Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

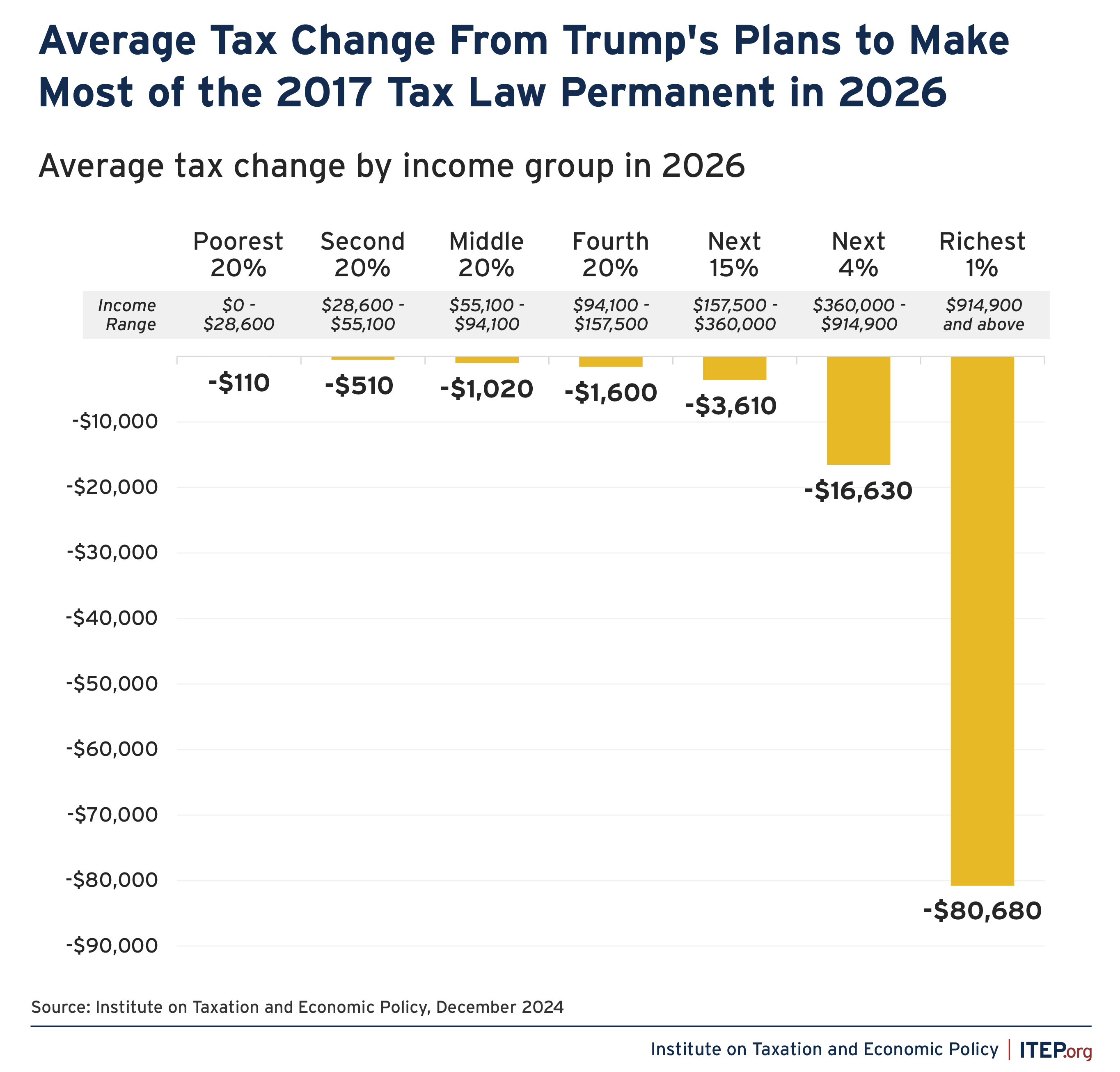

briefTrump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid which Trump has indicated he would not extend.

This plan would also be expensive. The resulting impact would be a cost of $466 billion in the first year alone. You can read more about these effects and the rest of the 2025 federal tax debate here.

Below are graphics for each state that show the effects on different income groups from making most of the temporary provisions from the 2017 law permanent.

Download all state-by-state-data here.

Download the State-by-State Graphics

Click below for each state’s estimates. For full U.S. estimates, click here.