May 15, 2025

May 15, 2025

The sprawling tax and spending bill before the House of Representatives would cut more than $200 billion from food assistance, potentially affecting 4 million children and 7 million adults, while providing an estate tax cut costing roughly the same amount to a few thousand people who will leave behind more than $7 million to their heirs.

The bill would increase the estate tax exemption to $15 million for single people and $30 million for couples in 2026 and allow it to rise with inflation moving forward. In other words, a couple could leave $29.99 million to their heirs in 2026 without paying a cent of estate tax.

This would continue a decades-long effort to weaken a critical tool to prevent the hoarding of wealth from one generation to the next.

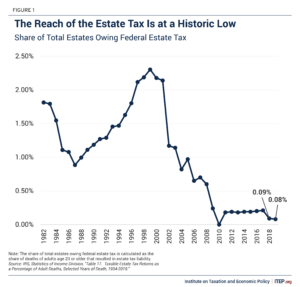

Less than a generation ago, the estate tax was much more robust, with an individual exemption of $675,000 in 2001. Adjusted for inflation, that would amount to an exemption of $1.2 million per individual today. Even so, the tax was paid by just a tiny fraction of Americans; just 2.14 percent of all estates were subject to the tax in 2001.

But since then, lawmakers have weakened the estate tax four times, most significantly via the 2017 Trump tax law. That law doubled the estate tax exemption, bringing it to about $14 million today ($28 million for couples). This would revert to roughly $7 million if the Trump tax provisions expire at the end of this year as scheduled.

As we explained in a 2023 report, these cuts have taken the tax to historic lows. The most recent data from the IRS, from 2019, show that just 0.08 percent of all deaths resulted in estate tax liability that year, when the estate tax had an exemption of $11.4 million per person.

People across the country, including many Republicans, are expressing concern about the breadth and depth of proposed cuts to food assistance, health care, and other public services that are part of the reconciliation package the House is currently moving forward. At the same time, overwhelming majorities of Americans think that wealth inequality is a problem that leaders need to solve.

Given this, the least that lawmakers can do is allow the estate tax to drop slightly back down in 2026 instead of cutting it for the wealthiest families yet again.