A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1

briefSummary

Mississippi lawmakers have approved the most radical and costly change to the state’s personal income tax system to date. House Bill 1, which was recently signed by Gov. Tate Reeves, ultimately eliminates Mississippi’s personal income tax. That process begins by reducing the state’s flat income tax rate from 4 to 3 percent (the current rate of 4.4 percent is already phasing down to 4 percent based on legislation enacted in 2022) and then, using triggered reductions, reduces the rate to zero over time. The legislation also increases the state’s excise tax on gasoline from 18.4 to 27.5 cents per gallon and reduces the sales tax on groceries from 7 to 5 percent.

In addition to reducing state revenues by nearly $2.7 billion a year when fully implemented, this deeply regressive legislation will create a windfall for the wealthiest residents of the poorest state in the nation while simultaneously jeopardizing the state’s ability to fund public services that support Mississippians and the state’s economy.

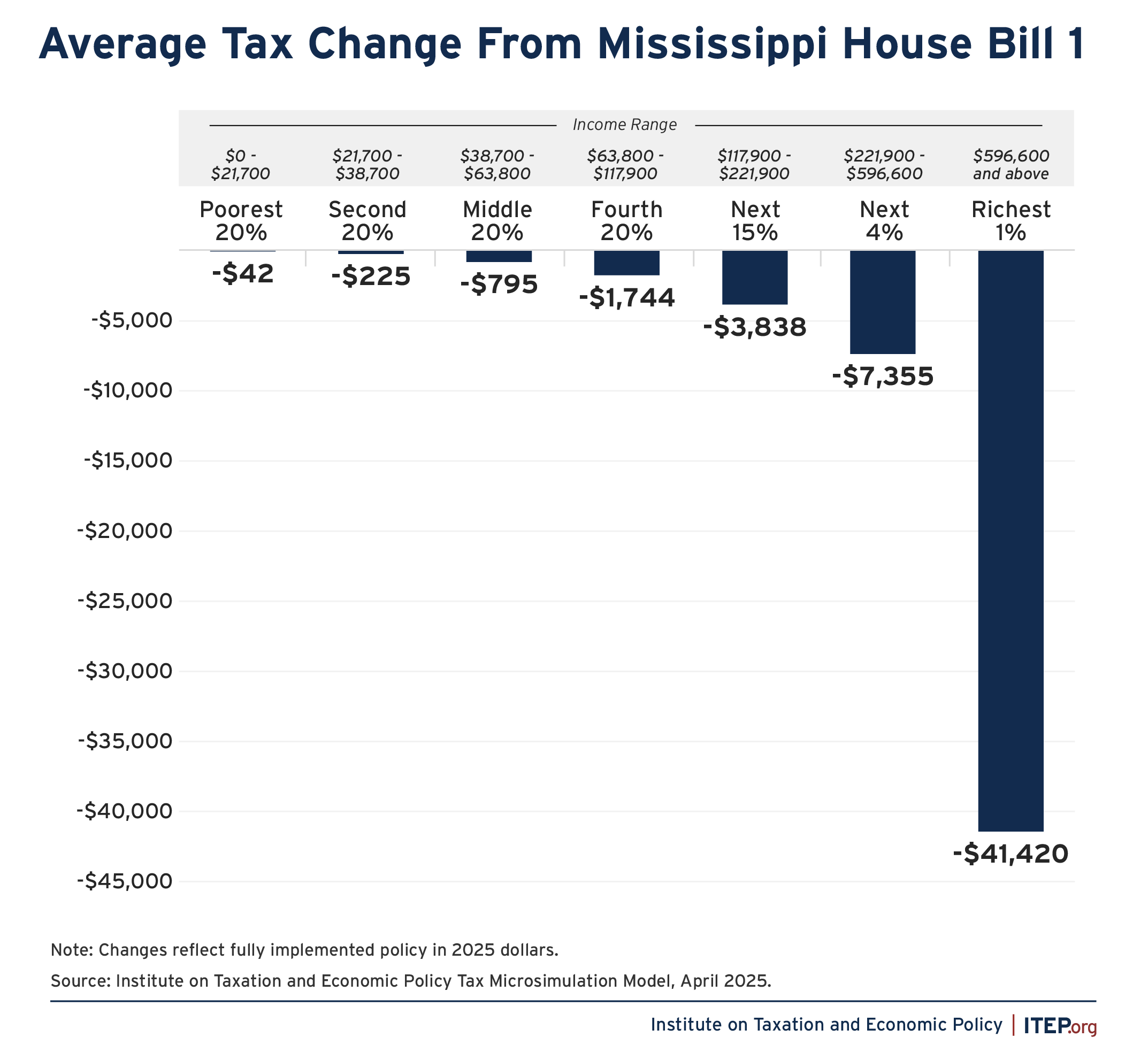

The state’s wealthiest 1 percent of households – with average annual incomes of $1.4 million – will receive an average tax cut of $41,420, or roughly 3 percent of their annual income. Meanwhile, households in the bottom 20 percent of income earners—with average annual incomes of $13,400—would see a cut of just $42. These costly, top-heavy tax cuts come at a time when states need to preserve revenue as the uncertainty of federal dollars for programs like food assistance, Medicaid, and education hang in the balance.

Bill Summary

Mississippi House Bill 1 would make the following changes to state tax law:

- Reduce the personal income tax rate from 4 to 3 percent between 2027 and 2030.

- Beginning in 2031, the 3 percent tax rate may drop further through triggered reductions. Those reductions are based on 0.85 percent of the cost of a 1 percentage point personal income tax rate reduction (which today would equal roughly $5 million). If the difference between the current year’s state general fund collections and the following year’s appropriations exceed this number, the income tax rate will be reduced by 0.2 to 0.3 percentage points, under the most common interpretation of that trigger language being reported in the press.[1] Eventually, the personal income tax will be eliminated if these triggers are met.

- Increase the gasoline excise tax by 9 cents from 18.4 to 27.5 cents per gallon over three years.

- Reduce the sales tax on groceries from 7 to 5 percent beginning July 2025.

Bill Analysis

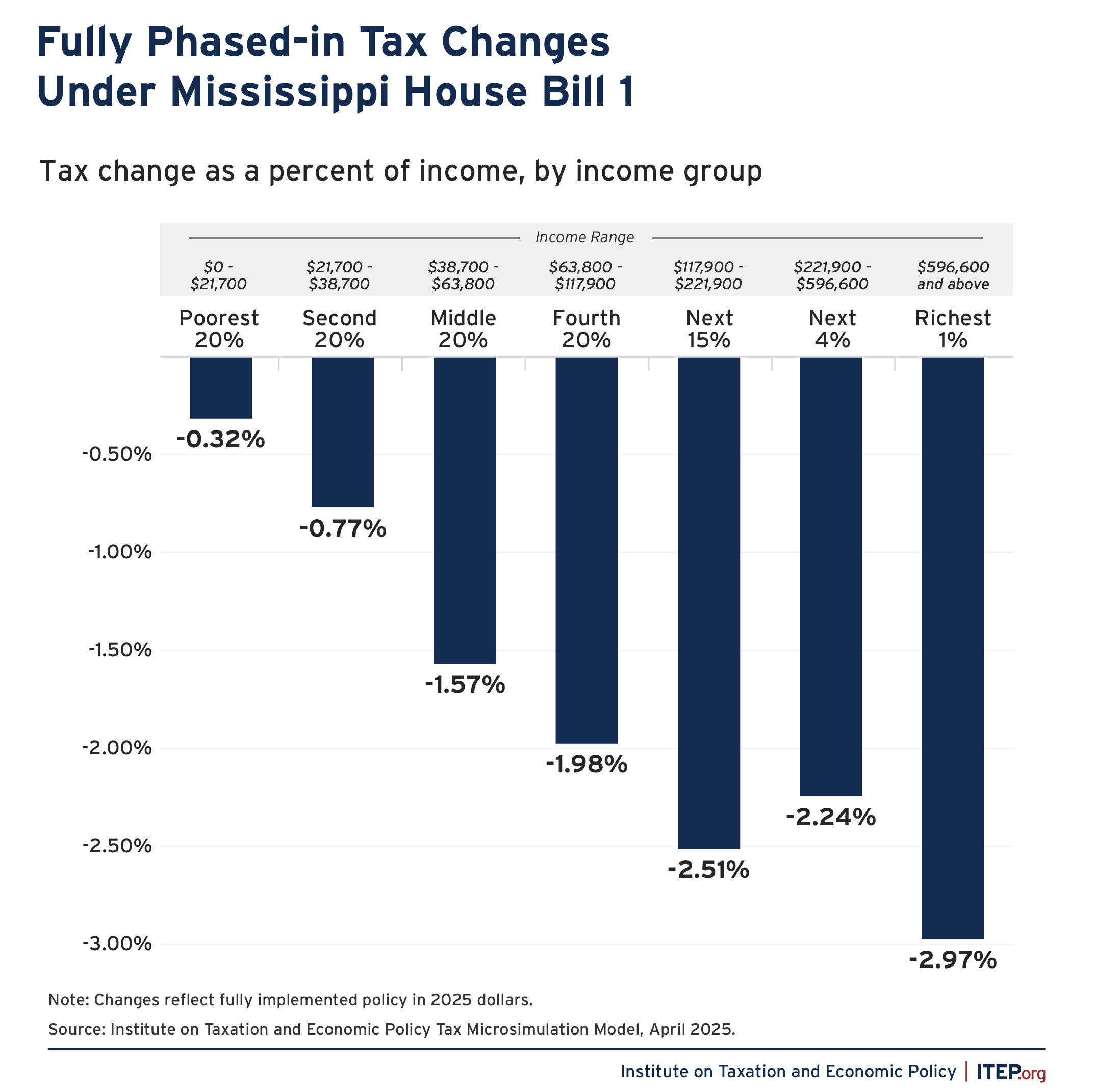

A near $2.7 billion cut to Mississippi’s annual revenues, the revenue effect if fully implemented this year, would result in a dramatic reduction to the state’s general fund which typically raises around $7 to $8 billion a year. The vast majority of this tax cut will flow to the state’s wealthiest households. The tax reduction for a household in the top 1 percent will, on average, equal nearly 3 percent of their annual income. Middle-income households would see just half that tax cut, with an average cut of around 1.6 percent of their annual income. Lower-income households will see even less of a tax reduction, with a cut of just 0.3 percent of their income.

FIGURE 1

Translating this into dollar amounts, Mississippi’s wealthiest households will receive, on average, a tax cut of $41,420, nearly the average starting salary for a public school teacher in the state.[2] Middle-income households can expect to see an average cut of $795, which equates to just over $2 a day. Mississippi’s lowest-income households will receive an average annual tax cut of $42.

FIGURE 2

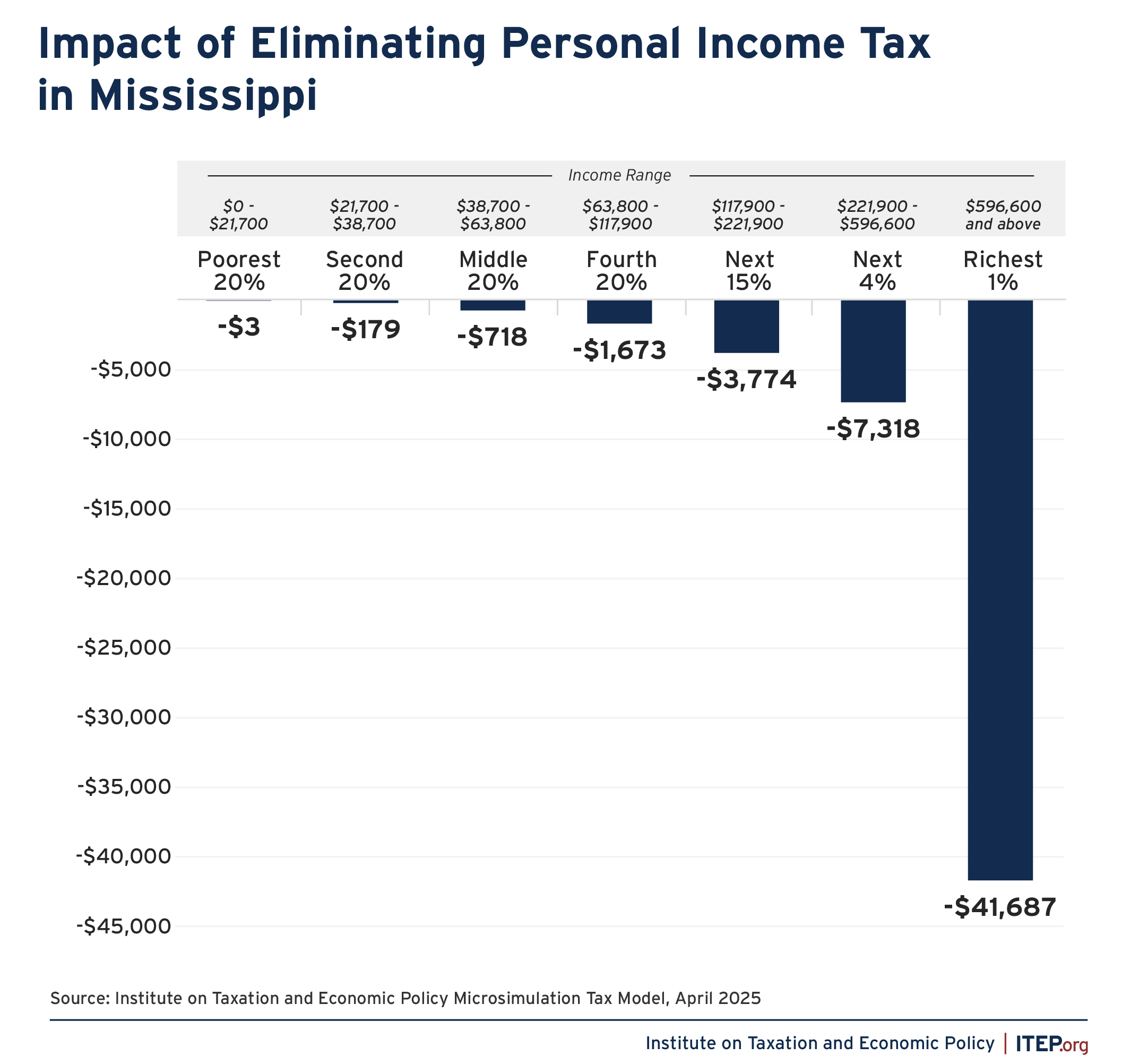

While multiple tax changes were included in this legislation, the most significant component is total elimination of the state’s personal income tax. It is the driving force behind the legislation’s overall regressive impact. Eliminating the personal income tax results in a nearly $42,000 annual tax cut for the wealthiest 1 percent of households, and just $3 for the poorest 20 percent. Forty percent of the income tax cut will flow to the state’s richest 5 percent, with average annual incomes of over half a million ($541,800).

FIGURE 3

The bill also includes a trigger mechanism. If the difference between the current year’s state general fund collections and the following year’s appropriations exceeds this trigger, the income tax rate will be reduced further. The triggers that will drive the state’s personal income tax rate from 3 percent (in 2030) to full elimination are the result of a typo in the bill text[3] Still, the bill was passed by the House and signed by Gov. Reeves under full awareness that the Senate intended to require significantly higher revenue growth to reduce the personal income tax rate. The design of the triggers structure also incentivizes anti-tax legislators to push for cuts to appropriations to artificially manufacture the ratio needed to hit the trigger requirements for a rate reduction.

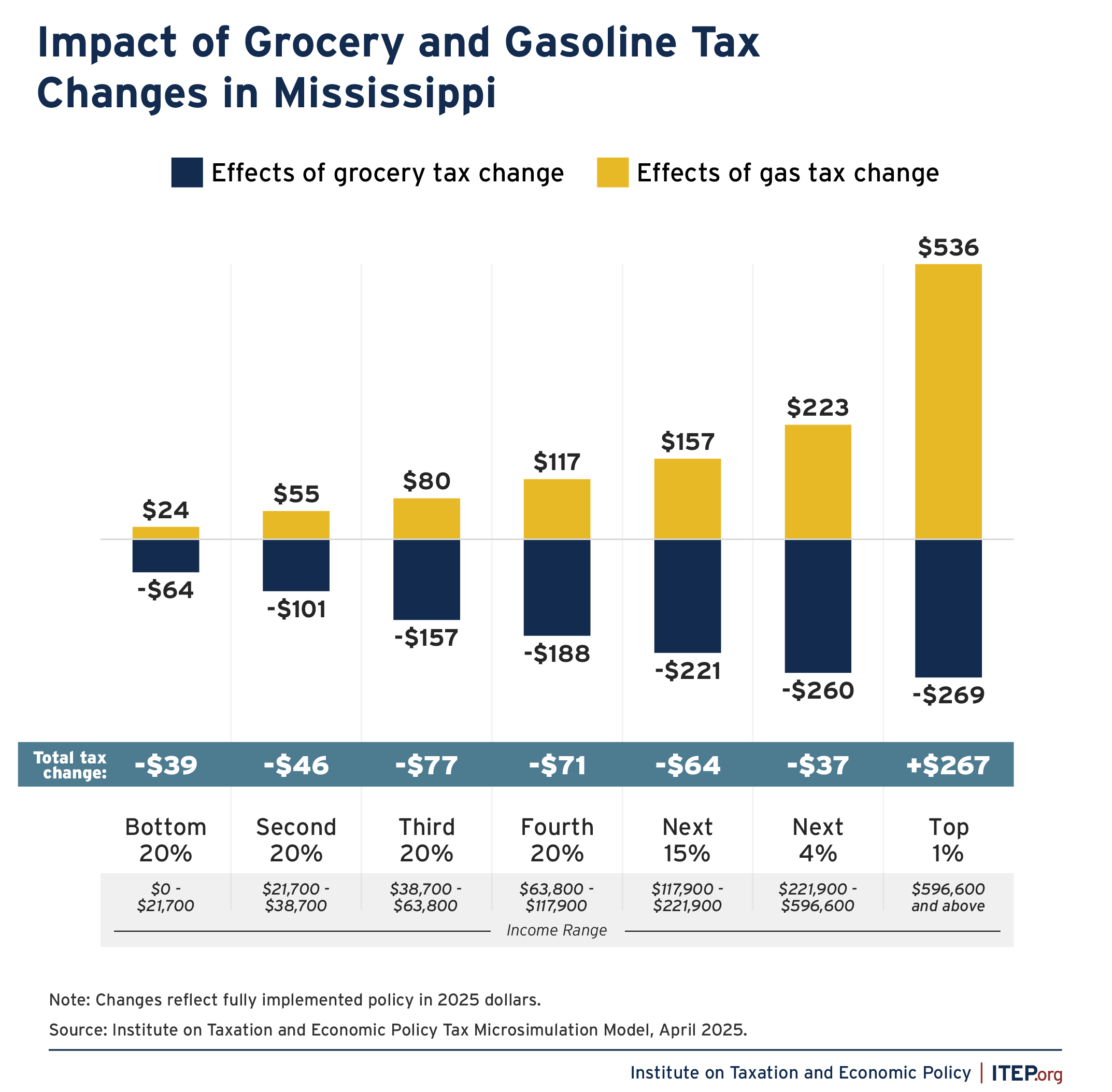

In addition to changes to the personal income tax, Mississippi reduced its sales tax on groceries from 7 to 5 percent. This change alone would be progressive and disproportionately benefit lower- and middle-income households who must spend large portions of their paychecks on everyday necessities like groceries. But a significant portion of this benefit is erased by the simultaneous 9 cent increase in the state’s gasoline excise tax. When combining these two policies, low- and moderate-income Mississippians will see an average annual tax cut of just over $50.

FIGURE 4

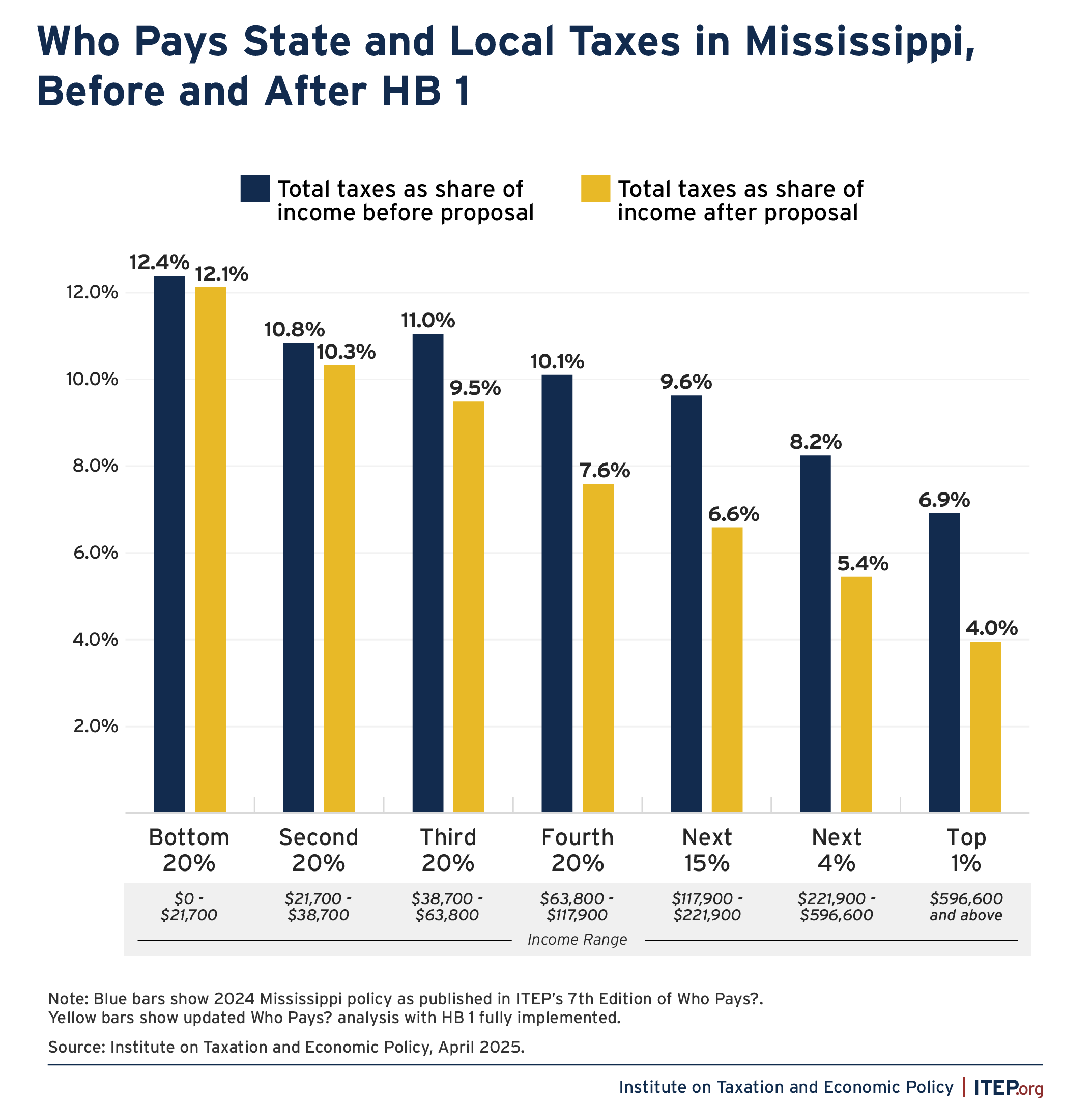

This legislation will make Mississippi’s tax system even more deeply inequitable. Already the richest people in the state pay significantly lower effective tax rates than any other group.[4] That imbalance will be exacerbated by this legislation. The top 1 percent of Mississippians now pay roughly half the tax rate faced by the state’s lowest-income earners. When HB1 is fully implemented, the top 1 percent will pay just one-third of the rate faced by low-income families and will pay less than half the rate faced by middle-income earners.

FIGURE 5

Conclusion

House Bill 1 is radical and regressive legislation that will make the state’s tax system less favorable to everyday families while jeopardizing Mississippi’s ability to raise revenue and fund key priorities. Mississippi, the nation’s second-largest recipient of federal dollars as a percentage of state spending, is at significant risk if federal cuts to programs like food assistance, Medicaid, and education materialize. Enacting deep cuts to the state’s individual income tax or eliminating the tax altogether, as this legislation will do, puts a large portion of the state – where 18 percent of people and 23 percent of children live in poverty – even more deeply at risk.[5] Sacrificing billions in state revenue while giving millionaires an average $41,420 windfall does not set Mississippi up for future economic success but instead sets the state and most of its residents up for hardship.

Endnotes

[1] The trigger language that was signed into law specifies a very gradual percent reduction in the income tax rate that will result in a long phase out period if taken literally. Media reports of proponents’ description of the measure, on the other hand, describe the law as triggering percentage point reductions, which would cause the income tax to be eliminated much more quickly. As an example, if the state begins with a 3 percent tax rate in 2030, a 0.2 percentage point reduction to that rate would result in a 2.8 percent tax, whereas a 0.2 percent reduction would result in a rate of 2.994 percent.

[2] National Education Association, “Educator Pay in America,” October 17, 2024. https://www.nea.org/resource-library/educator-pay-and-student-spending-how-does-your-state-rank?utm_medium.

[3] Gov. Tate Reeves and House legislators historically have pushed for elimination of Mississippi’s individual income tax, while Senate leadership has been more hesitant to commit to such a drastic tax cut. The Senate compromise plan contained a typo. The Senate intended for the variance between the State General Fund and the following years appropriations to be 85 percent of the cost of a 1 percentage point reduction in the personal income tax – which today would equate to roughly $515 million – at which point the trigger would be enacted if the variance met or exceeded this amount. The typo added an unnecessary decimal, making the trigger 0.85 percent. This version was passed by the House and signed by Gov. Reeves.

[4] Who Pays?: A Distributional Analysis of the Tax System in All 50 States, 7th Edition. Institute on Taxation and Economic Policy, January 2024. https://itep.org/whopays-7th-edition/. Analysis shows 2024 Mississippi law, as published in ITEP’s Who Pays? report versus fully-phased in impact of HB 1.

[5] U.S. Census Bureau, U.S. Department of Commerce, “Poverty Status in the Past 12 Months,” 2023. American Community Survey, ACS 1-Year Estimates Subject Tables, Table S1701, 2023. https://data.census.gov/table/ACSST1Y2023.S1701?q=poverty&g=040XX00US28.