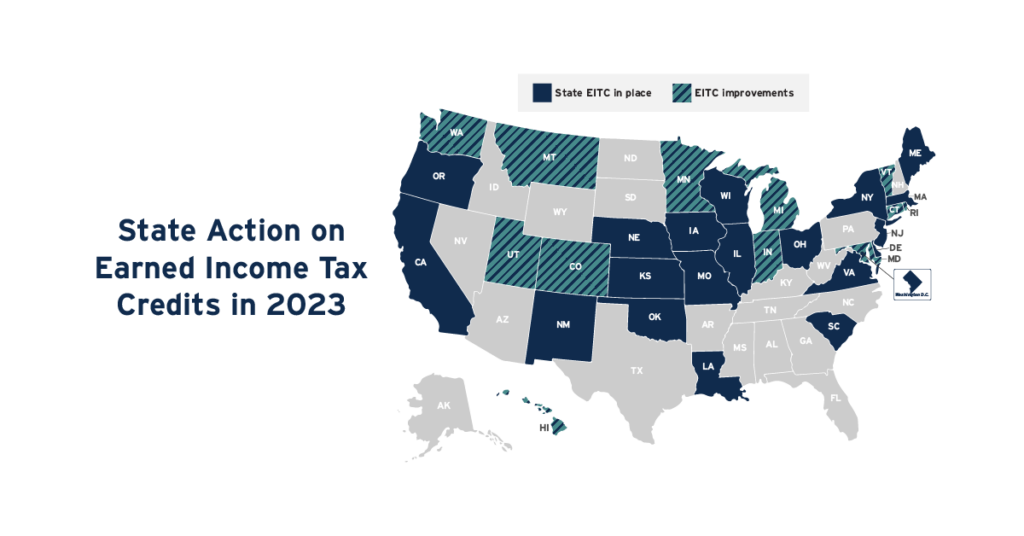

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week, as yet another group of states come close to pushing additional improvements to their credits across the finish line. In Oregon, a bill to create a $1,000 Child Tax Credit for kids under 6 is now on the governor’s desk after a nearly unanimous vote in both chambers. Across the country, New Jersey families are likely to see their Child Tax Credit double to $1,000 if the governor signs the new budget agreement. And in Maine, the bipartisan budget deal includes a now fully refundable Dependent Exemption Tax Credit. For a 50-state view of the actions states have taken on these credits (to date) in 2023, be sure to visit our updated maps here.

Major State Tax Proposals and Developments

- WISCONSIN Republicans are moving a bill that would reduce income tax brackets by 15 percent, resulting in $3.5 billion in lost revenue over a biennium. While this policy is being framed as a middle-class tax cut, it’s far from it. The state’s fiscal office analysis shows that nearly half the tax cut would go to households making over $200,000 annually. – NEVA BUTKUS

- The OREGON legislature passed legislation that would create a $1,000 Child Tax Credit available to children under the age of 6 and capped at five qualifying children. Households earning $25,000 would be eligible for the full value of the credit and it would be phased out at $30,000. The credit would be available through the end of 2029. The legislation passed nearly unanimously in both chambers and heads to Gov. Tina Kotek’s desk for further action. – MILES TRINIDAD

- The NEW JERSEY budget bill that would double the Child Tax Credit from $500 per child to $1,000 has been approved by budget committees in both chambers. Additionally, lawmakers agreed on additional property tax cuts for seniors, including an increase to the Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program. – MARCO GUZMAN

- MAINE lawmakers have reached a bipartisan agreement on additional budget spending that now includes a fully refundable child credit and funding for paid family leave, among other things. -MARCO GUZMAN

State Roundup

- The CALIFORNIA legislature has passed—and Gov. Gavin Newsom is expected to sign—a reauthorization of the state’s $330 million film and television tax credit. Additionally, unlike the prior version, the bill makes the credit refundable. According to its author, most major studios—including Netflix, Warner Bros. Discovery, Sony and Paramount—will benefit.

- The Democratic gubernatorial candidate in MISSISSIPPI is calling on current Gov. Tate Reeves to eliminate the 7 percent sales tax on food in a special session.

- TEXAS Gov. Greg Abbott called for a second special session on property tax cuts after House and Senate legislators could not reach an agreement. The governor, who prefers the House’s plan, is focusing this special session on creating a pathway to eliminating school district maintenance and operation taxes and finding a way to compress school district property tax rates. Lt. Gov. Patrick, who favors the Senate’s plan, prefers to see a homestead exemption passed.

- The VIRGINIA legislature could enter a special session as Gov. Glenn Youngkin continues to pursue tax cuts in the state’s budget negotiations. While the new two-year budget is scheduled to begin this Saturday, Youngkin has proposed cuts to the corporate income tax and individual income tax as lawmakers continue to negotiate over the annual revisions to the plan, which would be in place through June 2024.

What We’re Reading

- The Center on Budget and Policy Priorities’ Bernie Gallagher lays out the troubling trend on limiting statutory revenue and budgets through arbitrary caps designed to give small sets of special interests permanent veto power over necessary investments.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Aidan Davis at [email protected]. Click here to sign up to receive the Rundown via email.