May 10, 2025

May 10, 2025

President Donald Trump has proposed extending all the temporary tax cuts he signed into law in 2017 with one (newly announced) exception – allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers.[1] But many other special breaks in the tax code – some introduced by Trump’s 2017 tax law and many others that existed prior to it – would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

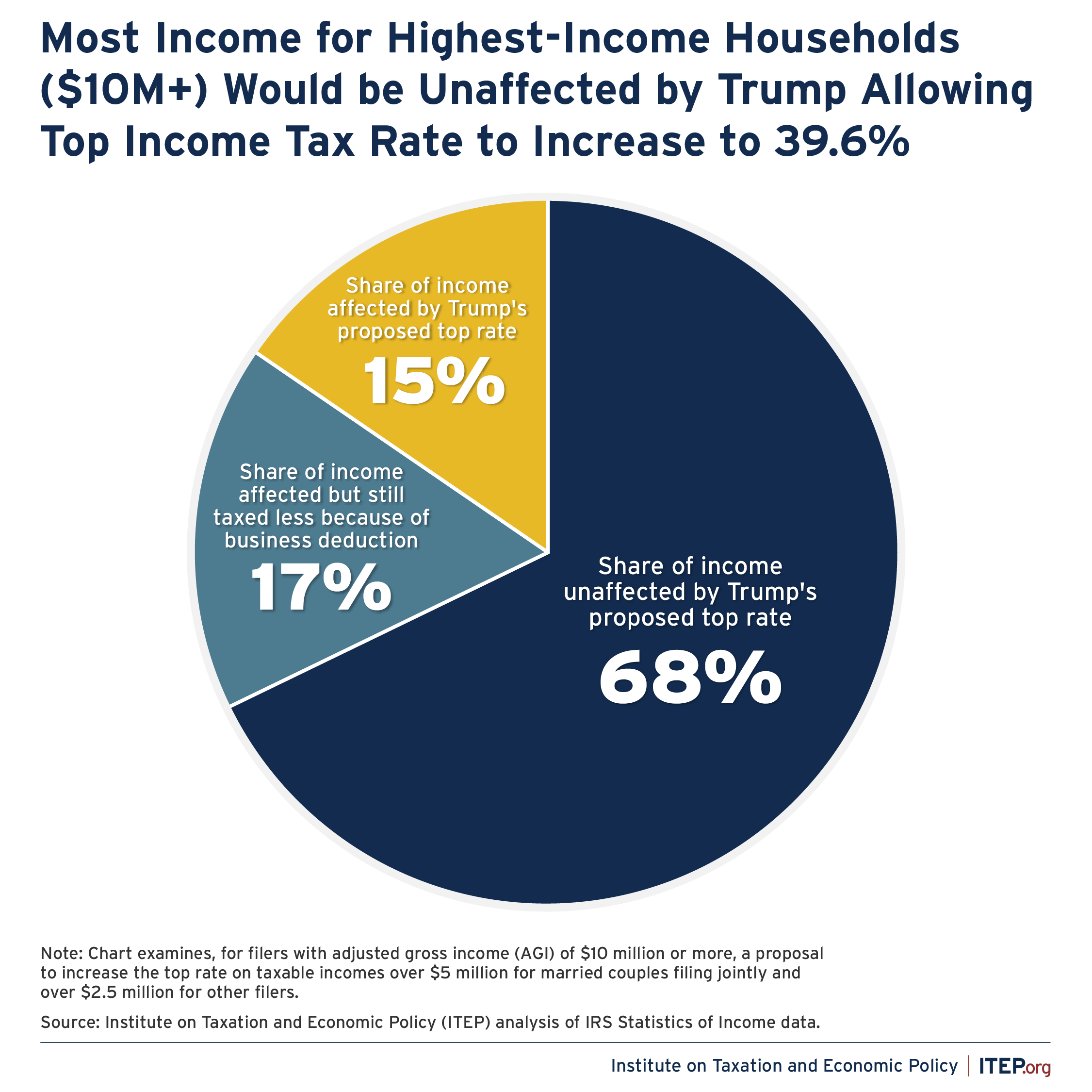

The very richest taxpayers broken out in IRS data are those with adjusted gross income (AGI) exceeding $10 million. Calculations using the most recent IRS data, which is for 2022, show that 85 percent of income from these extremely well-off taxpayers would not have been taxed at this higher rate, had it been in effect that year.

Of the $1.05 trillion in income reported by these taxpayers (who all reported at least $10 million), only $162 billion (15 percent of their total income) would have been subject to the 39.6 percent rate.

FIGURE 1

Another $176 billion (17 percent of their total income) would be taxed at a lower effective rate due to the 20 percent deduction for business income enacted as part of the 2017 tax law.

The vast majority of the income flowing to this group, $713 billion (68 percent of their total income) would not have been affected at all by Trump’s 39.6 percent rate. Most of this income is long-term capital gains and qualified dividends that have long been taxed at special, lower rates enacted under former President George W. Bush. It would be difficult for Congress to ever adequately tax extremely well-off people without reforming these and other special tax breaks for capital gains and dividends.

The 68 percent of income for these taxpayers that would not be subject to the 39.6 percent rate also includes income taxed at ordinary rates in brackets below the proposed 39.6 percent bracket. In addition, it includes income that is not taxable because of various deductions, like the deduction for charitable giving.

Had this proposal been in effect in 2022, the total additional tax paid by people with AGI exceeding $10 million would have been less than $8 billion.[2] The overall cost of extending the 2017 tax cuts, plus many new cuts that Trump and his supporters in Congress are considering, would cost orders of magnitude more than that.[3]

In some ways, very well-off people are even more shielded from Trump’s proposed top rate than is illustrated in these figures. They have vast amounts of income that they are not required to report to the IRS, which are not included in this data and which are exempt from taxes under federal law. Most importantly, a wealthy person’s increase in net worth due to appreciation of assets is capital gain income that is not taxed until the assets are sold and the capital gains are “realized” as profits.

The corporate tax cuts enacted as part of the 2017 law mainly helped these taxpayers by increasing the value of their stocks, meaning they likely benefited from increased unrealized capital gains not reported in this data. The drafters of the 2017 law made those corporate income tax cuts permanent, unlike the personal income tax cuts and estate tax cuts that are temporary and being debated now as they near expiration. It will be difficult to adequately tax extremely well-off taxpayers without revisiting and reversing some of these corporate income tax cuts.

All else equal, it would be slightly better to let the top tax rate revert to 2017 levels as Trump suggests. But nobody should be deceived: the wealthiest taxpayers got enormous tax breaks from Trump’s 2017 law and are getting additional large tax breaks in what Trump and Republicans are proposing now. We need legislation that requires rich people to pay more taxes, not less. The Republican legislation will do the opposite, regardless of whether or not Congress includes this latest suggestion from Donald Trump.

[1] Jacob Bogage and Jeff Stein, “Trump Tells Congress to Raise Taxes on the Rich in Budget Bill,” Washington Post, May 9, 2025.

[2] The revenue generated by a 39.6 percent rate compared to a 37 percent rate would be 2.6 percent of whatever taxable income is affected. As explained, only $162 billion of income for these taxpayers would have been entirely subject to the 39.6 percent rate, and 2.6 percent of $162 billion yields $4.2 billion. As explained, another $176 billion would have been subject to the 39.6 percent rate but because of the 20 percent deduction for pass-through business income, the revenue saved would be 20 percent less, yielding $3.6 billion. The sum of the two amounts is $7.9 billion. A small but indeterminate amount of additional revenue would also be raised from taxpayers with AGI below $10 million.

[3] Steve Wamhoff et al., “A Distributional Analysis of Donald Trump’s Tax Plan,” Institute on Taxation and Economic Policy, October 7, 2024.