March 6, 2024

March 6, 2024

The governors of both Kansas and Wisconsin recently stood up to legislators who tried to push through costly tax cuts that would overwhelmingly benefit the most well-off. Lawmakers in those states and others should shift their focus from expensive, top-heavy tax cuts to tried and true policies that help middle-class and low-income families.

For the second straight year, the Republican-controlled Kansas legislature failed to override Gov. Laura Kelly’s veto of a flat personal income tax. The vetoed bill would have replaced Kansas’ graduated income tax brackets with a single flat rate of 5.25 percent. Multiple Republicans joined the vast majority of Democrats to sustain the veto by three votes. In 2023, a veto override of a 5.15 percent flat tax failed in the Senate by one vote.

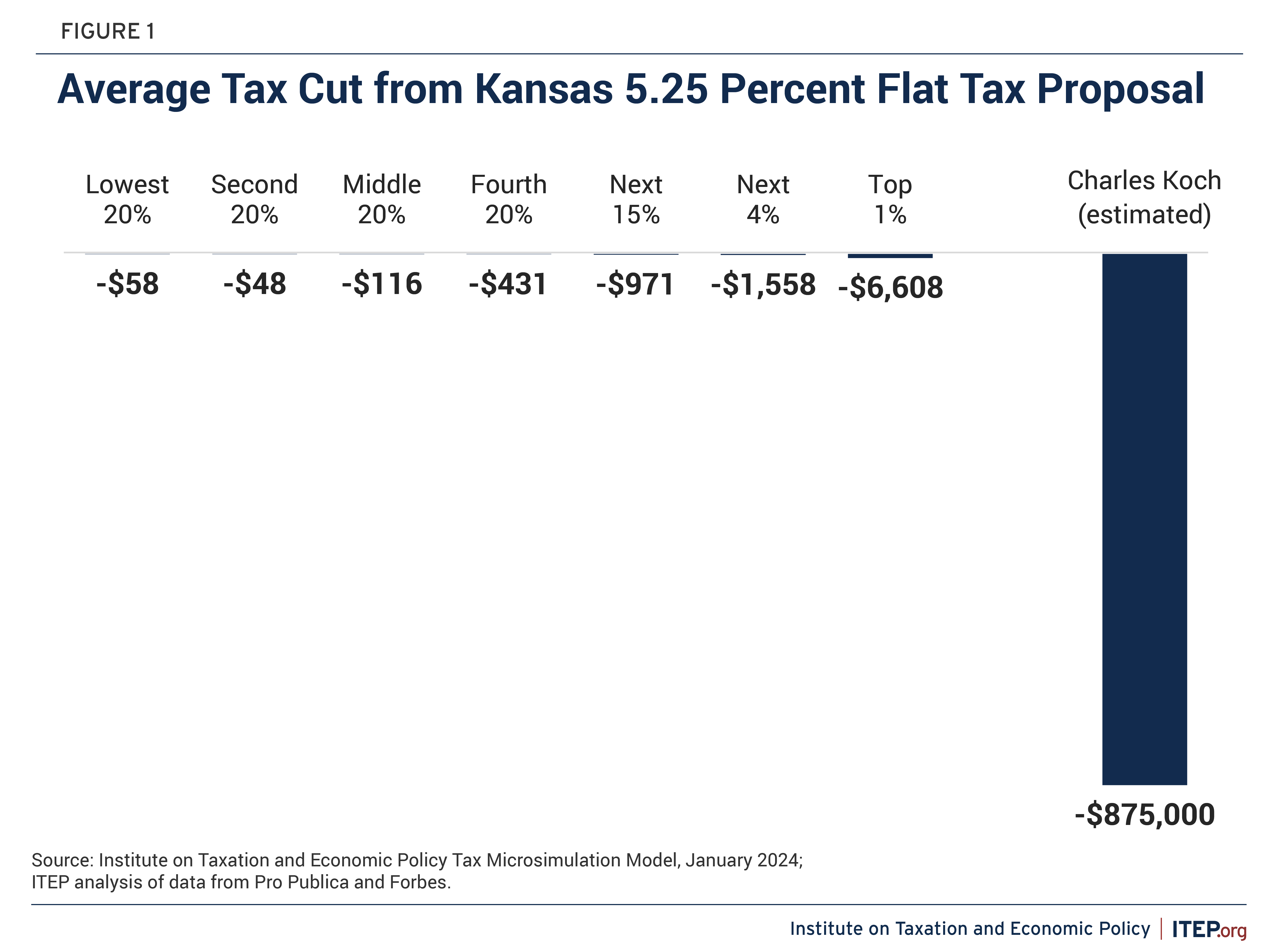

Legislators on both sides of the aisle criticized the flat tax bill as expensive, with little benefit going to middle-class Kansans. They were right. Despite proponents of the bill claiming it as a win for the middle class, the bill’s largest beneficiary would have likely been Kansas billionaire, Charles Koch, whom ITEP calculated would have seen an annual income tax cut of around $875,000 if it had passed. That’s 12 times as much as the typical Kansas household makes in a year.

Flat taxes are bad tax policy, as the bipartisan group of legislators who rejected this policy confirmed. Switching to a flat tax typically involves a large windfall to the wealthiest families. An ITEP analysis of Kansas’ latest flat tax proposal highlights this: 70 percent of the tax cut would have gone to Kansans in the top 20 percent of income earners who, on average, have an annual income of $315,000. The bill’s hefty price tag and tilt to the wealthiest dredged up concerns from the era of former Gov. Sam Brownback, whose failed tax experiment gutted state revenues and sent the state (and Kansas’s education system) into a spiraling fiscal crisis.

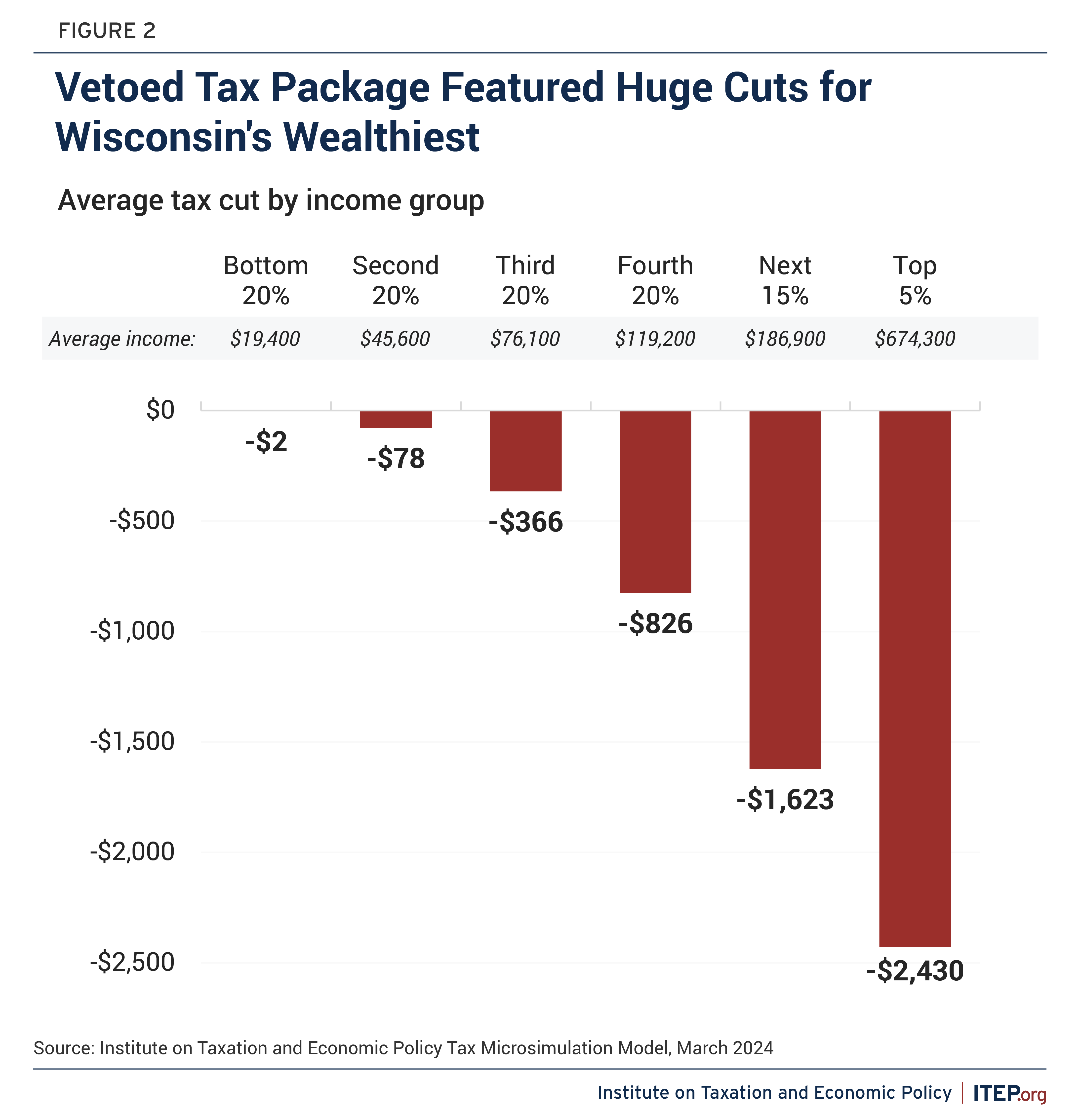

Kansas isn’t the only state not buying into the deception of “middle-class tax cuts.” For the second year in a row, Wisconsin Gov. Tony Evers vetoed income tax cuts passed by the Republican-controlled legislature. The latest tax cuts vetoed by Gov. Evers would have increased the amount of income taxed by the state’s second bracket, expanded tax exemptions for wealthier retirees, and increased a nonrefundable credit for married filers – all while costing the state $2 billion annually. Like Kansas, supporters of these bills marketed them as a tax cut for middle-class Wisconsinites. And while some middle-class families would have received a tax cut, the bulk of the benefit – 59 percent of the $1.9 billion – was set to go to Wisconsin’s wealthiest households. A Wisconsin household making $45,600 annually would receive, on average, just $78, a fraction of the $2,641 that households in the top 5 percent, making an average of $674,300 annually, would receive. And the $1.9 billion revenue loss would hit hard at services that middle-class families need.

In 2023, Gov. Evers vetoed cuts to the state’s two highest tax brackets while allowing tax cuts for lower brackets to take effect. The rate cuts proposed in 2023 would have also effectively consolidated the state’s middle two brackets and significantly flattened the state’s income tax structure.

Similarly, the centerpiece of this year’s tax cut package was a proposal to expand the state’s second bracket of 4.4 percent, a policy change that would have cost the state upwards of $800 million.

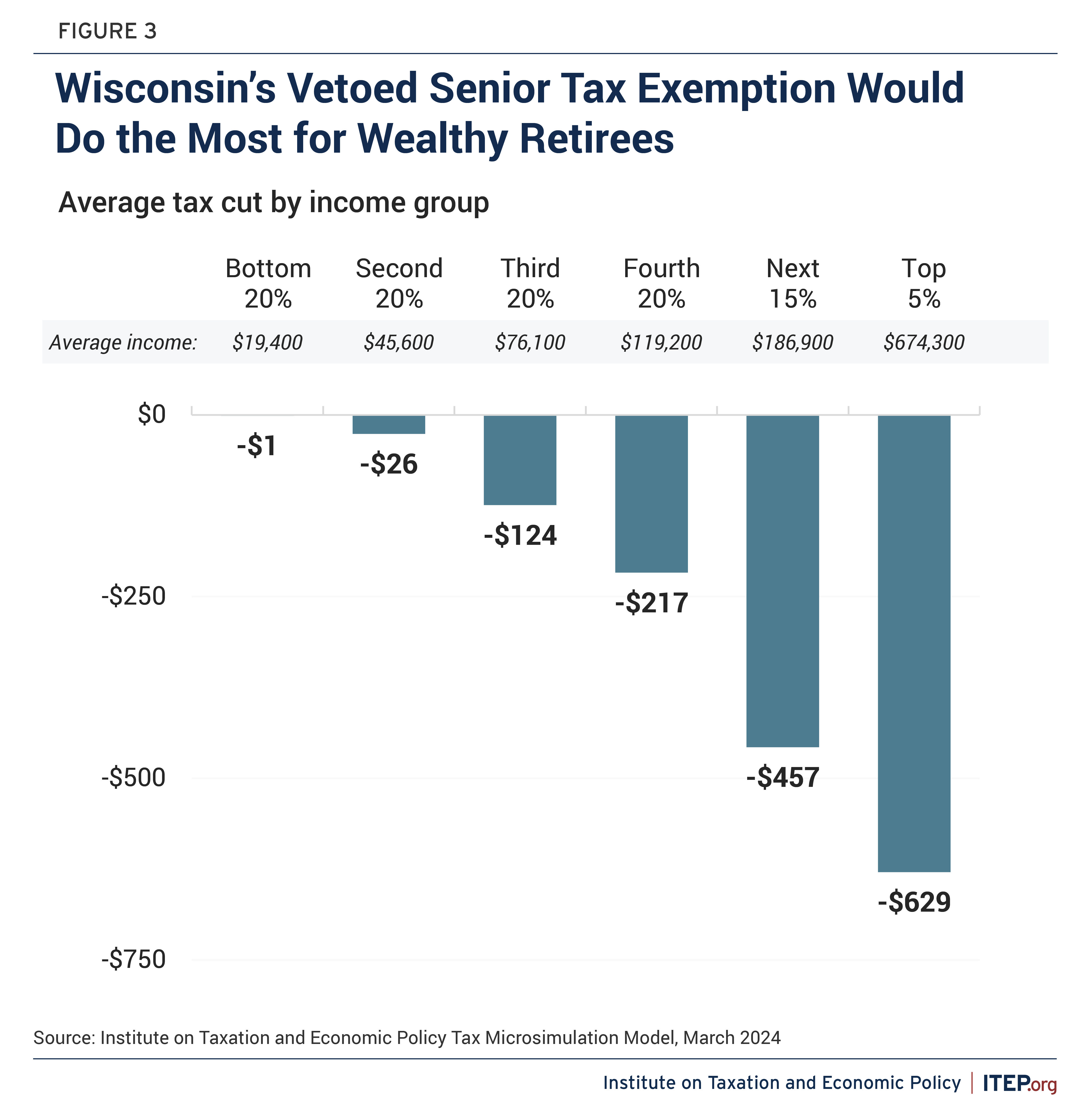

Another major regressive component involved retirement income. Currently in Wisconsin, senior households with incomes of $15,000 for single filers or $30,000 for married filers can exempt up to $5,000 of qualified retirement income from tax. This is well targeted, as lower-income seniors are the only households who qualify. But the proposal, vetoed by Gov. Evers, would have changed the existing subtraction into a blanket exemption of retirement income on the first $75,000 for single filers and the first $150,000 for married filers. This means that even the wealthiest seniors would no longer pay taxes on up to $150,000 of retirement income. It would have cost the state nearly $500 million annually while doing little to nothing for low- and moderate-income seniors who struggle most to make ends meet.

Ensuring seniors have the financial resources to age with dignity is not achieved through expensive tax subsidies for wealthy seniors. Wisconsin already exempts Social Security income from tax for all seniors regardless of income. Large tax breaks won’t prevent some seniors from moving to warmer climates. But they will make it harder to fund services that seniors, and their neighbors, rely on, like healthcare, housing, and transportation.

With these tax cuts now defeated, lawmakers should focus on making taxes more equitable and making strategic investments in their communities. In Kansas, legislators are considering legislation to create the state’s first child tax credit, and to expand homeowner property tax relief programs to senior and low-income renters. In Wisconsin, lawmakers and advocates for families, workers, and children have pointed to numerous investments the state could make that would reduce inequality and build strong communities instead of enacting permanent tax cuts that primarily benefit wealthy households. These include a statewide paid leave program, expanded mental health services, more post-secondary education funding, making housing affordable for low- and moderate-income seniors, and expanded access to childcare.

Repeated attempts at income tax cuts in Kansas and Wisconsin keep failing because too many lawmakers know these proposals do little to improve the lives of everyday families. Luckily, research-backed policies that will reduce inequality and help all Kansans and Wisconsinites thrive are available. There’s so much we can do when we choose to invest in each other and our communities.