The Education Department today announced a proposed new federal tax credit for so-called school choice. The $5 billion proposal would give those who donate to private school voucher programs a tax credit. Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy.

“This proposal amounts to a federally funded voucher program. The program would be built around a supersized, dollar-for-dollar tax credit that would drain federal revenues without requiring participants to contribute a dime of their own money.

“This proposed tax credit isn’t intended to incentivize charitable giving; it’s a brazen effort to distort the tax code into a tool for funding private and religious schools with public dollars.

“Typically, a tax break for charitable gifts is supposed to encourage people to be generous with their own money by providing a modest tax incentive. But so-called ‘donors’ to school voucher programs would get their entire donation reimbursed by the federal government. Under this proposal, donors would not be asked to make any financial sacrifice at all. This creates even more inequity in our tax code because the vast majority of people receive no federal tax break when they choose to donate to the charities they feel most passionate about.

“In the 2017 tax overhaul, Congress and the Trump Administration eliminated charitable giving incentives for most people who had previously received them. Now they want to put a supersized one back into the code, but only if you donate to the cause they’ve cherry-picked for you: private K-12 schools.”

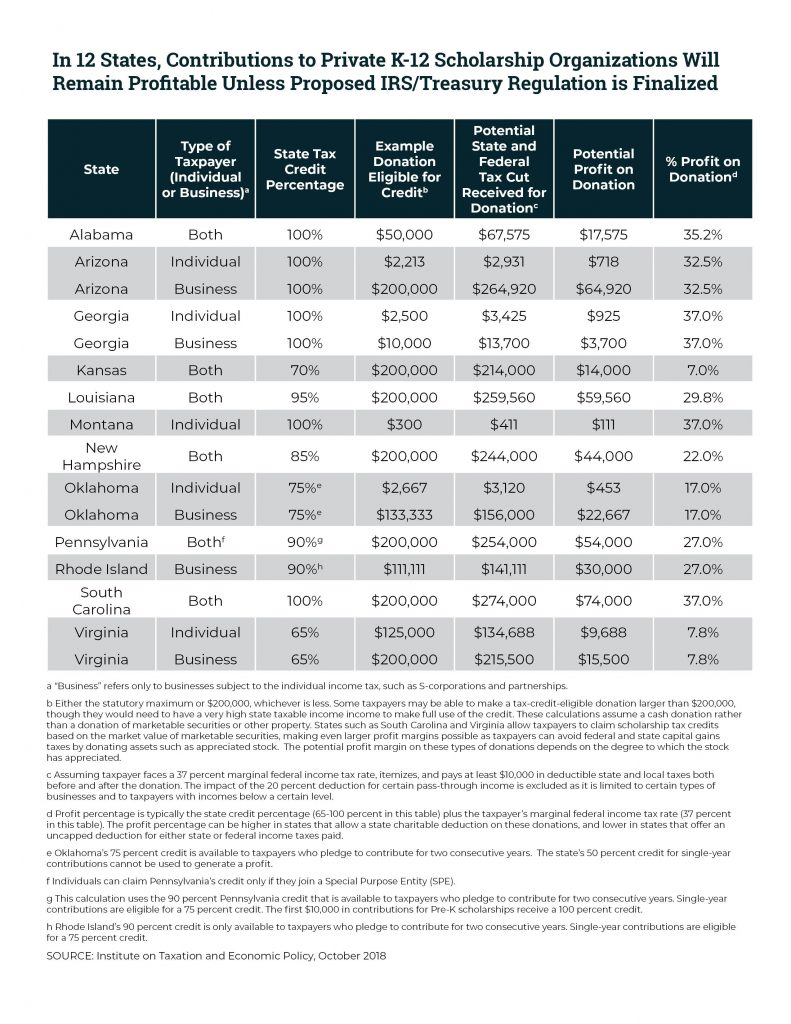

For more information, read Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education and Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This.