Before Wednesday, you may have forgotten about tax reform given that President Trump’s remarks on the Charlottesville white supremacist rally, as well as the first U.S. solar eclipse since 1979, and Hurricane Harvey, overshadowed most other news. But Republicans on the House Ways and Means Committee, which in theory is the starting place for any tax legislation, certainly tried to get the public to focus on their vision for tax reform. They released a “reason for tax reform” each day in August. Unfortunately, these “reasons” are a combination of ideas that their proposals fail to address and misleading assertions. Here’s a sample.

Claims that cutting rates, reducing brackets and other breaks will help all Americans.

“Americans at every income level deserve to keep more of their paychecks.”

“Our broken tax code has too many brackets.”

“Our broken tax code perpetuates stagnant wages.”

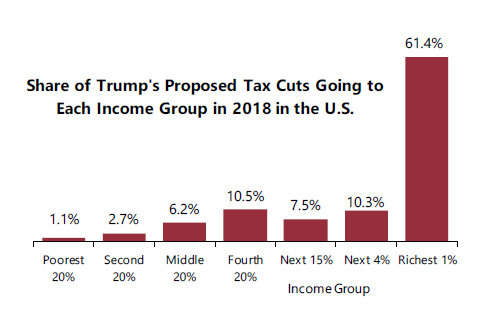

The proposals Republicans have discussed, which include fewer income tax brackets, lower rates and other types of breaks, would allow the rich to keep more of their income and offer negligible tax cuts to everyone else. In some cases, these proposals would result in higher taxes on middle-income families.

Under the tax proposals released by the Trump administration in April, more than 61 percent of the tax cuts would go to the richest 1 percent, who would get an average tax cut of more than $145,000 next year alone. Meanwhile the entire bottom 60 percent of income earners would receive just 10 percent of the tax cuts, and an average break of just $400 next year. Proponents of these tax cuts argue that the benefits will “trickle down” to lower income households because lower taxes will result in increased investment and job creation. But previous tax cuts aimed at the rich failed to expand our economy while tax hikes on the rich have often been followed by increased economic growth.

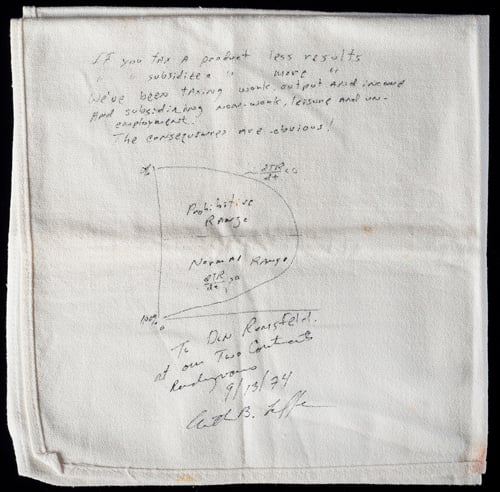

Proponents of these tax cuts argue that the benefits will “trickle down” to lower income households because lower taxes will result in increased investment and job creation. But previous tax cuts aimed at the rich failed to expand our economy while tax hikes on the rich have often been followed by increased economic growth.

Claims that American Corporations Pay Too Much in Taxes

“World’s Highest Corporate Tax Rate”

Republicans have long claimed that the statutory 35 percent federal corporate income tax rate is too high. But most American corporations pay far less than this because of various loopholes and special breaks.

A 2016 report from the Government Accountability Office found that the effective tax rate paid by large profitable American corporations from 2008 through 2012 was just 14 percent. It also found that the share of these corporations paying no federal income tax at all was 19.5 percent in 2012 and 24.1 percent in 2011.

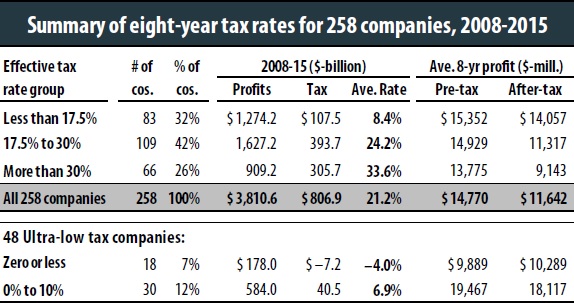

A recent study from ITEP examines a particularly profitable group of corporations – the Fortune 500 corporations that were profitable each year from 2008 through 2015. Even among these super-profitable companies, the effective federal income tax rate from 2008 through 2015 was just 21.2 percent. Several of the corporations had effective tax rates that were close to zero or below zero for the eight-year period.

Nor is there any evidence that American corporations are taxed more than those of other advanced economies. The latest data from the OECD show that the total amount of corporate income tax revenue collected by the federal government is equal to 2.2 percent of economic output in the United States compared to an average 2.9 percent in other OECD countries.

Claims that the U.S. and Its Businesses Are Not Competitive

“Our broken tax code is a drag on our economy.”

“High rates for Main Street job creators.”

“Our broken tax code makes America less competitive.”

Corporate profits in the United States are higher as a share of the economy than they have ever been. Large, multinational corporations in particular do not need new breaks but

Republican proposals would give them advantages over small businesses. The territorial tax system proposed by the Trump Administration would exempt offshore profits of American corporations from U.S. taxes. This would increase the already substantial rewards that multinational corporations can obtain when they use accounting gimmicks to make their profits appear to be earned in a foreign country with low or no corporate tax. These gimmicks are not available to the small businesses that most Americans associate with “Main Street.”

Claims that Our Tax Code Is Too Burdensome for Businesses to Comply With

“Businesses spend too much money filing taxes.”

“Costly compliance burdens for small businesses.”

“Our broken tax code encourages businesses to make decisions based on tax breaks.”

Far from simplifying business taxes, Republicans have offered several proposals that would make taxes vastly more complex for businesses and would cause their owners to make even more decisions based on arcane tax rules rather than sound economics.

For businesses that are “pass-throughs,” meaning their profits are subject to the personal income tax but not the corporate income tax, the Trump Administration has proposed a 15-percent tax rate. This would cause enormous complexity as highly paid employees would likely attempt to form their own pass-through companies to benefit from the 15-percent rate. Congress or the IRS would have to create a lot of rules (and long forms) to prevent this form of tax avoidance.

Even if they succeed, this proposal would do nothing to help middle-income business owners, most of whom already pay a rate lower than 15 percent. ITEP estimated that 79 percent of the benefits of this break would go to the richest 1 percent of taxpayers.

As for large multinational corporations, the Trump Administration has proposed a “territorial tax system” that would also make taxes far more complex. There are already rules determining which corporate profits are considered domestic versus foreign, and, despite the arcane detail of these rules, they are already failing to prevent companies from shifting profits into offshore tax havens. This problem will grow far worse under a territorial system, which exempts the offshore profits of American companies from U.S. taxes, providing even bigger benefits for companies that use accounting schemes to make their profits appear to be earned in offshore tax havens.

Claims that GOP Proposals Will Make Corporations Less Likely to Move Jobs and Profits Offshore

“Our broken tax code encourages companies to relocate overseas.”

“Our broken tax code encourages ‘profit shifting.’”

“Our broken tax code drives American jobs overseas.”

“Our broken tax code traps business investment overseas.”

Corporations move operations from one country to another for all sorts of reasons, and it’s not clear that taxes play much of a role. What is clear is that our tax system has a loophole allowing American corporations to use mergers to characterize themselves as foreign companies for tax purposes even though their ownership has not changed and they continue to be managed in the United States. Republican leaders in Congress have blocked legislation that would close the loophole allowing these so-called “inversions.”

The biggest problem with our corporate tax system is that it allows corporations to use accounting gimmicks to make their U.S. profits appear to be earned in countries where they won’t be taxed. Congressional Republicans are correct to point out this problematic “profit shifting,” but unfortunately their proposals will only make the problem worse.

Their proposal to implement a “territorial tax system,” which was included in President Trump’s proposals in April, would exempt the profits that corporations characterize as having been earned outside the U.S. This means that offshore profit shifting by corporations would reap even greater savings than it does now.