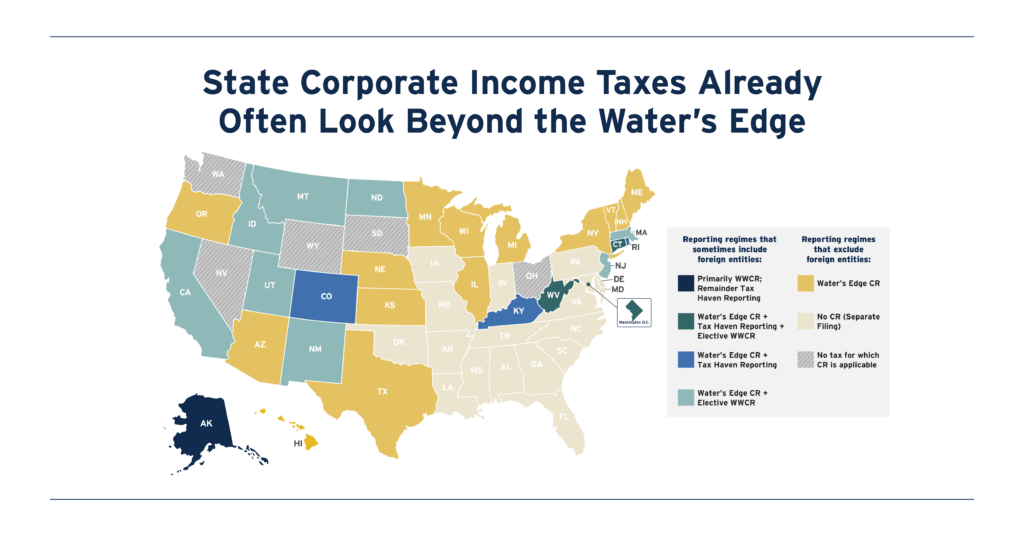

Maryland lawmakers are considering enacting worldwide combined reporting (WWCR), also known as complete reporting. This policy offers a more accurate, and less gameable, way to calculate the amount of profit subject to state corporate tax. Enacting WWCR in Maryland would represent a huge step toward eliminating state corporate tax avoidance as it neutralizes a wide array of tax planning strategies that corporations use to pretend their U.S. profits were generated overseas, outside the reach of state tax authorities.

The Tax Foundation recently published a blog designed to discourage Maryland lawmakers from enacting WWCR that includes a number of misrepresentations—some pertaining to ITEP’s own analyses—that we address below.

1. The Tax Foundation advances the far-fetched theory, without evidence, that WWCR “could lead to less taxable income in the state.” In other words, that enactment of WWCR might actually be a tax cut overall.

The furious opposition that WWCR has provoked from the business community, and the overwhelming evidence of massive international profit shifting, strongly indicate that this is not the case. Previously unreported data provided, upon request, by the Massachusetts Department of Revenue also offer clear evidence against this argument. Massachusetts already allows corporations to file on a worldwide combined basis if they so wish, but less than 4 percent of the state’s corporate income tax revenue came from corporations voluntarily choosing to pay on a worldwide combined basis during the seven-year period spanning 2015 to 2021. If WWCR offered a tax cut to a meaningful number of companies, this figure would be far higher.

2. The Tax Foundation mischaracterizes the methodology we devised to estimate the revenue potential of worldwide combined reporting, saying that we “assume that all foreign earnings are tax avoidance, as if corporations never actually market their goods and services abroad.”

This is completely untrue: in fact, we start from an estimate of international profit shifting from the Congressional Budget Office and no legitimate foreign earnings contribute to our revenue estimates. Some of the nation’s most respected corporate tax experts called this line of criticism from the Tax Foundation “unjustified.”

3. The Tax Foundation asserts, without evidence, that WWCR “may make corporate income tax collections even less predictable and more volatile.”

The aim of WWCR is to tax Maryland income regardless of whether it has been shifted offshore artificially or not—not to tax profits earned legitimately in other countries. In fact, taking away the ability of companies to play accounting games will, in some respects, make forecasting easier as Maryland tax collections will no longer depend in large part on the pace with which corporate tax planners are able to innovate new tax avoidance strategies. Turning on the lights will always make it easier to see.

4. The Tax Foundation makes a mountain out of a molehill when it decries the alleged complexity of adding up profits earned in various foreign currencies into one total dollar value.

U.S. corporations are already required to take currency translations into account when preparing financial statements. Any company operating internationally is perfectly adept at dealing with currency valuations and as corporate accounting goes, this is not a particularly complex exercise. The Tax Foundation also seeks to seize on the absence of mundane details, like guidance on the timing of currency translations, as some kind of flaw of the legislation being debated in Maryland. In fact, this is precisely the kind of thing that can (and arguably should) be handled through the regulatory process, with plenty of opportunity for input from corporations and experts in the field.

5. The core problem with the Tax Foundation’s critique of WWCR is the substance of its arguments, not the messenger. It is also worth noting, however, that the Tax Foundation has deep connections to corporations that are well known among tax experts for aggressive international tax avoidance of the type that WWCR is meant to curtail.

More than 40 percent of the Tax Foundation’s grants and contributions come directly from corporations. While it is not possible to know which corporations are funding the organization, we do know that its board of directors includes Microsoft’s Tax Policy Counsel and that Gilead’s Vice President of Tax also serves as an official advisor to the organization. Until a few hours ago, the Tax Foundation’s website identified Pepsi’s Senior Vice President of Tax as a board member as well. All three of these companies are notorious for their use of offshore tax shelters. Our review of Pepsi’s financial filings, for instance, indicates Pepsi has 134 subsidiaries in Delaware and 29 across Bermuda, the Cayman Islands, and Luxembourg. The Tax Foundation’s arguments deserve to be assessed on the merits—as we and others have done—but it is also relevant that the organization is heavily dependent on the funding, and leadership, of entities that have a direct financial stake in the outcome of these debates, and that appear to have used offshore tax havens to shelter their profits from U.S. federal and state income taxes.

At the end of the day, WWCR is an eminently sensible reform that will enable Maryland, and any other state adopting this reform, to tax the income of the biggest multinational corporations in a way that fairly represents those companies’ actual in-state activities. The largest multinational corporations are terrified that they might lose their long-cherished ability to hide their Maryland profits in offshore tax havens. With this in mind, the motivation behind the dizzying array of half-baked arguments that have emerged in opposition to WWCR is much clearer. Putting an end to offshore tax avoidance will unambiguously bolster Maryland’s tax base, thereby raising substantial revenue and putting small businesses that don’t have subsidiaries in foreign tax havens on a more even playing field with the huge multinational corporations that are currently gaming the system.