on the intersection of race and tax policy is now available.

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

State Rundown 12/17: New and Old State Tax Debates Await in 2021

December 17, 2020 • By ITEP Staff

Our last Rundown of 2020 includes news of yet another misguided proposal to eliminate a state income tax, this time in Arkansas. Florida and Missouri, on the other hand, are looking to modernize their tax codes by becoming the last two states to enforce their own sales taxes on online retailers. Leaders in Maryland and Oregon, meanwhile, are working to decouple the state from unnecessary and regressive tax cuts included in the federal CARES Act. And Missouri and Nevada lawmakers both got updated estimates of the revenue shortfalls they will need to resolve when they convene in 2021. The Rundown…

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

State Rundown 9/11: Benefits of Progressive Taxation Getting Well-Deserved Attention

September 11, 2020 • By ITEP Staff

Readers may want to start with our “What We’re Reading” section this week, which is full of good reading on how progressive taxation is needed to fund vital public services, helpful for state and local economic growth, and popular among voters as well. In that spirit, leaders in both New Jersey and New York are looking at small taxes on stock trades to help improve their budgets and tax codes. These last couple of weeks have also featured more state fiscal action than is typical this time of year, for example in North Carolina, where lawmakers decided to use federal…

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

South Strong: Racial Equity and Taxes in Southern States

August 26, 2020

Southern states have a particularly egregious record on tax equity, rooted partly in racism. Lawmakers baked some of the most egregious and anti-democratic tax policies into southern state constitutions, such as supermajority requirements to raise taxes in Florida, Mississippi and Louisiana, income tax rate caps in North Carolina and Georgia, and the recent elimination of […]

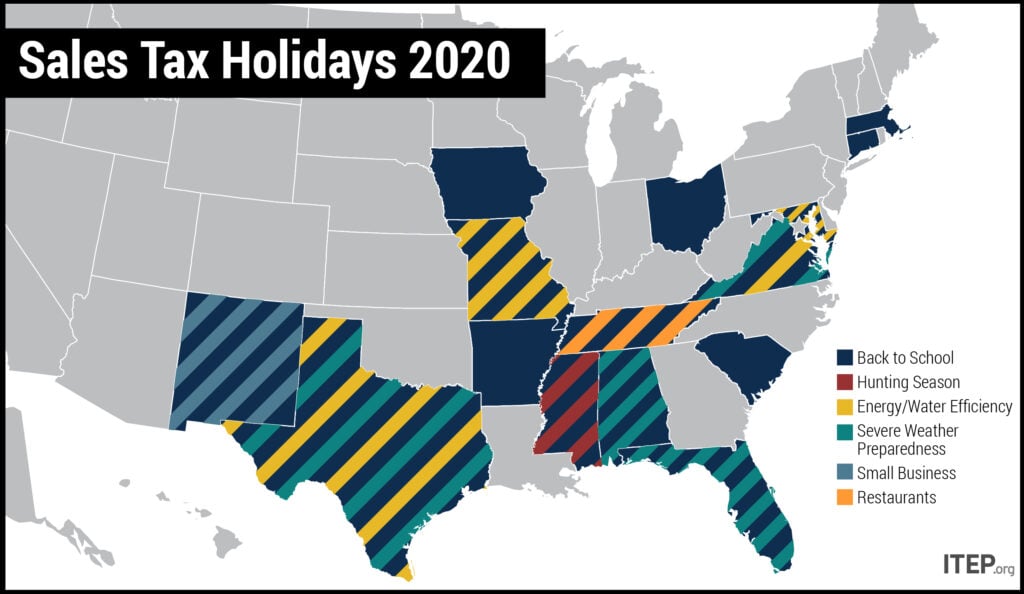

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

State Rundown 7/8: Many State Legislatures Reconvene for Special or Resumed Sessions

July 8, 2020 • By ITEP Staff

Local leaders in the District of Columbia and Seattle, Washington, approved progressive tax changes to raise needed funding this week for priorities such as coronavirus relief, affordable housing, and mental health. Arizona advocates submitted signatures to place a high-income surcharge on the ballot for November. And as a number of states made decisions on how to use federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds, North Carolina decoupled from costly business tax cuts contained in the act and Nebraska started discussing doing the same.