April 24, 2025

April 24, 2025

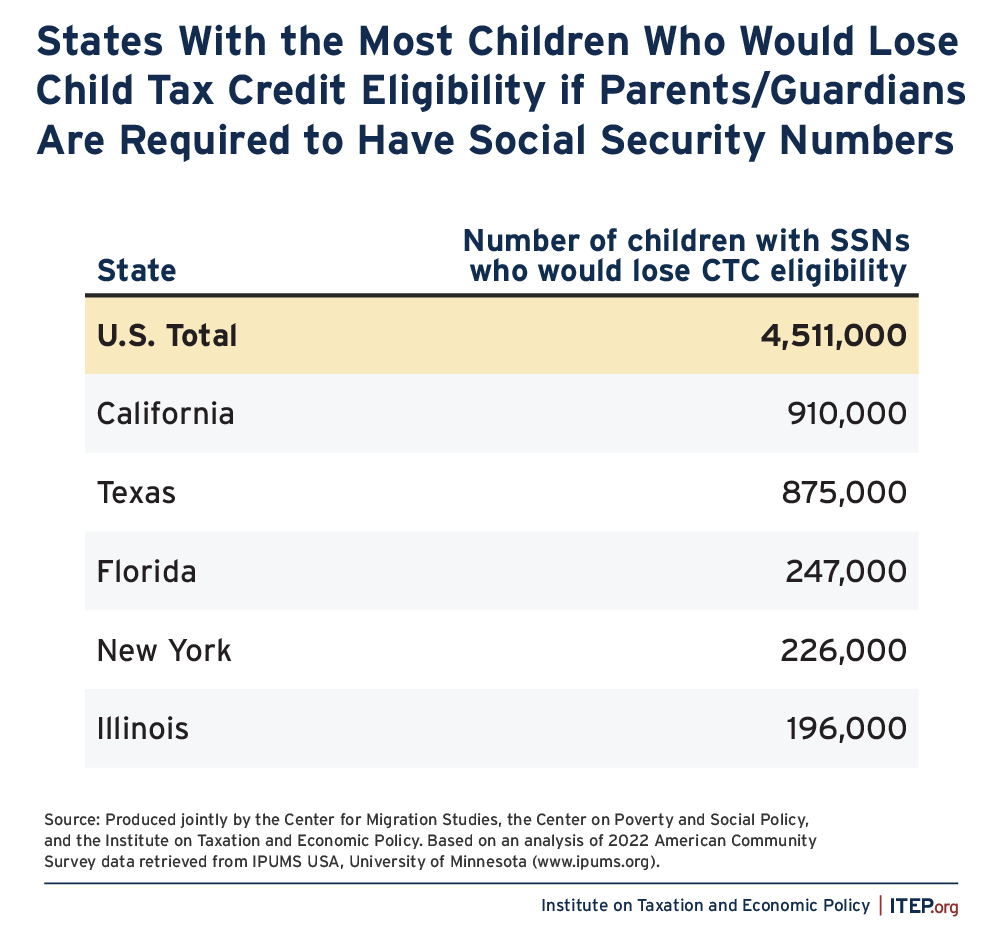

Congressional Republicans have floated a proposal to strip the Child Tax Credit (CTC) from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers (SSNs). In a joint study from the Center on Migration Studies, the Center on Poverty and Social Policy at Columbia University, Boston University Institute for Equity in Child Opportunity & Healthy Development, and ITEP, we found that 4.5 million citizen children with SSNs would lose access to the credit under this proposal.

As a result of tax law changes enacted by President Trump and a Republican Congress in 2017, the CTC may only be claimed for children with SSNs; that is, children who are citizens or legal permanent residents of the U.S. The credit may be claimed regardless of the immigration status of the tax filer (usually the child’s parent). As ITEP has previously reported, undocumented immigrants, who work and pay taxes despite not having an SSN, paid nearly $100 billion in federal, state, and local taxes in 2022. Republicans have shifted even further to the right on immigration since 2017, now believing that American citizens in mixed-status households should not qualify for the credit. Stripping the CTC from citizen children in these households (along with other actions taken by the current administration) will likely suppress the tax filing rate of these households.

More than 50 percent of the children affected live in five states that are close to a border or have large numbers of immigrants. Approximately 900,000 children in both California and Texas would lose access to the CTC if Congress passes new laws that target legally residing or citizen children of undocumented parents.

The five states with the most children affected each receive more than $1 billion each in state and local tax revenues from undocumented immigrants. And in almost all states, undocumented immigrants pay higher state and local tax rates than the top 1 percent of households in the state. These payments will almost certainly decline if undocumented immigrants with citizen children are further dissuaded from filing.

It should also be noted that the CTC is a key tool in combating child poverty. Children who grow up in poverty are less likely to thrive in school, have higher long-term healthcare costs, and are less productive as adults. The CTC drastically reduces child poverty, making for a more prosperous economic environment with lower public costs in the long term.

The targeting of citizen children of undocumented parents is a continuation of the administration and Republicans’ proposals to deter tax compliance among undocumented households. In February, the White House announced it would begin deputizing IRS agents as immigration enforcement. As long as the administration pursues policies that encourage these households to stay off the radar of the IRS, revenues at the federal, state, and local levels are likely to decline.

These proposals, while supposedly targeted at undocumented immigrants, ultimately harm citizen children. And when taken as part of a broader agenda of deterring immigrants from complying with the tax code, they do not even raise revenues.