This brief was updated July 2018

Read this Policy Brief in PDF here.

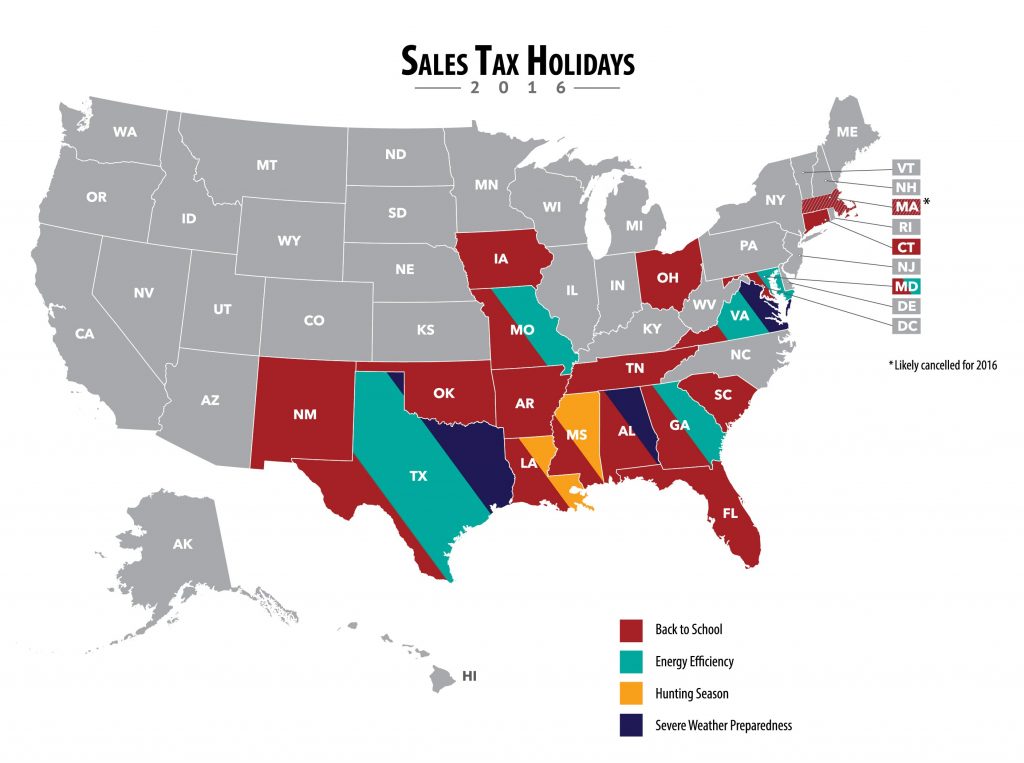

Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 17 states will hold them in 2016[2]), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief examines sales tax holidays, identifies the many problems associated with them, and concludes that they have more political than policy benefits.

How Sales Tax Holidays Work

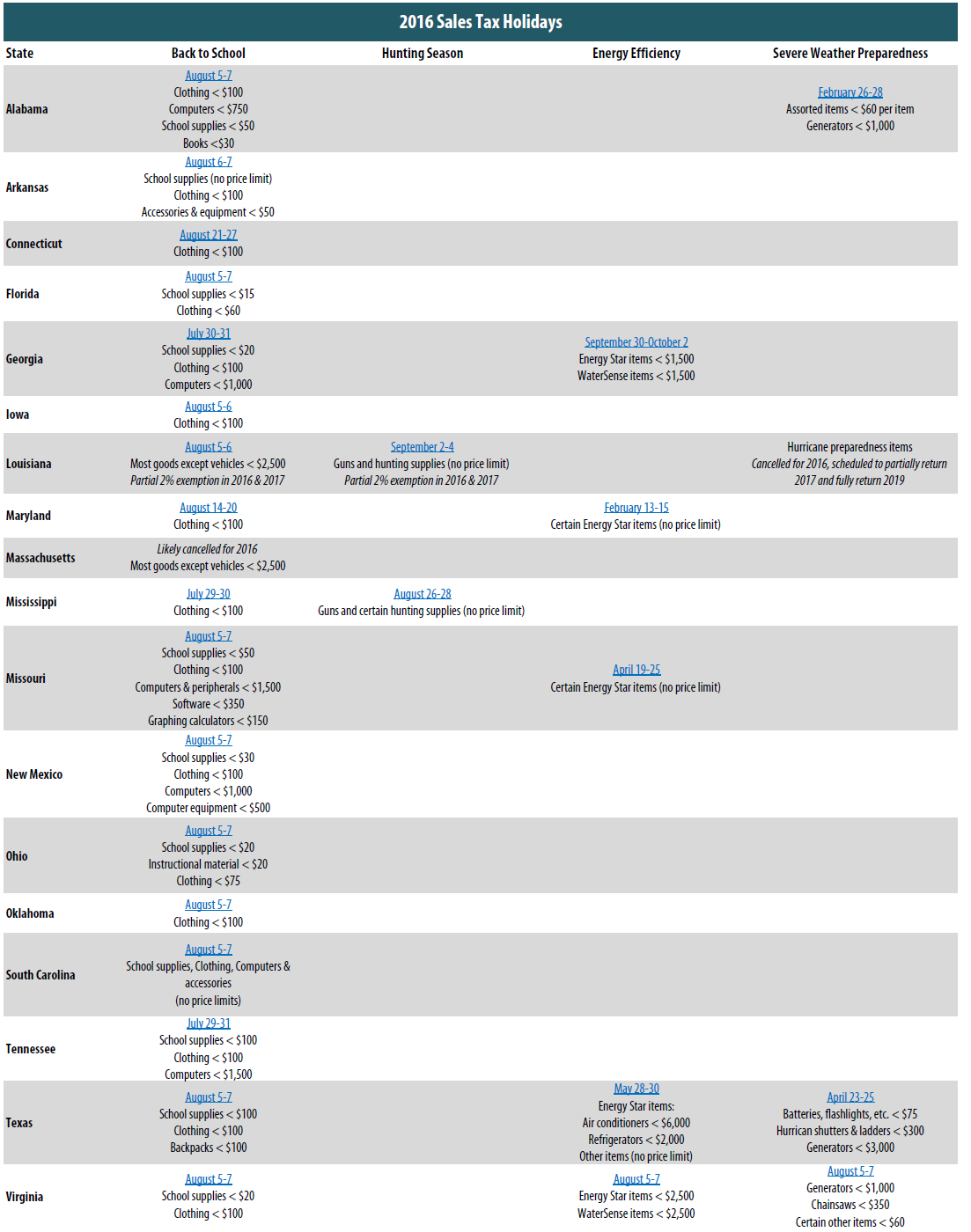

Sales tax holidays are temporary sales tax exemptions, usually applying to a small number of taxable items for a very limited period. These holidays are typically timed to take place in August, during the traditional “back to school” shopping season, and offer breaks on school-related items such as clothing, school supplies, and computers. However, a few states exempt all taxable goods during the holiday. Separate holidays for energy efficient appliances, guns and hunting season equipment, and storm preparation materials are becoming increasingly common as well. Most sales tax holidays last only two or three days, and almost all holidays apply only to items below some specified price (e.g. clothing items worth over $100 are generally not exempted).

History of Sales Tax Holidays

The notion of a holiday was first introduced in 1980 when Ohio and Michigan opted to not tax the sale of automobiles for a period of time.[3] New York experimented with the current concept of sales tax holidays in 1996, but has since abandoned the policy. More than twenty states have enacted legislation at some point to provide holidays and proposals to extend the concept to more states and more types of purchases continue to appear each year.

But not all states are jumping on the popular sales tax holiday band wagon. Holidays in Illinois, New York, North Carolina, West Virginia, and Vermont were either short-lived or repealed. Lawmakers in Kansas, Maine, Nebraska, Rhode Island, and Wisconsin recently rejected new back to school holidays and North Carolina decided not to reinstate theirs. Florida lawmakers reduced the state’s back to school holiday this year from 10 to 3 days and limited the tax break to purchases of clothing under $60 and school supplies under $15. Florida lawmakers also rejected proposals to create new holidays for hunting and fishing gear, items bought from small businesses, and all purchases by veterans.

Many states have either repealed or temporarily suspended sales tax holidays when facing significant revenue gaps. For example, lawmakers in Florida, Georgia, Maryland, Massachusetts and Washington D.C. all canceled holidays during the height of the recent economic recession (though all but D.C. have reinstituted them in recent years). Louisiana has pared back its use of holidays considerably due to recent budget woes, suspending its hurricane preparedness holiday for 2016 and limiting it to a partial exemption in 2017 and 2018, and applying similar limits to its holidays for back to school shopping and hunting season for 2016 and 2017. Massachusetts also appears poised to cancel their back to school holiday for 2016 due to a significant revenue gap.

Problems with Sales Tax Holidays

Policy makers tout sales tax holidays as a way for families to save money. On the surface, this sounds good. However, a two- to three- day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and create administrative difficulties.

Sales Tax Holidays Are Poorly Targeted

- Because wealthier taxpayers also benefit from sales tax holidays, they offer less “bang for the buck” from a fairness perspective than more targeted tax breaks such as low-income sales tax credits (described in ITEP Policy Brief, “Options for Progressive Sales Tax Relief”) or Earned Income Tax Credits (described in ITEP Policy Brief, “Rewarding Work Through Earned Income Tax Credits”).

- Wealthier taxpayers are often best positioned to benefit from the holidays since they have more flexibility to shift the timing of their purchases to take advantage of the tax break–an option that isn’t available to families living paycheck to paycheck. Many low-income taxpayers spend most or all of their income just getting by, which means that they also have less disposable income than wealthier taxpayers to spend when the holiday arrives. One recent study found that while households that earn more than $30,000 were likely to shift the timing of their clothing purchases to coincide with a sales tax holiday, but households earning less than $30,000 were not.[4]

- The benefits of sales tax holidays are not limited to state residents, but instead extend to anybody who happens to be within the state’s borders at the time of the holidays, including tourists and individuals who live close to the border.

Sales Tax Holidays Cost Revenue

In 2016, these holidays will cost states and local governments more than $300 million. Revenue lost through sales tax holidays will ultimately have to be made up somewhere else, either through painful spending cuts or increasing other taxes.

Some Retailers Exploit Sales Tax Holidays

Unscrupulous retailers could take advantage of the shift in the timing of consumer purchases by increasing their prices or watering-down their sales promotions during the tax holiday. One study of retailers’ behavior during a sales tax holiday in Florida found evidence of precisely that: up to 20 percent of the price cut consumers thought they were receiving from the state’s sales tax holiday was actually reclaimed by retailers.[5]

Sales Tax Holidays Create Administrative Difficulties

Sales tax exemptions create administrative difficulties for state and local governments and for retailers who must collect the tax. For example, exempting groceries requires a sheaf of government regulations to police the border between non-taxable groceries and taxable snack food. A temporary exemption for clothing (or for any other back-to-school item) requires retailers and tax administrators to wade through a similar quantity of red tape for an exemption that lasts only a few days. Further complexity can arise in states with local sales taxes when some localities opt not to participate in the holiday and consumers unexpectedly end up paying local sales taxes on their purchases.

Conclusion

Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Lawmakers must understand that they cannot resolve the unfairness of sales taxes simply by offering a short break from paying these taxes. If the long-term consequence of sales tax holidays is a higher sales tax rate, low-income taxpayers may ultimately be worse off as a result of these policies. Policy makers seeking to achieve greater tax fairness would do better to provide a permanent refundable low-income sales tax credit or Earned Income Tax Credit (EITC) to offset the impact of the sales tax on low- and moderate-income taxpayers.

[1] U.S. Census Bureau, U.S. Census Bureau, 2014 Annual Survey of State Government Finances.

[2] Massachusetts lawmakers have to appropriate funding for their sales tax holiday each year, and as of the time of publication, the legislature is still in session and appears unlikely to approve a holiday for 2016.

[3] Janssen, C. B. (2012), (Un) Happy Holidays: The True Meaning of Sales Tax “Holiday” Policy, Loyola Consumer Law Review. 24: 411–440.

[4] Marwell, Nathan and Leslie McGranahan (2010), The Effect of Sales Tax Holidays on Household Consumption Patterns. Federal Reserve Bank of Chicago.

[5] Harper, R. K., Hawkins, R. R., Martin, G. S. and Sjolander, R. (2003), Price Effects around a Sales Tax Holiday: An Exploratory Study. Public Budgeting & Finance, 23: 108–113.